Best Accounting Software

Compare accounting software.

You won’t struggle to find accounting software for your business. But finding the best option for you might take a little research.

Accounting and bookkeeping software varies widely in terms of features and fees. We’ve summarised some key points about each of the best accounting software in the UK, to make it easy for you to compare.

And if you’re not sure about which features will work for you, read on. There’s plenty more coming up about how to review and choose the accounting software for small business that best suits your needs.

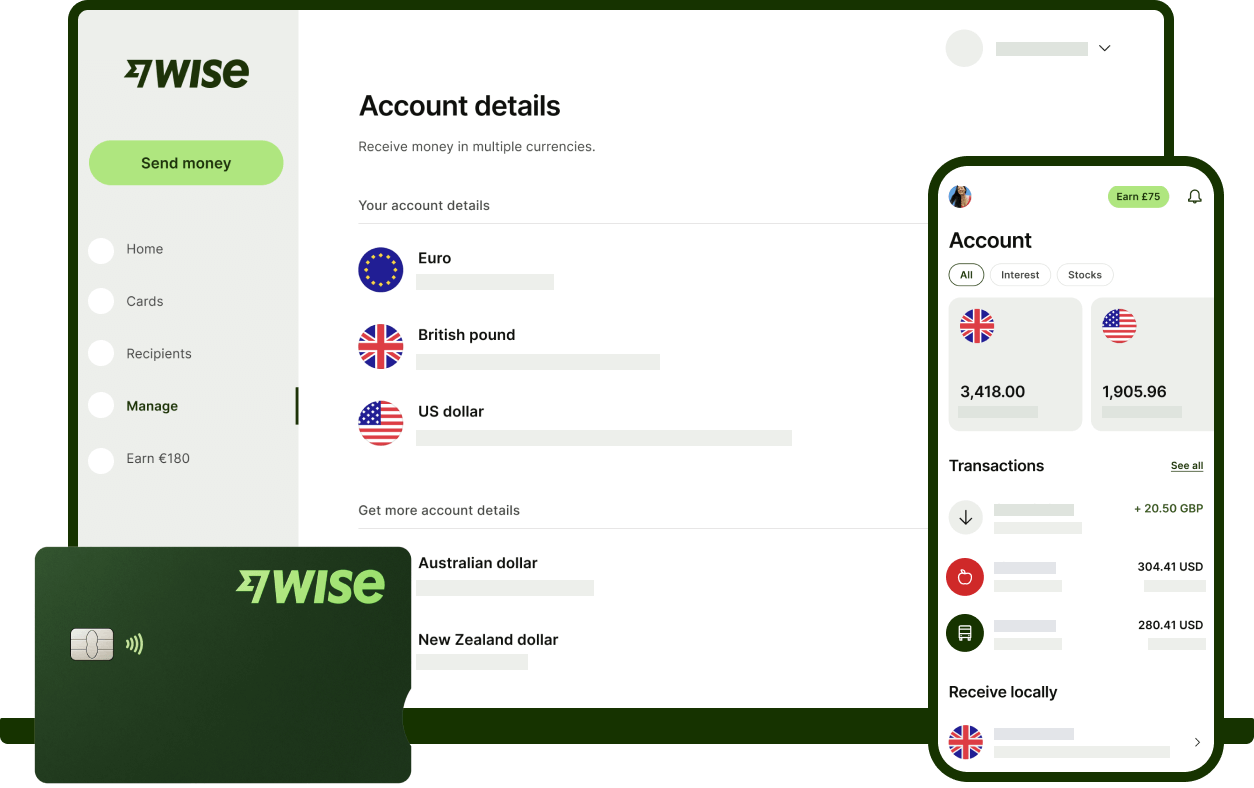

Reduce costs and extend your reach with Wise Business.

Great small business accounting software can help you grow your business.

You can also improve your reach, protect your margins, and save time and money by using Wise Business to pay and get paid in multiple currencies.

Improve your cash flow by helping clients overseas to pay you faster - and cut your international payment costs when working with suppliers or employees based abroad.

You’ll get bank details for the US, UK, euro area, Poland, Australia and New Zealand, to receive fee-free payments from these regions. Hold 40+ different currencies, and switch between them using the mid-market exchange rate. That’s much cheaper than your normal bank.

Wise Business can help you save time as well as money thanks to smart integrations with Xero and Quickbooks. Check and reconcile payments, analyse your business performance, and connect seamlessly to customers and clients all over the world.

Best accounting software in the UK.

The table below outlines what each accounting software option can provide regardless of plan.

For more detailed plan breakdowns, check out our comparisons of starter plans for sole traders and the self employed or of second and third tier plans for small business and SMEs further down the page.

Compare the costs

| Plans start from | |

|---|---|

| Zoho Books | £6 + VAT |

| KashFlow | £8 + VAT |

| Xero | £10 + VAT |

| Quickbooks | £12 |

| Sage Business Cloud Accounting | £12 + VAT |

| Free trial | |

| Zoho Books | 14 days |

| KashFlow | 14 days |

| Xero | 30 days |

| Quickbooks | 30 days |

| Sage Business Cloud Accounting | 30 days |

| Invoicing | |

| Zoho Books | ✓ |

| KashFlow | ✓ |

| Xero | ✓ |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✓ |

| Quote management | |

| Zoho Books | ✘ |

| KashFlow | ✓ |

| Xero | 3 months free for 1 user then £2.50 a month + £2.50 a month per additional user |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✓ |

| Expense tracking | |

| Zoho Books | ✓ |

| KashFlow | ✓ |

| Xero | ✓ |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✓ |

| Receipt tracking | |

| Zoho Books | Auto-scan add-on 40 scans for £4 a month |

| KashFlow | ✓ |

| Xero | ✓ |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | Free for first 3 months with AutoEntry |

| Cash flow tracking | |

| Zoho Books | ✘ |

| KashFlow | ✓ |

| Xero | App integrations available |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✓ |

| Time tracking | |

| Zoho Books | ✓ |

| KashFlow | App integrations available |

| Xero | App integrations available |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✘ |

| Project tracking | |

| Zoho Books | ✓ |

| KashFlow | App integrations available |

| Xero | £5 a month for 1 user + £5 a month per additional user |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✘ |

| Inventory tracking | |

| Zoho Books | ✓ |

| KashFlow | ✓ |

| Xero | App integrations available |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✓ |

| Payroll | |

| Zoho Books | ✘ |

| KashFlow | Up to 5 employees |

| Xero | 3 months free for up to 5 employees then £5 a month extra, + £1 a month for additional employees |

| Quickbooks | £4 a month extra |

| Sage Business Cloud Accounting | £7 + VAT a month extra |

| Custom business reports | |

| Zoho Books | ✓ |

| KashFlow | ✓ |

| Xero | ✓ |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✓ |

| Handle VAT and MTD Compliant | |

| Zoho Books | ✓ |

| KashFlow | ✓ |

| Xero | ✓ |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✓ |

| Smart bank feeds | |

| Zoho Books | ✓ |

| KashFlow | ✓ |

| Xero | ✓ |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✓ |

| Bank transaction reconciliation | |

| Zoho Books | ✓ |

| KashFlow | ✓ |

| Xero | ✓ |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✓ |

| Multiple currency support | |

| Zoho Books | ✘ |

| KashFlow | ✓ |

| Xero | ✓ |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✓ |

| Add extra users | |

| Zoho Books | 10 users |

| KashFlow | ✓ |

| Xero | ✓ |

| Quickbooks | ✓ |

| Sage Business Cloud Accounting | ✓ |

All the accounting software in this table have a mobile app and the ability to connect with 3rd party integrations.

Accounting software features explained.

VAT and MTD

If your business has a taxable turnover above £85k you must use digital VAT records and returns under the Making Tax Digital for VAT scheme. Choose HMRC-recognised MTD software from the table above to make this easier.

Smart bank feeds and bank transaction reconciliation

Connect your business bank account to your accounting software to automatically sync transactions and access bulk transaction categorisation. Avoid manual accounting, cut down on errors and have more time to grow your business.

Multiple currency support

With multi currency support your accounting software will allow you to invoice and get paid in foreign Invoice and get paid in foreign currencies, and have your bookkeeping software automatically check, chase and reconcile your accounts.

If you work with customers or suppliers overseas, you could benefit even more with a Wise Business account.

Pay invoices, buy inventory, and handle payroll with the real exchange rate in over 40 currencies and get your own UK, Eurozone, Australian, New Zealand, and US bank details without a local address.

Best accounting software for sole traders and self-employed.

If you’re self-employed or a sole trader, an accounting software starter plan might work for you. They’re typically very reasonably priced and often have all of the features you need to streamline your bookkeeping.

Get started finding the best small business accounting software for your needs by using the tables on this page to compare benefits, costs and options.

It’s worth noting that starter plans don’t usually support multi currency transactions. If you trade overseas, use Wise Business in conjunction with your accounting software to pay and be paid, while saving on sneaky fees hidden in bank exchange rates.

Compare accounting software for sole traders and self-employed.

The accounting software in this table is ordered by monthly fee, left to right.

Compare the costs

| Monthly fee | |

|---|---|

| Zoho Books Basic | £6 + VAT |

| KashFlow Starter | £8 + VAT |

| Xero Starter | £10 + VAT |

| Quickbooks Simple Start | £12 |

| Sage Business Cloud Accounting Start | £12 + VAT |

| Free trial | |

| Zoho Books Basic | 14 days |

| KashFlow Starter | 14 days |

| Xero Starter | 30 days |

| Quickbooks Simple Start | 30 days |

| Sage Business Cloud Accounting Start | 30 days |

| Invoicing | |

| Zoho Books Basic | ✓ |

| KashFlow Starter | 10 a month |

| Xero Starter | 5 a month |

| Quickbooks Simple Start | ✓ |

| Sage Business Cloud Accounting Start | ✓ |

| Quote management | |

| Zoho Books Basic | ✘ |

| KashFlow Starter | ✓ |

| Xero Starter | 5 a month |

| Quickbooks Simple Start | ✓ |

| Sage Business Cloud Accounting Start | ✘ |

| Expense tracking | |

| Zoho Books Basic | ✓ |

| KashFlow Starter | ✓ |

| Xero Starter | 3 months free for 1 user then £2.50 a month + £2.50 a month per additional user |

| Quickbooks Simple Start | ✓ |

| Sage Business Cloud Accounting Start | ✓ |

| Receipt tracking | |

| Zoho Books Basic | Auto-scan add-on 40 scans for £4 a month |

| KashFlow Starter | ✓ |

| Xero Starter | ✓ |

| Quickbooks Simple Start | ✓ |

| Sage Business Cloud Accounting Start | ✘ |

| Cashflow tracking | |

| Zoho Books Basic | ✘ |

| KashFlow Starter | ✓ |

| Xero Starter | App integrations available |

| Quickbooks Simple Start | ✓ |

| Sage Business Cloud Accounting Start | ✘ |

| Time tracking | |

| Zoho Books Basic | ✓ |

| KashFlow Starter | App integrations available |

| Xero Starter | App integrations available |

| Quickbooks Simple Start | ✘ |

| Sage Business Cloud Accounting Start | ✘ |

| Project tracking | |

| Zoho Books Basic | ✓ |

| KashFlow Starter | App integrations available |

| Xero Starter | £5 a month for 1 user + £5 a month per additional user |

| Quickbooks Simple Start | ✘ |

| Sage Business Cloud Accounting Start | ✘ |

| Inventory tracking | |

| Zoho Books Basic | Zoho Inventory add-on |

| KashFlow Starter | ✓ |

| Xero Starter | App integrations available |

| Quickbooks Simple Start | ✘ |

| Sage Business Cloud Accounting Start | ✘ |

| Payroll | |

| Zoho Books Basic | ✘ |

| KashFlow Starter | ✓ |

| Xero Starter | 3 months free for up to 5 employees then £5 a month extra, + £1 a month for additional employees |

| Quickbooks Simple Start | £4 a month extra |

| Sage Business Cloud Accounting Start | £7 + VAT a month extra |

| Custom business reports | |

| Zoho Books Basic | ✓ |

| KashFlow Starter | ✓ |

| Xero Starter | ✓ |

| Quickbooks Simple Start | ✓ |

| Sage Business Cloud Accounting Start | ✓ |

| Handle VAT and MTD compliant | |

| Zoho Books Basic | ✓ |

| KashFlow Starter | ✓ |

| Xero Starter | ✓ |

| Quickbooks Simple Start | ✓ |

| Sage Business Cloud Accounting Start | ✓ |

| Smart bank feeds | |

| Zoho Books Basic | ✓ |

| KashFlow Starter | ✓ |

| Xero Starter | ✓ |

| Quickbooks Simple Start | ✓ |

| Sage Business Cloud Accounting Start | ✓ |

| Bank transaction reconciliation | |

| Zoho Books Basic | ✓ |

| KashFlow Starter | Reconcile 25 transactions a month |

| Xero Starter | Reconcile 20 transactions a month |

| Quickbooks Simple Start | ✓ |

| Sage Business Cloud Accounting Start | ✓ |

| Multiple currency support | |

| Zoho Books Basic | ✘ |

| KashFlow Starter | ✘ |

| Xero Starter | ✓ |

| Quickbooks Simple Start | ✘ |

| Sage Business Cloud Accounting Start | ✘ |

| Add extra users | |

| Zoho Books Basic | 2 users |

| KashFlow Starter | ✘ |

| Xero Starter | ✓ |

| Quickbooks Simple Start | ✘ |

| Sage Business Cloud Accounting Start | ✘ |

All the accounting software in this table have a mobile app and the ability to connect with 3rd party integrations.

Best accounting software for small businesses and SMEs.

Small business owners may find that it’s worth paying for a more comprehensive accounting software plan to access additional features needed to manage and grow their business finances.

Take a look at the tables below comparing second and third tier bookkeeping software plans from the most popular providers in the market.

When choosing the best accounting software for your small business, you’ll want to consider the features you need now, but also those you might need in the future.

Pick a provider that will grow with your business. If your favourite provider doesn’t have a certain feature, see if it offers third party integrations which cater to your needs.

All the plans in the tables below have the following features as standard:

- Invoicing

- Custom business reports

- Handle VAT and are MTD compliant

- Smart bank feeds and bank transaction reconciliation

Accounting software second tier plans.

The accounting software in this table is ordered by monthly fee, left to right.

Compare the costs

| Monthly fee | |

|---|---|

| Zoho Books Standard | £12 + VAT |

| KashFlow Business | £16.50 + VAT |

| Quickbooks Essentials | £20 |

| Xero Standard | £24 + VAT |

| Sage Business Cloud Accounting Standard | £24 + VAT |

| Free trial | |

| Zoho Books Standard | 14 days |

| KashFlow Business | 14 days |

| Quickbooks Essentials | 30 days |

| Xero Standard | 30 days |

| Sage Business Cloud Accounting Standard | 30 days |

| Quote management | |

| Zoho Books Standard | ✘ |

| KashFlow Business | ✓ |

| Quickbooks Essentials | ✓ |

| Xero Standard | ✓ |

| Sage Business Cloud Accounting Standard | ✓ |

| Expense tracking | |

| Zoho Books Standard | ✓ |

| KashFlow Business | ✓ |

| Quickbooks Essentials | ✓ |

| Xero Standard | 3 months free for 1 user then £2.50 a month + £2.50 a month per additional user |

| Sage Business Cloud Accounting Standard | ✓ |

| Receipt tracking | |

| Zoho Books Standard | Auto-scan add-on 40 scans for £4 a month |

| KashFlow Business | ✓ |

| Quickbooks Essentials | ✓ |

| Xero Standard | ✓ |

| Sage Business Cloud Accounting Standard | Free for first 3 months with AutoEntry |

| Cash flow tracking | |

| Zoho Books Standard | ✘ |

| KashFlow Business | ✓ |

| Quickbooks Essentials | ✓ |

| Xero Standard | App integrations available |

| Sage Business Cloud Accounting Standard | ✓ |

| Time tracking | |

| Zoho Books Standard | ✓ |

| KashFlow Business | App integrations available |

| Quickbooks Essentials | ✘ |

| Xero Standard | App integrations available |

| Sage Business Cloud Accounting Standard | ✘ |

| Project tracking | |

| Zoho Books Standard | ✓ |

| KashFlow Business | App integrations available |

| Quickbooks Essentials | ✘ |

| Xero Standard | £5 a month for 1 user + £5 a month per additional user |

| Sage Business Cloud Accounting Standard | ✘ |

| Inventory tracking | |

| Zoho Books Standard | Zoho Inventory add-on |

| KashFlow Business | ✓ |

| Quickbooks Essentials | ✘ |

| Xero Standard | App integrations available |

| Sage Business Cloud Accounting Standard | ✘ |

| Payroll | |

| Zoho Books Standard | ✘ |

| KashFlow Business | ✘ |

| Quickbooks Essentials | £4 a month extra |

| Xero Standard | 3 months free for up to 5 employees then £5 a month extra, + £1 a month for additional employees |

| Sage Business Cloud Accounting Standard | ✓ |

| Multiple currency support | |

| Zoho Books Standard | ✘ |

| KashFlow Business | ✓ |

| Quickbooks Essentials | ✓ |

| Xero Standard | Pay with Wise for £3 a month + 35p transaction fee |

| Sage Business Cloud Accounting Standard | ✘ |

| Add extra users | |

| Zoho Books Standard | 3 users |

| KashFlow Business | ✓ |

| Quickbooks Essentials | ✓ |

| Xero Standard | ✓ |

| Sage Business Cloud Accounting Standard | ✓ |

All the accounting software in this table have a mobile app and the ability to connect with 3rd party integrations.

Accounting software third tier plans.

The accounting software in this table is ordered by monthly fee, left to right.

Compare the costs

| Monthly fee | |

|---|---|

| Zoho Books Professional | £18 + VAT |

| KashFlow Business + Payroll | £22.50 + VAT |

| Quickbooks Plus | £30 |

| Xero Premium | £30 + VAT |

| Sage Business Cloud Accounting Plus | £30 + VAT |

| Free trial | |

| Zoho Books Professional | 14 days |

| KashFlow Business + Payroll | 14 days |

| Quickbooks Plus | 30 days |

| Xero Premium | 30 days |

| Sage Business Cloud Accounting Plus | 30 days |

| Quote management | |

| Zoho Books Professional | ✘ |

| KashFlow Business + Payroll | ✓ |

| Quickbooks Plus | ✓ |

| Xero Premium | ✓ |

| Sage Business Cloud Accounting Plus | ✓ |

| Expense tracking | |

| Zoho Books Professional | ✓ |

| KashFlow Business + Payroll | ✓ |

| Quickbooks Plus | ✓ |

| Xero Premium | 3 months free for 1 user then £2.50 a month + £2.50 a month per additional user |

| Sage Business Cloud Accounting Plus | ✓ |

| Receipt tracking | |

| Zoho Books Professional | Auto-scan add-on 40 scans for £4 a month |

| KashFlow Business + Payroll | ✓ |

| Quickbooks Plus | ✓ |

| Xero Premium | ✓ |

| Sage Business Cloud Accounting Plus | Free for first 3 months with AutoEntry |

| Cash flow tracking | |

| Zoho Books Professional | ✘ |

| KashFlow Business + Payroll | ✓ |

| Quickbooks Plus | ✓ |

| Xero Premium | App integrations available |

| Sage Business Cloud Accounting Plus | ✓ |

| Time tracking | |

| Zoho Books Professional | ✓ |

| KashFlow Business + Payroll | App integrations available |

| Quickbooks Plus | ✓ |

| Xero Premium | App integrations available |

| Sage Business Cloud Accounting Plus | ✘ |

| Project tracking | |

| Zoho Books Professional | ✓ |

| KashFlow Business + Payroll | App integrations available |

| Quickbooks Plus | ✓ |

| Xero Premium | £5 a month for 1 user + £5 a month per additional user |

| Sage Business Cloud Accounting Plus | ✘ |

| Inventory tracking | |

| Zoho Books Professional | ✓ |

| KashFlow Business + Payroll | ✓ |

| Quickbooks Plus | ✓ |

| Xero Premium | App integrations available |

| Sage Business Cloud Accounting Plus | ✓ |

| Payroll | |

| Zoho Books Professional | ✘ |

| KashFlow Business + Payroll | Up to 5 employees |

| Quickbooks Plus | £4 a month extra |

| Xero Premium | 3 months free for up to 5 employees then £5 a month extra, + £1 a month for additional employees |

| Sage Business Cloud Accounting Plus | £7 + VAT a month extra |

| Multiple currency support | |

| Zoho Books Professional | ✘ |

| KashFlow Business + Payroll | ✓ |

| Quickbooks Plus | ✓ |

| Xero Premium | ✓ |

| Sage Business Cloud Accounting Plus | ✓ |

| Add extra users | |

| Zoho Books Professional | 10 users |

| KashFlow Business + Payroll | ✓ |

| Quickbooks Plus | ✓ |

| Xero Premium | ✓ |

| Sage Business Cloud Accounting Plus | ✓ |

All the accounting software in this table have a mobile app and the ability to connect with 3rd party integrations.

Accounting software integrations.

Third party integrations let you do a lot more than bookkeeping with your accounting software.

In fact, smart third party integrations allow you to integrate your bookkeeping software with your ecommerce store, accept different types of payment, and manage and grow relationships with your customers.

Check out our handy table to see how different accounting software options work with some popular integrations.

If you send or receive international payments for your business, choose accounting software that integrates with Wise. You’ll be able to keep track of and automate payments, while benefiting from quick and safe international payments which are far cheaper than your regular bank.

Spend less time on business admin and more time on connecting with customers and growing your business.

| Integration | Zoho Books | KashFlow | Quickbooks | Xero | Sage Business Cloud Accounting |

|---|---|---|---|---|---|

CRM | |||||

Hubspot | ✘ | ✘ | ✘ | ✓ | ✘ |

Mailchimp | ✘ | ✓ | ✘ | ✓ | ✘ |

Ecommerce | |||||

Shopify | ✓ with Zoho Inventory | ✓ | ✓ | ✘ | ✘ |

Amazon | ✓ with Zoho Inventory | ✓ | ✓ | ✘ | ✘ |

Payments | |||||

Stripe | ✓ | ✓ | ✓ | ✓ | ✓ |

Square | ✓ | ✓ | ✓ | ✓ | ✘ |

PayPal | ✓ | ✓ | ✓ | ✓ | ✘ |

Wise | ✘ | ✘ | ✓ | ✓ | ✘ |

Best accounting software FAQ.

Save time and money with Wise Business

Smart, simple ways to save time and money. Spend less on bank fees and watch your business grow.