To our 13 million customers

It's hard to think that it's been two months since the start of the war in Ukraine, and the continued violence towards civilians. Whilst we made progress towards our mission last quarter, we also prioritised what we could do to support.

We reduced fees when sending money to Ukraine, and waived fees for transfers to charities entirely. We increased transfer limits to £100,000 when sending money to Ukraine. We made it easier for refugees to set up Wise accounts by easing documentation requirements and offering digital Wise cards.

And, what about making money move without borders? - instant, convenient, transparent and eventually for free.

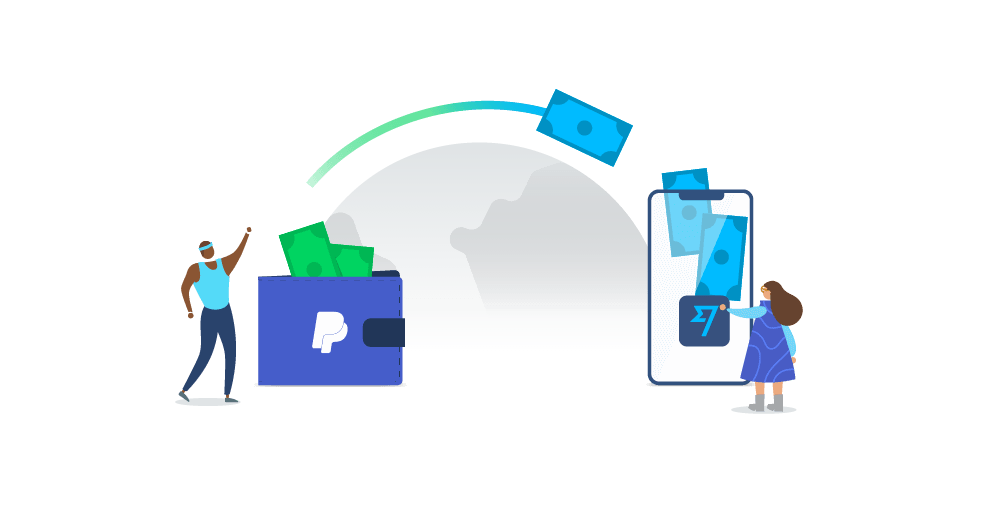

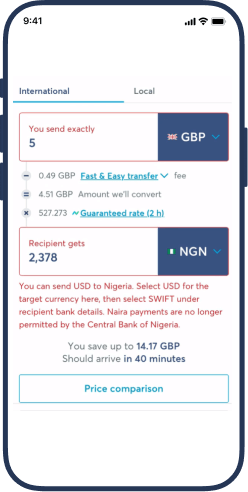

Sending money got faster and 49% of transfers are now instant. We launched new features - Auto Conversion is now available to everyone, and the Wise multi-currency account with the card landed in Brazil. By popular demand, we partnered up PayPal to make sending money even more convenient. Business customers can now sync up with Quickbooks and pay bills with Wise.

Scroll on to get the full lowdown.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)