Best CRM for Startups (UK - 2025)

Get insights on the best SRM for startups to optimize customer relationship and drive growth.

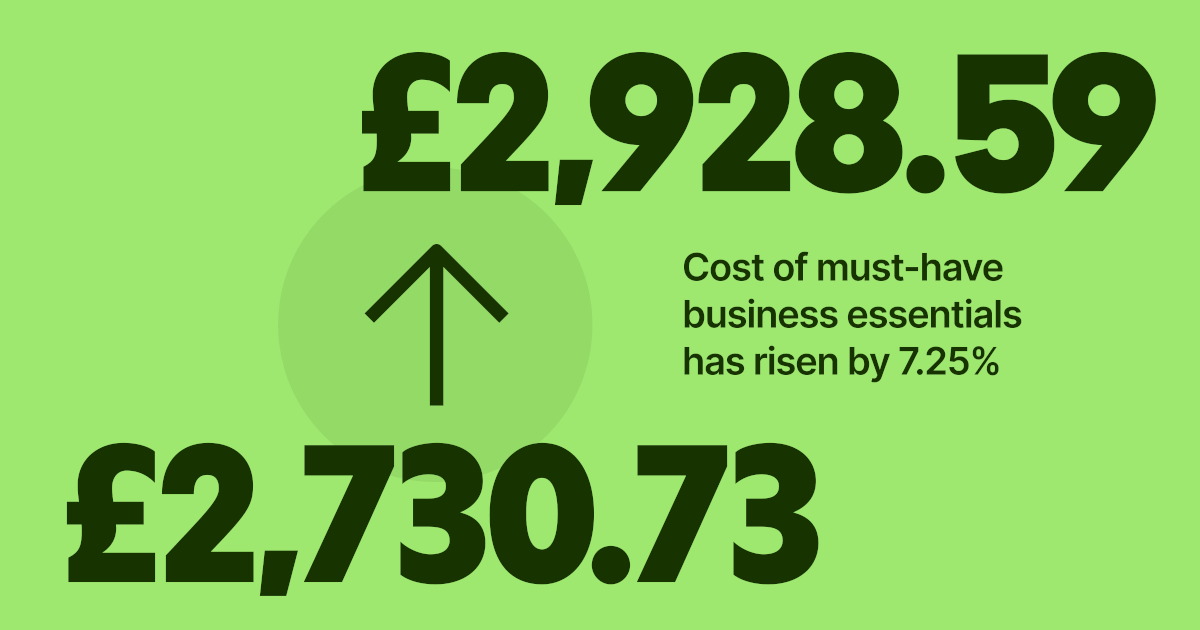

As customers and clients pull back their spending, many UK businesses are also feeling the squeeze. With prices continuing to rise, businesses are struggling to keep pace with the current rate of inflation which is at 6.3% (September 2023, ONS). We’ve crunched the numbers on headline operating costs and a list of 12 essential business items, which reveals that costs for UK businesses have gone up by 7.25% in the past year.

At Wise Business, we're focused on building a multi-currency account that helps businesses to grow internationally while tackling the rising costs of doing business. That's why we launched our Interest * feature, which allows UK businesses to earn a return on their GBP, USD and EUR balances.

When you switch on Interest, your balance is invested in a fund that holds low risk government-guaranteed assets. But unlike other investment products, you won’t need to lock your money away. With Interest you can continue to access your money as normal and send, spend, and manage your business funds any time, all while you grow.

Currently Interest offers a variable return of 4.87% * on GBP balances, 5.09% on USD and 3.42% on EUR balances, which includes our 0.29% annual fees.

*Capital at risk - past performance does not guarantee future growth. Variable rate is based on 7 day performance as of 21 September 2023. For full 5 year past performance of funds, please visit the link below.

For our analysis, we looked at a basket of 12 essential items to assess how much more businesses are spending on day-to-day expenses in the UK. Let's start with some of the basic operating costs and bills businesses are responsible for.

Operating costs

📈In the 12 months to August 2023, Labour costs have seen a significant uplift, in fact they’ve increased by 23% based on figures from the Office for National Statistics, as worker shortages and inflation-related pay increases begin to weight on companies’ bottomline ONS.In addition, business tax including the headline rate of corporation tax has risen from 19% to 25% as reported by HMRC. In addition, some retail units in London have experienced an increase in rental costs of 9.5%, with rents rising at record rates across the UK. It's not all bad news though, with the pressure on energy markets easing, businesses have seen a decrease in 40% of the cost of gas and electricity over the last 12 months.

Luckily, with Wise Business there are no recurring monthly subscriptions and we’re working hard to ensure that our customers can send, spend and manage their funds with zero hidden fees and at the mid-market exchange rate.

In July 2022, this basket of business items cost £2,730.73, whereas the current price of the same basket is £2,928.59 - a price increase of £197.86. Let's take a closer look.

🏢 If you're a small business, you may need a flexible office space. The average cost of a coworking space was £179/month in July 2022 compared to slightly lower £178/month in 2023.

☕ For businesses (and employees) in need of coffee beans for their morning brew, there has been a notable increase of 12% in the price of 1kg of coffee beans (ONS). This means that 1kg of coffee beans have gone up in price from £11.25 to £12.59.

🪭 To combat the summer heat and keep everyone cool, businesses may consider purchasing a fan. For our analysis, we have chosen the classic white office fan available on a mainstream purchasing website , which has seen a price decrease of £2 to the current price of ** £24.99.

🧊 Another essential item for keeping the office bearable and drinks chilled during a heatwave is the mini fridge. The good news is that the price of a mini fridge has decreased from * £135 to £119- another refreshing change to the general trend.

🖨️Even though businesses conduct most of their operations online nowadays, with electric documents and digital tool such as a Wise Business account for their international business finances, there are still situations where printer ink is necessary. The cost of printer ink has increased from £16.37 to £21.25.

🖋️When it comes to highlighting important information in printed documents, the price of a set of 3x highlighters has actually decreased from £4.90 to £3.00. Good news for all businesses who like to cover their books in bright yellow!

💻For businesses in need of new laptops however, the newest model from a leading brand costs £1,399 while that would have been priced at £1,249 in July 2022.

🖼️As a small business, you're likely to use a design tool to help you with your marketing and creative needs. The subscription for a popular design tool has fortunately remained unchanged at £10.99 per month.

👕And nothing says team spirit like company merch. The cost to design your own branded t-shirts has risen too, with the price of T-shirts up 7%. (ONS).

🍱Lastly, treating the team to a business lunch, perhaps sushi for 12 people, has seen an increase of 9.1% as food inflation continues to bite. While we'll keep the choice of our restaurant a secret, the average cost of such a corporate lunch for 12 people comes in at an estimated £384.

| In July 2022, this basket of twelve items cost £2,730.73, whereas the current price of the same basket is £2,928.59, an increase of 7.25%. |

|---|

Like their customers, businesses are facing a challenging economic landscape, with the cost of essential goods and services eating away at their bottomline. As a result many are looking overseas to tap new markets in order to build their business. At Wise Business, we understand the hurdles hindering your growth, particularly when expanding internationally. 🌎

That's precisely why the Wise Business account offers no monthly fees, multi-currency transactions at the mid-market rate and a seamless user experience. Trusted by more than 300,000 business customers globally, Wise Business allows you to send and spend in 40+ currencies to 160 countries around the world.

And if you’d like to earn a return on your money as you grow your business, you can opt to switch on Interest. With Interest, you can invest your money and earn a variable return of 4.87%* on your GBP balance, with other variable rates on your USD and EUR balance. See our website for more details

*Capital at risk - past performance does not guarantee future growth. Variable rate is based on 7 day performance as of 21 September 2023. For full 5 year past performance of funds, please visit wise.com/interest

**prices sourced from Camel Camel Camel

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Get insights on the best SRM for startups to optimize customer relationship and drive growth.

Discover the best 0 interest business credit card you can get in the UK to help you manage cash flow and business spending.

Can you use Airwallex in the US? Find out here in our essential guide for UK businesses, covering everything you need to know.

A business that needs access to working capital should consider debt factoring advantages and disadvantages before making a decision.

Discover the best startup business credit cards to improve cash flow and streamline financial management.

Can you use Airwallex in the UAE? Find out here in our essential guide for UK businesses, covering everything you need to know.