Banks and brokers have been misleading us about the true cost of making international payments for decades. We think that needs to change, and today we’ve seen an important step forwards.

In January we wrote to the CEOs of the major UK banks asking them to voluntarily uphold the EU’s second Directive on Payment Services (PSD2). The directive mandates transparency in foreign currency transactions and states that the customer must know the real cost of transferring money abroad - far removed from the customer experience today.

We didn’t have much luck. Most of the banks either didn’t reply or sent one line responses. So you can imagine our surprise when we spotted an addition to Barclays online banking.

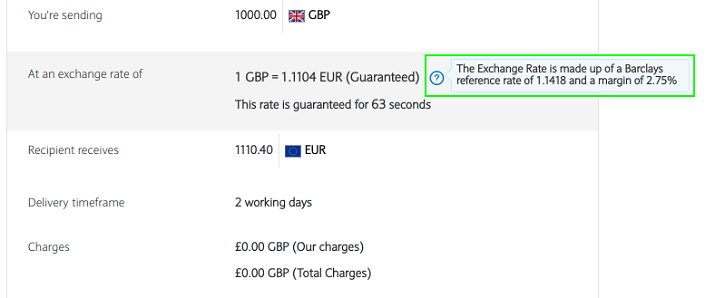

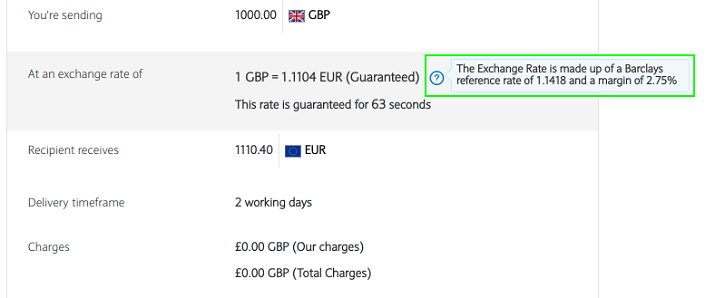

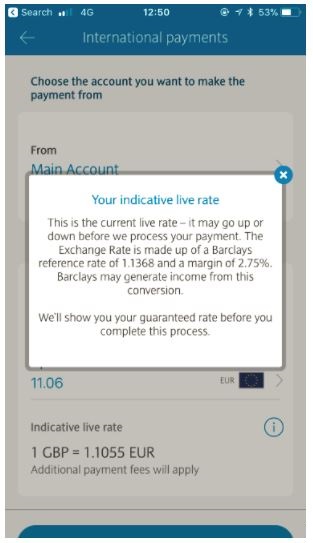

Not only has Barclays switched to a live exchange rate, the bank has explained that it adds a margin of 2.75% to that rate and that they ‘may’ make money on that. It’s a momentous step, the first time a bank has admitted to customers that they take a fee in the exchange rate as part of the payment flow. Nice one Barclays.

Is this really transparency?

It’s a vital step forward, but it doesn’t equal complete transparency. The message is only available if you choose to click for extra information. Moreover, when you click through to the payments summary, Barclays states the fee for the transaction is £0 if you’re happy with a slower delivery time.

Huh? They just told us they make money in the exchange rate. In the first screenshot, for a £1,000 into euro transaction with a standard Barclays account, the rate mark-up equates to a fee of over €30.

We know from YouGov research that almost three quarters of people who regularly make international transfers can’t figure out the cost of a transaction by comparing exchange rates. The fee has to be stated separately to avoid confusion.

What’s next?

Barclays is showing the banking sector the way forward. The FCA could make an even bigger difference by mandating that others in the sector follow suit.

But even that is not enough. We’re calling on Barclays to take their efforts further and quantify their exchange rate mark-up as an upfront fee. With a host of fintech current accounts gathering momentum, and the upcoming launch of our own Borderless account and debit card, 2018 will be the year we see strides in consumer uptake of fintech. Barclays, there has never been a better time to take the lead in delivering transparency.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.