Best Digital Banks in Malaysia comparison (2024)

Find out which are the best digital banks in Malaysia and how they compare.

CIMB is one of the most important banks in Southeast Asia, with a presence in 14 countries. CIMB current account options include a broad range of products to suit different customer needs. That’s great, but it can mean that picking one is a bit tricky. This guide covers all you need to know about popular CIMB accounts, including how to open a CIMB current account, and the account fees and charges to know about.

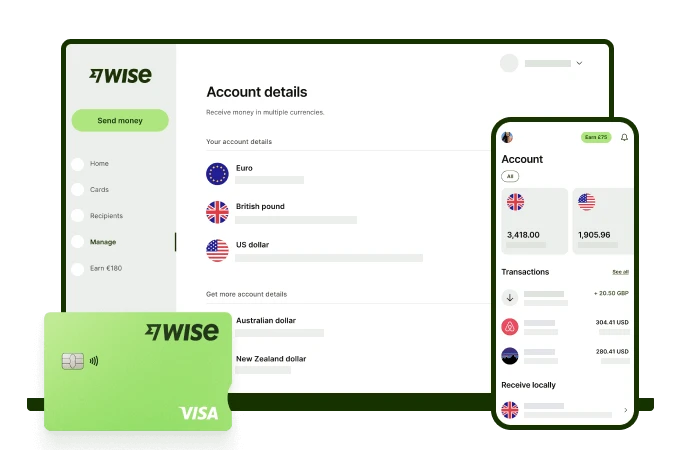

We’ll also introduce the Wise multi-currency account as a smart, low cost way to hold, exchange, send and spend at home and internationally.

| Table of contents |

|---|

Current accounts are designed for day to day spending, and usually come with linked cards and cheque books for convenience. Different account types are offered which can include accessible current accounts for younger people, basic accounts which have low minimum balances, and prime accounts for high wealth customers looking to earn more interest. CIMB also offers foreign currency current accounts for people who need to hold and manage their money in a different currency.

In this guide we’ll cover some most popular conventional current accounts CIMB offers. CIMB also has a good range of business and Islamic accounts - contact the bank directly for more on these account types.

If you’re already a member of CIMB Preferred, the Preferred Current Account¹ is the natural choice for you, with higher interest rates offered for customers holding large value balances in the account. You’ll be able to earn monthly bonus points which you can then redeem as air miles, gift vouchers and more², and all accounts come with a linked debit card and cheque book.

The Preferred Account has a relatively low minimum deposit of 1,000 MYR - but you’ll also need to be a member of CIMB Preferred, which does mean meeting fairly restrictive eligibility requirements.

| CIMB Account Name | CIMB Preferred Current Account |

|---|---|

| Eligibility | Aged 18 or over Member of CIMB Preferred - membership is based either on holding 250,000 MYR in eligible investments, 1 million MYR in home or business financing, or 300,000 MYR in hire purchase financing |

| Minimum deposit amount | 1,000 MYR |

| Account fees³ | Account service fee - 10 MYR every 6 months for accounts with less than 1,000 MYR balance Online international transfer fee - 10 MYR + exchange rate markup + third party charges In branch international transfer fee - 10 MYR - 30 MYR based on currency + exchange rate markup + third party charges⁴ Account closure fee - 10 MYR - 20 MYR Account closure fee - 10 MYR - 20 MYR |

| Interest rates | 0% - 1.55% based on account balance |

| Account limits | Default daily card spend limits - 20,000 MYR Minimum foreign transfers - 250 MYR⁵ Maximum online foreign transfer - 50,000 MYR daily (no limit if done in a branch) |

CIMB Foreign Currency Current Accounts⁶ are offered for investors looking to hold a balance in a foreign currency, and people exporting or trading internationally who want to retain a proportion of their income in foreign currencies. 13 major foreign currencies are offered, including USD, GBP and EUR.

Once you have an account you can add and withdraw funds through foreign currency telegraphic transfers, demand drafts and transfers to and from your MYR account. These accounts are not intended for travel spending or shopping internationally particularly, and do not come with a linked debit card or cheque book.

| CIMB Account Name | CIMB Foreign Currency Current Account |

|---|---|

| Eligibility | Aged over 18 years - apply in branch only |

| Minimum deposit amount | 500 MYR |

| Account fees | Account service fee - 10 MYR every 6 months Online international transfer fee - 10 MYR + exchange rate markup + third party charges In branch international transfer fee - 10 MYR - 30 MYR based on currency + exchange rate markup + third party charges |

| Interest rates | Non-interest bearing account |

| Account limits | Minimum foreign transfers - 250 MYR Maximum online foreign transfer - 50,000 MYR daily There are also limits about the eligible sources of funds for deposit to this account type - get all the details before you open your account ⁷ |

There are also limits about the eligible sources of funds for deposit to this account type - get all the details before you open your account ⁷

Looking for a cheaper and more flexible way to manage your money across currencies? The Wise multi-currency account can be 3x cheaper than a regular bank account, with an easy online and in-app opening process, 50+ currencies and a linked debit card. Get your account for free with no minimum balance requirements and no ongoing charges, then manage your money easily on the move, switching between currencies with the real mid-market exchange rate and low, transparent fees. More on that coming up later.

CIMB’s Basic Current Account⁸ is a no-frills solution for Malaysian citizens and PRs, looking for a simple account with a linked debit card and cheque book. Accounts can be opened by businesses as well as individuals, and joint accounts are allowed. Account maintenance fees are waived if you hold a balance of 1,000 MYR or more, and the CIMB current account minimum opening deposit is a relatively low 500 MYR.

| CIMB Account Name | CIMB Basic Current Account |

|---|---|

| Eligibility | Aged over 18 Malaysian citizens and permanent residents only |

| Minimum deposit amount | 500 MYR |

| Account fees | Account service fee - 10 MYR every 6 months for accounts with less than 1,000 MYR balance Online international transfer fee - 10 MYR + exchange rate markup + third party charges In branch international transfer fee - 10 MYR - 30 MYR based on currency + exchange rate markup + third party charges Account closure fee - 20 MYR if account is closed within 3 months of opening |

| Interest rates | Non-interest bearing account |

| Account limits | Default daily card spend limits - 10,000 MYR Minimum foreign transfers - 250 MYR Maximum online foreign transfer - 50,000 MYR daily |

CIMB’s Regular Current Account⁹ offers full banking facilities, plus an overdraft for eligible customers. With this account you can get a free CIMB current account statement on a monthly basis, or pay an extra fee for more frequent statements. As with all CIMB accounts, you’ll be able to manage your money online through the CIMB Clicks online banking service.

| CIMB Account Name | CIMB Regular Current Account |

|---|---|

| Eligibility | Aged 18 or over |

| Minimum deposit amount | 1,000 MYR |

| Account fees | Account service fee - 10 MYR every 6 months for accounts with less than 1,000 MYR balance Annual debit card fee - 15 MYR Dispatch of cheque books - 10 MYR Online international transfer fee - 10 MYR + exchange rate markup + third party charges In branch international transfer fee - 10 MYR - 30 MYR based on currency + exchange rate markup + third party charges Account closure fee - 10 MYR - 20 MYR |

| Interest rates | Non-interest bearing account |

| Account limits | Default daily card spend limits - 10,000 MYR Minimum foreign transfers - 250 MYR Maximum online foreign transfer - 50,000 MYR daily |

With the CIMB Prime Account¹⁰, Prime members can have monthly account fees waived by maintaining a 1,000 MYR balance, as well as earning bonus points based on account use. The Prime Current Account is interest bearing, with the levels of interest earned based on the balance of the account - hold more in the account to achieve a better rate of up to 0.75%. Prime Accounts also come with a linked debit card and cheque book to make it easy to transact day to day.

| CIMB Account Name | CIMB Prime Current Account |

|---|---|

| Eligibility | Aged 18 or over |

| Minimum deposit amount | 1,000 MYR |

| Account fees | Account service fee - 5 MYR/month for accounts with less than 1,000 MYR balance, waived for Prime members Annual debit card fee - 15 MYR Replacement debit card fee - 12 MYR Online international transfer fee - 10 MYR + exchange rate markup + third party charges In branch international transfer fee - 10 MYR - 30 MYR based on currency + exchange rate markup + third party charges Account closure fee - 10 MYR - 20 MYR |

| Interest rates | Up to 0.75% |

| Account limits | Default daily card spend limits - 10,000 MYR Minimum foreign transfers - 250 MYR Maximum online foreign transfer - 50,000 MYR daily |

Looking for a smart all-in-one solution to manage your money day to day in both MYR and a broad range of other currencies? You need the Wise multi-currency account.

Wise accounts are opened and managed online or in the Wise app, and come with local MYR account details, plus account details for 9 other currencies including SGD and USD. Use these account details to get paid like a local from 30+ countries, and hold and exchange 50+ currencies all in the same place. Wise currency exchange always uses the mid-market exchange rate with low, transparent fees which can mean you save 3x compared to using a regular bank. It’s also free to make domestic MYR transfers with the Wise card.

There’s no fee to open the Wise account and no ongoing charges - just a low one time fee to get the linked Wise Visa debit card. You can then use your Wise card to spend and withdraw all over the world with no foreign transaction fees, the perfect solution for travel and international shopping, as well as day to day spending.

Whether or not you can open your CIMB account online will depend on the specific account you select, and your personal situation. Once you’ve selected the right CIMB current account for your needs you’ll have to take the following steps:

Some CIMB accounts, such as the Foreign Currency Current Account, can only be opened in a branch, and most will require you to complete an online opening process and then attend a branch in person to present your documents and get your account up and running.

CIMB Malaysia has a good range of current account options which are designed to suit different customer needs. All accounts offer online banking through CIMB Clicks, and most have linked debit cards and cheque books to make day to day spending simple.

If you travel often, or like to shop online with international ecommerce sellers, it’s worth knowing that CIMB’s accounts don’t tend to be the most flexible when it comes to foreign currencies. That can mean you’re forced to switch currencies unnecessarily - at an extra cost - or run into foreign transaction fees when you spend overseas. Modern alternatives like the Wise multi-currency account, are an innovative solution with easy spending in person and online, in both MYR and a huge range of other currencies. Before you open an account, compare the CIMB current account options against Wise, to see which suits you best.

You can get a CIMB currency account statement online through CIMB Clicks, and in some cases can also get mini-statements from ATMs. Fees may apply, depending on statement frequency and the specific account.

You can transfer up to 50,000 online daily from a CIMB current account.

Close your CIMB current account by calling into a CIMB branch or giving written notification that you want your account to be closed.

Sources:

Sources checked on 19.07.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find out which are the best digital banks in Malaysia and how they compare.

Foreigner opening a bank account in Malaysia? Read more what options are available, documents needed to open a bank account and more

Looking to open a bank account online Malaysia? Read more about how to open a bank account or international account online and their requirements.

Need a local bank account in Singapore? Here’s how to open an account online in Malaysia, without leaving your home.

Looking to open an HSBC Global account in Malaysia? We reviewed the features, currencies, fees and more.

Revolut isn’t currently available for Malaysians. We cover the best non-bank providers similar to Revolut.