10 Best Business Bank Accounts for Startups

Read our essential guide to the best business bank accounts for startups in the UK, comparing all of the most popular providers

Not happy with your current bank? Perhaps you need more advanced services from a business bank account, or your head’s been turned with money-saving offers from another bank.

Whichever is the case, you can usually switch your business bank account using the Current Account Switch Service. This is a free service suitable for businesses with a turnover of less than £6.5 million and fewer than 50 employees. Using the service, you should be able to switch over to a new business bank account in around 7 working days.¹

In this guide, we’ll cover a few of the main things you should be thinking about before switching business bank accounts. Plus, what to look for in a new bank. We’ll also show you how a multi-currency account could save you money on international transactions.

Changing your business bank account is far easier and less disruptive than it used to be, partly thanks to schemes like the Current Account Switch Service.

But this doesn’t mean you shouldn’t think carefully before switching banks. It could mean a major change for the way your business handles its everyday finances. You need to be confident that you’re making the right decision before going ahead.

Here are just a few of the questions to ask yourself:

Does the new bank understand your needs, and does it already cater to businesses like yours?

What’s their customer service record like?

Are there introductory offers you can take advantage of? And once these special offers end, will the account be cheaper or more expensive to run than your existing one?

Will you get additional tools to help you run or grow your business? For example, free accounting software packages, merchant services, specialist business support or access to lending products.

Will you be able to manage your new account in a way that suits your business? For example, online or via a mobile app.

Are there fees for the services your business relies on most? For example, international transfers or cash deposits. If this is your main concern, you could simply try using third party providers like Wise to cut the cost on international payments and take advantage of a multi-currency account.

Is the bank a part of the Current Account Switch Service? If not, opening your new account could be disruptive and time-consuming. You may also have to deal with the new and old banks yourself, whereas the Switch Service handles everything for you.

If you’re determined to switch your business bank account, it’s important to choose the right provider.

Every business is different, so there’s no one-size-fits-all account. You need to think about what’s important to you. Is it low fees, access to tech or specialist support, or the convenience of managing your account on the move? If you’re lucky, you could find a bank that ticks more than one of your must-haves.

But with this in mind, here are just a few of the things to look out for in the ideal business bank account:

Introductory fee-free banking period. Many banks offer this to lure in new customers, and it works. This gives you the freedom to try out the account without paying a monthly fee or transaction charges for potentially up to 18 months. Unless you’re tied in, you can then switch or stay once the introductory period ends.

A straightforward tariff. You don’t want to be trawling through endless small print to find out how much a particular service or transaction will cost you. Look for banks that keep their fee structure simple and easy to understand.

Low fees. Focus on the services you use most, and compare prices with different business bank accounts across the market.

Business support. While convenience, flexibility and low fees are great, you should also be looking for a bank you can build a great relationship with. Look out for providers that offer advice and support on business planning, credit and investment services.

Flexibility. Can you extend your overdraft limit or add on a business credit card? It’s flexible services like this that make a business bank account adaptable to your needs. This could be particularly useful as your business grows.

International payments is one area that is often overlooked by businesses choosing a new bank account. Some may not need to send money overseas right now, while others just assume it’ll be included fee-free as part of the package.

But whether or not your business trades in other countries, it’s always important to check out the situation with international payments when researching banks. Imagine you suddenly need to make an urgent payment abroad, or receive payment from a foreign client.

Most business bank accounts allow you to send and receive international payments. But there’s nearly always a fee involved, and this can be expensive. On top of this, unfavourable exchange rates and currency conversion fees can eat into your money too.

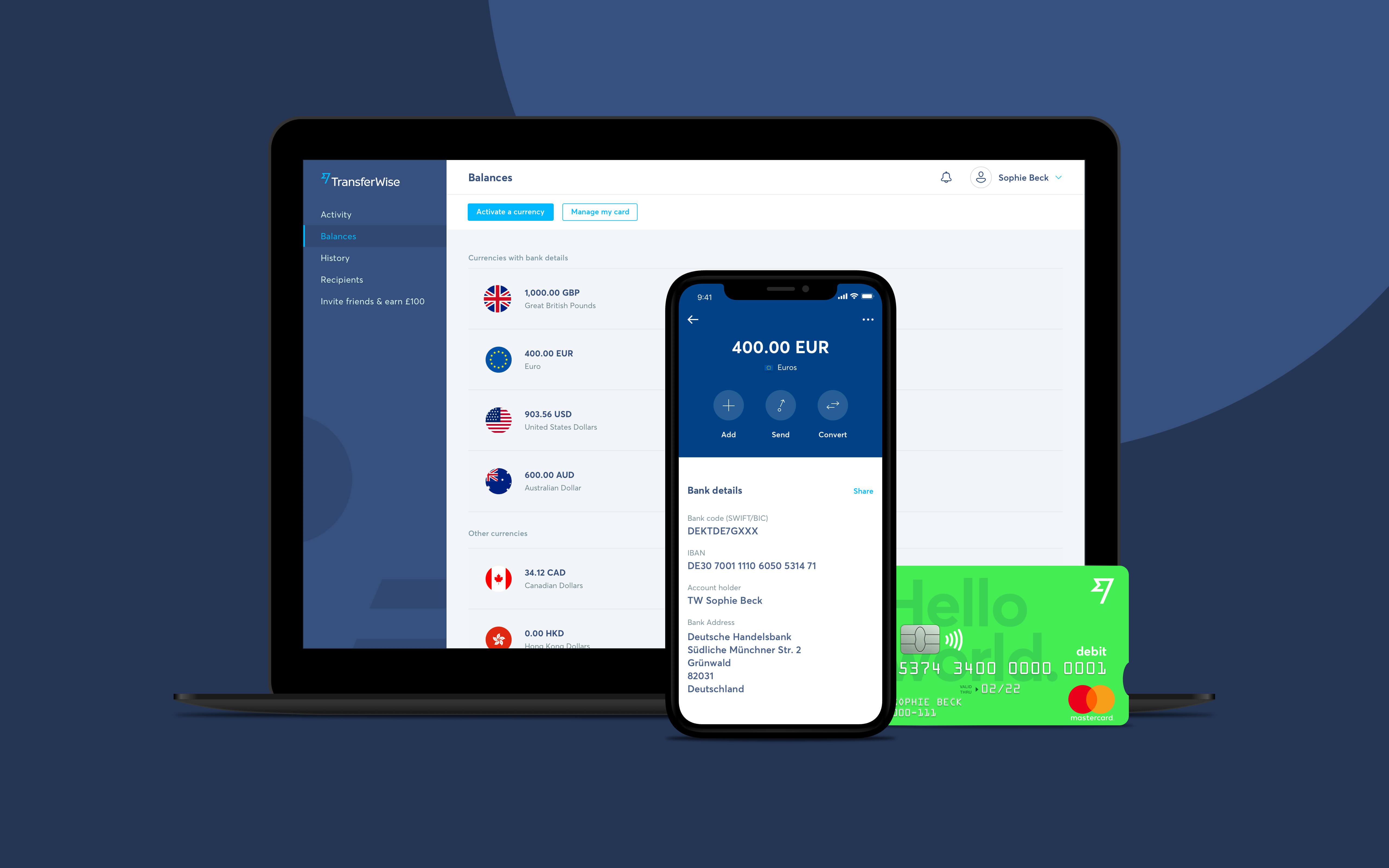

Luckily, there is a better way. Open a Wise Business account and you can send, receive and spend internationally for low fees. Even better, you’re guaranteed the real exchange rate on every transaction.

You may not need it just yet, but a Wise Borderless account is a very handy financial tool for any business to have. You can hold 55+ currencies at once and switch between them when you need to. Invoice like a local and spend like one too, thanks to a Wise debit Mastercard for business.

You can even integrate your account with Xero and quickbooks for an easy way to manage your business finances, and automate payments using the powerful open API.

Ready and raring to switch business bank accounts? After reading this guide, you should have a checklist of the most important things to consider – including what to look for in a new bank account.

Just remember to take your time and focus on what your business really needs. Shiny introductory offers are a great way to save money in the short-term, but they aren’t everything. It could be much better for your business long-term to find a bank you can build a relationship with, which offers tools and services to help you thrive.

Good luck finding your new account!

Sources used:

Sources checked on 26-January 2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our essential guide to the best business bank accounts for startups in the UK, comparing all of the most popular providers

Read our guide to the best online business bank accounts in the UK, including Tide, Starling, Revolut, ANNA and Wise Business.

Discover how to send money from Payoneer to Wise easily. Follow our step-by-step guide to transfer funds securely and save on international transactions.

Read our essential comparison of business bank account fees in the UK, including upfront, monthly and usage charges.

If you’re just starting out on an entrepreneurial journey you need smart ways to manage your money. This probably means you’re looking for the best bank...

Find the best business saving accounts to maximize profits and ensure financial security for your growing business needs.