Wise Partner Program – Your Onboarding Guide

Welcome to the Wise Partner Program! In this guide, you will find all the information you need to get started, optimize and succeed as a Wise partner. Simply...

We changed many of the fees on Wise this week. Some of you benefited as a lot of routes got cheaper, but some of you will also see an increase in some fees.

Our mission is to lower the cost of moving money across borders. We’ve made progress over the last 13 years, bringing the average fee on Wise to 0.67% globally. The changes this week don’t bring down this overall average price 一 but they do bring us one step closer to lowering fees further in the future.

Why are we making these changes? Each feature and route we serve comes with its own underlying costs. In our most recent review of all our routes and costs, we found that some have become much more cost-efficient over time, while others are more expensive to support.

As a result, we have rebalanced our fees to reflect the cost of each transaction so that you only pay for the services you use. It also shows us where we need to do more work to cut costs to bring the fees down even further in the future.

Here is an overview of the changes:

People and businesses who move money between major currencies such as the Euro, the US dollar, the Great British pound, the Australian dollar and others will now pay less.

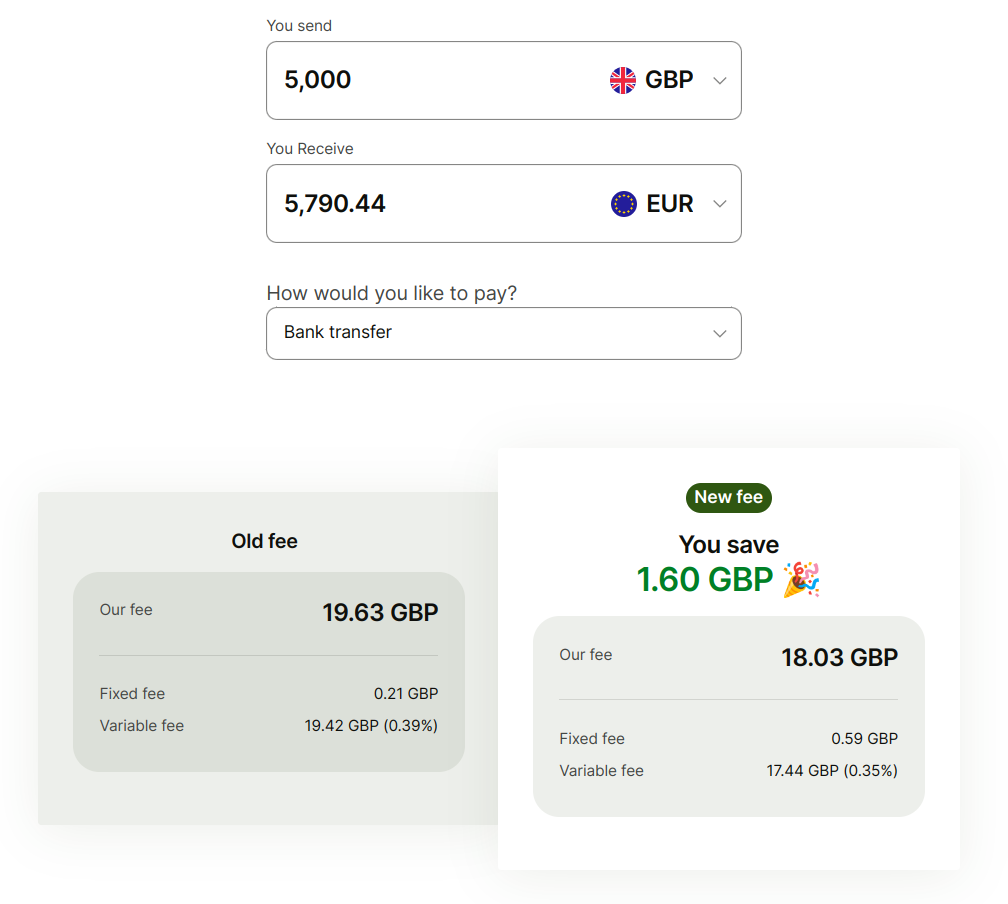

For example, sending GBP to EUR used to cost £0.21 + 0.39%. This is now £0.59 + 0.35%. An even bigger impact when sending SGD to GBP used to cost S$0.38 + 0.47%, which is now S$0.92 + 0.36%. This means the fee for a SGD 10,000 transfer is now 22% cheaper than before.

This is a great outcome for the biggest users of Wise, especially those who already get their salary directly into the Wise account or use Wise Business to invoice international clients.

Here's a convenient calculator to see how much each of the routes benefited from this change.

These changes mean that using your Wise card across major currencies got cheaper. In some cases, smaller currencies got the benefit too. For example, if you live in the UK, and are going on a trip to Turkey, it will now be 56% cheaper to pay in Lira, dropping from 0.80% to 0.35%.

For example, sending GBP to MXN used to cost £0.31 + 0.55%. This is now £0.68 + 0.62%. This means the fee for a GBP 5000 transfer to Mexico is now 14% more expensive than before, but still cheaper and faster than most providers.

This affects people and businesses who use their Wise account to make payments locally in the same currency. For example, paying locally from your AUD balance increased from A$0.57 to A$1.23. Local payments within the US went up from $0.39 to $1.13.

Local payments in the UK, Eurozone, Singapore and Hungary remain free.

Fees for loading your Wise account or funding transfers from some bank-issued cards and direct debit (ACH) in the US and Canada got more expensive.

For example, funding your GBP balance from a Mastercard debit card is now 0.62% compared to 0.45% previously. But the good news here is that if you use bank transfers or the convenient open banking in the UK, funding your GBP balance costs nothing. In addition, using Visa debit cards in Europe and the UK is now cheaper in some cases too.

If you’re using Wise in Europe, you can easily fund your account using bank transfers, and in the US, wires provide a cost-effective 一 if less convenient 一 way to fund larger transfers.

Finally, if you’re receiving your salary or invoices directly into your Wise account, you won’t incur any of these additional charges that come with moving money from your other bank to Wise. You’re also likely to get a better return on your own money if you opt into ‘Interest’ Assets in the UK, Singapore or Europe, or ‘USD Interest’ in the US.

While this change didn't reduce the average fees on the global level, we shouldn't yet claim success on our mission. It was an important step for us to align our fees with what it costs us to serve these routes and payment methods.

Along with international transfers, most conversion on your Wise account are now cheaper. Here are some examples of major currencies. This is just a selection of routes, check the calculator for your route.

| EUR to USD | 0.50% | GBP to USD | 0.37% |

| EUR to GBP | 0.52% | GBP to EUR | 0.35% |

| EUR to AUD | 0.47% | GBP to AUD | 0.34% |

| USD to EUR | 0.39% | AUD to USD | 0.37% |

| USD to GBP | 0.43% | AUD to GBP | 0.39% |

| USD to AUD | 0.38% | AUD to EUR | 0.35% |

One thing to keep in mind is that most banks would never tell you about increasing their fees on international transfers. They would just crank up the markup on their exchange rate and unless you check every time against the mid-market exchange rate - you would never find out. To make it easier for you, we’ve set up a comparison table that covers a few banks and other cross borders specialists.

Onwards,

Kristo

Investments can fluctuate, and your capital is at risk. Interest is offered by Wise Assets UK Ltd, a subsidiary of Wise Payments Ltd. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you're uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Welcome to the Wise Partner Program! In this guide, you will find all the information you need to get started, optimize and succeed as a Wise partner. Simply...

We're thrilled to introduce a powerful new feature designed to save you time and eliminate the frustration of manual data entry when sending money. Now,...

The new Wise Card is here! 🇧🇷

We have great news for our customers in Brazil! You can now set up your own Pix key directly in the Wise app

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

Our mission is to lower the cost of moving money across borders. And since we started 13 years ago, we’ve made good progress, particularly over the past...