6 Best ecommerce payment providers

Discover the best ecommerce payment providers in the Uk to optimize payments and drive growth.

Managing employee expenses is essential for any business to run efficiently. While different businesses may have their own varied approaches to employee expense management, using a comprehensive expense policy and process to clarify what can be claimed, and when, is a simple and transparent approach.

Plus, businesses can make expense reporting easier for team members, to cut down admin time, with dedicated employee expenses management software or an employee expenses app.

This guide covers the basics of how to manage expenses for your UK business. We’ll also look at easy ways to make international employee expenses effortless, with Wise.

| 📝 Table of content: |

|---|

Employee expense management involves setting out which business expenses employees can claim money back for, the process to make a claim, and the timescales in which claims are to be submitted and reimbursed. Employee expenses generally include only things which are necessary to allow the employee to do their job, and for the business to continue to operate.

Allowable employee expenses under a company expense policy could include:

An up to date, clear and comprehensive expense policy is important for business management, as it sets out what expenses employees may be entitled to reclaim from the company, and what costs they need to cover themselves.

An expense policy should cover all the details needed for a new employee to understand - before spending on behalf of the company - what are considered reasonable expenses to reclaim, the process to submit a claim, the documents needed to support a claim, and the way money will be repaid.

Expense policies differ quite widely depending on the business type and preferred approach. However, a good expense policy would usually include:

Clear set of rules: details of what constitutes a business expense which can be reclaimed, including any maximum limits or caps, and any advance approval required prior to incurring a business expense.

Easy to understand and read: the policy should be easily accessible, and written in plain English. While expense policies can’t generally cover every possible example of an allowable expense, including some examples can also be helpful.

Up to date information: company policies need to be reviewed from time to time, so including details about the date the policy was written and when it may be due for review is useful.

Clear explanation about the expense management process: including the documents the employee should retain, the reclaim process and time scales, and how the money will be paid.

Contact information: policies should also clarify who the point of contact or approval is - the direct line manager, finance or HR department for example - in case of queries or problems.

Let’s walk through a step by step process of expense management as an illustration. Not every business will work exactly the same, but this gives a good outline of how the employee expense management may work to ensure efficient and timely repayment to employees incurring costs on behalf of their employer.

Naturally, the first step involves the employee spending on behalf of the company. Company expense policies may detail whether or not advance approval is required before incurring a specific expense. This may be set to allow employees to spend up to certain limits without approval, or to ensure that all spend in specific categories is approved in advance, for example.

Let’s imagine an employee needs to arrange business travel to meet a client, as an example. In this case, they may be able to go ahead and book transport themselves or through an approved employee travel agency, or they may need to get advance approval before making payment. In this case, let’s say that the employee settles the bill for tickets themselves using their personal credit card.

Whenever an employee submits an expense claim they’ll need to provide some supporting information and documents, to demonstrate what they spent and when. The expense receipt retained may cover the entire expense claim - such as a train ticket for example - or may need further information to support the claim. This can happen if an employee is using a private car for example, and fills the tank with petrol, but uses only a portion of this for business related mileage.

In both cases, the employee should retain any relevant receipts, which can then be submitted to support their expense claim. Receipts may be retained and submitted manually - but to save time, many apps and software solutions are now available to allow employees to scan receipt data to automatically populate expense claims and submit the required paperwork digitally.

The employee will now need to complete and submit their expense claim. In many cases this can now be done digitally through smart software and apps. However, it’s also possible that this step includes the employee completing a physical form and submitting this along with the receipts for approval.

The expense reporting process requires the employee to detail the amount of the claim, the currency, the reason for the expense and any other relevant information, so the approving manager can check if the claim is within policy.

Once an employee expense claim has been submitted there’s usually an approval process. This is often manual, although some businesses may have automatic approvals for certain low value payments, to cut down admin time. The approving manager might be the employee’s direct line manager, a member of the finance team, or another dedicated individual who can assess claims against the expense policy to ensure they fulfil the requirements.

Once the expense has been approved or signed off by the designated manager, it can be submitted to finance for repaying. To avoid the employee being out of pocket for any longer than is necessary, a fast approval process is best, so the repayment of legitimate claims can be done quickly.

The final step is for the approved claim to be repaid, and for the employee to be reimbursed. This could be done as a one off payment to the employee’s bank account, or the expense amount could be rolled into the next salary payment, and all the money owed paid at once.

In the case of our original example - the employee who booked business travel on his credit card - you’d ideally want the reimbursement to be paid out prior to the credit card bill coming due. This means the employee has the money to repay their credit card bill instantly, and doesn’t risk incurring interest or penalty fees due to business expenses.

Ensuring a clear and efficient expense management process is essential to make sure all employees can be reimbursed as quickly as possible for costs incurred on behalf of the business.

The good news is that expense management software and apps can contribute to optimising the employee expense process. Here are a few to consider:

Xero expenses: app based options to allow employees to scan receipts to submit expense claims - and managers to review and approve costs - all from a phone.¹

Zoho expenses: app based expense management, with free basic plan options, and a selection of highly customisable fee paying tiers for larger and more established businesses.²

Concur expenses: cloud based software, plus an app for easy on the go expense management - plans and pricing are tailor made to individual businesses.³

Webexpenses: software and app options with customisable pricing and extras like out of policy alerts and carbon emissions tracking for travel expenses.⁴

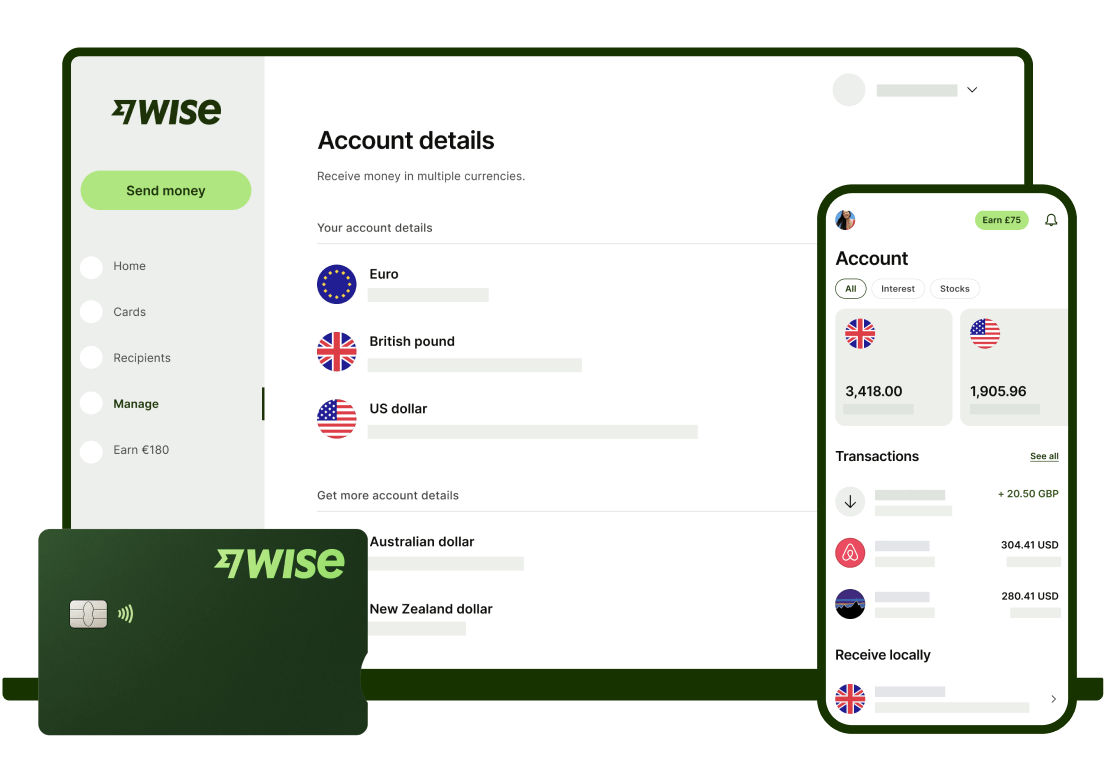

Open a multi-currency Wise Business account online or in app for a one time low fee, to hold and exchange 40+ currencies, get paid with local bank details for 9 currencies, and get linked debit and expense cards to drive down the cost of business spending at home and abroad.

Make international employee expenses effortless, with Wise - so you can focus less on admin, and more on business performance and growth.

Having a clear and straightforward employee expense management process is essential for both the business, and your team, to protect your profits and ensure everyone has the tools and information needed to do their jobs. Use this guide as a starting point if you’re designing your expense policy or working out what a great employee expense process will look like for your business.

And don’t forget to check out the Wise Business account if you and your team are looking for simple ways to cut the costs of spending at home and abroad, with no ongoing charges, and cashback opportunities on eligible business spend.

Manage employee expenses easily

with Wise Business

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the best ecommerce payment providers in the Uk to optimize payments and drive growth.

Discover the best digital vat software for small businesses to improve efficiency and streamline financial management.

Learn how predictive analytics in accounts receivable can improve efficiency, predict late payment, forecast cashflow and streamline financial management.

Read our guide to the venture capital process and best practices, for both VC investors and startups looking for funding.

Find out how to extend your startup funding runway, with strategies and tips for UK startups funded by venture capital.

When is venture debt right for your business? Find out here in this essential guide, covering what venture debt is, pros and cons and more.