Wise x Joe Thomas’ guide to the ultimate stag or hen do

Thinking of combining your pre-nuptial celebrations in a sten do? Read expert tips from Wise and Inbetweeners' actor Joe Thomas on a united stag and hen do.

When you convert currencies with traditional providers, such as a bank, a broker or PayPal, you typically pay a lot more than you expect. On top of any fees they charge, they use an exchange rate with a mark-up, which often ends up costing you more than the stated fee itself.

Wise is different. Unlike other providers, Wise uses the real exchange rate with no mark-up, so you know exactly how much you’re paying with each transaction. Its fees are completely transparent, and they come to a fraction of the price charged by banks or brokers.

8 million customers transfer billions of pounds though Wise’s platform each month, saving over $3 million a day in bank fees and bad rates.

• Transfers typically between 0.3-1% of the amount you’re sending

• You always get the real exchange rate with no costly mark-up

• You can make transfers from wise.com, or from its iOS and Android apps

• Our payments are fast: 25% are instant, and over 77% complete within 1 hour

• It takes minutes to set up a free account

• You can make transfers of up to €1m to 55 currencies

Try our calculator to see how much your transfer will cost:

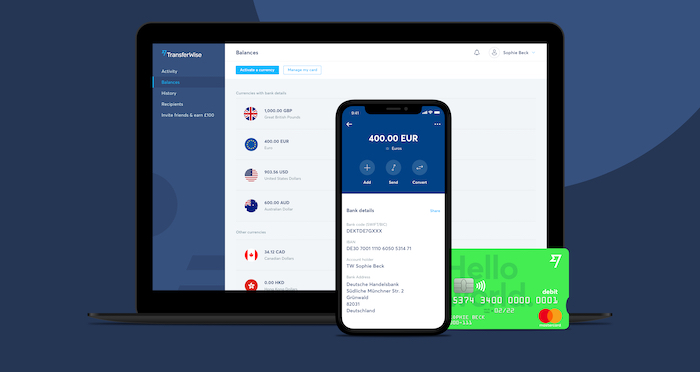

Wise also offers a free multi-currency account, which lets you hold balances in over 55 currencies. You can convert between them instantly and make payments directly in a single click.

It takes minutes to create an account and you can manage your balances and payments in the app or on its website, making it the simplest way to manage your international banking.

A unique feature of the Wise account is that it equips you with your own local bank details for the US, EU, UK, Australia and Poland. That means that it’s free to receive payments directly into your account from any of those currencies. It’s a bit like getting paid like a local from around the world.

The account also comes with a debit Mastercard to help you spend internationally safely and cheaply. You can freeze your card in the app if you lose it, reset the pin, and review all your transactions, balances and statements in a few clicks.

Wise’s founders Kristo Käärmann and Taavet Hinrikus started Wise 10 years ago because of their own frustration at the high costs they were being charged to send money internationally. They built Wise to make money transfers cheaper and fairer.

Today, Wise’s 8 million customers send billions of dollars through the platform each month, saving $3m each day in bank fees and hidden exchange rate costs. Visit wise.com to start saving time and money on your international banking. It also has an invite reward programme to thank you for spreading the word: for every 3 people who sign up and make a transfer of £200, you’ll earn £50 or its equivalent in your currency.

| Click here to set up your free account and join 8 million customers saving at wise.com, or through our Android or iOS app. |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of combining your pre-nuptial celebrations in a sten do? Read expert tips from Wise and Inbetweeners' actor Joe Thomas on a united stag and hen do.

Organising a stag or a hen do? Here are our top tips from Inbetweeners' actor Joe Thomas and Wise on keeping costs down and keeping it classy.

Organising a stag or hen that fits everyone's budget can be a 'mare. Read our expert guide from Wise and Inbetweeners' actor Joe Thomas on budgeting like a boss

Got plenty of moolah for a stag or hen do? Check out this exclusive guide from Wise and Inbetweeners' actor Joe Thomas on exotic locations for splashing cash

10 years down, and now over 10 million of you have joined our mission of money without borders. There’s also 2,400 Wisers across 15 offices working to make...

Still using a bank or broker to send money? Chances are you're overpaying. Traditional providers are deceptively expensive because they use bad exchange...