To the Wise community,

You have made Wise possible. You keep our lights on, so that we can move money faster and cheaper for you today and for the generations after you. The bigger our community, the faster and cheaper Wise becomes.

Here’s a roundup of the progress we’ve made on our mission from July to September.

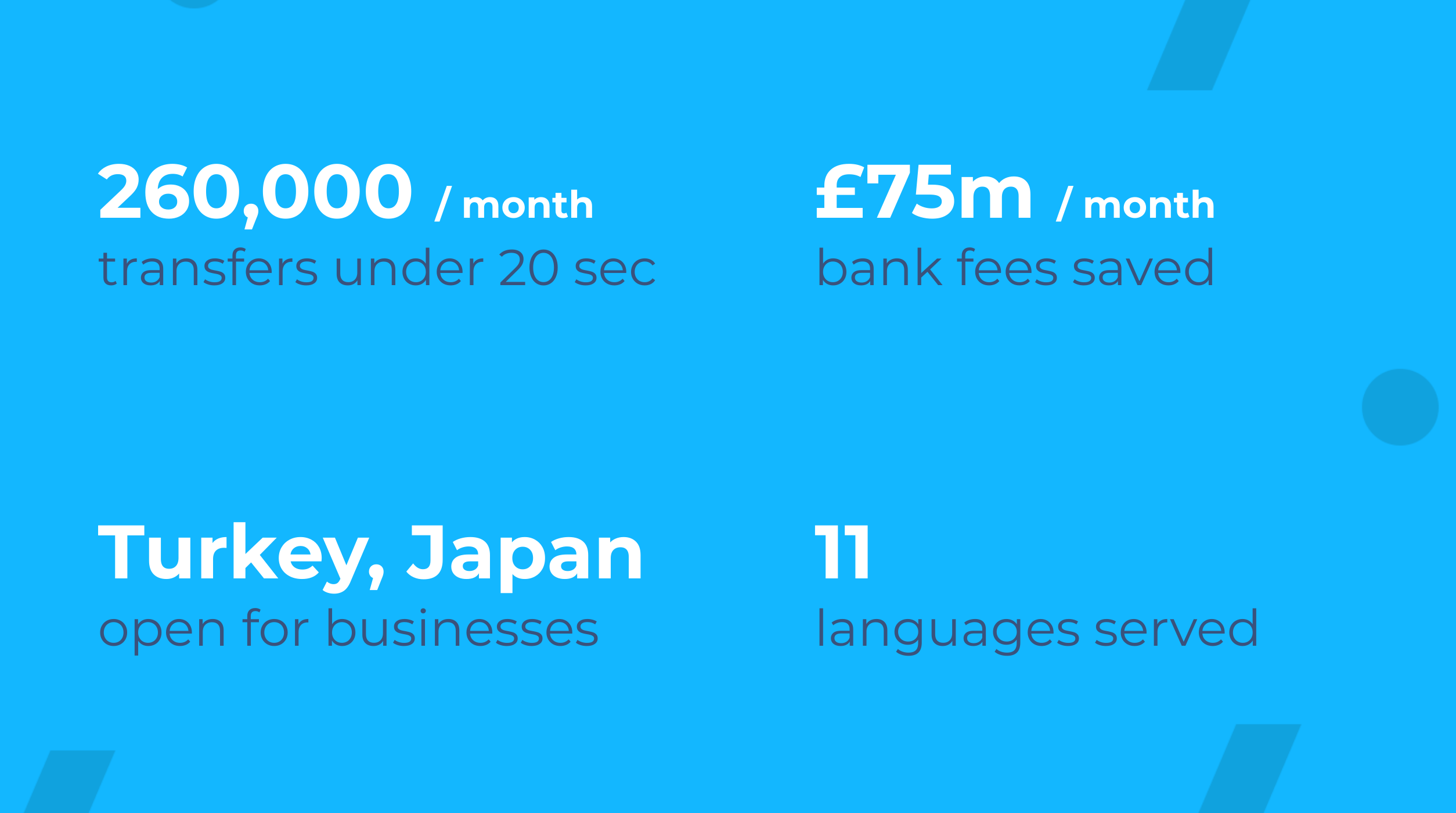

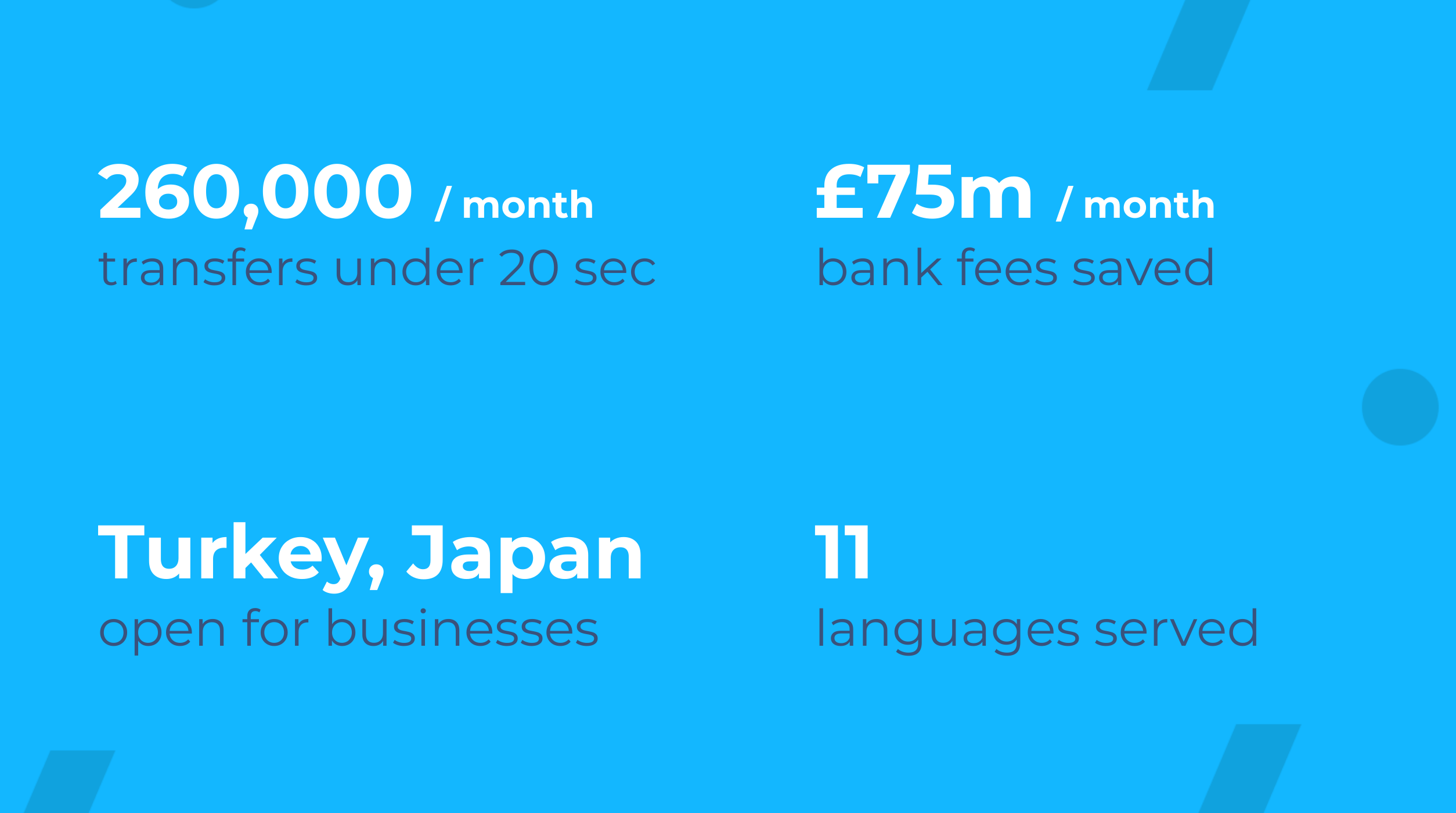

Speed. Instant transfers up by 50%.

Money is information and should move at the speed of light. We take a looser definition and call payments instant when it takes less than 20 seconds to move money from your bank to become usable at another bank in another country in another currency. Yes, 20 seconds from start to finish.

The share of instant payments is going up on Wise. In September we made 12.4% of these sub-20-second payments, up from 8.3% instant in June. This was thanks to adding two fast new channels. We're now able to make instant transfers from US debit cards, as well as send instantly to the majority of recipients in India.

Some other routes got faster too. Our users sending money from Switzerland previously had to wait more than 24 hours for us to receive the Swiss Franc from their bank to start their transfer. A new integration, which cut out another middleman, has reduced these slow transfers from 45% to 11%. The majority of transfers from CHF now reach us in less than 4 hours. Transfers to the UAE have also become faster - over 60% now arrive the same day, rather than the next day as previously.

Our reverse engineering of all the cutoffs, processing times and holidays at the world’s banks, has become more precise. This means that we are more likely to give you an accurate estimate about when exactly your money is going to arrive at the recipient's bank account. In Q3 75% of transfers got an estimate that was within 2 hours of the time money eventually arrived, up from 64% in Q2.

Jonathan's post about why Wise isn't always instant? explains how fast transfers are and how they will be instant.

Fees. Ups and downs.

After big price drops in Q2 we made less progress this quarter. In positive news we improved our payout connections in Thailand and Indonesia, which let us reduce the fees on many routes to THB and to IDR.

Embarrassingly we made a mistake with transfer fees for people using the borderless balances. In July we removed the ~50p fee on same-currency payouts, e.g. when you're paying out from your borderless GBP balance to another UK bank. After a more thorough analysis we realised that the costs relating to these transfers hadn't disappeared and we had to put the fees back in. There are no excuses for creating a temporary illusion of free and flip-flopping with your expectations.

Our mission towards zero fees on cross-border payments will, in time, be successful through a thousand little price cuts as we remove and reduce costs involved in moving money. The same logic applies to the costs and fees of same-currency transfers - as we bring the costs down, we can gradually cut the fees to get closer to zero. You may be used to banks taking a different approach: offering basic banking for free and making it back on excessive overdraft fees and hidden fees in cross-border transfers.

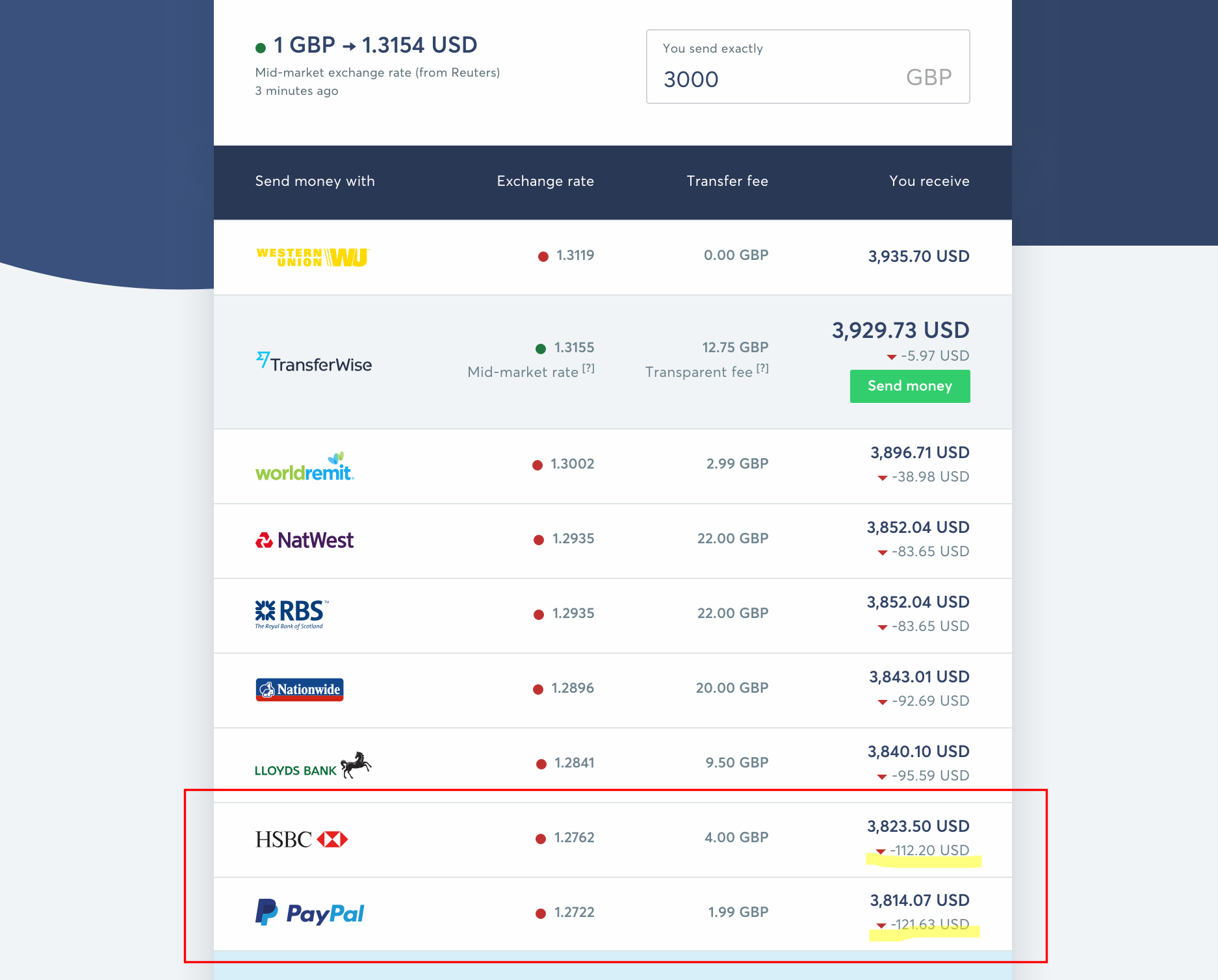

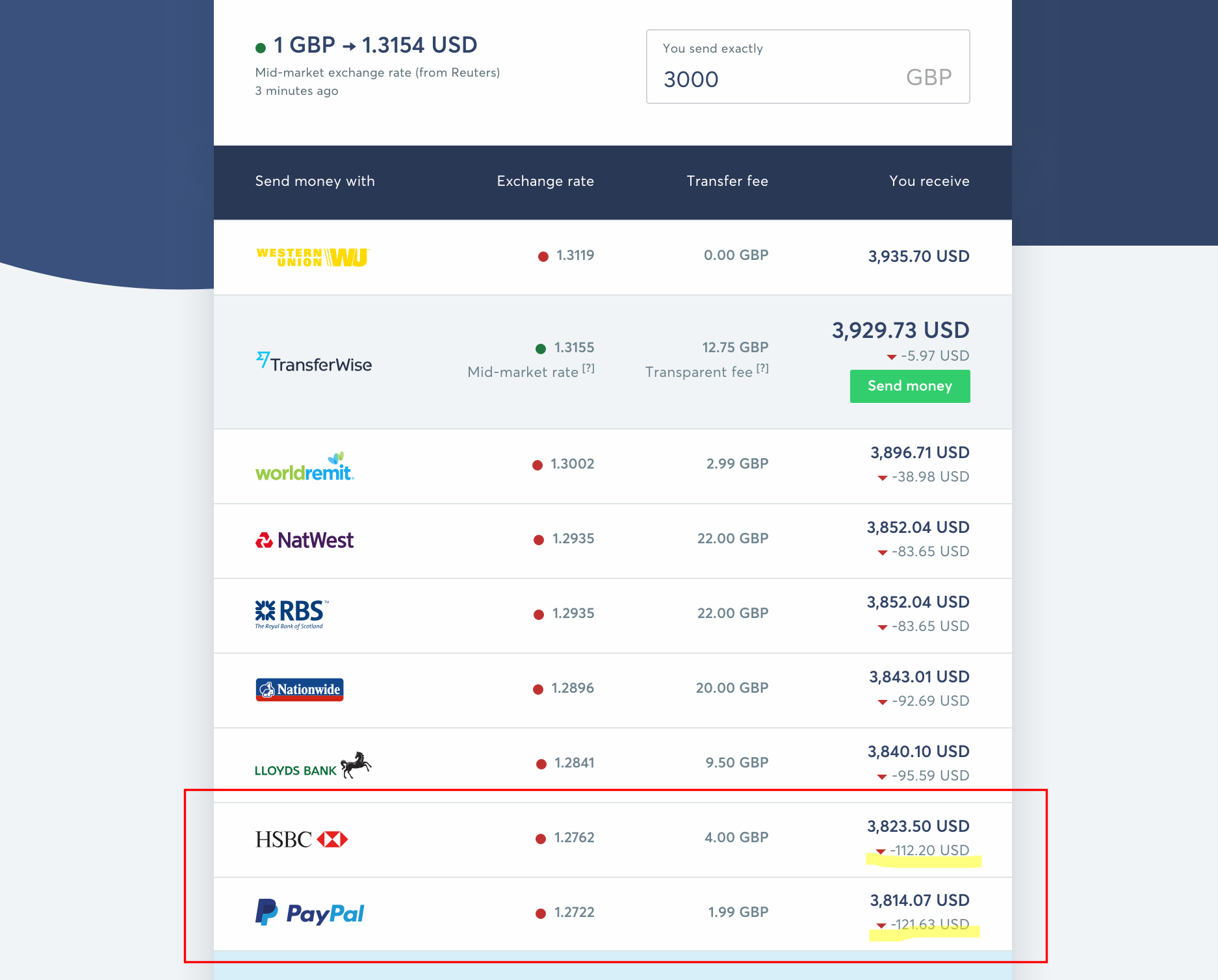

Big old banks vs big old tech companies

Which is more expensive - HSBC or PayPal? We now have the answer since we added both to the comparison tables. While HSBC was just expensive, Paypal turned out to be tricky to reverse engineer all the places where they hide the fees.

Our comparison site now has 58% bank coverage in the UK - missing just Barclays and Santander. By adding the 4 largest banks in New Zealand, UOB in Singapore, Hang Seng and HSBC in Hong Kong, we improved price transparency in the Asia Pacific region.

The grumbling sound of your disappointment with banks hiding their fees is becoming more and more difficult for financial regulators to ignore. Australian regulator ACCC launched an investigation into hidden exchange-rate markups by Australian banks. They are looking for your contribution, so make sure to get involved and don't hold back.

The EU parliament has drafted amendments requiring European banks to disclose their fees in exchange rate mark-up, against the banks' lobby. These are early baby steps, but please say thanks to your MEP for staying cool and pushing on.

Convenience

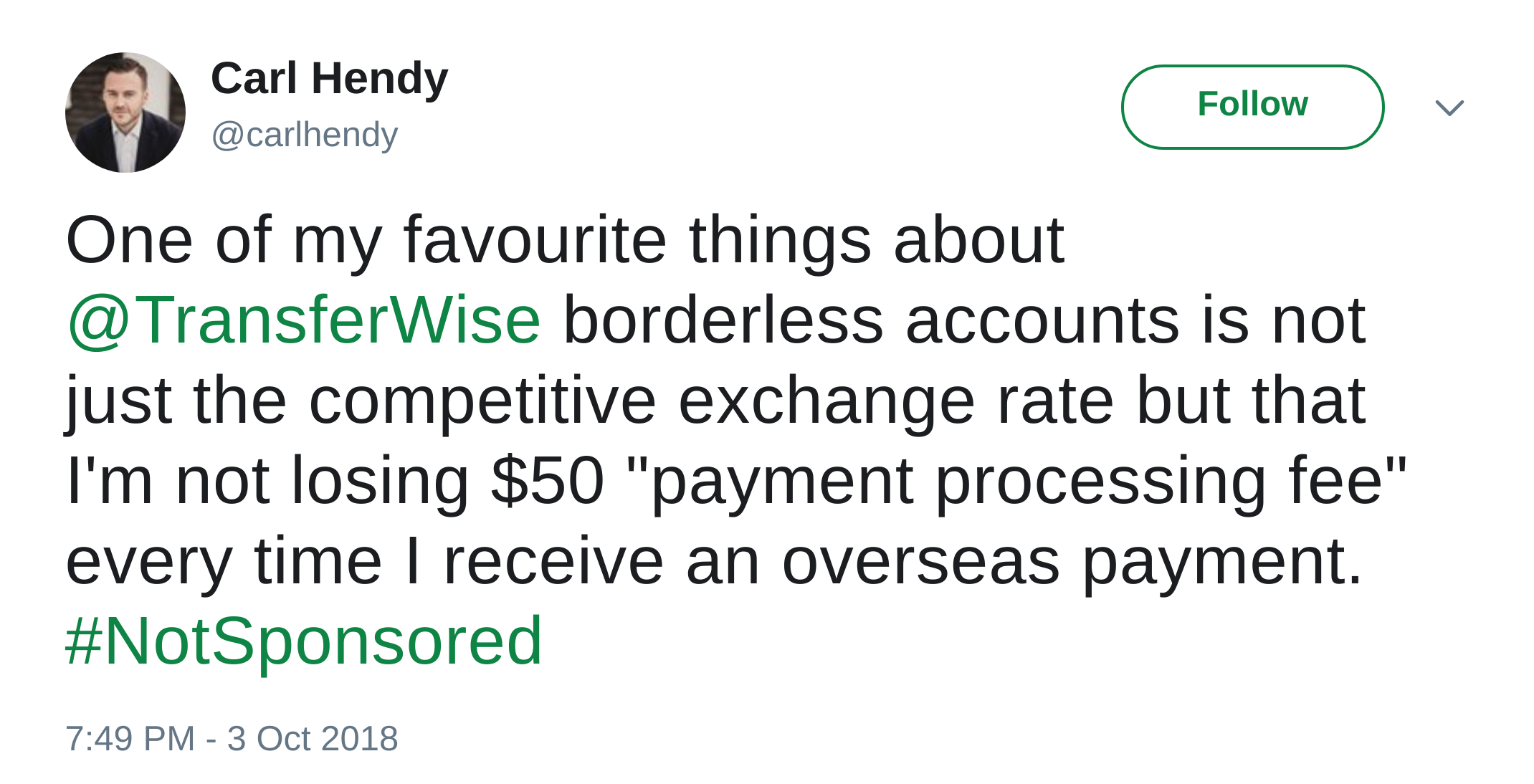

We’re here to make cross-border payments convenient for our 4 million users and all these international moments in your lives. Some people get a smooth sailing through the experience, for others we have much work to do.

How do we measure convenience? One useful proxy has been what we call contact rates - if part of the app is unclear, inaccurate or just inconvenient, it is quite likely that you’ll reach out to us for help or for telling us off. We respond to 100,000 contacts per month and you call us out, where we’re cutting corners. In fact we increased the chat opening times by 2 hours and made Portuguese and Spanish phone lines available for longer.

Our Android users can now pay with a debit or credit card when sending from HUF, CZK, BGN, HRK and RON. We also increased the card limits for Australians to AU$ 18k. Canadians are now able to send money abroad using bill payments from their bank to fund them. They love it, about 21% of new transfers are funded as a bill payment. For Europeans we took a step back and closed the SEPA Direct Debit method for funding transfers from EUR, as it wasn’t affordable .

We listened to our Romanian users’ requests and translated the website, apps and communication to Romanian. It is now the 11th language in which Wise is available.

A big part of convenience is keeping you informed of what’s happening to your transfer. E.g. has your money left your bank yet, has it reached Wise, is something holding it up, has it been paid out to your recipient, have they received it yet? We call this part of the app a money tracker, which in Q3 was upgraded to take into account any manual review that might have stopped the transfer go through.

The other way to measure convenience is through the transfers that get caught for a manual review or need a manual fix. As our models get more accurate, we need to pause fewer payments for manual review. In Q3 we stopped nearly 25% fewer payments for a manual touchpoint. While we endeavor to keep the manual reviews within 24 hours, often it takes longer and can become a source of frustration.

Coverage

Leave no-one at the mercy of their bank’s hidden fees. We built Wise for everyone, whoever they are, wherever they live. We’re gradually adding more countries, currencies and cross-border use cases to the app.

Our borderless account now gives local US account numbers to US residents and businesses registered in the US. These account numbers were initially limited to non-residents.

This quarter we made Wise more available to more businesses worldwide. Businesses in Japan and in Turkey can now send and receive money much cheaper and faster than previously using their banks.

More than 5,000 businesses in Europe received their green debit card through the beta programme, so they can use their borderless balances directly.

More news for businesses, who use Hubstaff’s time tracker. They now have the automated Wise payroll integrated through our API.

Team

As you read above, we have plenty of work to do. We still only power a fraction of the world’s cross-border payments, banks charge $200bn annually in hidden exchange rate markups and it is crystal clear how to fix it.

Did you know that 80% of our team leads were promoted internally, 250 people changed team, or role, or office last year and 14 of our Wise leavers have now gone on to start their own businesses.

Sound like something you’d like to get stuck into? Read about working on our mission on Glassdoor, then apply on our jobs site and join the team of 1200+ people from 71+ nationalities, working in 11 offices around the world.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.