Benefits of a Business Bank Account

Discover the benefits of setting up a separated business bank account to manage your business finances separated from your personal ones.

Thinking of switching business bank accounts? One option you’re likely to come across is Virgin Money, which offers a number of current accounts for companies of all sizes.

To help you decide if the bank is the right choice for your business, we’ve put together a comprehensive Virgin Money business bank account review. We’ll look at the different account types and features available, along with fees, customer service info and everything else you need to know.

We’ll also show you a non-bank alternative - Wise Business, which lets you effortlessly manage your business finances across 40+ currencies, including GBP, USD and EUR.

💡 Learn more about Wise Business

While the Virgin Money brand was founded in 1995, the company only acquired its banking licence in 2010. Its most popular business account, the Virgin M business account, was only launched in 2021.

Since then, the bank has expanded its offer to include four different account types aimed at companies of different sizes and types. It also offers savings, card payments, finance, international and specialist banking services for businesses.

Here’s an at-a-glance look at what Virgin Money has to offer for UK businesses:¹

| M Account for Business | Business Current Account | Business Choice Account | Professional Firms Client Account | |

|---|---|---|---|---|

| Monthly fee | None | None for 25 months, then £6.50 | £6.50 | None |

| Designed for | Startups and businesses with <£1m turnover | All businesses | All businesses | Businesses which manage client funds |

| Business debit card | ✅ | ✅ | ✅ | ✅ |

| Online and app banking | ✅ | ✅ | ✅ | ✅ |

| FSCS protection | ✅ | ✅ | ✅ | ✅ |

| Cashback on spending | 0.25% | 0.35% | 0.35% | ❌ |

| Credit interest | ❌ | ❌ | ✅ | ❌ |

| Overdraft (on application) | ✅ | ✅ | ✅ | ❌ |

| Optional savings account | ✅ | ✅ | ✅ | ✅ |

| Integration with accounting tools | ✅ | ✅ | ✅ | ✅ |

When choosing a new business account, there are a number of factors that are likely to influence your decision.

The most important are likely to be - features, account types, fees and customer service. We’ll take a detailed look at how Virgin Money stacks up on these four aspects below.

But first, it’s worth a quick look at what other business customers think of the bank. Unfortunately, it’s not a wholly positive picture when looking at Virgin Money business account reviews on TrustPilot.

Virgin Money has a ‘Poor’ rating of 2.5, based on over 8,000 reviews (although bear in mind that many of these will be from personal customers).²

While it depends which account you choose, some of the main features available with Virgin Money business current accounts include:

- Contactless debit Mastercard, compatible with Apple Pay and Google Pay

- Online, mobile and telephone banking, including in-app money management tools

- Integration with accounting tools such as Xero and Quickbooks

- Deposit cheques digitally

- Overdraft (on application)

- Paper-free statements and letters

- Cashback on debit card spending

- FSCS protection.

Virgin Money has four main account types available for business customers, each designed for a specific type of business (with their own eligibility requirements). Some have monthly fees and additional perks, but there’s also a fee-free account available. We’ll run through all options here.

The Virgin M Account for Business is designed for startups, sole traders and small businesses with an annual turnover of less than £1 million. It’s a digital account with no monthly fees and no charges for day-to-day banking.³

Features include a debit Mastercard, 0.25% cashback on eligible debit card purchases³ and a range of money management tools in the Virgin Money mobile banking app. The account can be integrated with accounting tools such as Xero, Sage and Quickbooks.

It does have a few limits, however, You’ll be limited to a daily cash withdrawal limit of £700, and a £10,000 international purchases limit.⁴

The Virgin Money Business Current Account is available for businesses of all kinds, including startups, sole traders, limited companies and partnerships. But it’s designed for medium and larger businesses with an annual turnover of less than £6.5 million.⁵

If you’re new to the bank, you’ll get 25 months of no monthly fees and free day-to-day banking - after which fees will apply.⁵

The account has features such as discounts on business purchases and 0.35% cashback on eligible debit card purchases.⁵ It has a debit Mastercard included and can be integrated with accounting tools like Xero, Sage and Quickbooks.

You’ll also get access to all the money management tools in the Virgin Money mobile app, including instant payment notifications and in-app cheque scanning.

There’s a cash limit of £250,000 a year on this account, which covers money paid in or out of the account.⁵

The Virgin Money Choice Account is designed for larger businesses, and is only available for companies with an annual turnover of more than £6.5 million.

It’s an all-round account offering all the features you get with the bank’s other current accounts, along with extras such as:⁶

- Access to advanced digital tools

- Access to a team of business banking experts

- Discounts on business purchases

- 0.35% cashback on eligible debit card purchases

- Integration with accounting tools such as Xero, Sage and Quickbooks.

The account does have monthly fees, however. You’ll also pay fees for some day-to-day business banking services.

Virgin Money also has a Professional Firms Client Account, which is only for businesses which hold and/or manage client funds. It offers the following features:⁷

- Instant, penalty-free access to funds

- Unlimited deposits

- No monthly fees or transaction charges for designated client accounts.

The fees you’ll pay as a Virgin Money business account holder depend on what account you have. Some accounts such as the M Account for Business are fee-free, while others such as the Business Current Account only have a limited fee-free period.

Let’s take a look at a few of the main charges, payable by certain accounts and for specific transaction types (including international transactions):⁸

| Type | Fee |

|---|---|

| Monthly fee | £0 to £6.50 depending on account |

| Payments in and out of the account | £0.30 per debit/credit |

| Unplanned borrowing | £25 a day |

| ATM withdrawals | Free in the UK/EEA 3.75% (min £1.50) everywhere else |

| Debit card payments | Free in the UK/EEA 2.75% (min £1.50) everywhere else |

| International payments | £0 to £7 depending on currency, amount and destination |

If you need assistance from Virgin Money customer service, the best way to get in touch is by phone.

Call 0800 756 0800, available Monday to Friday 8:00am to 6:00pm.⁹

Unlike some banks, Virgin Money has a few fee-free business banking options available. If your business is eligible as a start-up or small business, you can open a Virgin Money M Account for Business. It has no monthly fees or charges for day-to-day banking.

There’s also the Business Current Account, which offers fee-free banking for 25 months if you’re a new customer or switching to the bank for the first time.

Depending which account you open, you’ll usually need to provide the following details and documents as part of your Virgin Money business account application:⁵

- Financial information for your company, including business turnover

- Companies House name or registration number (if applicable)

- Three years of personal address history for anyone who will be operating and using the account. You’ll also need to provide this for anyone who owns or controls 25% or more of the business, and for Directors, Partners and Members of Senior Management (for Limited Companies, Partnerships and Limited Liability Partnerships)

- The authority to apply for this account on behalf of the business

- A business email address and mobile phone number.

You may also need to complete ID verification processes. This usually involves providing a live selfie and an identity document to confirm who you are with the bank’s identity partners HooYu.

Virgin Money doesn’t say exactly how long it takes to open a business account, but it aims to make the process as quick as possible.

In some cases, it may need to ask you for further information - and advises that you respond within 5 working days to prevent any delays opening your account.¹⁰

Yes, your company’s finances are safe with Virgin Money. It’s a fully licensed bank, regulated by the Financial Conduct Authority (FCA) in the UK.

It uses sophisticated security measures to keep your money safe, and also offers Financial Services Compensation Scheme (FSCS) protection of up to £85,000 on all eligible deposits.

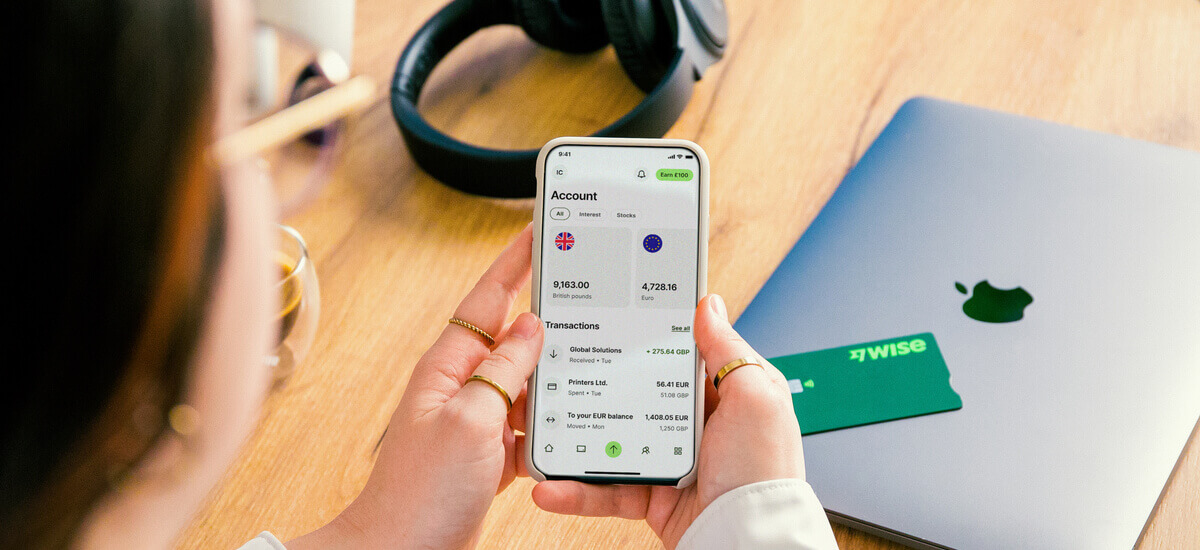

If you need to pay or get paid in foreign currencies, you could be better off with a simpler and more straightforward option - the Wise Business account.

Whether it’s managing your business finances in the UK, paying contractors and suppliers overseas, or accepting global customer payments digitally, Wise has low cost solutions to help.

Wise Business account can hold and exchange 40+ currencies, send payments to 160+ countries and come with local account details to get paid in 8+ currencies like a local.

Use your Wise account to get paid in a selection of major foreign currencies by customers and clients, and through online marketplaces. Whenever you need to send, spend or exchange foreign currencies, you’ll benefit from the mid-market exchange rate, with low, transparent fees.

When you open a Wise Business account, you’ll benefit from all of these useful features:

- Hold and exchange 40+ currencies in one powerful online account

- Send payments to 160+ countries for low fees and mid-market exchange rates

- Get local account details to get paid in 8+ currencies like a local.

- No ongoing fees, minimum balance requirements or foreign transaction fees

- Debit and expense cards for you and your team, which you can use in 150+ countries

- Multi-user access for team members, with ways to control and manage permissions

- Pay up to 1,000 people at once with the Wise Batch Payments feature

- Integrate with your favourite cloud accounting solutions, and use the Wise API for automation and streamlining workflow

- Use the Wise Interest feature to make your money work harder when you’re not using it.

It’s quick and easy to open a Wise Business account, with a fully digital application, verification and on-boarding process. Check out the requirements here.

Get started with Wise Business 🚀

And that’s it - everything you need to know about opening and using a business account with Virgin Money. The great news is that there are a few different accounts to choose from, including fee-free options for smaller businesses.

Sources used:

Sources last checked on date: 23-Aug-2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the benefits of setting up a separated business bank account to manage your business finances separated from your personal ones.

Read our essential guide to the best business bank accounts for startups in the UK, comparing all of the most popular providers

Read our guide to the best online business bank accounts in the UK, including Tide, Starling, Revolut, ANNA and Wise Business.

Discover how to send money from Payoneer to Wise easily. Follow our step-by-step guide to transfer funds securely and save on international transactions.

Read our essential comparison of business bank account fees in the UK, including upfront, monthly and usage charges.

If you’re just starting out on an entrepreneurial journey you need smart ways to manage your money. This probably means you’re looking for the best bank...