Wise Business Pricing Explained

Having trouble deciding which Wise Business account is best for your business? We’re breaking down the differences between the ‘Essential’ and ‘Advanced’...

New to managing payroll? If you’re an employer, you’ll need to get to grips with the ins and outs of the Pay As You Earn (PAYE) system. This means understanding UK tax codes.

The UK tax system can be complicated to understand, but don’t worry. When it comes to tax codes, we’re here to help. We’ve put together a useful guide to employee tax codes, covering everything you need to know.

This includes what tax codes mean, a breakdown of the different tax codes in the UK, and much more.

Tax codes are used in the UK to identify how much income tax an employee should be paying. The code tells the employer how much tax to deduct from the person’s salary or pension.

HM Revenue & Customs (HMRC) issues tax codes. But it’s still important for them to be checked from time to time, especially if an employee’s circumstances should change. For example, they start working more hours. If the tax code isn’t right, it could mean they end up paying too much or too little tax.

When an employee starts working for your company, you’ll be able to get their initial tax code from their P45 form. Once the person’s information has been sent to and processed by HMRC, the tax code may be updated.

It’s really important for employers to keep up with these changes, or it could result in under or overpayment of tax. As the employer, it’s your responsibility to make sure you deduct and pay the correct income tax for your staff.

💡 Learn more about how Wise helps RemotePass to handle global payroll

If you have a new starter, here’s how to find their tax code.

If the employee has a P45 form:¹

If the employee doesn’t have a P45 form:¹

Remember that if HMRC needs to change or update a tax code, it will usually write to you. As well as communicating by post, you should also be able to view any updates online if you use the HMRC PAYE Online for employers service.

Tax codes are made up of both letters and numbers. For example, the tax code 1257L - one of the most common codes used for UK employees.

The numbers here tell the employer or pension provider the maximum amount the employee can earn before paying tax. This is calculated by HMRC based on the person’s personal allowance and any other untaxed income they get.

The letter in a typical tax code indicates how a worker’s circumstances affect their annual personal allowance.

Additionally, letters in tax codes let HMRC communicate to employers any blanket changes to tax codes. For example, HMRC may issue guidance to employers at the start of a new tax year telling them to update all ‘L’ codes to reflect the new, updated personal allowance amount.

Here are some of the most common tax code letters used in the UK, along with what they mean:²

| Tax code letter | Meaning |

|---|---|

| L | The most common tax code letter, meaning that the employee is entitled to the standard tax-free personal allowance |

| M | Marriage allowance, where the employee has received 10% of their spouse’s personal allowance |

| N | Marriage allowance, but where the employee has transferred 10% of their personal allowance to their spouse |

| 0T | This is for new employees who aren’t able to provide the details needed to get a tax code, or whose personal allowance has been used up |

| BR | This indicates that all income is taxed at the basic rate, used for employees who have more than one job or pension |

| D0 | This indicates that all income is taxed at the higher rate, used for employees who have more than one job or pension |

| NT | No tax is payable on this income |

There are also emergency tax codes such as W1, M1 or X, which we’ll look at in more detail shortly. You can find a full UK tax codes list over on the GOV.UK website.

One of the most common tax codes used in the UK is 1257L. This is used for employees who only have one job or income source.

The number 1257 denotes the current personal allowance for the current tax year, in this case 2024/2025. It means that the person can earn up to £12,570 per year before they’ll pay tax on their earnings.¹

The L means that they are entitled to the standard personal allowance.

You may also come across the term ‘cumulative tax code’ when managing payroll as an employer. But what is it?

Actually, cumulative tax codes are the norm for most employees. It means that the person’s tax is calculated on an ongoing or cumulative basis over the course of the tax year. The tax due for each salary payment is worked out after taking into account the tax already paid for the year.³

The only non-cumulative tax codes are emergency tax codes, which we’ll look at next.³

As an employer, you don’t need to worry about cumulative tax codes, or do anything specifically about them. All you need to do is apply the codes provided by HMRC, including any updates or changes.

Now, let’s take a look at the last type of tax code you need to know about as an employer managing payroll. This is the emergency tax code.

It is used when HMRC doesn’t receive new income details in time for an employee to get paid. It happens after a change of circumstances, such as a new job, the start of employment after being self-employed, or the receipt of the state pension or company benefits.

You can identify this kind of code as it’ll have either W1, M1 or X at the end, following any numbers. Here’s what each means:¹

Emergency tax codes are only given on a temporary basis. As an employer, it’s important to provide HMRC with full and up-to-date details as soon as possible, so that the tax code can be updated.

Looking for a smarter, more cost-effective way to manage payroll for both UK and overseas workers? Check out Wise Business.

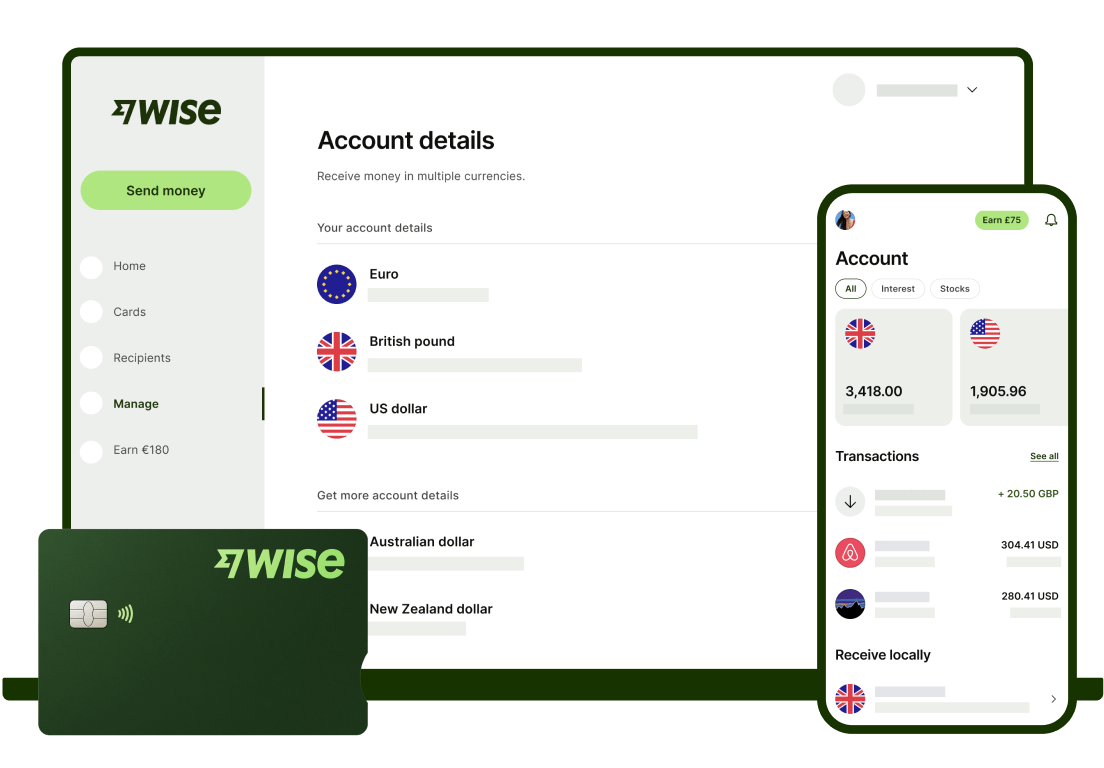

Wise Business lets you run payroll for up to 1,000 people in a matter of minutes. You can make secure batch payments in multiple currencies, saving time by automating your workflow with the powerful Wise API.

You can also seamlessly link Wise to your accounting and other business tools. Plus, you can add and manage user permissions so everyone in your team has the tools they need to do their job.

Wise Business also offers a whole heap of other useful features, including:

Get started with Wise Business 🚀

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

After reading this guide, you should be all clued up on UK tax codes. We’ve looked at what they are, common and emergency tax codes, and what you need to do as an employer to manage tax codes when running payroll.

Sources used for this article:

Sources last checked on December 27, 2024.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Having trouble deciding which Wise Business account is best for your business? We’re breaking down the differences between the ‘Essential’ and ‘Advanced’...

From messaging upgrades to hosted onboarding, here is how we’re evolving to help you and your end customers move money with speed and confidence.

Discover the essential costs involved in starting a business in Malaysia as a UK resident. Our guide covers incorporation fees, capital requirements, and more.

There comes a time in almost every startup’s journey — whether in the UK, Europe or further afield — when its executive team considers expansion to...

Learn about all the costs to budget for to start a business in Spain as a UK resident. Our guide covers incorporation fees, capital requirements, and more.

Learn all about popular credit cards UK self-employed individuals can use in 2026. Our guide explains features and fees to help make an informed decision.