Stop typing, start uploading — your shortcut for adding new recipients

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

Our mission is to lower the cost of moving money across borders. We’ve made progress over the last 13 years, bringing our average fee to 0.64% globally. As we develop our infrastructure, improve connections to payment systems, and more people and businesses adopt Wise, we’re able to optimise the costs of moving and managing your money. As our costs come down, we pass these savings to you in lower fees.

We share an update like this every time we make changes to our pricing because we’re committed to two things; transparency, and dropping our fees whenever we can.

You may have seen some of our previous updates while we’ve been making some changes to our fees over the last few months — a series of adjustments between April and August.

Overall the fees are now better for everyone. In April, we lowered fees for Swiss, Danish, Swedish, and Kiwi customers, as well as a good list of destinations.

We then made some bigger structural changes in May to ensure that we don’t need to cross-subsidise costlier payment methods and smaller transfers. This means that you only ever pay for what you use, not what other Wise customers use.

In June we updated you on the impact of those May changes — major routes got cheaper, and there were also a few increases.

Now we’re in August, and we’ve made some further changes. We’ve dropped fees across 14 currencies, made it cheaper to use cards, ACH, and Wire in the US and Canada, and recalibrated our fee structure to make sending larger transfers cheaper. I’ll explain more below.

Here is a summary of changes since August:

People and businesses who send US dollars, Singapore dollars, New Zealand dollars, and send money to places like Brazil, Hong Kong, Romania, and others will now pay less.

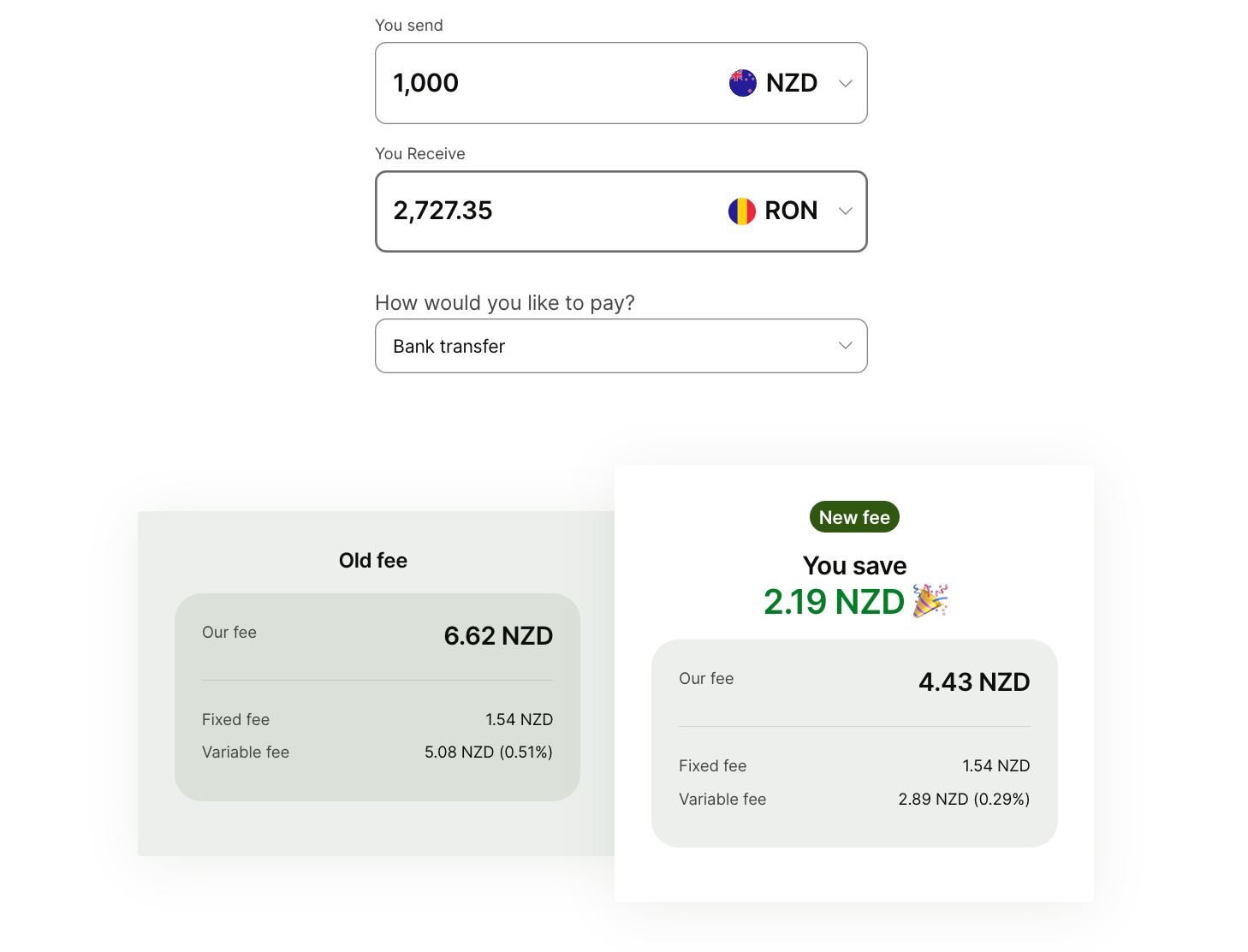

For example, sending 1,000 NZD to RON used to cost 1.54 NZD + 0.51%. This now costs 1.54 NZD + 0.29%. This means the fee for a 1,000 NZD transfer is now 33% cheaper than before.

You can use the calculator on the Wise homepage (or use this link to access the calculator directly here to see how you could benefit from these changes.

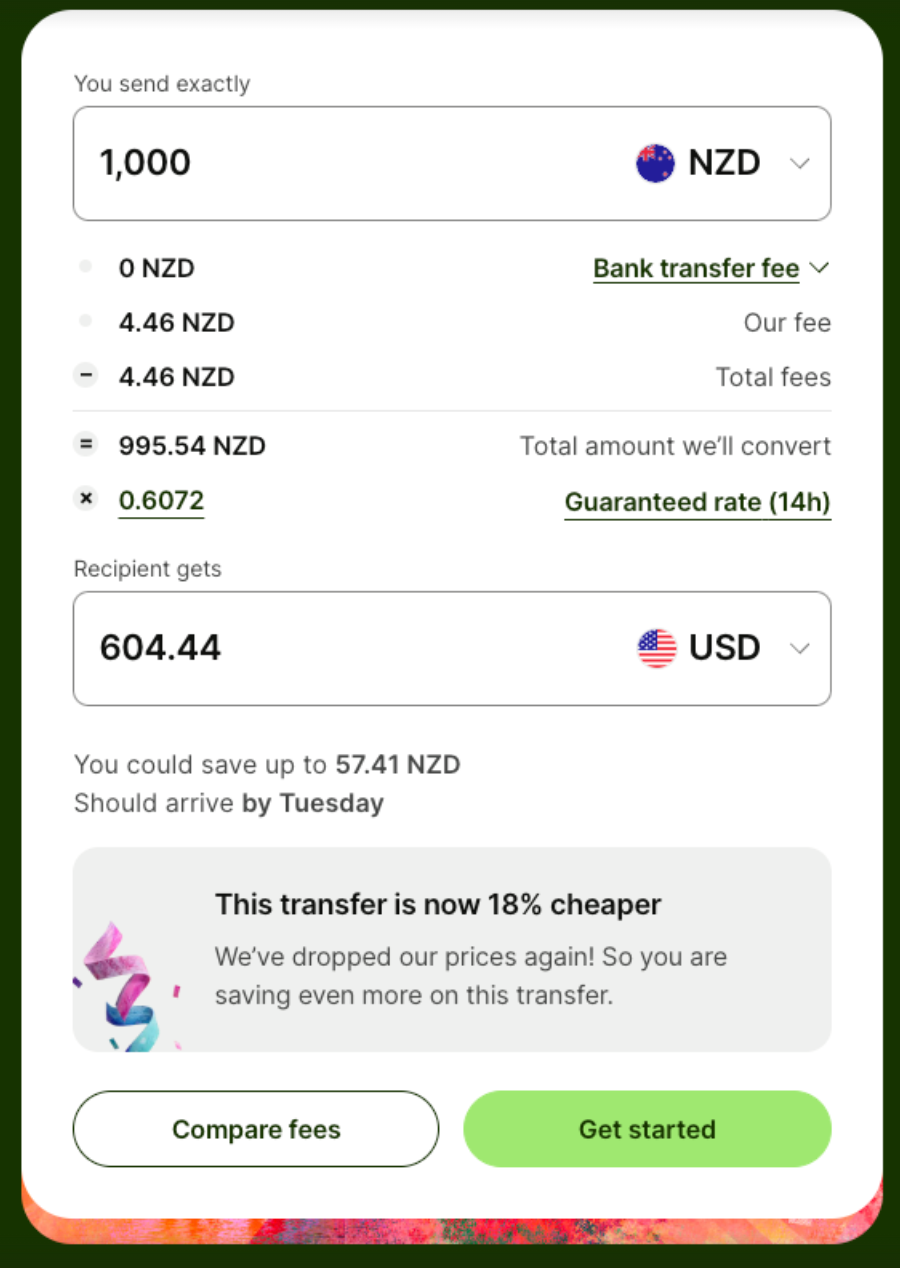

Adding money to your Wise account or funding transfers using bank-issued cards, direct debit (ACH), and Wire transfers all got cheaper.

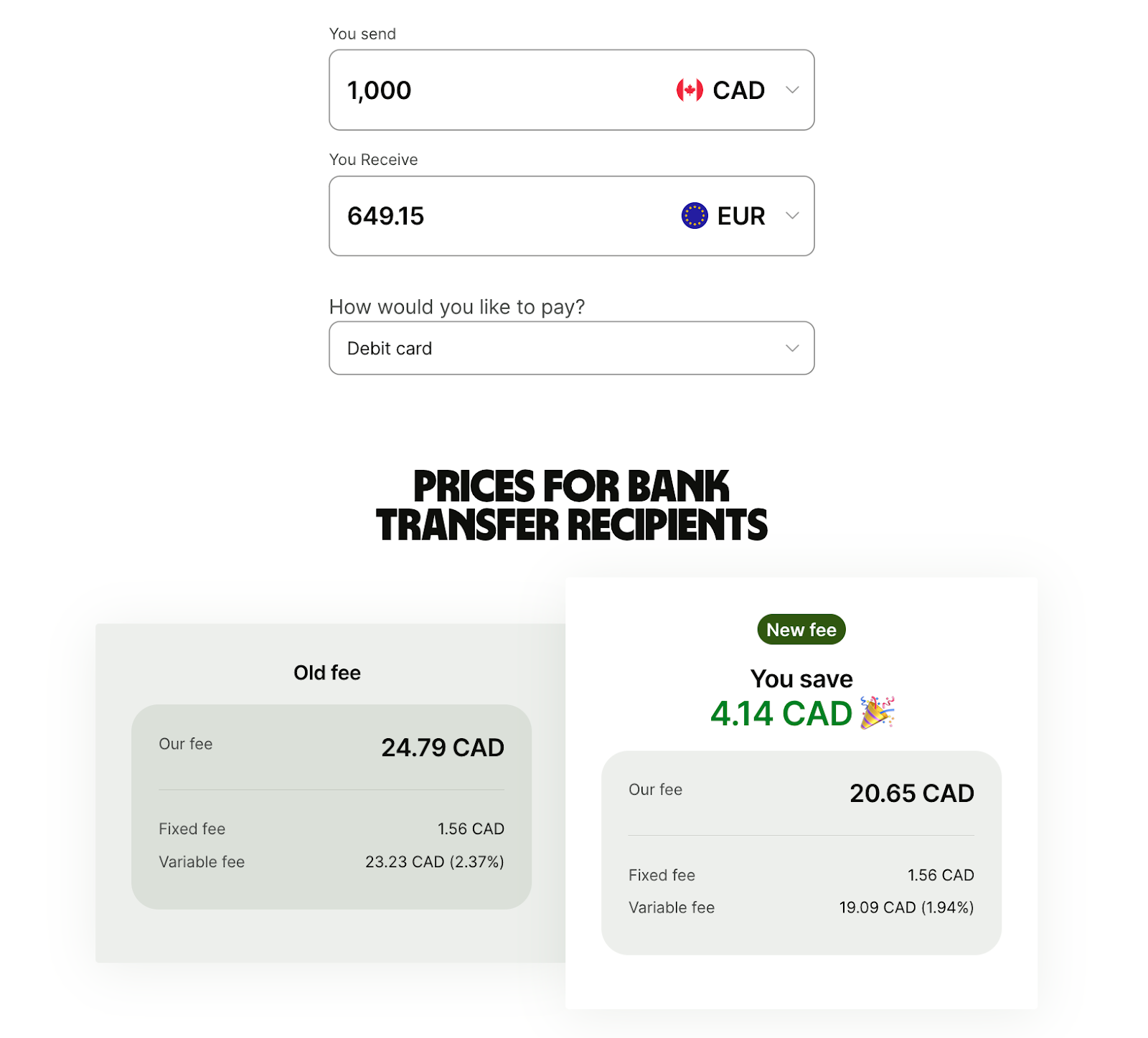

*For example, if you’re in Canada it’s now cheaper to fund your transfer using a bank card. Using your card to fund a transfer of 1,000 CAD to Euro it used to cost 24.79 CAD and will now cost you 20.65 CAD. That’s 18% cheaper than before.

*

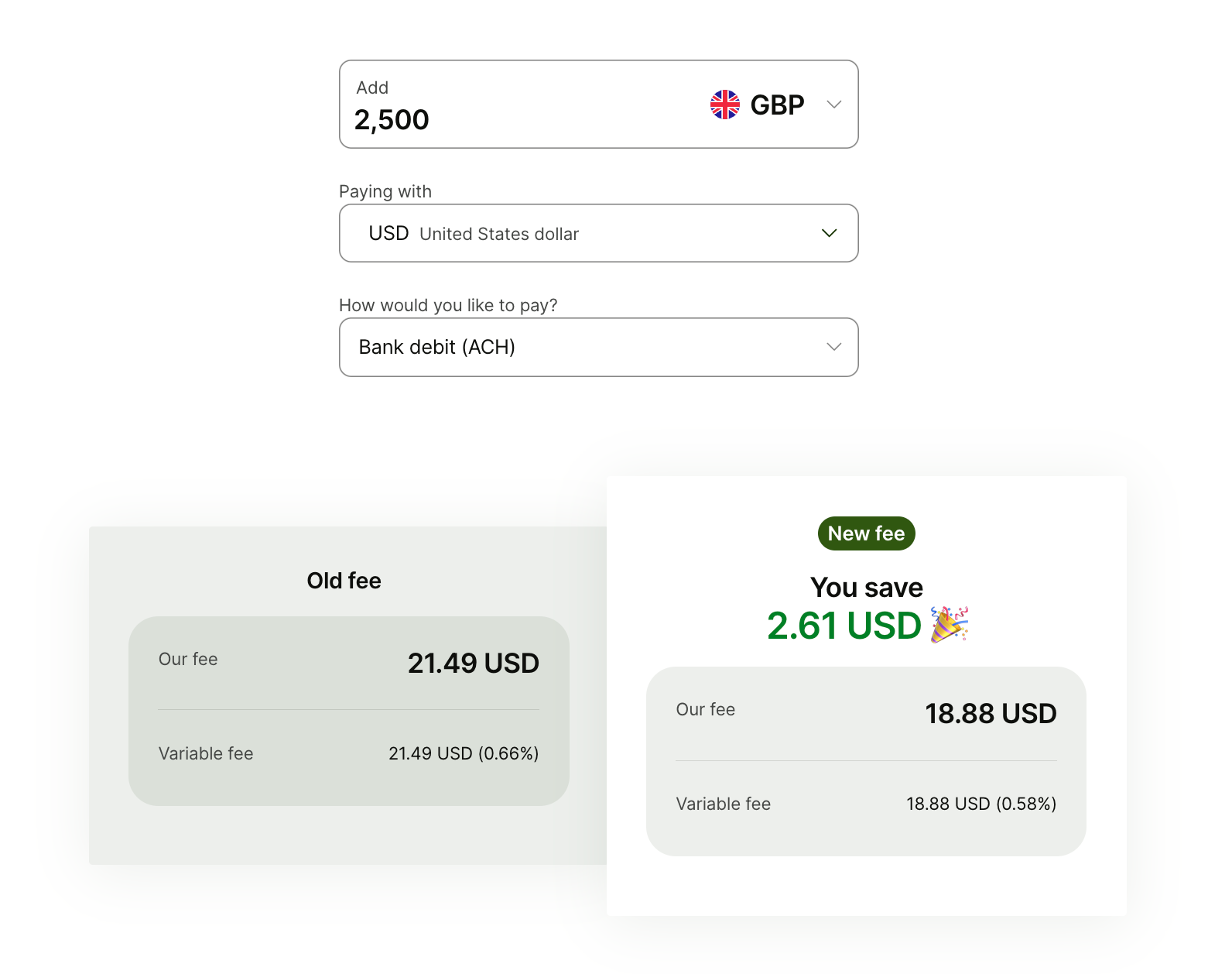

*Or, if you live in the US and want to add money to your GBP balance using ACH, it will now cost you 18.88 USD, instead of 21.49 USD - 13% cheaper than before.

*

You can avoid these types of fees altogether by using your Wise account details to receive money more regularly - like your salary, invoices or regular payments from friends and family. That way you avoid the fees that come with moving money from your other bank to Wise.

The more you send with Wise, the more you save. And we’ve made it easier for you to save money when you send large transfers or lots of transfers within a calendar month.

Previously, if you sent over 100,000 GBP (or equivalent) in a month, we’d automatically apply lower fees on any transfers after the 100,000 GBP limit. In August, we lowered this limit to 20,000 GBP (or equivalent) so more of you can unlock lower fees.

*Let’s say that in September, you send 2 transfers of 20,000 GBP to EUR, and 1 transfer of 500 GBP to EUR. On the first transfer, we’ll charge our normal fee for sending GBP to EUR by bank transfer, which is 0.41%. On the second transfer, we’ll charge 0.31%, because you sent more than the 10,000 GBP limit.

*

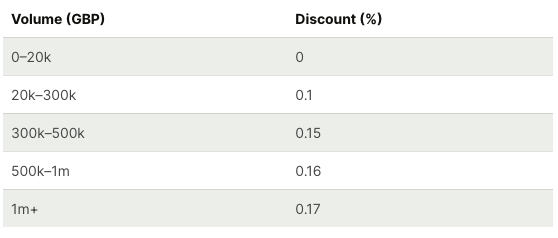

This table shows the estimated percentage discount depending on how much you send within one month.

If you're sending or converting more than 2m GBP or equivalent read more info here.

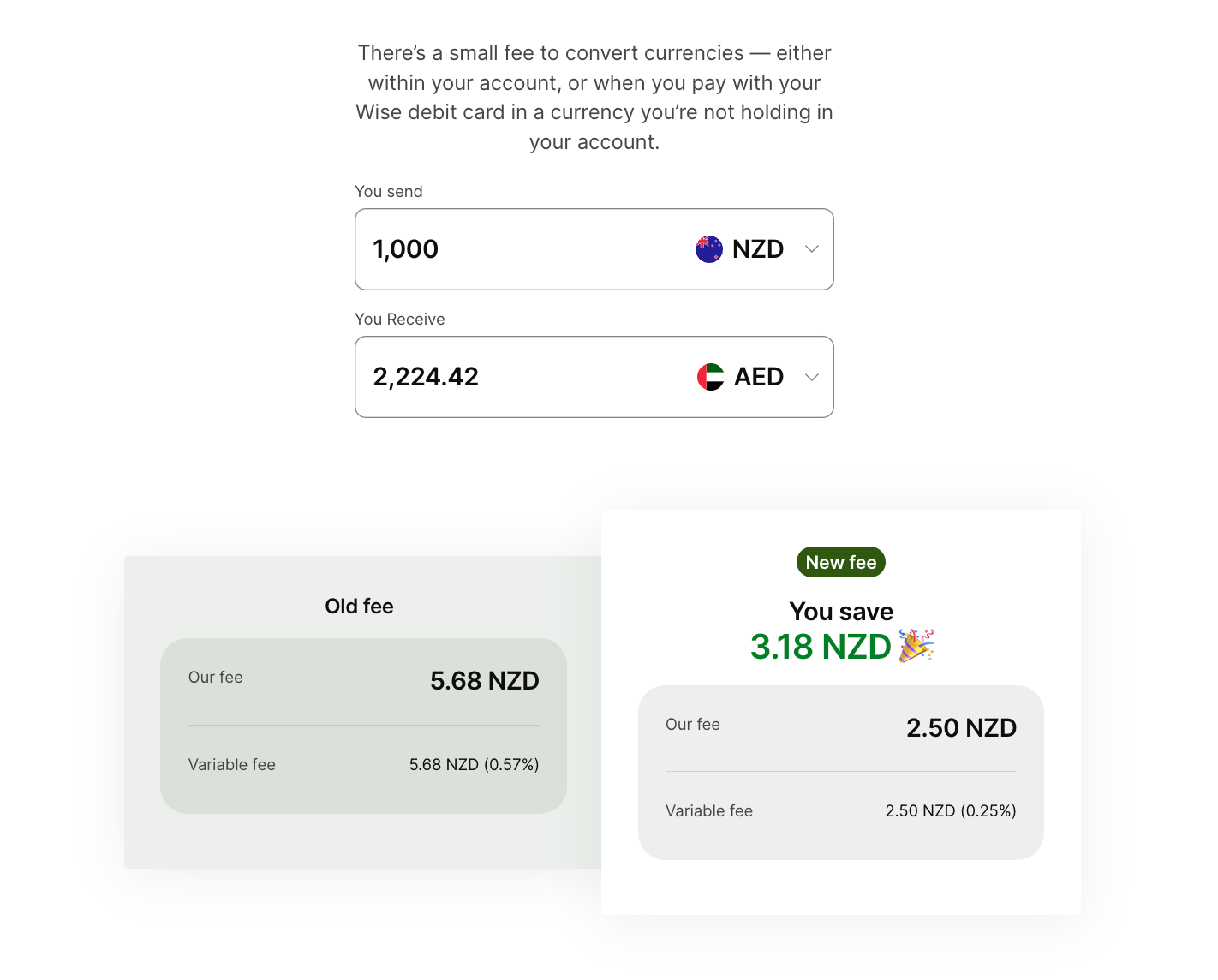

Along with international transfers, some conversions on your Wise account are now cheaper.

*For example, converting 1,000 NZD to AED used to cost 5.68 NZD and now costs 2.50 NZD. That’s 56% cheaper than before. *

You can find out how much your next conversion will cost here.

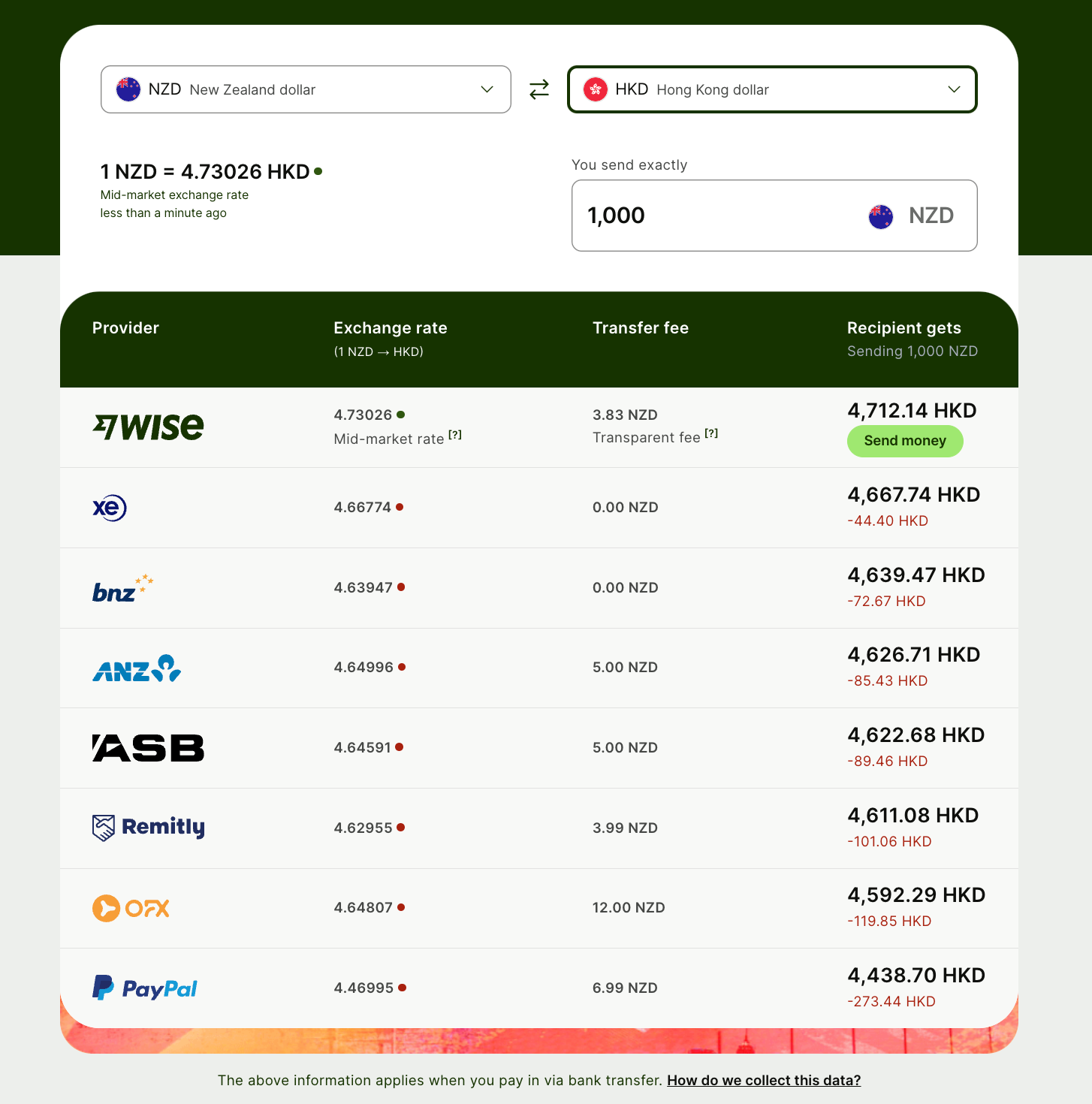

Whether you choose to use Wise or not, you should know exactly how much your transfer will cost.

Most banks aren’t transparent about their fees and crank up the markup on their exchange rate. Unless you check it against the mid-market exchange rate (the real exchange rate with no hidden fees), you’d never know.

To make it easier for you, you can use our comparison table to compare a few banks and other cross border payment specialists.

Onwards

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

Welcome to the Wise Partner Program! In this guide, you will find all the information you need to get started, optimize and succeed as a Wise partner. Simply...

We're thrilled to introduce a powerful new feature designed to save you time and eliminate the frustration of manual data entry when sending money. Now,...

The new Wise Card is here! 🇧🇷

We have great news for our customers in Brazil! You can now set up your own Pix key directly in the Wise app

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...