Can a foreigner open a bank account in Malaysia? Guide for foreigners

Foreigner opening a bank account in Malaysia? Read more what options are available, documents needed to open a bank account and more

In April 2022, it was announced that Malaysia would start to issue digital banking licenses, initially creating 5 digital banks in Malaysia with new products and services for customers. Fast forward a couple of years and these banks are now establishing themselves in their own niches - so which is the best digital bank in Malaysia for your needs?

Read this guide to the digital banking scene in Malaysia to help you decide. Plus, as Malaysian digital banks usually only let you hold MYR, we’ll also touch on another multicurrency alternative - Wise. The Wise account isn't technically a bank account but does offer account and card services in 40+ currencies, and is licensed under the laws of Malaysia by the Bank Negara Malaysia. More on that later.

| Table of contents |

|---|

So - what is digital banking? The first digital bank in Malaysia is only a couple of years old, so you may not be so familiar with how digital banking works.

In short, digital banks are banks without a physical branch network. Instead, services are offered online and through an app, usually with a card for easy payments and withdrawals. In Malaysia digital banks are pretty new, so the accounts and services available may be a little more limited than what you’ll find from a major bank with a physical network. For example, you can usually only hold MYR in your account, and you may not be able to send or receive payments in foreign currencies. Digital bank accounts in Malaysia may also only be available for Malaysian citizens who are also residents of Malaysia - not for expats or Malaysians working overseas.

Digital banks may offer slightly different features to physical banks though - which can include extras like reward earning opportunities and good interest or profit rates. As their overheads are lower than a bank with a branch network, they may be able to offer lower fees and higher returns for customers, while still being a profitable business which can invest in growth.

Digital banking is a rapidly developing market in Malaysia and the world over, so it’s well worth getting to know that’s out there to see if any of these providers might suit you. Read on for more about the best digital bank in Malaysia for different services and customer needs.

Whether a digital bank or a regular bank with a physical branch network will work best for you depends on your personal preferences and how you like to transact. If you manage your money online and with your phone anyway, a digital bank account could mean lower fees. However, if you prefer a face to face service and need to pay in cash often, a traditional bank might be better for you. Here’s a quick side by side comparison:

| Digital Bank | Traditional Bank |

|---|---|

| No branch network | Branch network available |

| Account products and services may be limited | Full range of account services available including credit cards, insurance, investment and loans |

| Fees are often pretty low | Fees may be on the high side |

| International services might not be available - no multi-currency holding or payments for example | Options often available to send money overseas and hold foreign currencies |

| Help and support offered digital and by phone only | Face to face service offered in branches, as well as phone and digital services |

This guide on the best digital banks in Malaysia covers 3 major options - GXBank1, Boost2 and AEON3. All 3 hold banking licenses from the Bank Negara Malaysia, which means they can offer a wide range of services. At the time of writing these banks are relatively new, which means additional services and products are likely to be added to their portfolio over time.

Here’s a quick head to heads comparison, with a little more detail about each coming up later:

| GXBank | Boost | AEON | |

|---|---|---|---|

| Interest/profit rates | 2% | 3.2% on savings account or up to 4% with special jars | 0.88% - 3% |

| Deposit account features and fees | No minimum deposit or balance No account operations fees for normal services | No minimum deposit Account dormant fees apply4 Accounts for personal and business use | Initial deposit and minimum balance of 20 MYR6 Early close and dormancy fees apply |

| Debit card features and fees | GX Bank debit card - some reward earning opportunities available No foreign transaction fee GX Bank waives ATM fees at the time of writing | Boost card linked to savings account, physical or virtual card available 8 MYR annual fee5 1.25% foreign transaction fee + Mastercard fees for overseas use ATM fee 1 MYR -10 MYR depending on location and ATM operator | Debit Card-i: Shariah compliant card linked to deposit account 12 MYR issuance fee7 2% foreign transaction fee ATM fee 1 MYR -10 MYR depending on location and ATM operator |

| Loans | Flexicredit available - a flexible line of credit you can draw on when needed | Available for business customers | Not supported |

*Details correct at time of writing - 12 March 2025

🌎 Looking for an international debit card with no hidden fees when paying in foreign currency? Learn more about how Malaysians can use the Wise card abroad

Get your free Wise account now

GXBank is one of the first digital banks in Malaysia, already used by over 750,000 customers. You can get a deposit and savings account, debit card, and access to a credit line which you can draw on when you need it.

|

|---|

GXBank has personal deposit accounts which pay interest, as well as a linked debit card. GXBank’s fee policy is intended to keep costs for customers extremely low, so there are pretty much no fees to worry about with either the account or card product - including no foreign transaction fee to pay when you spend overseas.

Account interest rates are variable but sit at 2% at the time of writing. There’s also a flexible credit option which allows you to apply for a credit line which you can use when you need a little extra cash, to repay at a later stage.

Boost is the Malaysian digital bank which was created through a partnership between Axiata and RHB, offering account and card services for personal customers, plus some business services

|

|---|

Boost accounts are available for Malaysian citizens who are also resident in Malaysia, with no minimum deposit needed. You can get a Boost physical or virtual card linked to your savings account which makes it more convenient to transact from your account. Accounts have very few fees to pay, but it's worth knowing that some ATM fees apply, plus foreign transaction costs which can be due to both the bank and the card network.

You can earn rewards known as Boost Stars as you transact. Plus accounts have lots of easy ways to make local payments through the Boost e-wallet.

AEON is the first Islamic digital bank in Malaysia, offering deposit and savings accounts with a linked debit card, all with Shariah compliant features

|

|---|

AEON is one of the new Malaysian digital banks, and one of only a couple of Islamic banks to be handed a license as yet. You can currently open an AEON account only if you’re a Malaysian citizen with a valid MyKad. There’s no maximum deposit amount for the deposit account, but you must have at least 20 MYR in your account at any time for it to remain open.

Products available at the time of writing include a deposit account which comes with an optional linked Shariah compliant debit card. The options available from AEON are likely to increase over time so it’s worth keeping an eye on their offering if you’re looking for something different.

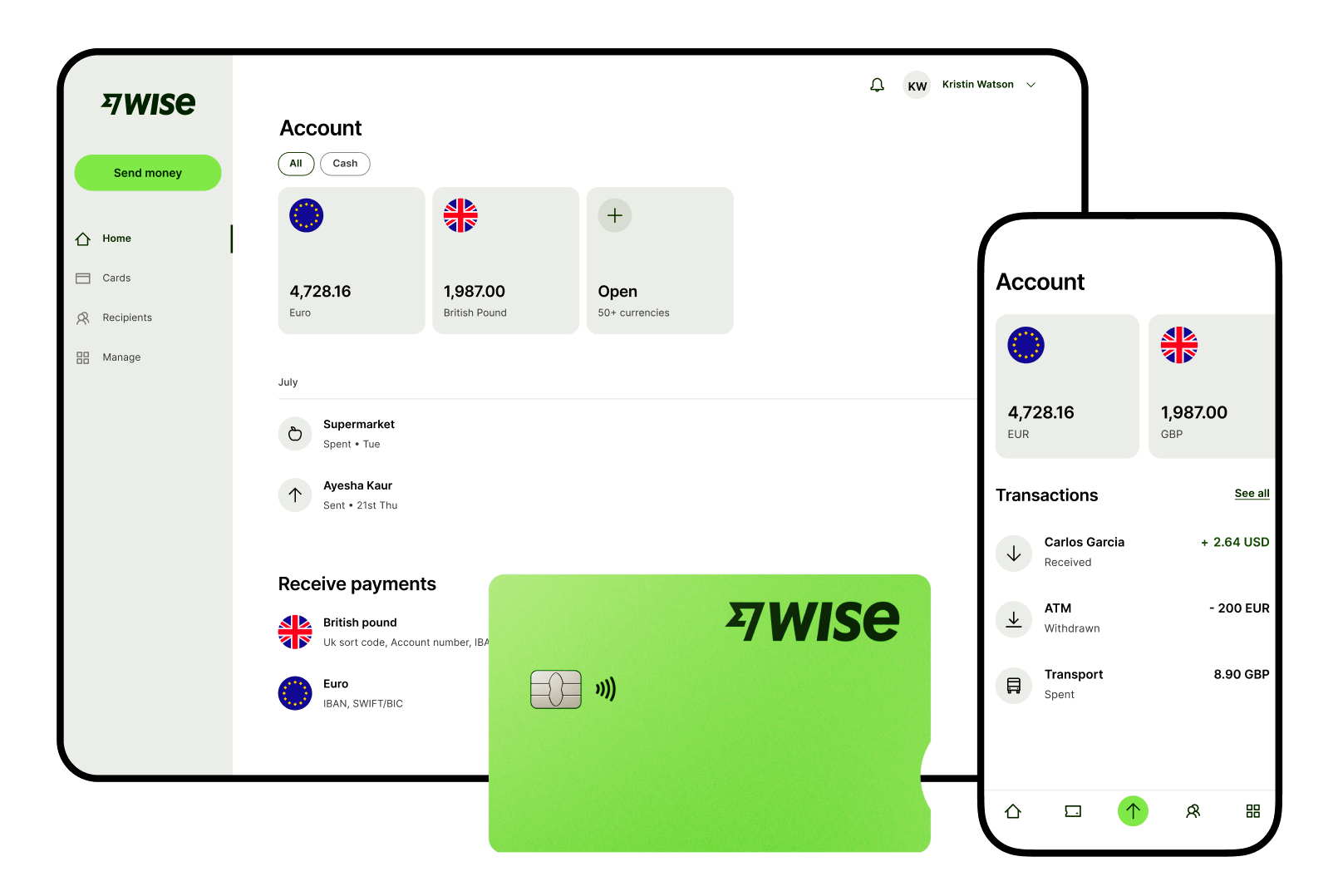

While you’re shopping around for ways to manage your money digitally, why not also check out Wise.

Wise is not a digital bank, but it is a safe global provider of money transfers and multi-currency account services, fully licensed and regulated in Malaysia Bank Negara Malaysia.

Wise offers a powerful multi-currency account which can hold and exchange 40+ currencies, and the Wise card for easy spending and withdrawals. Use your Wise account to send payments to 160+ countries overseas, or to receive payments in foreign currencies, using local and SWIFT account details for 8+ major currencies.

Where Wise really excels is in currency exchange and international transactions. You can add money to your account in MYR and convert to any available currency - alternatively, have others send payments right to your account in select currencies too.

Whenever you convert from one currency to another, you’ll get the mid-market exchange rate with low fees from just 0.33%8, with no foreign transaction fee even when you spend with your card. Order a Wise card for a low, one time fee, to spend in 150+ countries, with up to 2 free ATM withdrawals every month, to the value of 1,000 MYR, with low and transparent ATM fees after that.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Foreigner opening a bank account in Malaysia? Read more what options are available, documents needed to open a bank account and more

Looking to open a bank account online Malaysia? Read more about how to open a bank account or international account online and their requirements.

Looking to open a CIMB current account in Malaysia? Here's how to open an account with CIMB and review of each current account.

Need a local bank account in Singapore? Here’s how to open an account online in Malaysia, without leaving your home.

Looking to open an HSBC Global account in Malaysia? We reviewed the features, currencies, fees and more.

Revolut isn’t currently available for Malaysians. We cover the best non-bank providers similar to Revolut.