5 Ways to Stand Out and Boost Black Friday Sales

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Interested in starting a business in Northern Ireland? Perhaps you’re considering expanding your UK business, or are simply starting from scratch after a move to NI.

Whichever is the case, read on. We’ve put together a useful guide covering everything you need to know on how to start a business in Northern Ireland. This includes essential steps like choosing a structure and getting your new business onto the company register in Northern Ireland.

We’ll also show you a smart way to manage your company’s finances in Northern Ireland, using Wise Business - the ideal solution for international businesses.

💡Learn more about Wise Business

Northern Ireland is one of the fastest-growing regions of the UK. It is particularly attractive for small and medium-sized businesses, offering minimal regulation and red tape, low running costs and a skilled, highly educated workforce. The country also has excellent transport links and routes to Ireland, the UK and Europe.

The main industries which contribute the most to the economy in Northern Ireland include:¹

- Financial services

- Software

- Contact centres

- Services industries

- Manufacturing

- Engineering

- Aerospace

- Construction

- Health technology

- Agriculture

- Tourism.

One of the first things you’ll need to do when setting up a new business in Northern Ireland is register it with Companies House.

Headquartered in Belfast, Companies House is the official body responsible for incorporating and dissolving limited companies. It keeps a register of company information, and makes this available to the public. Companies House in Northern Ireland is sponsored by the Department for Business and Trade.²

Just before you register at Companies House, you’ll need to decide on a type of legal entity for your new business. There are a few different business structures to choose from, including sole trader, partnership, limited liability partnership (LLP) and limited liability company (Ltd). We’ll run through each of these legal structures in more detail below.

For each legal structure type listed below add what it is, how it works and the relevant requirements, liability and tax obligations related.

A sole trader is a structure for just one person running their own business. This person is solely liable for any debts, but it also means that they will have full control over their business. It’s the simplest type of business structure available, and it’s also possible to set up as a sole trader without having to pay any registration fees with Companies House.

Sole traders must keep records and accounts, complete annual tax returns and pay income tax and National Insurance.

A partnership is a structure designed for two or more people running the business together. They share ownership as well as profits and liability.

There are a few different types of business partnership in Northern Ireland

The first is an ordinary partnership. This is where the partnership has no legal existence separate from the partners. So, if a partner dies, resigns or goes bankrupt, the partnership will need to be dissolved. However, the business itself can continue.

Ordinary partnerships need to register with HMRC.

There are also limited partnerships. This is where the business is owned by a mix of ordinary and limited partners. The latter’s liability is limited in proportion to the amount of money they have invested in the business.

Limited partnerships must register at Companies House, who will inform HMRC in order for tax records to be set up. This company type doesn’t usually need to file accounts or annual returns.

The third type of partnership is a limited liability partnership (LLPs), which we’ll look at next.

An LLP is a corporate entity, although it’s taxed as a partnership. This business type must have two designated members, all of whom have limited liability.

LLPs must register with Companies House in Northern Ireland, send an annual return and file accounts. Companies House will inform HMRC of registration, and tax records will be set up.

The last type of business entity, and a common choice, is a limited liability company.

A limited company is separate from its owners, meaning that its finances are kept completely separate. This kind of business will typically have shareholders, who receive shares in the company in return for the capital they put in. Shareholders will have ownership rights and liabilities according to the value of their investment.

Limited companies must be registered at Companies House, and must have at least one member and one director. The company must file annual returns and accounts, and inform HMRC that it exists and whether it is liable for Corporation Tax, VAT, PAYE for employers and other taxes.⁵

To make it just a little easier to get your new business off the ground, here’s a step-by-step look at the process of starting a company in Northern Ireland:

If you’re new to Northern Ireland or this is your very first business, you’re bound to have questions about setting up your new company. We’ll address some of these below, including how to get help and how to set up a business bank account in Northern Ireland.

You may also find it useful to have a business bank account in Northern Ireland. The process varies from bank to bank, but you’ll generally need to have the following in order to open an account:⁹

- A valid form of ID

- Proof of address

- An account opening mandate

- A list of people who can sign on the bank account and their signature

- Bank statements for the business (if you already have a business account)

- Details of your credit history

- A business plan, including details of your company and its activities

- Details of where the start-up finance for your business has come from

- A certificate of incorporation (for limited companies).

You may be able to open an account online, although some banks may require you to visit a branch in person.

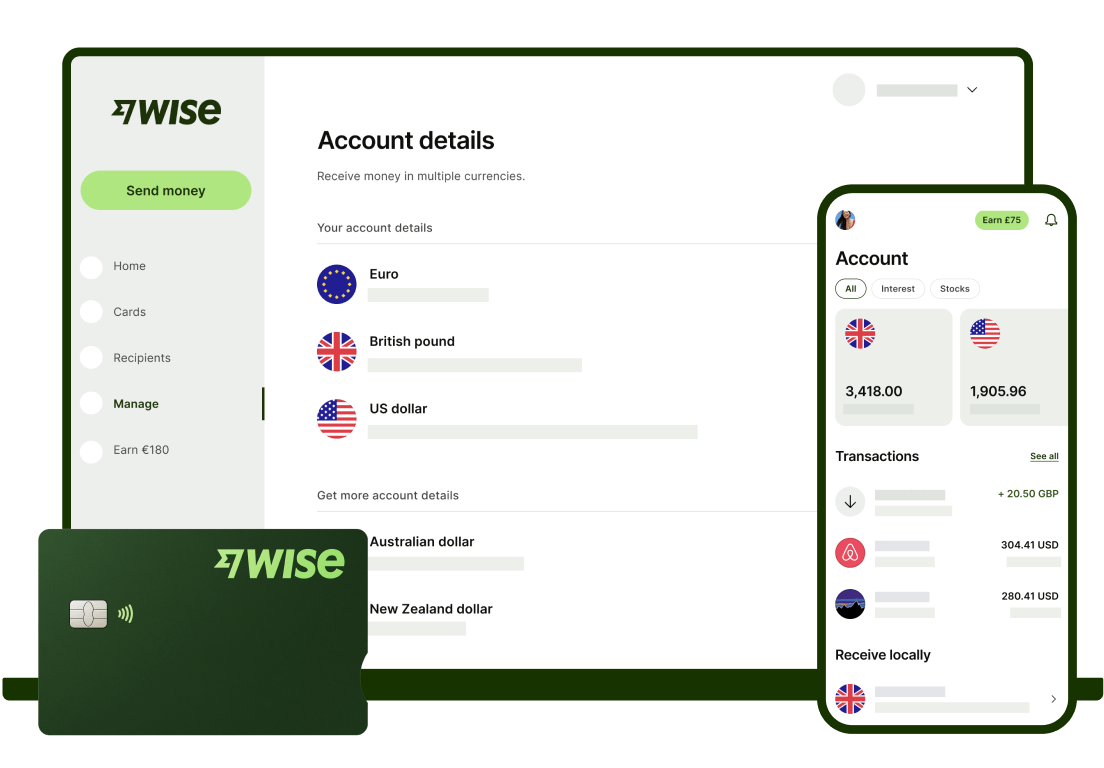

There are also alternatives to bank accounts available. One of these is Wise Business, which gives you the power to manage your company’s finances in 40+ currencies at once. It also offers easy invoicing, batch payments, expenses cards, automation tools and much more.

It’s easy to open a Wise Business account online. You’ll need a few details for yourself and the business, along with proof of ID and address. Plus, your business documents.

Then you simply need to sign up online, follow the on-screen steps and upload your documents when requested. Your account will be verified and you’ll receive confirmation within a day or two. Find out more about how to open a Wise Business account here.

Get started with Wise Business 🚀

There aren’t any specific personal requirements to open a business in Northern Ireland. Anyone can do it, as long as you follow the right process and complete all the correct paperwork. The only possible exception is if you’ve been declared bankrupt, as restrictions may apply on whether you can start another business.

There are a few different support options available if you need help getting your business off the ground. Here are a few useful resources to check out:

- Your local council in NI may offer free start-up business support, including tailored guidance from a local business adviser. You’ll just need to complete a short enquiry form or call 0800 027 0639 to register.⁷

- NI Business Info - this website is the official online channel for business advice and guidance in Northern Ireland. It has lots of information for setting up a new business in NI.

- Seed Fund Programme - this offers bursaries of up to £1,000 to entrepreneurs for business advice, training and mentoring.⁸

- Northern Ireland Explore Enterprise Support Service - this free service offers help for starting a business.⁸

To register your business with Companies House in Northern Ireland, you’ll pay £12 if you register online and £40 if you register by post. It’s also possible to get same-day registration for a fee of £100.⁶

If you’re expanding to Northern Ireland from the UK, you’ll need a way to manage your finances in both countries. And if you plan to trade with Ireland, Europe or globally, you’ll also need a cost-effective way to deal with cross-border payments. Luckily, there’s an ideal solution available.

Open a Wise Business account and you can manage your company’s finances in 40+ currencies. You’ll be able to pay suppliers and staff in euros and British pounds, as well as receiving payments in multiple currencies.

You can even automate payments using the powerful Wise API to save even more time. See how it works here in our case study.

There are even Wise cards to cover business expenses, letting you and your team spend like locals in 150+ countries across the EU and beyond.

Wise payments are fast and secure (even for large amounts). Best of all, you’ll only pay low, transparent fees and always get the mid-market exchange rate.

This is the rate that banks use to buy and sell currency, and is widely considered the fairest rate you can get. When banks carry out currency conversions on behalf of customers, they usually add a mark-up or margin to the exchange rate. This makes it more expensive for your business, as less of your money reaches your recipient.

It’s quick and easy to open a Wise Business account, with a fully digital application, verification and on-boarding process. Check out the requirements here.

Get started with Wise Business 🚀

And that’s it - your complete guide on how to start a business in Northern Ireland. We’ve covered all the key aspects, including how to register your company and an overview of legal structures.

You should now be all set to get started on the exciting process of starting a new company or expanding your business to Northern Ireland. Good luck!

Sources used for this article:

Sources checked on 22-Jan-2024.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Black Friday - Friday 29th November in 2024 - kicks off the end of year shopping period, with huge uplifts in on and offline sales as people grab a bargain...

The term "turnover" is used often in the world of business, but its implications vary significantly depending on the context. At its core, turnover is a...

Wise is a financial technology company focused on global money transfers that offers two different types of accounts: a personal account and a business...

In today's fast-evolving digital landscape, e-commerce is quickly transforming the ways consumers shop and how businesses operate worldwide. DHL’s E-Commerce...

In an increasingly interconnected global economy, small businesses in the United Kingdom (UK) have more opportunities than ever to expand through import and...