To the Wise community,

This is our report to you. You have made Wise possible. You keep our lights on, so that we can make money move faster and cheaper for you and bring it to all the next generations after you. The bigger our community, the faster and cheaper Wise becomes.

Fees: why does sending money still cost more than sending an email?

When we look back from the far future to 2018, one thing we’ll say is, “Remember, this was when we started systematically dropping prices.” We’re committed to always charging as little as we can, and lowering the costs of sending money not just for our community, but for the whole industry through our API. Growing volumes on the platform let us to drive the fees down.

The first wave of price changes were the trickiest to communicate, because we also had to change the structure of the way we charge.

The cost of moving money for Wise splits down into

- Cost per transaction such as processing payouts

- Cost per volume like liquidity costs

The most transparent way to price is to follow the same structure:

a small transaction fee + a transparent percentage fee

We’ve rolled out new fees under this structure to users in the US, Australia, New Zealand, Japan, Hong Kong. More than 100 routes became cheaper. Most significantly, payments smaller than £200 and larger than £1000 were as much as 30% cheaper.

We believe that every customer should pay for exactly the service they get — meaning no cross-subsidisation between different routes. It sounds simple, but it’s actually a radical approach and meant that on some routes where we’d mis-estimated the costs in the past we had to increase fees. That was a hard decision to make, and we’re working hard to bring costs down for those customers, too.

We’re committed long-term to continuing this approach of lowering prices as much as we can, as soon as we can. Perhaps most inspiring was to see our team in Singapore doing their second wave of price changes. And, given the new structure, it was a blanket price drop across the board.

The price of money transfers should drop to zero, but it happens only as fast as the costs move to zero. We’re excited to be the first non-bank payment services company in the UK to connect directly to Bank of England. We’ve bypassed the commercial bank middlemen completely.

I hope that the other thing we’ll be able to say looking back is, “This was the time when fee transparency first started getting traction with regulators.”

It’s wishful thinking that the cracks we see today will bring down the walls of hidden fees, but the Barclays margin disclosures, the nudge unit report by UK cabinet and the EU commissioner’s proposed legislation are the biggest steps forward we’ve seen since we demonstrated against hidden fees in our underwear.

Speed: why can’t money move as fast as email?

Progress on speed was less visible this quarter. The biggest impact was for Wells Fargo users in the US — they can now receive payments in a few hours instead of next day.

We continued rolling out Wise Instant. Now, money sent from a bank card anywhere in the world will arrive in any UK bank account in less than 20 seconds.

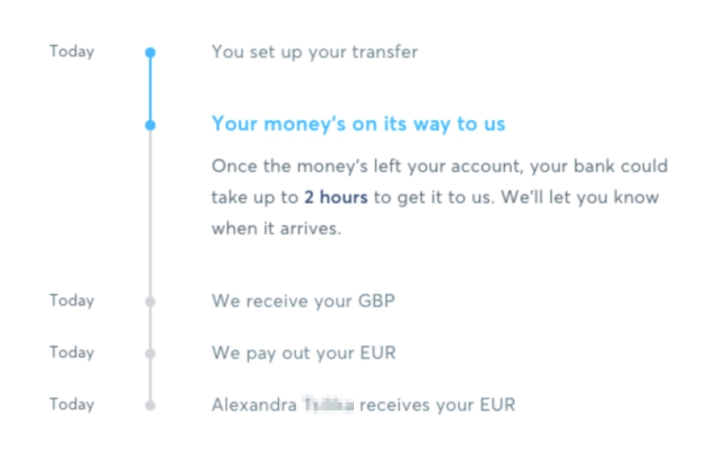

Most of the work here has gone into the speed “infrastructure.” You may remember how annoying the traditional SWIFT-based infrastructure was. For days or weeks you didn’t know where your money was. Not on Wise. Where we can’t deliver the money instantly we aim to predict when it will arrive on the recipient’s bank account with the accuracy of 2 hours.

It’s not easy to get right across 20,000 banks in 47 currency zones. Last quarter we achieved this level of accuracy on 17 out of 47 currencies.

Showing when your money will arrive on the other side still doesn’t answer the question “Where is my money?” We created a feature we call money tracker, which should answer that question every step of the way.

We now have over 3 million customers around the world. Our operating teams, which help our community with their questions and onboard new customers, were under heavy load. We've been lucky to bring on nearly 100 new Wisers this quarter to help out, but had to keep some of you waiting for a response while we were at it. That hasn't been okay and we know it, so we’re continuing to hire help.

Convenience and coverage

We launched the borderless multi-country account in May 2017. Users can hold 42 currencies, switch between them instantly 24/7 at the real mid-market rate and our ever-diminishing conversion fees. Freelancers and businesses get local account numbers in the US, UK, Germany and Australia to begin with.

In Europe we've been trialling a clever debit card attached to the borderless account. For example, it uses your euro balance when in France, your dollar balance when Stateside. And, if you don't have the balance in the right currency, instantly converts from another balance at the mid-market exchange rate and the same low Wise fees.

We're overwhelmed by the demand we’re seeing. Beyond businesses and freelancers, who are now getting paid abroad like locals, we have people who've realised they don't need to use Wise to ferry money between their 2 or more bank accounts — they can get paid and spend directly through the borderless account. Total deposits into borderless accounts just passed £1bn.

Transfers from Hong Kong went live, as did Nepal and Egypt as destinations. Our goal is to open up Wise to every person, regardless where they live. Yet we carefully balance opening new routes with making existing ones better. Last quarter we opened up USD to the rest of the world. Now you can use Wise to convert dollars residing anywhere in the world and we're also able to deliver dollars where you need them outside of the US.

Team

Wise can only achieve its mission at the speed of the 1000+ people building and operating it. With more brains in the room and hands on the keyboard we can build faster, continue to create a world class experience, and bring the revolution of money without borders to people and businesses around the world.

Yes, we want help. We're looking to fill ~200 positions across 133 roles in our 8 offices in London, Tallinn, Budapest, Tampa, Singapore, Cherkasy, Tokyo, New York.

Take part of the next phase in our mission.

Onwards.

Kristo

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.