Compound interest calculator

What is compound interest?

Ever heard the phrase ‘money makes money’? That’s compound interest.

Compound interest is where interest on a deposit or investment is reinvested, so the interest in the next period is earned on the principal plus the interest previously earned. That creates exponential growth and means your money is really working for you.

Over time, compound interest can mean that your investments grow significantly. Compound interest can be calculated based on any period - daily, monthly, quarterly or annually for example. But the longer you leave your investments to compound, the better chance you have of them growing.

You’ll be able to see how your investments may perform thanks to compound interest with our handy compound calculator.

Wise is the cheaper, faster way to convert between currencies.

Investments are borderless. Your money should be too.

Open a Wise multi-currency account to cut the costs of investing in foreign currencies. Diversifying your investments is a smart move, and simple, low cost currency conversion from Wise can make it easier and cheaper to build a better portfolio.

Use your Wise account to fund international investments and make withdrawals in foreign currencies - or set up a direct debit from your Wise account to make sure you stick with your investment strategy.

With Wise you can hold 55+ currencies, and switch between them when you need to, using the intuitive app. It couldn’t be easier.

How to calculate compound interest?

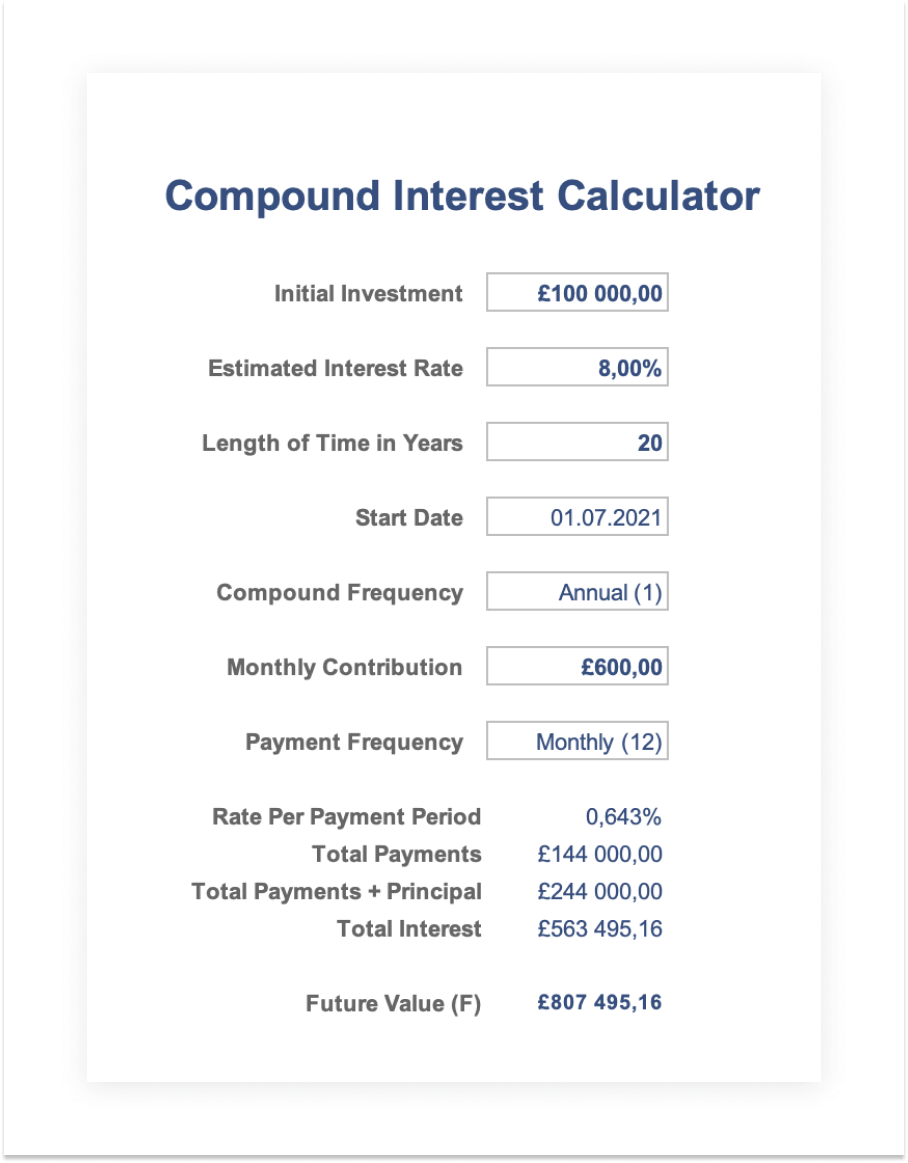

Use this handy calculator to see how your money might grow. You can calculate the compound interest if your money is in a savings account with a fixed interest, or if you were to choose to invest monthly to make the most of your money.

Our compound interest calculator includes options for:

- daily compounding

- monthly compounding

- quarterly compounding

- half yearly and yearly compounding

See how your passive investments could grow thanks to compound interest.

The value of your investments may go down as well as up. Tools provided are for information only. We do not offer investment advice, and will not be liable for any monetary losses arising in connection with this compound interest calculator. Seek professional advice if you want to learn more about investment opportunities.

What is the formula for compound interest?

The formula for compound interest, including principal sum, is:

A = P (1 + r/n) (nt)

A = the future value of the investment

P = the principal investment amount

r = the interest rate (decimal)

n = the number of times that interest is compounded per period

t = the number of periods the money is invested for

It's worth noting that this formula gives you the future value of an investment, which is compound interest plus the principal.

Compound interest example.

The easiest way to understand compound interest is to look at an example. Let’s say you have an investment of £10,000, and do not make any further contribution to this fund. If you earned a fixed interest, and did not make withdrawals, the growth of the fund would look something like the table on the right.

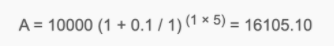

To calculate the year 5 interest amount based on a 10% annual interest, you’ll need to use the formula explained above:

A = P(1+r/n)(nt)

In this case:

- P (principal investment) = 10000

- R (rate of return) = 10/100 = 0.1 (decimal)

- n (times the interest compounds per period)= 1

- t (number of periods) = 5

So, the balance after 5 years is £16,105.10.

If you were to withdraw the interest annually you’d earn the same amount every year. That’s simple interest. However, by leaving the money to grow, you earn interest on the interest - meaning you get more every year, and can watch your investments grow exponentially.

Compound interest example.

| Year | Interest calculation | Interest earned | End balance |

|---|---|---|---|

Year 1 | £10,000 x 10% | £1,000 | £11,000 |

Year 2 | £11,000 x 10% | £1,100 | £12,100 |

Year 3 | £12,100 x 10%£ | £1,210 | £13,310 |

Year 4 | £13,310 x 10% | £1,331 | £14,641 |

Year 5 | £14,641 x 10% | £1,464.10 | £16,105.10 |

Compound interest FAQ

Save money with Wise on investing in different currencies

Cut the costs of currency conversion - and have more to invest - with Wise.