Best UK business bank accounts for non-residents

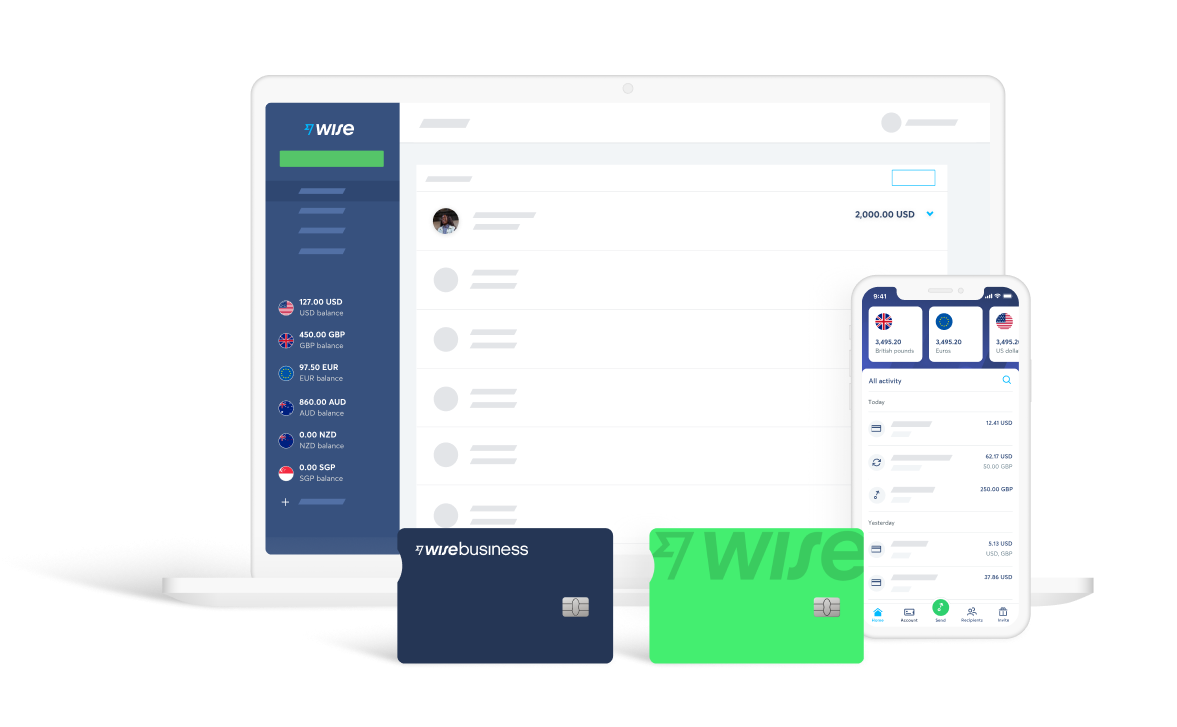

Read our comprehensive guide to the best UK business bank accounts for non-residents, including Wise Business, Revolut, Airwallex and Tide.

When running a business, not all purchases are created equal. Some purchases (such as a company car, equipment, machinery, etc.) provide benefits for a year or more. Other purchases (such as rent, utilities, insurance, etc.) typically provide more short-term benefits.

For example, rent paid monthly enables the business to continue leasing the premises on which it operates for the next subsequent month.

Shorter-term expenditures are classified as revenue expenditures (or operating expenses). On the other hand, expenditures that provide longer-term benefits are referred to as capital expenditures. The distinction between these two is important as the way that they are presented on financial statements for accounting purposes is very different, as we will further delve into over the course of this article.

| 💡💸 Save money on international expenditures with Wise. Find out more! |

|---|

To understand whether to classify an expense as a revenue expenditure, the easiest question to ask is whether it boosts the capability of the company to generate higher revenues. If the answer is yes, then the cost is most likely to be a capital expenditure. If the answer is no, then the cost is likely to be a revenue expenditure.

However, that does not mean that revenue expenditures are in any way less important than capital expenditures. Once a capital expenditure is completed, revenue expenditures are required to be paid to keep the asset running, and help realize its benefits.

| 💡 For example, imagine a company that upgrades its machinery to one that can generate higher output per day. Since this directly boosts the revenue and profit potential of the company, the purchase of the machine is a capital expenditure. |

|---|

Some of the main examples of revenue expenditures include:

Revenue expenditures are recorded on the income statement in the same accounting period that they take place.

If wages of £10,000 are paid out in Year 1, then the business’ income statement for Year 1 should show £10,000 in total wages paid.

Revenue expenditures also help businesses reduce their tax burden in the year. By being subtracted from revenues, they lower the total taxable income for the business. An illustrative example with a sample financial statement is as below.

Business A is an industrial business that had:

As described above, capital expenditure provides benefits for a period of a year or more. Companies that pursue capital expenditures are most often looking to make an investment in their business' operating infrastructure that enables them to scale up and increase profitability.¹

Typically, these purchases follow a similar pattern. There is a large initial cash outflow used to acquire an asset. Thereafter, this asset then provides benefits over its useful life (i.e., the period of time that the asset is in usable condition).²

Some of the major categories of capital expenditures may include the following:

As capital expenditures provide benefits over multiple years, the accounting treatment to ensure accurate recording of financial statements is a little bit more complex than that of revenue expenditures.

The purchase price of capital expenditures made in a year is not recorded on the income statement. Instead, it must be recorded on the cash flow statement as a ‘cash outflow from investing activities’. Next, the balance sheet must also be updated to increase the total amount of assets accordingly.

The impact of the capital expenditure on the income statement is seen in subsequent years when the company records depreciation amounts on total asset value to account for the wear and tear that assets go through over their useful life.

To illustrate the financial statement impact, imagine that a business with no existing fixed assets buys its first piece of machinery worth £10,000 at the end of Year 1 using its existing cash on hand of £15,000. Depreciation occurs at a rate of 20% per year starting from Year 2.

We will start with the cash flow statement. For the sake of simplicity, we will not populate the rest of the cash flow statement to keep the focus only on the capital expenditures. As can be seen, capital expenditures reduce “Cash Flow from Investing” in the cash flow statement in the year they are made.

Next, we move on to the balance sheet. Given that £10,000 of the £15,000 of cash is used to fund the capital expenditure, cash will reduce to £5,000 in the year that the capital expenditure is completed. Equipment will rise by £10,000.

The last step is the income statement. For simplicity’s sake, we have assumed that since the purchase was made at the end of Year 1, there is no depreciation recorded in that year. At a rate of 20%, depreciation starting in Year 2 would be £2,000 per year.

As the owner or manager of an international business, there may be both capital and revenue expenditures that you encounter that a business operating within one jurisdiction may not experience. From a revenue expenditure standpoint, some of these examples include:

| 💡 To easily manage international business expenses, it could save you a lot of time to have a Multi-currency account. |

|---|

Effectively controlling your revenue expenditures as you expand internationally can be a key step to improving your profitability while continuing to grow.

We have discussed some of the common revenue expenditures that businesses experience when they set up international operations.

However, there are simple changes that can be done to realize stronger profits when growing your business beyond borders. One of the expenses that are not as talked about is the concept of making international payments.

💸🌎 Traditional banks charge 2% - 3% FX mark-up when you convert between currencies. On top of that, there’s a Swift fee of £20 - £60 per transfer. When these add up, international payments become expensive. That’s £300 for every £10,000 pounds sent. On top of that, the receiving bank also takes a cut when your recipient receives the money.³

|

|---|

By making the right choices, you can save time and money. Contact our team today to find out how we can assist your growth ambitions internationally!

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Sources:*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our comprehensive guide to the best UK business bank accounts for non-residents, including Wise Business, Revolut, Airwallex and Tide.

Discover how EQ Bank launched international payments in just one month — with 75% arriving instantly* and 70% becoming repeat users.

Learn about the corporate tax system in Ghana, its current rates, how to pay your dues and stay compliant, and best practices.

Learn all about accounts payable turnover including how to calculate the ratio, interpret high vs low ratios, and optimise your payables in our guide.

Learn about the corporate tax system in Uruguay, its current rates, how to pay your dues and stay compliant, and best practices.

Discover what payment reconciliation is, why it matters and how to do it correctly. Our guide covers essential steps, best practices, and common challenges.