How to make money online and from home: For beginners, students and more (MY)

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

Open to residents with a registered address in the following countries: United States of America, Singapore, Malaysia, Australia or New Zealand.

Thinking of getting the Boost e-wallet in Malaysia but not sure if it’s the right option for you? Read on, as we’ve put together a handy guide covering everything you need to know.

We’ll walk you through how the Boost e-wallet works and give you the lowdown on features, benefits and merchants you can use it with. Plus, we can help you get started, by showing you how to top up your Boost e-wallet for the first time.

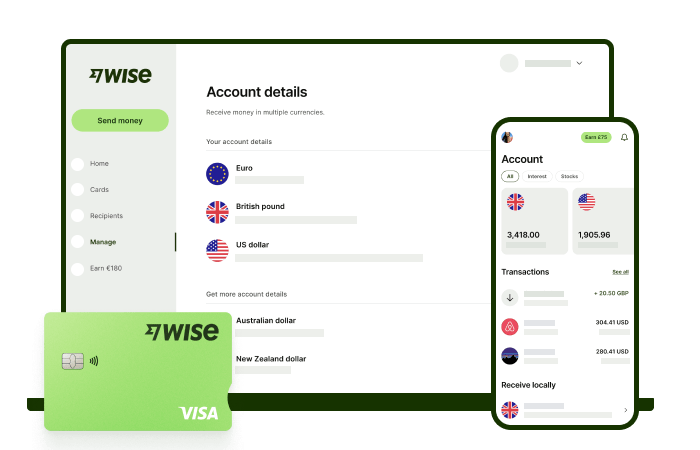

Before we move on, a handy tip to help you save money when shopping and spending internationally. Get the Wise account and Wise international debit card so you can shop online and in 150+ countries with the mid-market exchange rate and low, transparent fees.

But more on that later. For now, let’s get back to the Boost e-wallet.

| Table of contents |

|---|

The Boost e-wallet is an electronic money app for shopping and transferring money. It’s a prepaid wallet though, so you’ll need to top it up with ‘credit’ before you can use it.

You can use your Boost e-wallet to scan and pay at merchant touchpoints¹ throughout Malaysia. If you want, you can also benefit from the Boost PayFlex service which provides flexible finance plans to buy now and pay later in convenient instalments.

Using your Boost wallet you also have the option to pay bills, send money to friends, pay for transport and shop online.

As a Boost e-wallet user, you can look forward to the following features:

You’ll also earn rewards through the BoostUP Rewards Programme. This includes earning Boost Stars on your spending and top ups. Once you've earned enough Stars, you'll have the opportunity to rank up and earn even more Boost Stars when you do.

You can use your earned Boost Stars to redeem rewards from the BoostUP catalogue. This includes food vouchers, household appliances, game credits, gadgets and much more. Alternatively, you can exchange them for entries in the BoostUP Pick & Win competition taking place every month².

The list of brands and stores you can use Boost at in Malaysia is pretty extensive, and includes restaurants, grocery stores, fashion retailers, health and beauty brands, petrol stations and many more.

You’ll find them in the Boost marketplace within the app, and will have a choice to either Scan & Go, order to collect or order for delivery (depending on the merchant).

There are few limits and restrictions you need to know about with Boost. It all depends on whether you’re on the basic or premium plan, as this can affect everything from wallet size to your transaction limits. Let’s take a look³:

| Basic Plan | Premium Plan | Premium 10K | |

|---|---|---|---|

| Maximum wallet size | RM 1,000 | RM 4,999 | RM 10,000 |

| Monthly transaction limit | RM 2,000 | RM 4,999 | RM 9,999 |

| Annual transaction limit | RM 24,000 | RM 59,999 | RM 119,988 |

| Sending money between Boost e-wallets | Unavailable | Available | Available |

👀 Did you know that Boost has a linked prepaid debit card? See how the Boost Beyond card compares against the Wise card

You should find it pretty straightforward to use Boost. It all starts with downloading the Boost app and creating your account. We’ll run through how to do this next, along with how to top up and start using Boost for shopping and spending.

To join Boost, you’ll need to do the following⁴:

You’ll start off with a Basic account, but you can upgrade to a Premium account by completing an identity verification process. This includes uploading photos of ID documents, and recording a selfie video⁵.

To start using Boost, you’ll need to make your first top up. This means choosing one of the available Boost payment methods, which include credit/debit card and bank account.

To add a new payment method, follow these steps⁶:

Now you’re ready to top up. Simply tap the wallet icon in the Boost App, select your preferred payment method and key in the amount you want to add to your wallet.

You’ve got the Boost app, registered an account and made your first top up. Now you’re ready to start spending.

If you’d like to use your Boost e-wallet to Scan & Pay at a retail store, all you need to do is scan the merchant’s QR code at the checkout. Alternatively, you can get the merchant to scan the QR code in your Boost app¹. You’ll have the option to do either when you tap on ‘Scan & Pay’ in the app, selecting either ‘I Scan Them’ or ‘They Scan Me’. Either way should be quick and easy.

Cut down the costs of spending when you travel and shop internationally - get a Wise debit card.

You can open a Wise account online or in the Wise app, top up in ringgit and spend globally in 150+ countries with the mid-market exchange rate and low, transparent conversion fees from just 0.33%.

Choose to convert your MYR to the currency you need for your purchase in your account, and spend your foreign currency with no extra fees on and offline. Or leave your money in ringgit and let the card do the conversion for you at the point of purchase. In either case, conversion costs can be as low as 0.33% - so you can get even more from your online shop.

Need cash? Make up to 2 withdrawals globally, to the value of 1,000 MYR every month, before paying a Wise withdrawal fee.

| Spend freely online or while travelling, studying or working abroad, without worrying about poor exchange rates: |

|---|

| Get the Wise card today! |

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

If you need help, you can contact customer support through one of the following options⁷:

Unfortunately, there doesn’t appear to be a Boost customer service contact number for Malaysia.

To terminate your Boost account, you can email Boost using the address above and provide the following information:

You can use your Boost e-wallet to send money to a bank account if the recipient uses the Duitnow system. In this case, as long as you’re a Boost premium level customer, you can use your Boost account to send money from your e-wallet balance to your recipient’s Duitnow bank account.

Boost digital bank offers a pretty comprehensive - and growing - list of features and services. After reading this guide, you should be all clued up on the benefits, features and limits of the Boost e-wallet in Malaysia. We’ve covered everything from Boost merchants and Scan & Pay to the BoostUp reward scheme.

This should help you work out whether the Boost e-wallet is the right option for you, and sign up for a Boost wallet account if so.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

Learn more about the RHB Multi Currency Debit card in Malaysia, including benefits, requirements, fees and whether it’s worth getting.

We compared the top Affin Bank cards in Malaysia. Whether you’re looking for points, fees or rewards on travel spend, find out which credit card is for you.

Learn more about Revolut and Wise, including exchange rate comparisons, and whether the product can be used in Malaysia,

Want to know how much transaction fees you’re paying when using your Malaysian credit card overseas? Learn more about the types of fees and how to avoid them.

Learn more about the Maybank World Elite Mastercard in Malaysia, including benefits, requirements, fees and whether it’s worth getting.