How to Open a Maybank Saving Account Online in 2026

Thinking of opening a Maybank savings account online? Check out our 2026 guide on how to do so, from the easiest MAE app steps to hidden fees!

GrabPay¹ is a leading e-wallet in Malaysia, offering customers quick, convenient mobile payments for everything from rides to food to in-store transactions. If you’re wondering: how do you pay with Grab? This guide is for you.

We’ll cover all you need to know about Grabpay e-wallet, including how to use GrabPay, how to set up GrabPay wallet in the first place, and a quick comparison with a couple of alternative options to help you decide if the GrabPay wallet is right for you.

| Table of contents |

|---|

Let’s start with the basics. GrabPay is a popular e-wallet in Malaysia and the broader Southeast Asia region. As an e-wallet, GrabPay lets customers make mobile payments conveniently - which means there’s no need to fumble for change or even carry around your wallet full of cards.

Simply get the Grab app, top up your GrabPay wallet or add a bank card, and get started. You’ll also earn Grab rewards for all your purchases, which you can cash in later as discounts against future purchases.

On to the key question: what can GrabPay be used for? - Here’s a rundown:

So - where can I use GrabPay in Malaysia? Use GrabPay to pay in person in restaurants, convenience stores, petrol stations, pharmacies and when grocery shopping². And you’ll earn Grab rewards on everything you spend.

As the world has moved more and more to contactless payments, the list of places you can use GrabPay has grown and grown. You can use GrabPay in Burger King if you’re craving a burger. Or if chicken is more your thing - use your GrabPay e-wallet to pay in KFC.

Other popular stores accepting GrabPay wallet payments include MyNews, Tesco, Guardian, Watsons, McDonald’s, Mr.D.I.Y and SenHeng³.

Yes. GrabPay is offered as a payment option with plenty of online retailers - in fact, over 700 merchants are listed on the GrabPay directory, giving you lots of choice⁴.

However, if you’re wondering how to pay Lazada⁵ using GrabPay or asking the question: can I pay Shopee⁶ with GrabPay - unfortunately you’re going to be disappointed. Direct payments from your GrabPay eWallet aren’t supported by either Shopee or Lazada at the time of writing - but it’s worth checking in with GrabPay’s list of approved merchants in case they’re added in future.

In the meantime, if you’re shopping overseas with Shopee, Lazada, or any other ecommerce store, check out the Wise multi-currency account and card as a smart way to pay - and save money at the same time. You’ll be able to use your Wise card to pay online with merchants based anywhere in the world - with currency conversion which uses the real mid-market exchange rate. That means you ditch the bumped up exchange rates used by banks, cut the foreign transaction fees added by most cards - and pay a low, transparent fee instead.

To set up your GrabPay wallet you’ll need to take the following basic steps:

GrabPay wallets also give the opportunity to add an auto top-up, so you’ll always have a ready balance in your account. Just select the auto top-up option from within your wallet on the app, choose the minimum balance you want to keep in your account, and Grab will automatically pull funds from your linked card whenever your balance falls below this number. Easy.

When you set up your GrabPay e-wallet you’ll be offered the opportunity to top up your wallet manually, or add a linked credit or debit card. You can also add the auto top-up feature so your Grab balance won’t ever fall below a minimum you’ve set in the app.

If you’re using a Grab service - Grab rides or Grab Food, for example, you’ll just need to order as normal, and the payment will be deducted either from your linked card or the GrabPay balance in your wallet.

If you’re paying in a store, you’ll need to scan the merchant’s QR code, with the payment being deducted from your linked card or GrabPay balance.

And if you’re paying for an online purchase, simply select GrabPay when it’s offered in the merchant’s checkout, and follow the on-screen prompts to pay with Grab. It’s easy - and intuitive to use, even from the first time.

Here’s how to top up your Grab wallet:

GrabPay isn’t the only e-wallet available in Malaysia. Which wallet is right for you depends a lot on how you expect to use it. In many cases, it’s smart to have more than one e-wallet to hand, so you can always choose the provider which offers the best deal on the specific purchase you’re making.

To help you decide which e-wallet might work for you, let’s take a quick look at how GrabPay measures up against a couple of other wallets available in Malaysia:

| GrabPay | Touch ‘n Go⁷ | Wise | |

|---|---|---|---|

| Currencies available | MYR only | MYR only - make foreign remittances via AliPay | 40+ currencies |

| Foreign transaction fees | If you use GrabPay internationally, a currency conversion fee may apply | Foreign transactions use the AliPay exchange rate⁸ | Free to spend any currency you hold using your Wise card |

| Shop online | Yes - selected merchants | Yes | Yes - anywhere cards are accepted |

| Shop in person | Yes - selected merchants | Yes - selected merchants | Yes- anywhere cards are accepted |

| Pay on Lazada | No direct payment link | Yes | Yes |

| Pay on Shopee | No direct payment link | Not available | Yes |

| Send payments to others | Yes - recipient needs a Grab account | Yes | Yes - recipient does not need a Wise account |

| Rewards | Yes | Yes | Discounts from selected merchants are available |

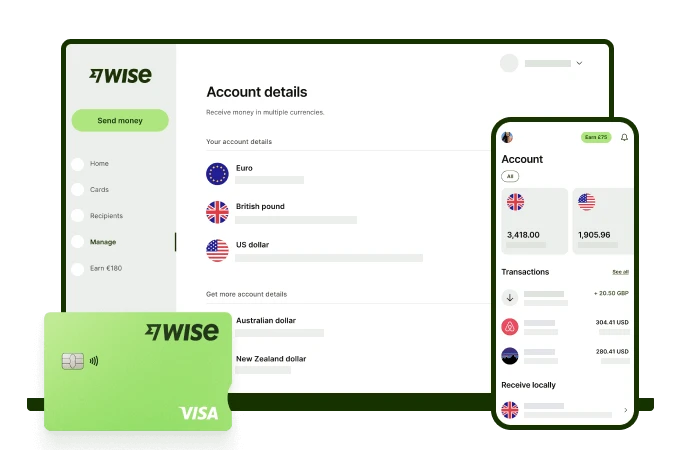

As you can see, each of these top e-wallets has its own features - but if you’re planning to travel or shop abroad you could be better off with the Wise multi-currency account and card.

While GrabPay only operates using MYR, Wise lets you hold dozens of currencies all in a free account you can manage online or using your smartphone. Get your Wise debit card to spend online and in person - and make cash withdrawals all over the world. Add your card to Google Pay for mobile payments - and if you’re spending in a foreign currency you’ll get the mid-market exchange rate every time, with no markup and no hidden fees. Easy.

Shop online cheaper with Wise 🚀

You can spend your GrabPay balance only by making Grab transactions - either paying merchants or paying with DuitNow QR. It's not possible to withdraw money directly from your Grab balance to your bank account, refunds can be issued only when your account is deactivated or if your top-up had a technical error. You can reach out to Grab support when this happens.

Upgrade your GrabPay wallet to a premium account by completing a verification step for security purposes. This usually requires you to enter your personal details, and upload a selfie with your government issued ID document, to confirm your document matches your image.

Sources:

Sources checked on 26.04.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of opening a Maybank savings account online? Check out our 2026 guide on how to do so, from the easiest MAE app steps to hidden fees!

Is the Maybank KrisFlyer Platinum actually worth it for 2026? Here's a breakdown of lounge access, miles rate, and how to save on foreign transactions.

Is Ryt Bank's interest really worth it for Malaysians? Compare the benefits and see how using Wise alongside your account can help you avoid hidden fees.

A guide to Maybank PayWave activation. We explain the 2026 security cooling period, contactless limits, and how to use Wise to avoid bank fees abroad.

Can you open a Public Bank account online? See which steps you can do from home, why a branch visit is likely, and how Wise offers a digital alternative.

A guide on Ryt vs GXBank and which is the best digital bank for 2026. Find out who wins on interest and how Wise can help you no matter which bank you pick.