Ryt Bank vs GXBank 2026: Which Digital Bank is Best for Your Ringgit?

A guide on Ryt vs GXBank and which is the best digital bank for 2026. Find out who wins on interest and how Wise can help you no matter which bank you pick.

Looking for an e-wallet in Malaysia? You’re in luck. Malaysia is pretty well served for e wallets which means you have plenty to pick from, depending on which features and services you need. This guide walks through all you need to know, including a head to head comparison on features, and a more detailed dive into how each wallet works.

We’ll look at each of these wallets in more detail next, but first a look at some of the best e wallets in Malaysia side by side:

| Features | Debit card available? | Payment methods | |

|---|---|---|---|

| Wise |

| Yes | Send local and international payments, shop online, transfer to other wallets |

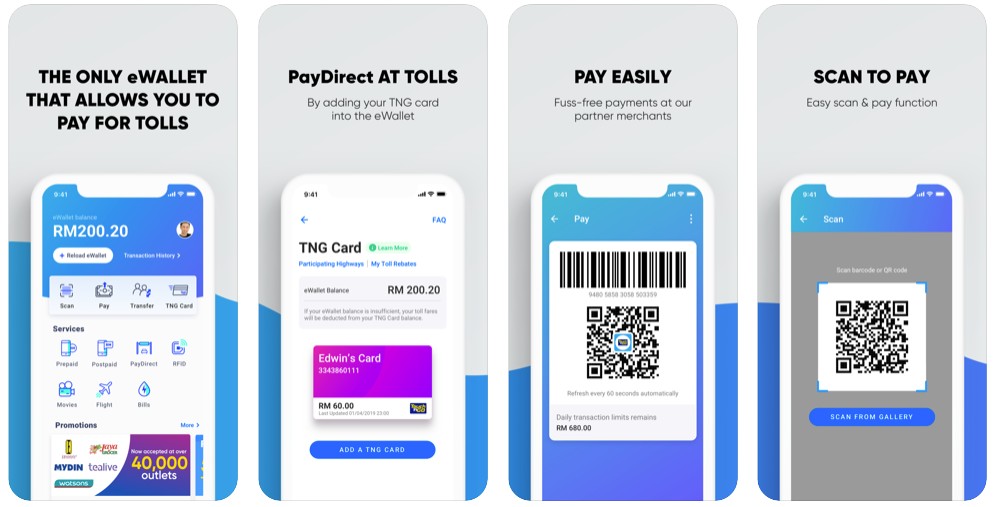

| Touch ‘n Go |

| Yes | Transfer to other wallets, pay using QR code, pay tolls by RFID |

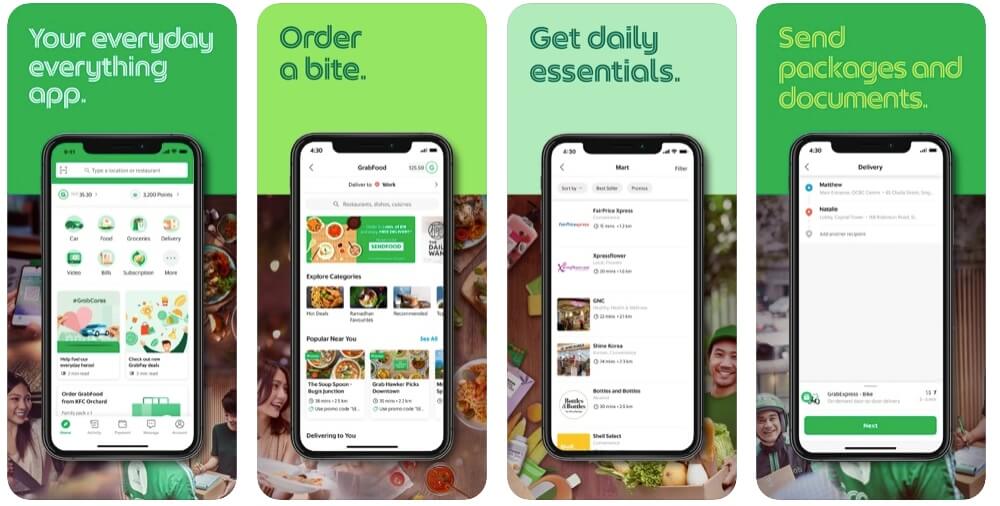

| GrabPay |

| Grab x Maybank credit card offered in partnership with Maybank¹ | Transfer to other wallets, shop online, pay using QR code |

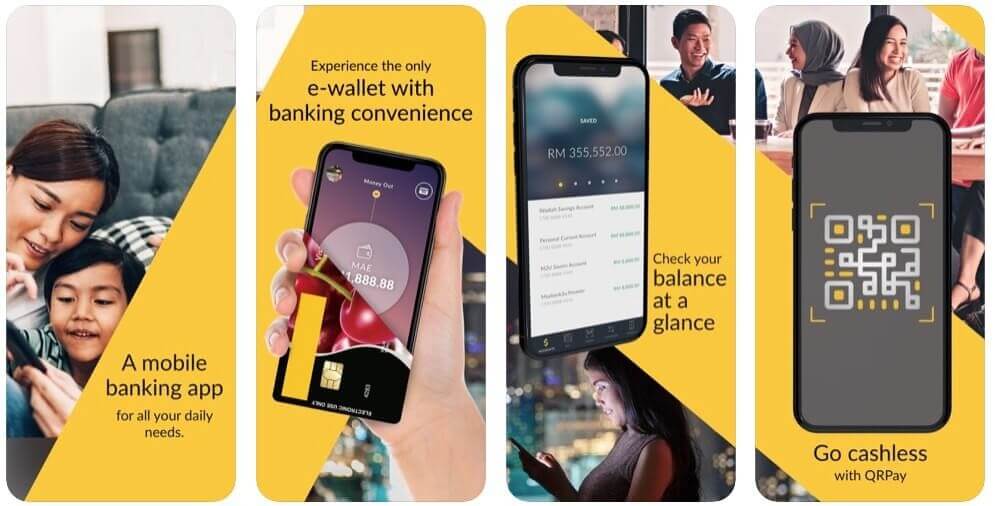

| MAE |

| Yes | Transfer to other wallets and bank accounts, shop online, pay using QR code |

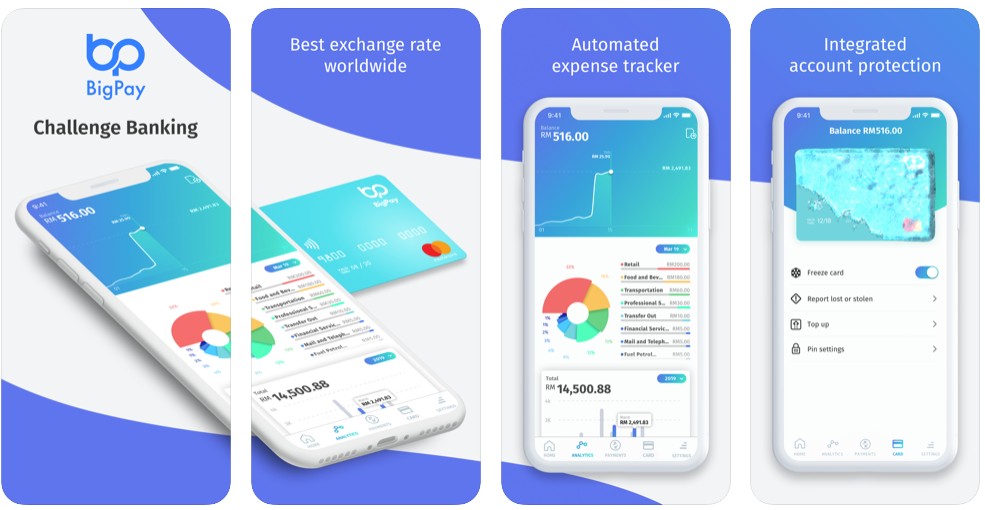

| BigPay |

| Yes | Transfer to other wallets and bank accounts, shop online, make QR payments |

| Boost |

| No | Transfer to other wallets, shop online, make QR payments |

| WeChat Pay (discontinued) |

| No | QR payments, send payments to other WeChat users |

| AliPay |

| No | QR payments, send money to others, shop online |

| Merchantrade Money |

| Yes | Send and receive local and international payments |

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

Wise lets you hold and exchange 40+ currencies, spend in 150+ countries, send payments to 140+ countries, and get paid fee free with local account details in 8+ currencies.

|

|---|

Wise might be a great e-wallet pick for you if you travel or shop online internationally, or if you ever need to pay or get paid from overseas. Many Malaysian e-wallets have fairly limited international services, but Wise has been optimised to make it easy to send, spend, hold and exchange currency whether you’re at home or abroad.

Open your Wise account online or in the Wise app, order your Wise card for a one time low fee and you’re good to go. You can switch between any of the 40+ supported currencies in a few taps, with the mid-market rate and low fees from 0.33%. Plus send payments to others and receive money in a selection of currencies for free.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

Touch ‘n Go² is one of the best known and longest established e-wallets in Malaysia, and comes with a linked payment card if you’d like one.

|

|---|

Touch ‘n Go ewallets can be used to hold a MYR balance, make payments to others, pay in stores by scanning a QR, and also offer a wide range of other features like bill pay and phone top ups. You can send local MYR payments using DuitNow, or manage overseas transactions in select locations through TNG’s link up with Alipay⁴.

Learn more about Touch ‘n Go e-wallet Malaysia here.

GrabPay⁵ ewallet allows you to easily make payments and get more from Grab’s services, including ride hailing and food order.

|

|---|

Grab offers a pretty broad range of services in Malaysia, and the GrabPay ewallet lets you access many of them easily. Top up your wallet or add a card, then use Grab to spend in person and online, or to pay when you top up your phone, order food, or more. You’ll be able to continue to earn Grab rewards as you use your GrabPay wallet, and can transfer credits to others too. Grab is available in several countries in the region - if you’re able to use your Grab wallet internationally you may find fees are applied, either by Grab or by your card issuer.

Find out more about GrabPay Malaysia here.

MAE⁶ is Maybank’s digital ewallet, which is offered through Maybank2u online and mobile banking system.

|

|---|

Maybank customers can download MAE to access a neat e-wallet to use for day to day expenses. And if you’re not already signed up you can also get started simply by downloading the app and getting verified. MAE features are pretty broad, as you’ll be able to access payments, online shopping, and ways to manage your money better, plus Maybank2u features like ways to check your banking details and receive payments.

Want to know more about MAE by Maybank2u? Read this.

BigPay⁷ is available in Malaysia for local and international payments, plus budgeting tools to help you make your money go further.

|

|---|

BigPay is an e-wallet with linked card which you can use in Malaysia and abroad. You’ll be able to add money to your account in MYR to access competitive exchange rates when overseas, and can transfer money internationally to select countries. International transfer fees are from 3.50 MYR to 22 MYR depending on where you’re sending to, and when you’re abroad you’ll pay an ATM fee of 10 MYR + a 1% currency conversion fee for card spending⁸.

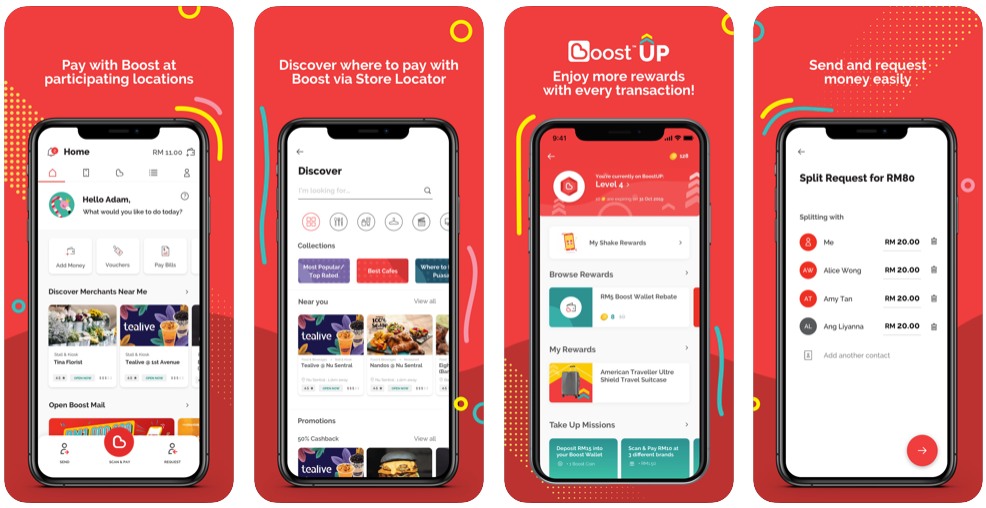

Boost⁹ is a prepaid e-wallet you can top up in advance in MYR, for easy spending in Malaysia.

|

|---|

Boost ewallets can be used pretty extensively in Malaysia, with a huge merchant list for QR payments, and ways to pay your bills and top up phones. You can also use Boost to earn rewards, and to buy insurance. There’s no Boost card, and as international merchants might not accept Boost QR payment you might find this ewallet can’t be used particularly widely overseas.

Learn more about Boost e-wallet in this guide.

| ⚠️ As of 1 September 2024 WeChat has stopped new user registration and has discountinued payment services. |

|---|

| Users will have till 31 December 2024 to withdraw existing balances |

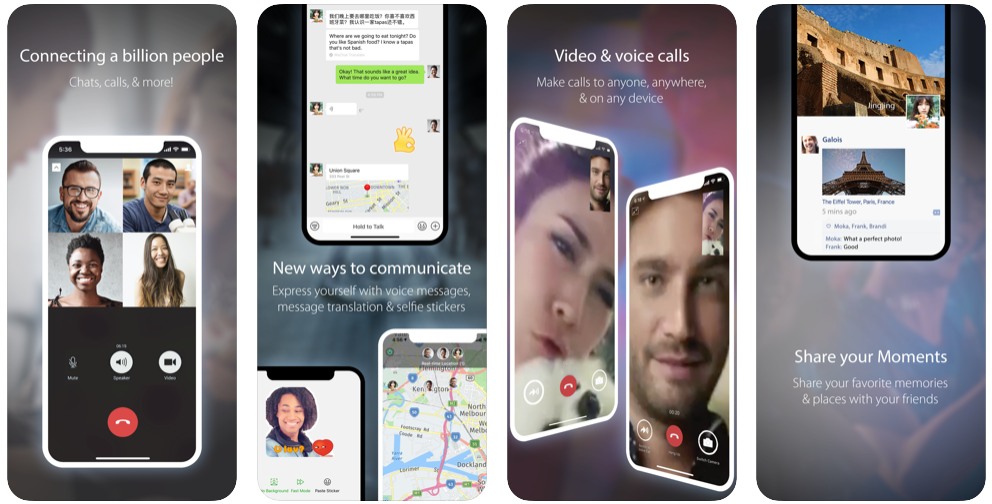

WeChat is a hugely popular service, and the WeChat Pay¹⁰ ewallet also gives options to make simple payments.

|

|---|

WeChat Pay allows Malaysian customers to link a Malaysian issued card to their WeChat account to make easy payments. That means you can send someone money right within your chat, as well as using your ewallet to pay in stores by scanning a QR. Mobile phone top ups and bill payments services are also available.

There’s more about WeChat Pay and how to use it here.

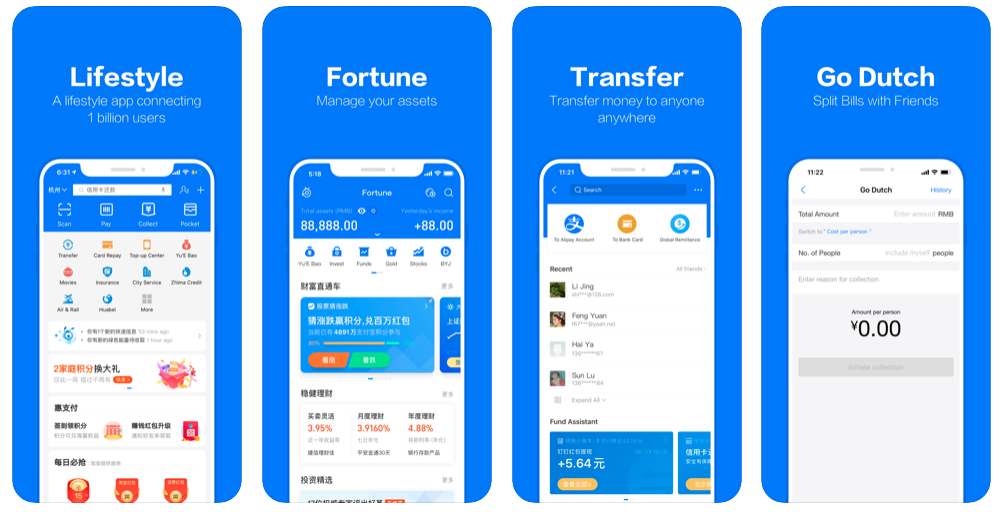

AliPay is a giant in payments - now AliPay Malaysia¹¹ customers can use the service to send money to others, shop online and in stores.

|

|---|

AliPay used to be tricky to use without a Chinese bank account, but it’s now much easier for Malaysians to use the service. Once you have an AliPay account you can pay with a QR code in stores, send money to others and shop online. Although AliPay’s international services are expanding, there are still some limitations. For example, to send an overseas payment you’ll usually need a Chinese bank account and ID.

However, it’s good to know that if you’re looking at AliPay because you need to send CNY to someone in China, you can still do so by using a different ewallet app - such as Wise¹².

Want to know more about AliPay Malaysia? Read this.

Merchantrade Money¹³ has a good range of services including an ewallet product which comes with a linked prepaid card.

|

|---|

Hold any of 20 supported currencies in your Merchantrade account, and switch between them when you need to. You can also get a linked prepaid payment card for easy use at home and abroad. Merchantrade has some handy international services although it’s helpful to know about the fees you’ll pay for overseas use - including an international ATM fee from 10 MYR, and a 1% overseas transaction cost when you spend a currency you don’t hold in your account¹⁴.

There’s more about Merchantrade Money in this review.

There’s no single best e wallet in Malaysia. Which one suits you will come down to the services and features you need to use.

If you need an easy way to make QR payments in Malaysia then Touch ‘n Go or GrabPay could be a good pick. If you’re after an ewallet from a big Malaysian bank, check out MAE by Maybank. Or, if you’re looking for ways to invest and get insurance with the same provider as your ewallet, maybe Boost will suit.

If you want an ewallet to use when you’re travelling or need to hold multiple currencies, consider getting Wise as one of the most flexible international ewallets on the market in Malaysia. You’ll be able to hold 40+ currencies, get paid like a local with account details in 8+ currencies, and send local and international payments easily.

Plus you can get a linked Wise card to spend in 150+ countries, with mid-market exchange rates every time you’re spending in a foreign currency.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A guide on Ryt vs GXBank and which is the best digital bank for 2026. Find out who wins on interest and how Wise can help you no matter which bank you pick.

Is Ryt Bank Malaysia’s best digital bank? Read our 2026 review on Save Pockets, AI bill payments, and the zero-fee Ryt Card.

Is Wise cheaper than a Malaysian credit card in 2026? We break down hidden bank fees vs Wise’s mid-market rates to help you stretch your Ringgit.

Transferring money from Malaysia? Compare Wise vs Western Union fees and exchange rates for 2026. See which provider is cheaper for your next transfer now.

Compare Wise vs GXBank to stretch your Ringgit. Earn interest with GXBank savings, but use Wise to avoid FX fees.

Maybank Grab Card 2026 Guide: Is it still worth it? Here's a review of the 5x GrabCoins benefit, the zero annual fee status, and more.