GoPayz¹ Malaysia is an e-wallet offering a broad range of financial services including online conventional and Islamic accounts, insurance, investments and more. You can transact and manage your app conveniently via the GoPayz app and with the GoPayz physical card.

This GoPayz review will focus on 4 key services offered by GoPayz - online currency exchange, international remittance, e-wallet and the GoPayz card. To help you decide if GoPayz is right for you, we’ll also compare it with 2 other popular e-wallet options, BigPay and Wise. Let’s dive right in.

What is GoPayz?

GoPayz offers a pretty comprehensive range of financial, Islamic and lifestyle services, including the following:

- E-wallet services

- Online and in person shopping with the GoPayz card

- International remittances

- Online currency exchange

- Investments

- Life insurance

- Personal accident, motor and travel insurance

- Islamic services including Zakat

- Pay bills and buy mobile airtime

- Buy game credits and entertainment subscriptions

- Donate to charities

- Pay for parking and travel

With so many services on offer you’ll need to invest a bit of time browsing the GoPayz website if you want to learn all about them. For the purposes of this guide we’ll focus on a few of their most popular services - the e-wallet and the GoPayz card, as well as GoPayz online currency exchange and international remittances.

GoPayz card

When you sign up for a GoPayz e-wallet account you’ll be automatically given 3 virtual cards, which helpfully are all on different payment networks - Visa, MasterCard and UnionPay². That means that if one network isn’t accepted by a merchant or online seller, you can always use another.

If you want to upgrade your virtual card to a physical card you’ll need to pay a fee of 16 MYR. This allows you to make cash withdrawals at home and abroad, as well as using your physical card for payments when a merchant can’t accept mobile card transactions. It’s worth noting that there are some fees involved in using your GoPayz card, including the following³:

- 1 MYR local ATM fee

- 10 MYR international ATM fee

- 1% foreign transaction fee when making international payments

You may also pay a fee to top up your GoPayz account, depending on the method you use.

Shopping online

When shopping online you can enter your GoPayz physical or virtual card details to make secure payments. Usually you’ll have to enter the following⁴:

- GoPayz card number

- GoPayz expiry date

- 3 digit security code

- Your name

When you shop you may be able to get exclusive GoPayz offers and bonuses, as well as earning reward points you can trade in for airtime top up, vouchers and more.

GoPayz online currency exchange - how good are the rates?

With GoPayz online currency exchange⁵ you can order foreign currencies in cash and have them delivered to your door in some areas - or collect them in person at branches of Max Money⁶.

The exchange rate used for GoPayz currency exchange is set by Max Money. There’s a good chance it will include a markup on the mid-market exchange rate, which is an extra fee. The mid-market exchange rate is the one you’ll find on Google or when using a currency converter tool. However, it’s common for banks and exchange services to add a markup to cover their costs and generate profit, which can mean you pay more than you expect for your currency exchange.

Max Money uses competitive exchange rates which may well beat the banks - but that doesn’t necessarily mean they’ll be the very best available. Compare some different options before you exchange currency to make sure you get the best deal.

How to use the GoPayz online currency exchange service⁷

Set up the transaction you want by ordering up to 5 different currencies at a time in the GoPayz wallet. You can then pay with your GoPayz e-wallet balance or by FPX from your online banking. There’s a minimum amount of 50 MYR and a maximum of 5,000 MYR for online currency exchange funded by GoPayz balance, and 50,000 MYR for exchange paid for using FPX.

GoPayz remittance

GoPayz also offers international remittance services via its partnership with Max Money⁸. Send money to any of the following countries⁹:

- Bangladesh

- India

- Philippines

- Indonesia

- Nepal

- Vietnam

- Pakistan

Service fees apply, which can vary based on the destination and the way you want your payment to be received. Options include direct bank deposits and having cash sent for collection at a local agent close to your recipient. There will also be an exchange rate markup - check the rates available on the Max Money website.

When it comes to currency exchange and international payments, using a specialist online service can mean you save money. For example, with the Wise multi-currency account you’ll be able to hold 50+ currencies, and convert them with the real mid-market exchange rate any time you like. To give an idea about whether GoPayz is right for you if you need to transact internationally, we’ve also got a full Wise vs GoPayz vs BigPay comparison coming up later.

E-wallet comparison: GoPayz vs Bigpay vs Wise

GoPayz isn’t your only option when it comes to e-wallets in Malaysia. You might also want to consider alternatives like BigPay and Wise.

BigPay offers a range of e-wallet features including in person and online payments and a linked card - as well as having budgeting tools and personal loan options. Learn more about BigPay here.

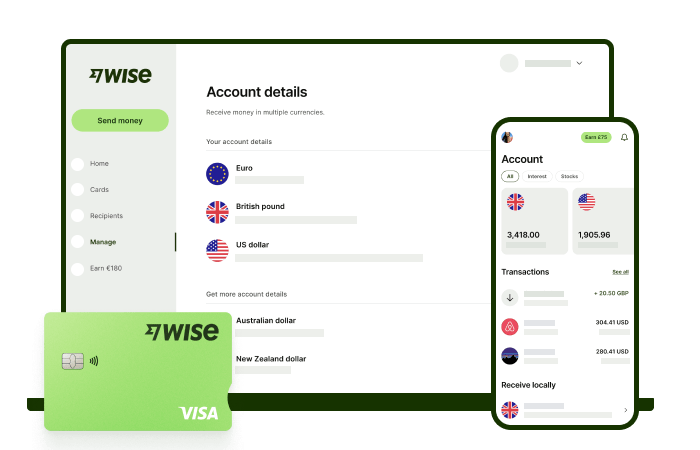

If you transact internationally often, you might find that the Wise multi-currency account suits you even better. You’ll be able to hold and exchange 50+ currencies in the account, with physical and virtual debit cards for easy spending online and in person. You can open your Wise account in many regions of the world, and access MYR bank details as well as local account details for 9 other currencies. That means it’s free to get paid from 30+ countries. You can send Wise international payments to an impressive 80+ countries, transact and review your balance in-app and online, and all with no minimum balance or ongoing fees. Easy.

Here’s a summary of how the three providers stack up:

| Feature | GoPayz¹⁰ | BigPay Card¹¹ | Wise |

|---|

| Eligibility | Malaysian citizen or resident | Malaysian citizen or resident | Wise accounts are available in many regions globally |

| Account service fee | No fee | 2.50 MYR/month for inactive accounts - fee waived at time of research¹² | No fee |

| Currencies you can hold in the account | MYR | MYR | 50+ currencies |

| Exchange rate | Mid-market exchange rate + markup | Mid-market exchange rate + markup | Mid-market exchange rate |

| Send international bank payments to | Bangladesh, India, Philippines, Indonesia, Nepal, Vietnam, Pakistan | China, Australia, Vietnam, Indonesia, Singapore, Malaysia, Thailand, the Philippines, India, Bangladesh, and Nepal | 80+ countries around the world |

| International bank payments - fees | Up to 13 MYR depending on market | 5 MYR - 13 MYR depending on market | Low, transparent fee based on destination |

| Local account details to get paid into account from abroad | No | No | Yes - bank details to get paid fee free from 30+ countries |

| ATM withdrawal charges | 1 MYR in Malaysia; 10 MYR overseas | 6 MYR in Malaysia; 10 MYR overseas | Up to 1,000 MYR/month fee free |

| Foreign transaction fee | 1% | 1% + network charges - percentage fee waived at time of research | No foreign transaction fee |

Learn more about Wise!

How to sign up to GoPayz

There are 2 different account levels with GoPayz - basic and premium. To transact fully with your account and take advantage of all GoPayz services, you’ll need to open a Premium Account, by getting verified in the GoPayz app. Here’s what to do:

- Download the GoPayz app

- Click Sign Up

- Enter your personal details

- Fill in the Know Your Customer (KYC) forms

- Upload an image of your government issued ID documents for verification

Accepted government issued ID documents include MyKad for Malaysians, MyPR for permanent residents and foreign passports.

How to top up your GoPay account?

You can top up your GoPayz account with no fee using your online banking service. Here’s how:

- Log into your account on the GoPayz Website or GoPayz App

- Select online bank transfer FPX

- Select your preferred bank

- Add the top up amount

- You will be redirected to your bank's online banking portal

- Complete the transaction on your online banking portal

Alternatively you can top up at a 7 Eleven - although you’ll usually pay a fee for this service. Here’s how:

- Log into your account on the GoPayz Website or GoPayz App

- Select Top up at 7 Eleven option

- Add the top up amount

- Press Proceed and a pop-up screen will display a barcode

- Present the barcode to 7 Eleven cashier counter

- Pay the cash amount in the receipt to the 7 Eleven cashier

Once you have arranged the payment in the app you’ll have 48 hours to visit a convenient 7 Eleven to top up in cash.

Summary

GoPayz has a really good suite of financial, Islamic and lifestyle services covering everything from e-wallets, payments, insurance and investments. If you’re looking for a way to get all your financial needs met by one provider they’re worth a look. However, you’ll need to review the terms and fees for the different services available.

If you’re specifically interested in e-wallet services, it’s also worth comparing the GoPayz wallet against a few other providers such as the Wise multi-currency account which can offer better value for international services, with the real exchange rate and low, transparent fees.

Frequently asked questions

How to contact GoPayz customer service

Email GoPayz on customercare@gopayz.com.my or call on +6018 388 3388.

How to transfer money from GoPayz to a bank account?

You can use GoPayz to send money to bank accounts internationally in a range of selected countries. Account deposit fees run up to 13 MYR depending on the currency involved. However, watch out for the GoPayz hidden charge which is in the exchange rate. GoPayz uses exchange rates provided by Max Money which may include a markup on the mid-market rate. This is a fee - but it’s not transparently disclosed. Compare the rate against the Google exchange rate to check.

Sources:

- GoPayz wallet

- GoPayz card

- GoPayz fees

- GoPayz ecommerce

- GoPayz online currency exchange

- MaxMoney

- Online currency exchange FAQ

- GoPayz remittance

- GoPayz remittance FAQ

- GoPayz e-wallet

- BigPay Card

- BigPay Card - fees

Sources checked on 21.07.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.