5 Ways to Stand Out and Boost Black Friday Sales

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Italy is an important trading partner for the UK, with thousands of UK businesses involved in importing from Italy to the UK. Whether your business is looking to ship in quality Italian wines, high end designer clothing, or any other well known Italian products, there’s demand in the UK.

This guide walks through the basics you need to know about importing products from Italy. We’ll also touch on Wise Business with a quick look at how a Wise account can cut costs when paying Italian suppliers, with the mid-market exchange rate and low, transparent fees.

💡 Learn more about Wise Business

| 📝 Table of contents: |

|---|

Importing from Italy to the UK is usually fairly straightforward - EU export rules are relatively easy to navigate, and shipping from Italy to the UK only takes a few days in travel time. However, there are still some important things to think about, including import charges from Italy to the UK, how to find a supplier and negotiate a deal, and legal and practical requirements.

In this guide we cover an overview of the process of importing from Italy to the UK. It’s helpful to know that there are lots of third party agents and freight forwarding companies which can also offer specific and professional advice to get you started on your importing journey hassle free.

You may need a specific licence or a certificate issued by the UK government, to cover the import of some items, such as animals, medicines, dangerous materials, waste and weapons. The rules for import can vary widely depending on the specific goods you’re bringing into the country, so it’s important to do your research and learn about the requirements based on what you plan to import.

Importing goods from Italy to the UK usually requires you to do the following¹:

- Apply for an Economic Operators Registration and Identification number (EORI number)²

- Check the business you’re buying from can export to the UK

- Get the commodity code for your goods

- Work out the value of your goods for duty and VAT purposes

- Check if you need a licence or certificate for your goods

- Check the customs duty rules based on the import type

- Check labelling and marketing rules for items like food and manufactured goods

- Complete the customs declaration and ship your goods

- Claim a VAT refund

After Brexit, some of the rules around importing from the EU - including EORI number rules - changed. Prior to Brexit you could use an EORI number from any EU member state, but since the UK left the EU, you’ll need an EORI number which starts with GB for most imports to the UK. Make sure your business information is up to date before you start importing, to avoid delays and extra costs.

You can also learn more about how to get an import licence in the UK and get pointers on how to start an export business in the UK in our handy guides.

Over 40,000 UK VAT registered businesses import from Italy to the UK³. Italy is the UK’s 10th largest trading partner, with major imports including medicines, drinks and clothes, as well as industrial machinery and ships.

You’ll usually find the most cost effective way to import your goods from Italy to the UK is by truck. This will take 4 to 6 days, depending on where exactly your shipment originates from. Different shipping companies have their own processes so you can compare a few to see which suits you best - you may find you need to book an entire shipping container for a large load, or you could choose to have your delivery packed with other deliveries headed to the UK if it’s a smaller amount.

Import tax may apply when you import from Italy to the UK. The UK’s import tax is usually calculated based on the commodity code for the type of product you’re importing. Different commodity codes have their own percentage import tax to pay, so you’ll need to find your code and check the percentage before calculating how much to pay based on the value of your shipment.

| Read more about importing charges from Italy to the UK |

|---|

Depending on what you’re bringing into the UK, you might find you need to pay import VAT as well as import duty.

While VAT is usually paid at 20%, there are some items which have different rates⁴, and several different ways you can go about accounting for import VAT. Many businesses choose to use an agent to help with this process and to make sure they are managing cash flow optimally.

Import duty rates are decided based on the commodity code for the items you’re shipping into the UK. Again, shipping agents can help you calculate this if you’re not sure what to pay and when.

Importing goods from Italy to the UK shouldn’t be too tricky, but there are still a few important things to think about. We’ll look at these in more detail next.

Business relationships in Italy are often based on mutual friendships and maintaining cordial relationships outside of business deals. Taking some time to get to know the people you’re dealing with at your Italian suppliers can help to build trust and make the process run smoother.

Before you decide on the Italian supplier you’ll use, you’ll want to view samples of the products you’re buying, and negotiate on costs, lead times and shipping. As with any business deal it’s crucial to have a formal contract which is set out in writing - although you’ll also be able to talk through your options in advance and get verbal agreements before the contact is prepared.

A great way of finding suppliers is to attend trade fairs in the country you intend to buy from. This means heading to Italy, and visiting a trade fair where you can check the products first handed, get to know suppliers in person and even negotiate better deals. To discover Italian trade fairs you can check the Trade Fairs Dates database.

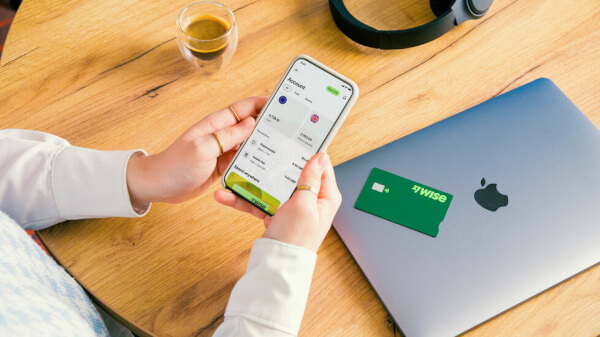

If you decide to visit a trade fair in Italy, Wise Business debit card can be a great way to spend in Euros with ease.

You can pay in EUR with your Wise Business card even if you don't have a balance for the currency on your multi-currency account. Wise smart technology will convert your spending automatically to GBP with the mid-market exchange rate. What is even better? You earn 0.5% cashback on your purchases.

Get started with Wise Business 🚀

As part of your contract with your preferred Italian supplier you’ll need to cover payment terms. Being clear about what you’ll pay, when and in what currency is important - particularly when arranging business deals overseas. Learning about internationally recognised incoterms⁶ can be helpful as these are generally used when setting up business agreements internationally to ensure understanding.

Wise Business can make it cheap and fast to pay your Italian supplier in Euros, with mid-market exchange rate currency conversion and low fees from 0.42%. More on that later.

Get started with Wise Business 🚀

Exactly how you transport your items from Italy to the UK will depend on what you’re importing, the value, time considerations and more. For shipments that aren’t highly time sensitive you can usually use a truck shipment which can arrive within a week. This is likely to be the cheapest option, although alternatives such as sending items by train, ship or air can also be used depending on your specific needs.

The UK customs requirements, including the documents needed, can vary depending on the type of items you’re importing, and can include:

- A bill of lading

- A commercial invoice

- A packing list

- A certification of origin

- Import licence

Many businesses choose to use a specialist third party to complete the customs processes at the UK border. There’s a fee for this, but it can mean the process is quicker and easier to manage.

UK business importing from Italy? Open a Wise Business account online or in the Wise app to make it easier to pay and get paid in EUR as well as a broad selection of other currencies.

Use your account to hold and exchange 40+ currencies, and send payments to suppliers and contractors quickly or instantly⁷, with the mid-market exchange rate and low fees from 0.42%. That can keep costs down - and because your Wise account also has extras like cloud accounting integrations, batch payment options, multi-user access and more, you could save time as well.

Get started with Wise Business 🚀

Use this guide to get started with importing from Italy to the UK - and remember to check out Wise Business for easy ways to pay in euros, using the mid-market exchange rate and low, transparent fees.

Sources used in this article:

Sources last checked March 25, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Black Friday - Friday 29th November in 2024 - kicks off the end of year shopping period, with huge uplifts in on and offline sales as people grab a bargain...

The term "turnover" is used often in the world of business, but its implications vary significantly depending on the context. At its core, turnover is a...

Wise is a financial technology company focused on global money transfers that offers two different types of accounts: a personal account and a business...

In today's fast-evolving digital landscape, e-commerce is quickly transforming the ways consumers shop and how businesses operate worldwide. DHL’s E-Commerce...

In an increasingly interconnected global economy, small businesses in the United Kingdom (UK) have more opportunities than ever to expand through import and...