Should Expenses be Paid Through Payroll?

Discover if expenses should be paid through payroll, with pros, cons and directions from HRMC.

Looking for a new business bank account? TSB could be one of the good choices, as it’s an established bank offering a range of services and benefits for businesses of all sizes.

Even better, TSB often has a free banking period for new customers¹. This means you can try out the account for a while before paying for it.

In this guide, we’ll cover everything you need to know about TSB business bank accounts. You’ll learn all about the different account features and of course, the fees. We’ll also show you how a multi-currency account could save you money on international payments.

So, let’s get started.

TSB has one main business bank account – the TSB Business Plus Bank Account. This is particularly suitable for new or smaller businesses, but it has all the features that most organisations will need for everyday business banking.

Here’s a quick rundown of what’s on offer with TSB Business Plus²:

To be eligible for the TSB Business Plus account², you’ll need to be a partner, director or sole trader over 18 years of age. Your business must be registered in the UK, and you must be opening the account purely for business use. Ticked all the boxes? Great, you’re ready to apply on the TSB website.

Alongside all the features listed above, the TSB Business Plus account also comes with a Business Debit Card². With this, you can withdraw money from an ATM and make transactions with no fees attached.

You can also apply for a TSB Business Credit Card if you need one. This gives you flexible repayment options and up to 45 days interest free credit on purchases made in GBP (provided you meet balance repayment requirements). The interest rate is 17.6% APR (variable) and there may be other charges to pay.³

The TSB Business Plus account is suitable for businesses with dealings overseas. If you need to pay a supplier in another country, you can send an international payment using the TSB Online International Payments Service. This is a relatively quick and easy way to send money in over 20 currencies.

But remember that sending money internationally with any bank is likely to come with fees and charges, and TSB is no different. We’ll cover international transfer fees with TSB next, but you should also take into account the exchange rate used for any currency conversion. There’s usually a mark-up on this, giving you an unfavourable rate and costing you more overall.

Check the fees and compare it with alternatives like Wise who offers fast cross currency transfers at the real exchange rate for a small fee.

When choosing a new business account, it often comes down to cost. It’s really important to take the time to research account fees and charges before signing up. Focus on the services your business needs, to see if the account really is good value for you.

Here’s what you can expect to pay for transactions and services with the TSB Business Plus account:²

| Service or transaction type | Fee |

|---|---|

| Monthly account fee | Free (for balances of £10,000+) or £5 |

| Cash and cheque deposits | £0.70 per transaction |

| Electronic payments within the UK (including Direct Debits, Faster Payments and standing orders) | Free |

| International transfers - sending⁴ | £15-£28 per transaction (free for payments in euros to qualifying EEA countries, higher fees charged for express payments |

| International transfers - receiving⁴ | £2-£7 depending on amount (free for payments in euros to qualifying EEA countries) |

| Business debit card transactions | Free |

| Transfer between TSB accounts | Free |

| Square Reader transactions (after initial fee-free period)⁵ | 1.75% for in-person payments and 2.5% for online payments |

While the TSB Business Plus account may be good value in other areas, it may not be the cheapest when it comes to international payments.

If your business regularly makes payments overseas, especially outside of EEA countries, or you plan to expand into international markets – you might need a better value solution.

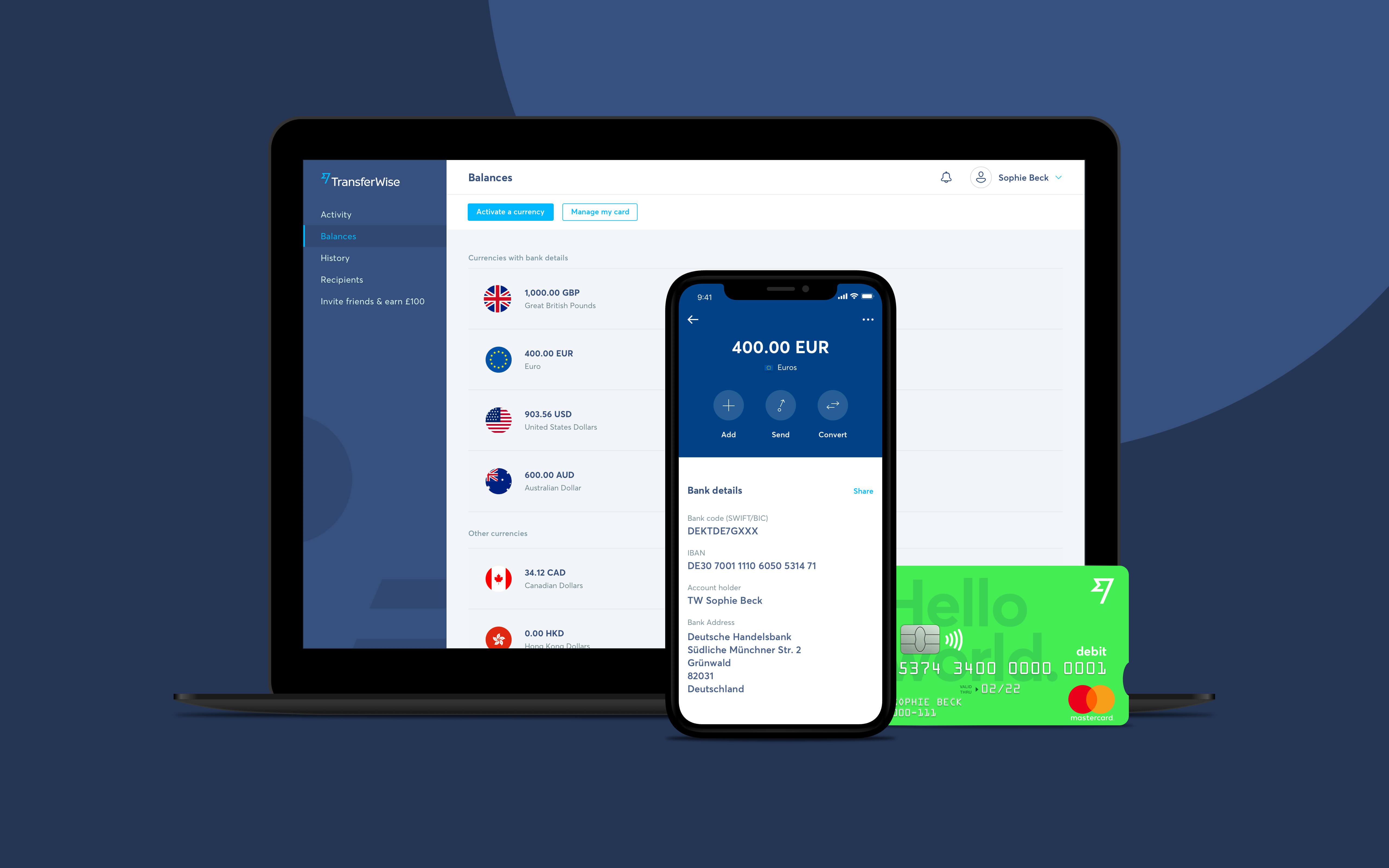

And here it is – Wise. You can open a Wise Business account in a matter of minutes. From there, you can send money worldwide for tiny, transparent fees and the real, mid-market exchange rate.

For some businesses, having a multi-currency account is a luxury due to the cost that comes with it and the complexity of getting one. Wise made it easy for businesses to open a multi-currency account without borders for a one-time setup fee of £16 - £21 depending on your country.

You can receive money in GBP, EUR, USD, AUD, NZD, PLN, SGD, HUF, TRY and CAD for free, invoice like a local and even spend in the local currency with a Wise Business Debit Card. Seamlessly integrate your Wise Borderless account with accounting software like Xero and Quickbooks, to make managing your money that much easier.

So there you have it – TSB business banking in a nutshell.

After reading this guide, you should have a better idea whether TSB is the right bank for your company. Its Business Plus account could be the ideal choice, especially if you’re a start-up, as it offers plenty of fee-free services and benefits.

But remember that TSB isn’t the only game in town. If there are services your business relies on, such as international payments, it really does pay to shop around for better value alternatives such as Wise.

Sources used:

Sources checked on 21-January 2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover if expenses should be paid through payroll, with pros, cons and directions from HRMC.

Discover the best practices when setting up per diem expenses, how to set up rate, proceed with payment and more.

We’re excited to announce that Morgan Stanley, a leading global financial services firm, has teamed up with Wise Platform, Wise’s global payments...

Discover how to automate expense reporting with our complete guide that covers step-by-step process, tools and best practices.

Travel and expense (T&E) processes are necessary in any business in which employees may spend on allowable business expenses, which need to be recorded,...

Discover the 6 best reconciliation tools available for businesses in the UK.