The state of FX: Three tips for navigating the currency markets with Wise’s FX Lead

2026 has kicked off with some significant shifts in the currency markets. To help your business navigate these movements, we sat down with Nathan Solomon, FX...

If you’re running payroll for your company and you have international workers, you may need to learn about tax codes in different countries. You don’t necessarily need to know everything about how the tax system works, but a working knowledge of the relevant tax codes can be really helpful.

In this guide for UK employers, we’ll be taking a look at tax codes in New Zealand. This includes what tax codes mean in New Zealand and how they work, plus a list of common tax codes you’re likely to come across.

We’ll also cover secondary tax codes, the concept of which may be unfamiliar to UK employers.

Tax codes are a way of telling an employer how much tax to deduct from an employee’s pay. They’re part of the Pay As You Earn (PAYE) system, and work in a very similar way to tax codes in the UK.

Every person in New Zealand who receives a salary or other wages, income-tested benefits or pensions will have a tax code.

It’s the employee’s responsibility to provide their tax code when joining a company or organisation.

But employers of people working in New Zealand still need to make sure that they’re using the right tax codes when running payroll. If the wrong code is used, it could result in the underpayment or overpayment of income tax, student loans and other contributions.

If your business is based in the UK but employs workers in other countries, it can be tricky to manage payroll and tax. You’ll need to understand your obligations with regards to tax codes, reporting and remitting tax, and this can be very complicated.

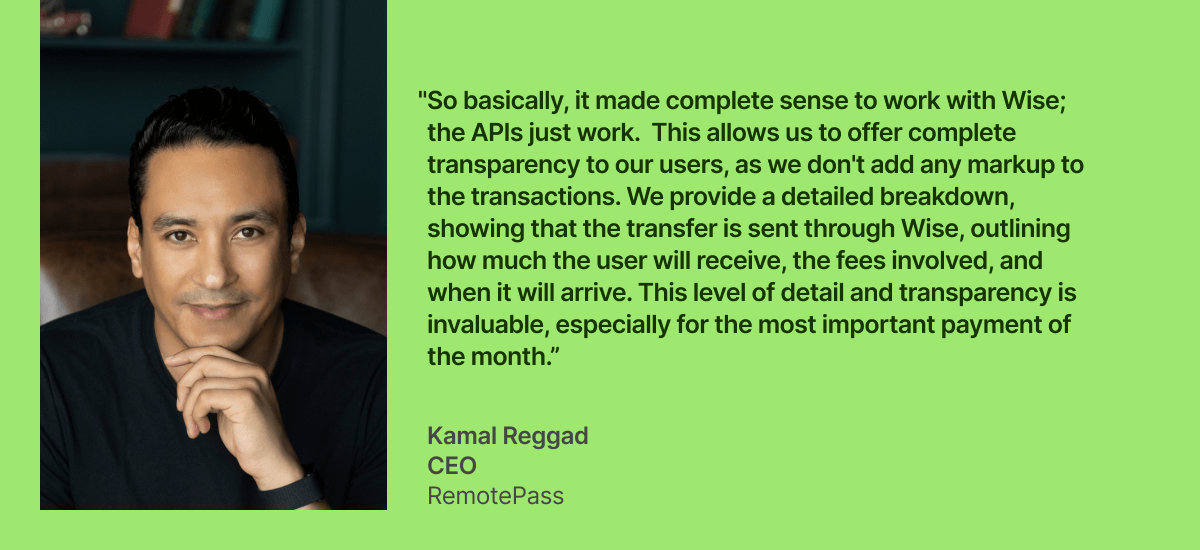

This is why it could pay to seek specialised help with global payroll and employee management. Take a look here to find out how international payment solutions such as Wise Business work with partners like the specialist RemotePass HR platform.

💡 Read RemotePass' complete case study

In the New Zealand tax ystem, there are two tiers of tax codes - primary and secondary.

Most employees have just one job, so only need a primary tax code. But for workers who have two jobs, they will also have a secondary tax code in addition to their primary tax code.

When starting a new job, employees need to complete a form called a Tax Code Declaration - IR330. If they have both a primary and a secondary tax code, they’ll need to complete an additional IR330 form for the second job and tax code.

Employers use the notes on the IR330 form to work out the correct tax code. They can then use the Inland Revenue’s online PAYE calculator to work out how much tax to deduct from each pay cycle.

It’s really important to ensure that employees are on the right tax codes, in whatever country they’re based in. Get it right, then you can use international payroll tools to ensure that everyone gets paid on time.

| Read more about how to start a business in New Zealand |

|---|

Tax codes in New Zealand are quite short, and are only made up of letters. For example, M, ME or M SL. This is unlike in some other countries such as the UK where tax codes are made up of both letters and numbers.

To help make payroll just a little easier for you as a UK employer, here’s a quick look at some of the most commonly used primary and secondary tax codes in New Zealand:²

| Primary tax codes | Meaning |

|---|---|

| M | The job is the person’s main source of income and earnings will not likely fall between $24,000 and $48,000 NZD |

| ME | The employee does not receive an income-tested benefit, and has an income of $24,000 to $48,000 NZD |

| M SL | As above (M), but the person also has a New Zealand student loan to pay off |

| ME SL | As above (ME), but the person also has a New Zealand student loan to pay off |

| Secondary tax codes | Meaning |

| SB | The job isn’t the main source of income, and earnings are less than $15,600 NZD |

| S | The job isn’t the main source of income, and earnings are $15,601 to $53,500 NZD |

| SH | The job isn’t the main source of income, and earnings are $53,501 to $78,100 NZD |

| ST | The job isn’t the main source of income, and earnings are $78,101 to $180,000 NZD |

| SA | The job isn’t the main source of income, and earnings are above $180,001 NZD |

As you can see from the table above, there are a number of secondary tax codes in New Zealand. These are for people with second jobs, which aren’t their main source of income.

For example, if a person has a weekend bar job in addition to their 9 to 5 office job. In this case, the employee will have two tax codes - one for each job and employer.

New Zealand has a progressive tax rate system, where the amount of tax paid by individuals increases as the earned income increases. From April 2025 new tax rates and bands will be applicable:3

| Income bands | Tax rate |

|---|---|

| Up to $15,600 NZD | 10,5% |

| From $15,601 to $53,500 NZL | 17,5% |

| From $53,501 to $78,100 NZL | 30% |

| From $78,101 to $180,000 NZL | 33% |

| From $180,001 and over | 39% |

Income tax can be complicated, but paying your staff doesn’t have to be. If you have employees spread across New Zealand, the UK and other countries worldwide, you can pay them all quickly and easily using Wise Business.

Open a Wise Business account and you can pay up to 1,000 people at once using the handy Batch Payments tool. It’s even possible to automate payments with the Wise API, and you can seamlessly integrate your accounting tools and other business software to keep things running smoothly.

Not only does Wise Business save you time on payroll, but money too. With Wise, you can send global payments in multiple currencies and mid-market exchange rates. If you have an international workforce, this could save your business a bundle.

Wise Business also has lots of other useful features. This includes cards for managing expenses, local account details so you can get paid faster in your client’s currency, and much more.

Get started with Wise Business 🚀

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

To determine the appropriate tax code for New Zealand employees you need to consider whether the income source is the main or secondary income, the type of income, and the estimated annual earnings.

So it is important to collect this information with the employee in order to select the correct tax code, this can be done using the IR330 form.

To support the employee with the tax code selection The Inland Revenue Department (IRD) provides an online questionnaire to assist individuals in selecting the correct tax code.4

The IR330 is a Tax Code Declaration form that individuals must complete to inform the employer of their correct tax code. This is essential to ensure tax withholding is done correctly.

Using an incorrect tax code can lead to either underpayment or overpayment of taxes.

Underpayment may result in the employee receiving a tax bill at the end of the year, while overpayment means they're paying more tax than necessary.

After reading this guide, you should have a better understanding of how New Zealand tax codes work.

It will always be complex to get tax right, especially when you’re hiring across international borders. But getting to grips with tax codes is an important first step to running payroll effectively.

Sources used for this article:

Sources last checked 24/09/2025.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

2026 has kicked off with some significant shifts in the currency markets. To help your business navigate these movements, we sat down with Nathan Solomon, FX...

Having trouble deciding which Wise Business account is best for your business? We’re breaking down the differences between the ‘Essential’ and ‘Advanced’...

Learn how to pay yourself as a UK business owner based on your business structure. Our guide explains tax implications, dividends, salary, drawings, and more.

Learn about the various costs you'll need to account for if you want to start a business in Abu Dhabi in 2026 in our comprehensive guide.

Maximise your Amazon FBA profits by learning about the best business accounts for UK sellers. Our guide provides key details and compares features and fees.

Plan the ideal corporate retreat abroad. Discover exclusive venues, unique team-building activities, and seamless logistics for a successful event.