Best Digital Banks in Malaysia comparison (2024)

Find out which are the best digital banks in Malaysia and how they compare.

If you’re moving to Malaysia for work or to study - or if you’re a frequent visitor there - you might be wondering if a foreigner can open a bank account in Malaysia. Having an account that can hold ringgit could make it easier to manage your money, and cut your costs when you spend in MYR.

This guide covers how to open a bank account for a foreigner in Malaysia, and the documents needed to open a bank account in Malaysia, so you can check if you’re eligible. And if you can’t open a standard Malaysian bank account, or want a more flexible mutli-currency product, we also have an alternative - Wise - for easy low cost ways to hold, send, spend and receive MYR.

| Table of contents |

|---|

Foreigners who are legal residents in Malaysia shouldn’t have any problem opening a Malaysian bank account, as long as they’re able to pull together the correct supporting documents. The only exception is for basic bank account products which are usually only available to Malaysian citizens and permanent residents.

You’ll pretty much always need to visit a bank to open your account as a foreign customer. Plus, in some cases you’ll need an introduction to a bank to be able to open an account, which means you’ll have to find a friend who already banks with the provider you’ve picked, to help you get your account up and running.

If you’re looking for something a bit more straightforward, you might prefer Wise as a non-bank alternative you can open from anywhere. More on that later.

Generally to open a bank account in Malaysia you’ll need the following:

In some cases you’ll also need an introducer. For Public Bank as an example, you’ll need to go along to the bank branch with all your paperwork and an introducer who must also have banked with Public Bank for 12 months or more¹.

We’ll look at each of our top picks one by one next - but first let’s get an overview of some of the main Malaysian banks and the products they offer for foreigners. We’ve also highlighted another option - Wise - as a non-bank alternative you could use to hold, send, spend and exchange MYR alongside 40+ other currencies.

| Wise (non-bank alternative) | CIMB² | Public Bank⁵ | Maybank⁸ | |

|---|---|---|---|---|

| Eligibility | Personal and business customers in Malaysia and most other countries | Personal and business customers in MalaysiaBasic current account available for Malaysian citizens and PR only | Personal and business customers in Malaysia, an introducer may be requiredBasic current account available for Malaysian citizens and PR only | Personal and business customers in MalaysiaBasic current account available for Malaysian citizens and PR only |

| Documents needed | Proof of ID and addressVisa document may be required for non-Malaysians¹² | Passport or NRICProof of addressSupporting documents like work permit or pass | Passport or MyKadSupporting documents like work permit or pass | Passport or MyKadSupporting documents like work permit or pass |

| Annual fee | No annual fee | 10 MYR every 6 months³ | 10 MYR every 6 months⁶ | 10 MYR every 6 months⁹ |

| Minimum deposit | No minimum deposit | 250 MYR (Regular current account) | 3,000 MYR (PBE Plus Current Account) | 1,000 MYR (Personal Current Account) |

| International payments | Fees from 0.41% | 10 MYR to 30 MYR depending on currency and how you set up the payment⁴ | 2 MYR + 15 MYR to 30 MYR cable charges⁷ | 10 MYR to 30 MYR depending on currency and how you set up the payment¹⁰ |

| Card availability | Available | Available | Available | Available for current accounts |

| Currencies supported | 50+ | MYR | MYR | MYR (multi-currency account available for investments, covering 16 currencies¹¹) |

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

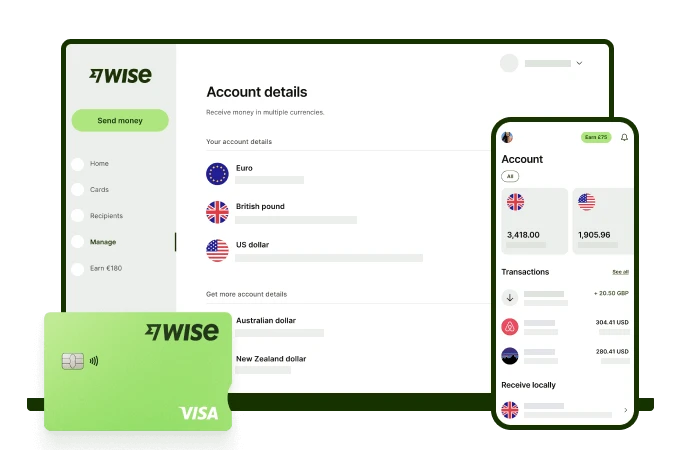

Wise accounts can be used to hold and exchange 40+ currencies, with an optional debit card you can use in 160+ countries. If you’re a Malaysian resident you’ll get local bank details to get paid in MYR, as well as local account details for up to 8 other major currencies.

And even if you’re not a Malaysian citizen or resident, you can hold and spend MYR, simply by adding funds in any of the other supported currencies and exchanging to ringgit in your account. Wise currency exchange always uses the mid-market exchange rate with low, transparent fees, and no foreign transaction fees to pay.

Opening a Wise Malaysia account is easy and can be done entirely online or using your smartphone. Here’s how:

To open a Wise account as a foreigner in Malaysia you’ll need to upload an image of your passport and a proof of address, plus your visa or pass to prove your legal residence status.

|

|---|

As a large and trusted bank, CIMB has some strong options for both current and savings accounts, including some accounts you can open as a foreigner in Malaysia. You’ll be asked to prove your Malaysian address to open your account in most cases, so you’ll need a utility bill or similar valid document to get your account set up.

Basic Bank Accounts can’t be opened by foreigners in Malaysia unless they hold PR status, but the current accounts available for foreign residents include the Regular Current Account which has a low opening deposit of 250 MYR.

|

|---|

Public Bank Malaysia has a solid range of account products including current and saving accounts. It’s helpful to know that some accounts - like the Public Bank Basic Current Account - can only be opened by Malaysian citizens and permanent residents. However, other account types can be opened by resident foreigners and even non-residents with appropriate connections and documents. You’ll likely find you need an introducer to go with you when you open your Public Bank account, along with a stack of documents and a minimum opening deposit of 3,000 MYR or more.

|

|---|

Maybank has a range of account products and services, including current accounts which foreigners living in Malaysia could use for day to day financial management. There are foreign currency accounts available too, but these are aimed more at people looking to invest in foreign currencies, with a fairly high minimum deposit requirements. Maybank has a large branch and ATM network which could make it a practical option if you’re looking for a traditional bank and prefer to manage your money face to face.

|

|---|

Foreigners are free to open a Malaysian bank account, but in most cases you’ll have to have a full suite of documents and a local Malaysian proof of address. You’ll also need to visit a branch in person to get started. If you just want an easier way to open an account online - check out Wise instead.

Wise accounts are flexible and can be used to hold and exchange over 40 currencies. If you’re a Malaysian resident you’ll get MYR bank details along with bank details for up to 10 other major currencies, so you can get paid easily - with smart, low cost ways to hold, send, spend and exchange currencies right from your phone.

One thing banks commonly ask foreign customers to provide is a letter from their employer, confirming their employment contract is valid. This is in addition to providing a work permit or pass, and means you’ll need to ask your boss or HR department to write you a note to take to the bank with you. Need some help? Get a template letter of employment confirmation here.

Sources:

Sources checked on 10/04/2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find out which are the best digital banks in Malaysia and how they compare.

Looking to open a bank account online Malaysia? Read more about how to open a bank account or international account online and their requirements.

Looking to open a CIMB current account in Malaysia? Here's how to open an account with CIMB and review of each current account.

Need a local bank account in Singapore? Here’s how to open an account online in Malaysia, without leaving your home.

Looking to open an HSBC Global account in Malaysia? We reviewed the features, currencies, fees and more.

Revolut isn’t currently available for Malaysians. We cover the best non-bank providers similar to Revolut.