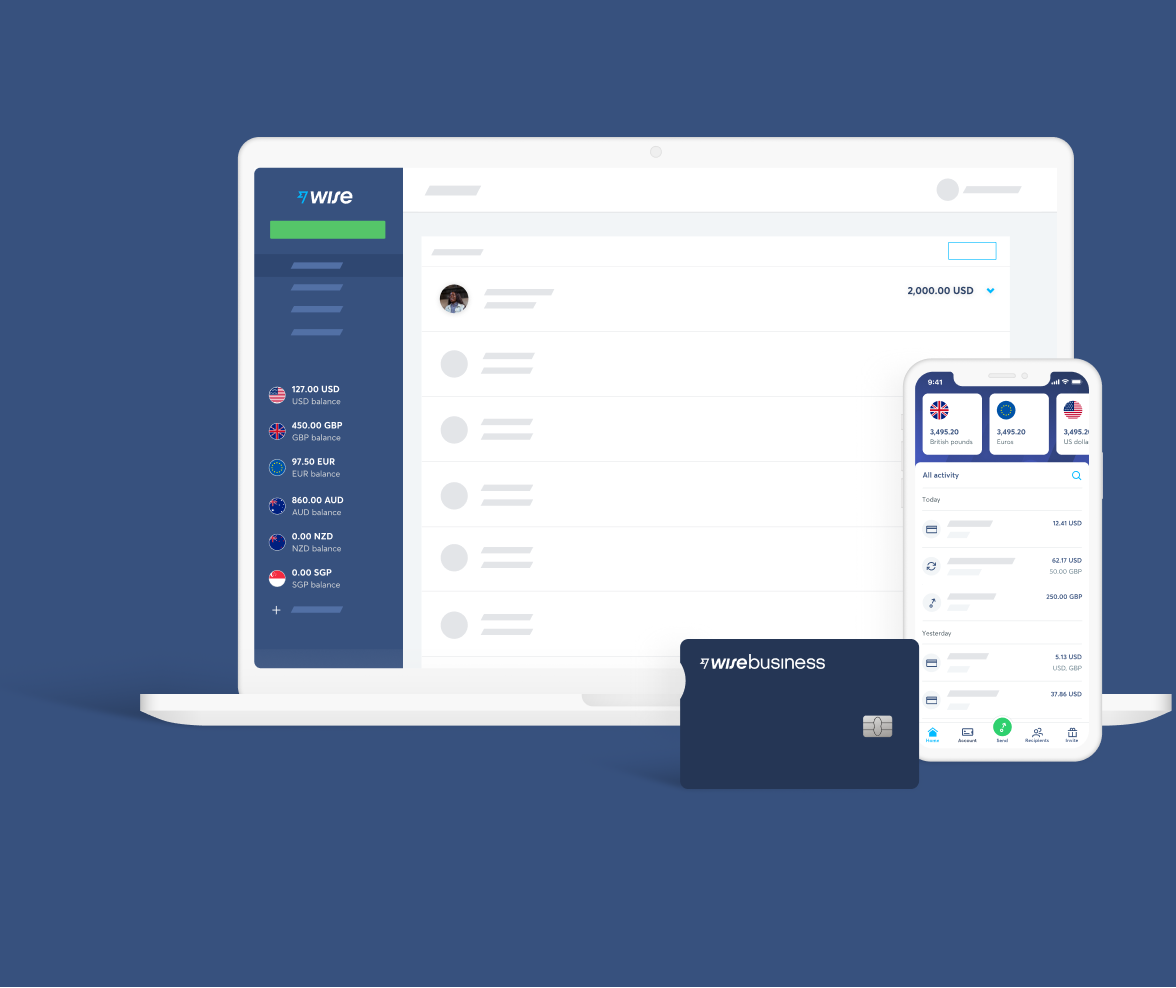

Multi-currency banking without the bank

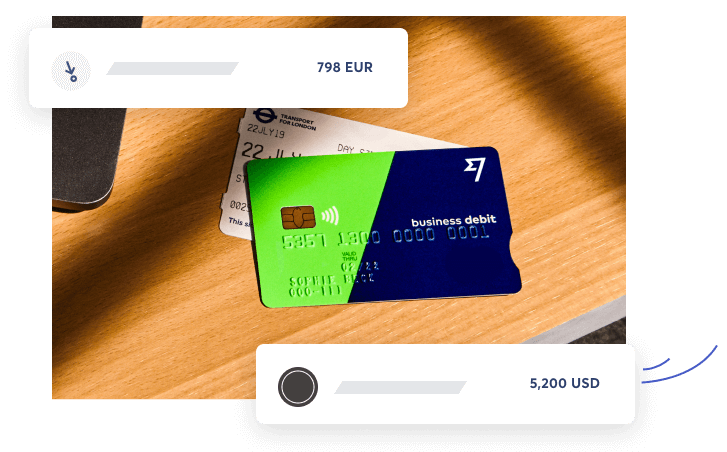

The Wise debit Mastercard® is issued by TransferWise Ltd under license by Mastercard International Inc. Mastercard is a registered trademark, and the circles design on the card is a trademark of Mastercard International Incorporated.

Get alternative local bank accounts from home.

Get a UK account number, Euro IBAN, US routing number, Australian BSB code, and more. Use them like you would any bank account numbers.

Set them up in minutes — no local address needed — and manage activity right from your phone.

Receive payments, set up direct debits, and more.

Share your account details with people who are paying you, or use them to set up direct debit.

They make your Wise Business account act like a bank account in the UK, US, Eurozone, Australia, and more.

Spend with your debit card in any currency.

Pay expenses online or in-store without foreign transaction fees. For way cheaper than other cards.

Get your card info the second you order, plus cards for your team. So you can track employee spending from wherever you all are.

Sell in any currency on Shopify, Stripe, and more.

Use your account details like you would a bank account to withdraw profit from sales platforms in any currency.

Avoid recipient and high conversion fees — while expanding to more customers.

Give your team access to your account.

Add your accountant as a viewer, your finance team as payers, or your co-founder as an admin — and work together as a team. You have complete control over who does what.

Connect your Wise Business account with platforms like Xero, FreeAgent, and QuickBooks.

Move money between offices and subsidiaries instantly.

No need to open a bank account for your offices and subsidiaries in other countries. Hold and convert money in seconds, and make payments right from Wise Business.

You can sync activity by currency to accounting platforms like Xero, QuickBooks, and FreeAgent.

Get these local account details

These are the account details you can share with others to receive money. Anyone can use these to pay you just like they'd pay a local.

GBPBritish Pound

Get your own Account Number and Sort Code.

EUREuro

Get your own SWIFT/BIC and IBAN details.

USDUS Dollar

Get your own Routing (ABA) and Account Number.

AUDAustralian Dollar

Get your own BSB Code and Account Number.

NZDNew Zealand Dollar

Get your own Account Number.

SGDSingapore Dollar

Get your own Account Number.

RONRomanian Leu

Get your own SWIFT/BIC and IBAN details. Currently only available to residents of the UK and Romania.

CADCanadian Dollar

Get your own Institution number, Transit number, and Account number.

HUFHungarian Forint

Get your own Account Number.

TRYTurkish Lira

Get your own Bank name and IBAN.

Hold and convert money

You can hold and convert money in 40+ currencies. It only takes a few seconds to open a new account in the currency you need.

GBPBritish Pound

AUDAustralian Dollar

AEDUnited Arab Emirates Dirham

BDTBangladeshi Taka

BWPBotswana Pula

BGNBulgarian Lev

CHFSwiss Franc

CLPChilean Peso

CNYChinese Yuan

CRCCosta Rican Colón

CZKCzech Koruna

DKKDanish Krone

EGPEgyptian Pound

GELGeorgian Lari

GHSGhanaian Cedi

HKDHong Kong Dollar

Send money to 73 countries

You can send money in your Wise account to any of the currencies we support.

United Arab Emirates Dirham

Australian Dollar

Bangladeshi Taka

Bulgarian Lev

Brazilian Real

Botswana Pula

Canadian Dollar

Swiss Franc

Chilean Peso

Chinese Yuan

Costa Rican Colón

Czech Koruna

Danish Krone

Egyptian Pound

Euro

British Pound

Georgian Lari

Ghanaian Cedi

Hong Kong Dollar

Hungarian Forint

Indonesian Rupiah

Israeli Shekel

Indian Rupee

Japanese Yen

Kenyan Shilling

South Korean Won

Sri Lankan Rupee

Moroccan Dirham

Mexican Peso

Malaysian Ringgit

Norwegian Krone

Nigerian Naira

Nepalese Rupee

New Zealand Dollar

Philippine Peso

Pakistani Rupee

Polish Zloty

Romanian Leu

Swedish Krona

Singapore Dollar

Thai Baht

Turkish Lira

Tanzanian Shilling

Ukrainian Hryvnia

Ugandan Shilling

Uruguayan Peso

US Dollar

Vietnamese Dong

West African CFA Franc

South African Rand

Zambian kwacha

FAQs

Get the only account you need to go global

Open your account today