At Wise, we strive towards a world where sending money across borders is as easy as a local transaction. Yet, the reality for many consumers and businesses is far from ideal. In 2020, the G20 developed a plan to address the slow speed, high cost, lack of transparency and access of these international transactions: the G20 Roadmap for Enhancing Cross-Border Payments, which sets ambitious goals to be achieved by 2027.

Every year, Wise issues a G20 Report to shed light on where we stand in improving cross-border payments and highlights both progress and challenges in all G20 countries. Progress has been inconsistent across nations, highlighting the need for renewed efforts.

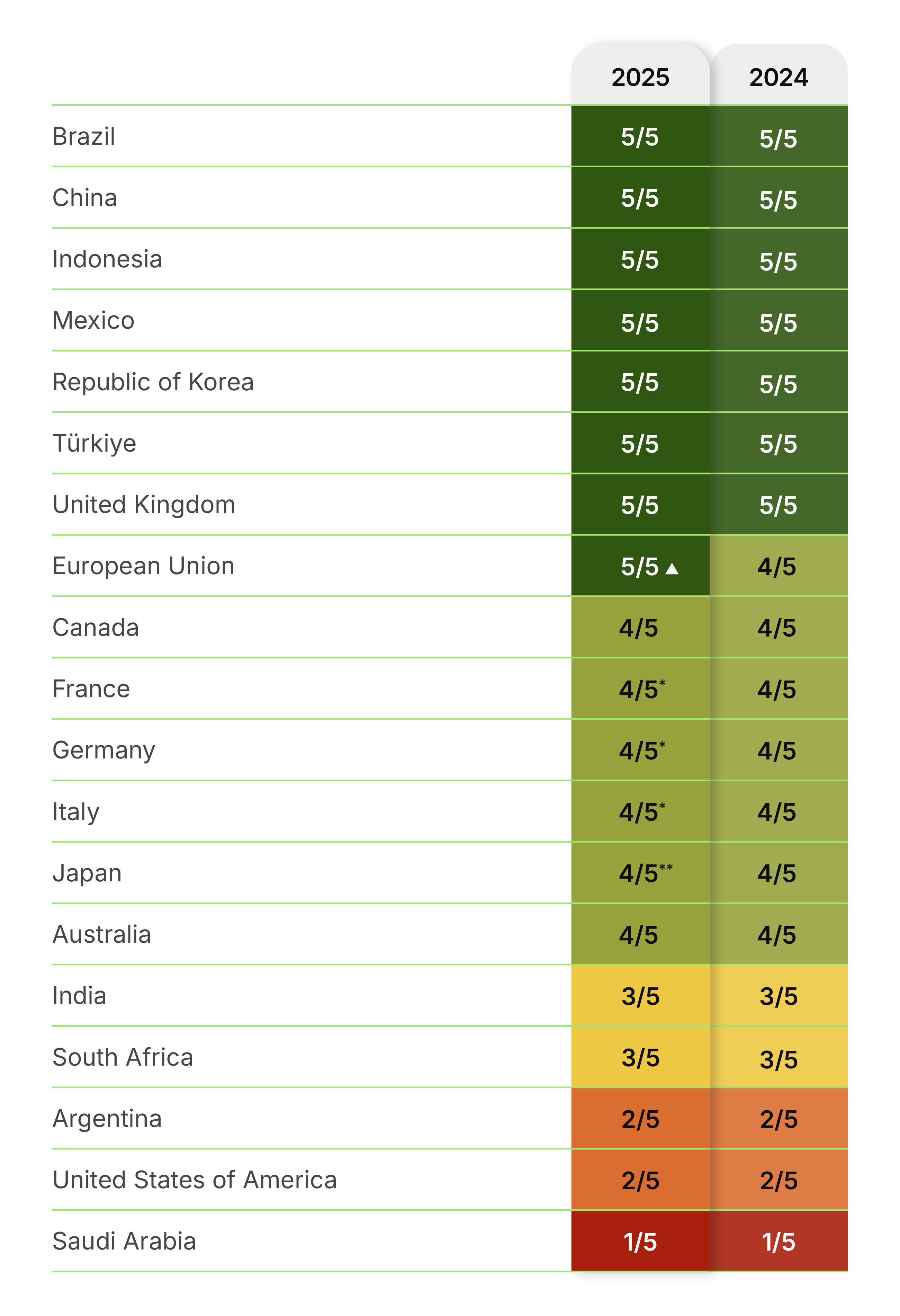

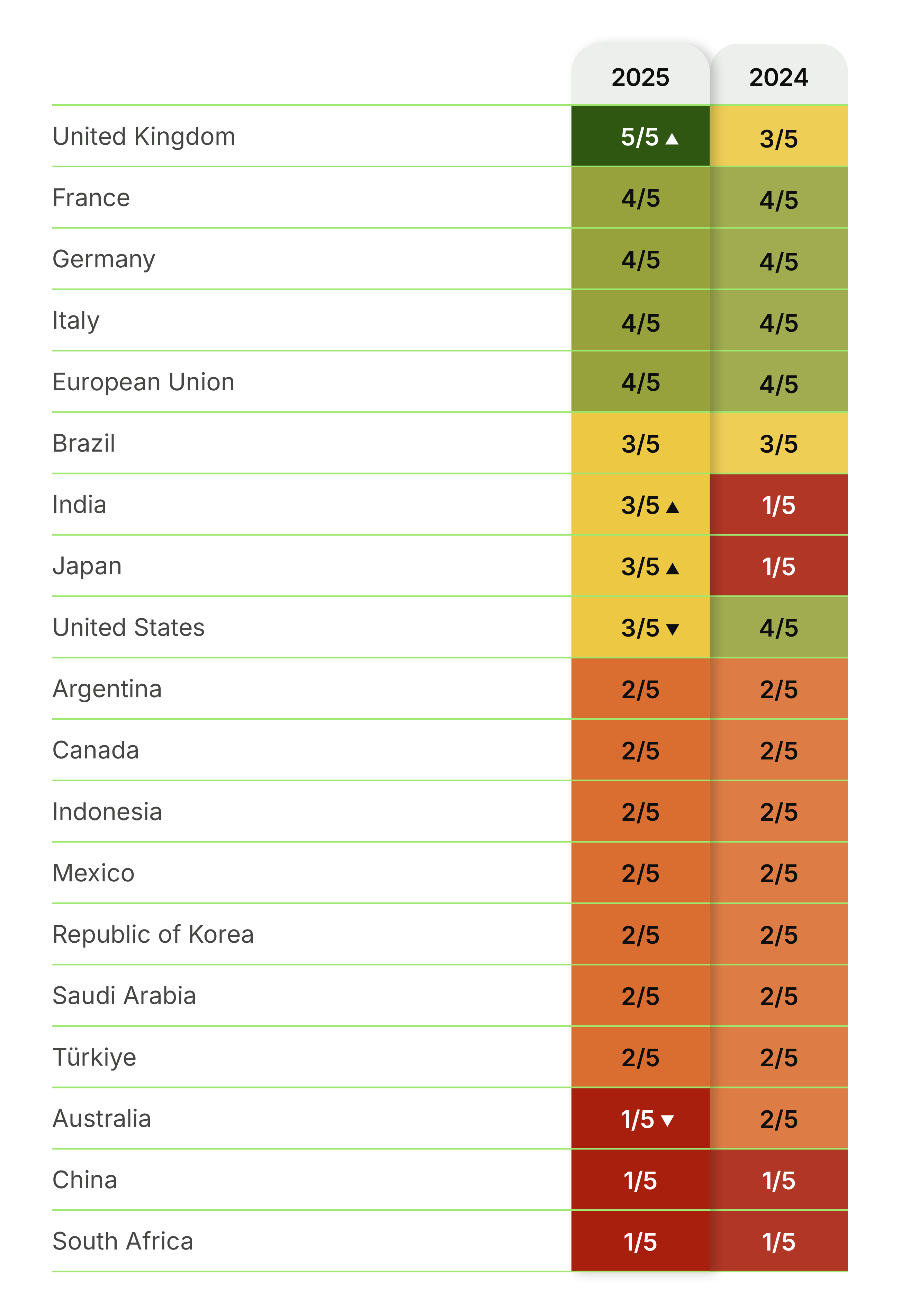

In the second iteration of Wise’s G20 Report—where we track progress on two key metrics, direct access to payment schemes for non-banks and price transparency—we’ve seen incremental improvements, and evidence of some countries sliding backwards.

Every year, Wise issues a G20 Report to shed light on where we stand in improving cross-border payments and highlights both progress and challenges in all G20 countries. Progress has been inconsistent across nations, highlighting the need for renewed efforts.

In the second iteration of Wise’s G20 Report—where we track progress on two key metrics, direct access to payment schemes for non-banks and price transparency—we’ve seen incremental improvements, and evidence of some countries sliding backwards.