Compound interest calculator in Excel

What is compound interest?

Ever heard the phrase ‘money makes money’? That’s compound interest.

Compound interest is where interest on a deposit or investment is reinvested, so the interest in the next period is earned on the principal plus the interest previously earned. That creates exponential growth and means your money is really working for you.

Over time, compound interest can mean that your investments grow significantly. Compound interest can be calculated based on any period - daily, monthly, quarterly or annually for example. But the longer you leave your investments to compound, the better chance you have of them growing.

You’ll be able to see how your investments may perform thanks to compound interest with our handy compound calculator.

Wise is the cheaper, faster way to convert between currencies.

Invest all over the world with low cost currency conversion from Wise.

Don’t lose out on poor exchange rates or high bank fees when you invest. Use the Wise multi-currency account to send or withdraw foreign currency payments, and get the real exchange rate every time. You can even set up a direct debit right from your account to make sure you stick with your investment strategy.

Hold 55+ currencies, and switch between them when you need to, using the Wise app.

How to calculate compound interest in Excel?

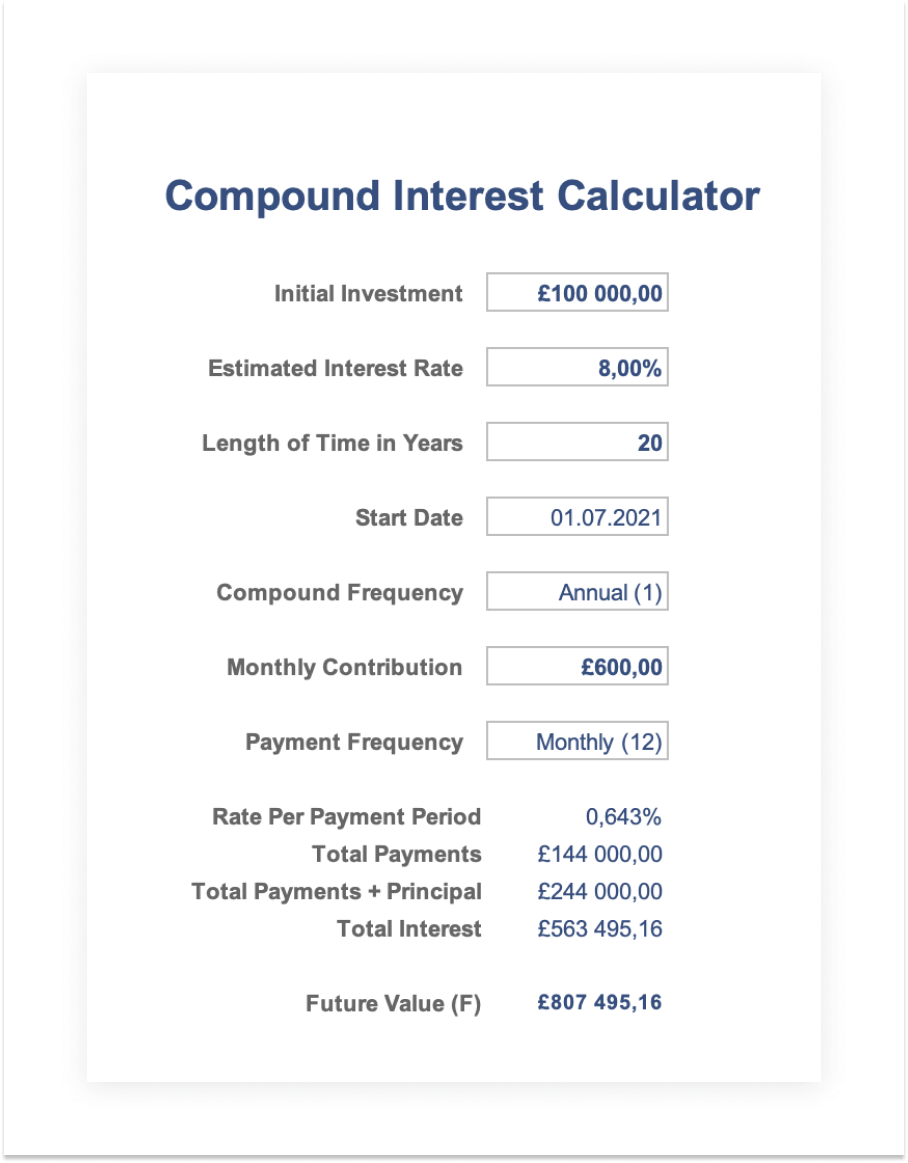

Use this handy calculator to see how your money might grow. You can calculate the compound interest if your money is in a savings account with a fixed interest, or if you were to choose to invest monthly to make the most of your money.

Our compound interest calculator includes options for:

- daily compounding

- monthly compounding

- quarterly compounding

- half yearly and yearly compounding

See how your passive investments could grow thanks to compound interest.

The value of your investments may go down as well as up. Tools provided are for information only. We do not offer investment advice, and will not be liable for any monetary losses arising in connection with this compound interest calculator. Seek professional advice if you want to learn more about investment opportunities.

What is the compound interest formula in Excel?

The compound interest formula in Excel is:

=FV(rate,nper,pmt,pv)

You can calculate compound interest in Excel using the FV function. The example above assumes that £1000 is invested for 20 years at an annual interest rate of 8%, with the interest compounded monthly. That means that the formula for calculating future value (F) is:

=FV(rate/n;t*pp;A;-P)

The FV function is handy when you want to calculate compound interest to estimate the future value of an investment. The details you’ll need to input are a rate, the number of periods, the periodic payment and the value of the initial investment.

You’ll need to input a period rate, which can be calculated by dividing the annual rate by the number of periods - or rate/n.

To get the total number of periods (nper) we multiply the term by the deposit frequency, or t*pp.

In this example, there is no periodic payment, so we use zero.

By convention, the present value (pv) is input as a negative value, since the $1000 "leaves your wallet" and goes to the bank during the term.

Save money with Wise on investing in different currencies

Cut the costs of currency exchange, leaving you with more money to invest and grow.