Should Expenses be Paid Through Payroll?

Discover if expenses should be paid through payroll, with pros, cons and directions from HRMC.

Yorkshire Bank promises innovative online and mobile banking, to help you manage your finances on the move. You’ll also get specialist support from expert business banking advisors, and a free banking period to boot.¹

In this guide, we’ll take a look at the business accounts available at Yorkshire Bank. We’ll cover everything from features and services to fees, including how much international payments will cost you. We’ll also show you how a multi-currency account could save you money on international payments.

There are two main business bank accounts to choose from at Yorkshire Bank.

The first is its standard Business Current Account, which offers²:

To apply for this Yorkshire business bank account, you’ll need to be over 18 and have an eligible business that is based and operates in the UK. Your annual turnover should be less than £6.5 million and your business has a straightforward and clearly defined business structure³.

There’s also the Yorkshire Business Choice Account². This flexible account offers all the same features and benefits as the Business Current Account, but with the added bonus of base-rate-linked credit interest.

And while both accounts are available to all businesses, the free banking period for start-ups and small businesses doesn’t apply to the Business Choice Account.

In addition, Yorkshire Bank offers a range of specialist accounts for clubs, societies, registered charities and non-profit organisations².

All business bank accounts with Yorkshire Bank come with a Contactless Debit MasterCard.

Using this, you can cover your business expenses and everyday spending. What’s more, you can withdraw up to £700 cash a day from an ATM².

Like many banks, Yorkshire will let you make international payments with any of their business bank accounts.

This is good news for businesses who trade overseas, or simply need to purchase supplies from another country. But it’s important to check the fees and charges for international payments carefully before choosing a new bank account.

We’ll cover the international transfer fees with Yorkshire Bank in the next section, but you should also pay attention to the exchange rates.

When you send money through your bank to another country, the currency will need to be converted. It’s common for a mark-up to be applied to the exchange rate. This leaves the overall rate pretty poor, which can make your transfer more expensive overall.

Check the fees and compare it with alternatives like Wise who offers fast cross currency transfers at the real exchange rate for a small fee.

Now, let’s get down to what really matters when choosing a business bank account – the fees.

Of course, the convenience and features of your new bank account are just as important. But it’s always worth scrutinising the small print to see how much a bank account will cost you to use. It’s a good idea to focus on the transaction types your business relies on.

Here’s a quick rundown of the main fees⁴ for a Yorkshire Bank business account:

| Service or transaction type | Fee |

|---|---|

| Monthly account fee | £6.50 (free for 25 months for new businesses and established small businesses switching to Yorkshire) |

| Cash and cheque deposits | £0.65 for cash£0.70 for cheques |

| Electronic payments within the UK (including Direct Debits and Standing Orders) | £0.30 |

| CHAPS payment (same day) | £25 |

| International transfers - sending | £20-£25 per transation⁵ |

| International transfers - receiving | Free to £7 (for transfers of £100+ in any currency) |

| Business debit card cash withdrawals | Free within the EEA and UK, between 3.75% of transaction value for outside the EEA. |

| Business debit card payments | Free within the EEA and UK, between 2.75% UK, between 2.75% outside the EEA |

| Borrowing charges | 29.25% per year (£25 daily fee for unplanned borrowing) |

Sending and receiving money internationally using your bank can be a little pricey. And that’s not to mention unfavourable exchange rates, or fees charged by the receiving bank in another country.

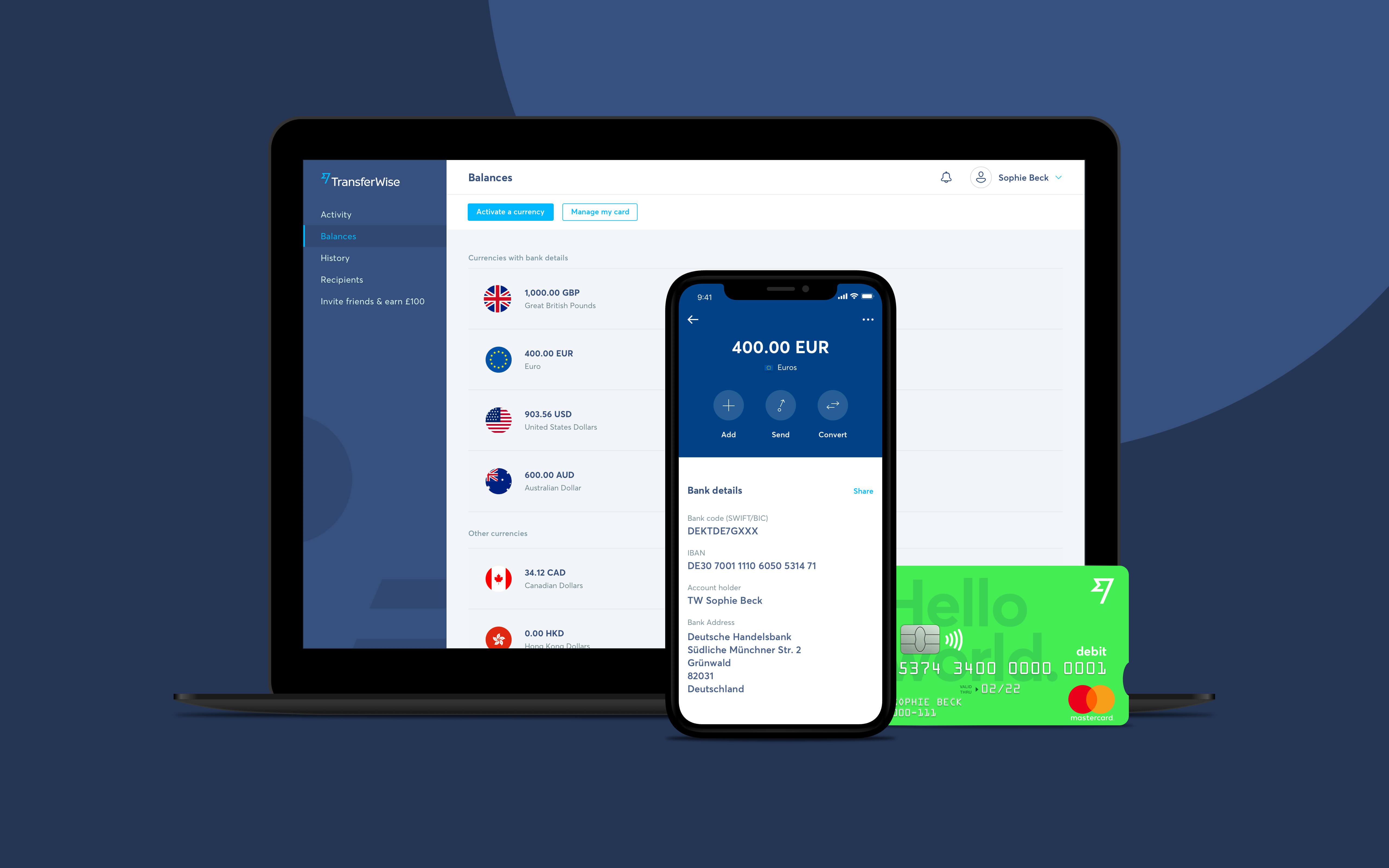

Luckily, there is a better alternative. Open a Wise multi-currency account and you can send, spend and receive 40+ currencies all in the one place.

You’ll only pay small, transparent fixed fees to send money abroad, and you’re guaranteed the real, mid-market exchange rate. This makes paying overseas suppliers and covering international business expenses cheaper – and the savings can soon stack up.

You can receive money in GBP, EUR, USD, AUD, NZD, PLN, SGD, HUF, TRY and CAD for free, invoice like a local and even spend in the local currency with a Wise Business Debit Card. Seamlessly integrate your Wise Borderless account with accounting software like Xero and Quickbooks, to make managing your money that much easier.

In short, Wise offers so much more for international businesses than banks. You can convert between currencies for tiny fees, seamless integration with accounting software such as Xero and Quickbooks to automate payments with a powerful open API.

So, if you’re looking for a new business bank account, you should now have a better idea of the options available at Yorkshire Bank. You have the fees and charges at your fingertips, and can compare features and services to see which ones your business needs.

But remember, there are alternatives out there for certain business-critical services – such as international transfers. By taking advantage of handy solutions like Wise, you can save money where it really counts.

Sources used:

Sources checked on 21-January 2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover if expenses should be paid through payroll, with pros, cons and directions from HRMC.

Discover the best practices when setting up per diem expenses, how to set up rate, proceed with payment and more.

We’re excited to announce that Morgan Stanley, a leading global financial services firm, has teamed up with Wise Platform, Wise’s global payments...

Discover how to automate expense reporting with our complete guide that covers step-by-step process, tools and best practices.

Travel and expense (T&E) processes are necessary in any business in which employees may spend on allowable business expenses, which need to be recorded,...

Discover the 6 best reconciliation tools available for businesses in the UK.