Best CRM for Startups (UK - 2025)

Get insights on the best SRM for startups to optimize customer relationship and drive growth.

If you’re searching the market for a new business bank account, you’re likely to come across Ulster Bank.

Owned by the Natwest Group, Ulster is one of the major banks operating across Ireland and Northern Ireland. It has a choice of business bank accounts, including a dedicated account for start-up businesses.¹

Ulster Bank claims to have customers in most sectors, so can offer specialist expertise and support if you need it. If you meet certain eligibility criteria, you’ll even get your own dedicated Relationship Manager when banking with Ulster.¹

In this guide, we’ll cover all you need to know about Ulster Bank business accounts, from the features to the fees.

We’ll also show you how a multi-currency account could save you money on international transactions.

There are two main types of Ulster Bank business accounts to choose from – the Business Bank Account and Startup Business Current Account.

However, there is also a dedicated account for not-for-profit organisations.¹

This everyday business current account offers:

You can apply for this account online or using the Current Account Switching Service. Your business will need to be registered in Northern Ireland and have an annual turnover of under £2 million.

This Ulster account offers all the same benefits as its standard business current account, including free access to FreeAgent accounting software. But there are also a few extra perks designed to help brand new companies to get off the ground. This includes no transaction fees for 18 months, which is good news for your cash flow.

Who can open a startup business account with Ulster Bank? As you’d expect, there are strict eligibility requirements you’ll need to meet. Your business will need to be less than a year old, have an annual turnover of less than £1 million and be registered in Northern Ireland.

The Business Bank Account with Ulster Bank comes with a Visa Debit Card², but you’ll need to register for one with the Startup account. However, you can do this at the same time as opening your new bank account.³

You can also apply for the Ulster Bank OneCard credit card. This has the following features:⁴

You can send and receive money internationally using your Ulster Bank business account, but bear in mind that fees may apply. We’ll cover the standard charges for international transfers in the next section.

Another thing to think about with international payments is the exchange rate used for currency conversions. This can vary depending on the provider, but when using banks there is likely to be a mark-up added. This gives you an unfavourable rate and could make your transfer more expensive overall.

We’ve covered the features on offer with different Ulster Bank business accounts, but what about the fees? If there are services your business relies on every day, you’ll need to make sure they won’t cost you a fortune.

Here are the main fees and charges with Ulster Bank for business customers⁵. This covers both standard and start-up business accounts.

| Service or transaction type | Fee |

|---|---|

| Account maintenance fee | £8 per quarter |

| Cash and cheque deposits | £0.70 per £100 for cash£0.40 per cheque |

| Electronic payments within the UK (free for 18 months for Startup Business Current Accounts) | £0.43 per Direct Debit£0.58 per Standing Order |

| International transfers - sending⁶ | £25 (for payments sent in GBP) |

| International transfers - receiving⁶ | £0 to £6 (depending on currency) |

| Business debit card transactions⁶ | Free to 2.65% (Non-Sterling Transaction Fee) |

International transfers with banks can often be expensive and complicated. You may end up losing money on hidden fees or an awful exchange rate, which can make your transfers more costly than they need to be.

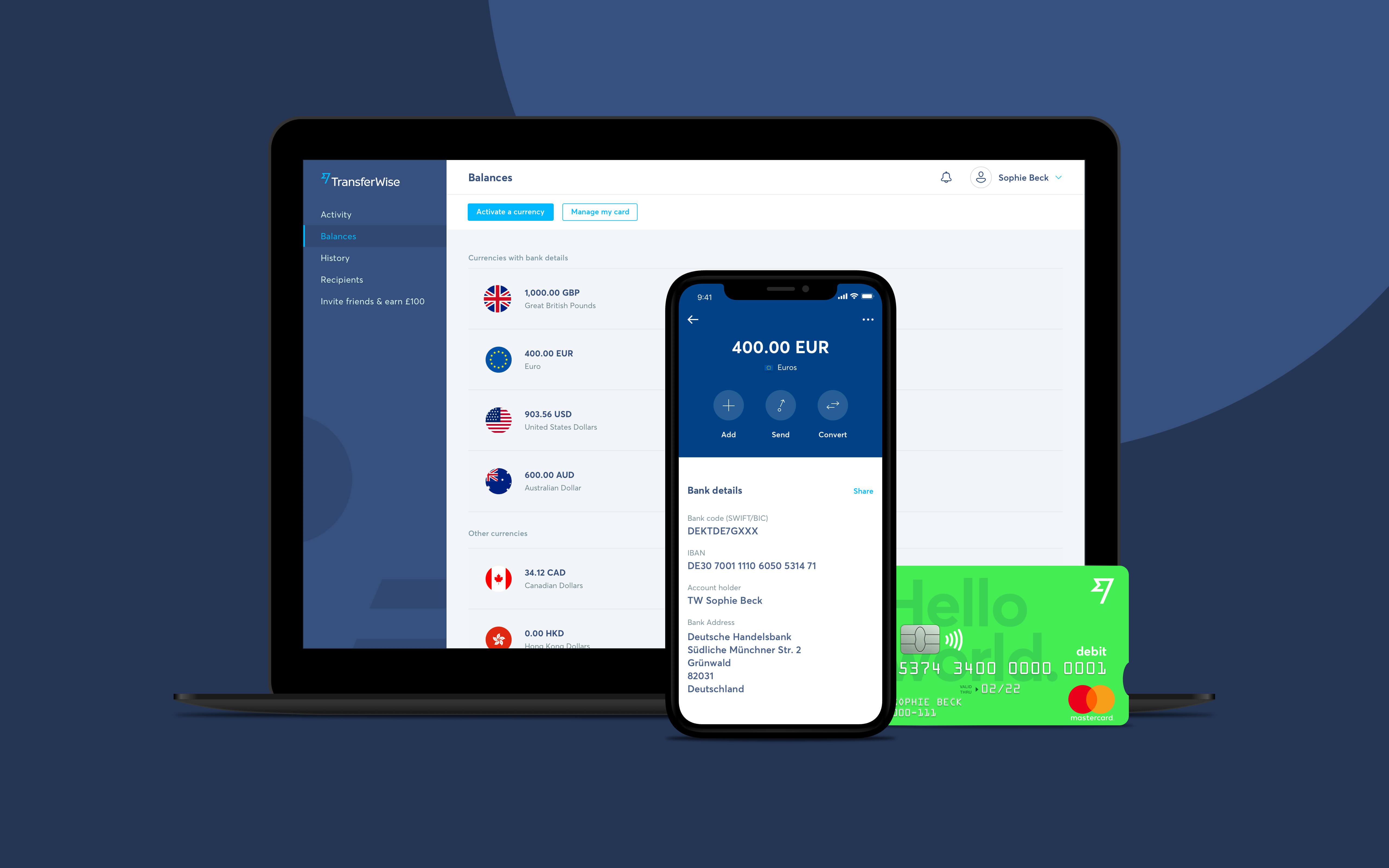

But banks aren’t the only option for sending money abroad. By opening a Wise Business Borderless account you can start sending money worldwide for low fees and always at the mid-market exchange rate. This means a fair rate without the mark-up.

You can hold 55+ currencies in your account at once, and only pay tiny fees for converting currencies. You can switch between them as and when you need to.

There’s a whole suite of other handy tools at your fingertips with Wise too. For example, a Wise debit Mastercard and integration with accounting software such as Xero and Quickbooks. Plus, a choice of local bank details so you can get paid by clients in other countries in their own currencies.

If your company is registered in Northern Ireland, Ulster Bank could be a good option for managing your everyday business transactions. It’s a particularly attractive option for startups wanting to save money on everyday transactions.

After reading this guide, you should have a handle on the account types and banking services available with Ulster. And crucially, you’ll know all about how much an Ulster Bank business account could cost you.

Remember – it pays to take your time when researching business bank accounts. Scrutinise the small print and choose carefully, to find a bank or payments solution that suits the needs of your business. Good luck!

Sources used:

Sources checked on 24-January 2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Get insights on the best SRM for startups to optimize customer relationship and drive growth.

Discover the best 0 interest business credit card you can get in the UK to help you manage cash flow and business spending.

Can you use Airwallex in the US? Find out here in our essential guide for UK businesses, covering everything you need to know.

A business that needs access to working capital should consider debt factoring advantages and disadvantages before making a decision.

Discover the best startup business credit cards to improve cash flow and streamline financial management.

Can you use Airwallex in the UAE? Find out here in our essential guide for UK businesses, covering everything you need to know.