6 Best ecommerce payment providers

Discover the best ecommerce payment providers in the Uk to optimize payments and drive growth.

If you’re starting out as an entrepreneur, freelancer, sole trader or business owner you may be looking for the best business account for self-employed people in the UK. Keeping your personal and business finances is essential, so picking one of the great business and sole trader bank accounts out there is worth doing early on in your business journey.

As well as looking at the best self-employed business accounts from banks, you may also want to consider a non-banking alternative like Wise Business. We’ll touch on Wise in this guide, as well as some great self-employed business accounts to help you weigh up your options.

💡 Learn more about Wise Business

If you’re a UK sole trader or freelancer you do not legally require a business account. However, if you have a registered business you’ll usually find that having a dedicated business account is mandatory.

Even if you don’t technically require an account dedicated to your business, it’s important to separate personal and business finances to make it easier to grow your company, pay your taxes, and keep on top of your admin. The good news is that there are some great business bank accounts out there for sole traders and registered business owners - this guide looks at some of the best bank and non-bank alternatives.

Self-employed business accounts can have a very varied range of features including ways to receive customer payments, pay suppliers or contractors, options to earn interest, and linked debit and expense cards. You’ll also often find handy analytics to review and grow your business - and some providers also offer multi-currency functions, which are useful for trading overseas.

Here’s a sneak peek at the banks and providers we'll review in the article:

- Tide

- Revolut Business

- Wise Business

- ANNA Money

- Starling

- Airwallex

We’ll start with an overview of some important features - the rating providers get on Trustpilot, which is a handy measure of customer satisfaction, and the ongoing costs.

| Bank | Trustpilot score | Monthly fee |

|---|---|---|

| Tide | 4 star, Good review from 20,000+ reviews6 | £0 - £49.99 per month depending on plan1 |

| Revolut Business | 4.2 star, Great review from 160,000+ reviews7 | £0 - £79 per month depending on plan2 |

| Wise Business | 4.3 star, Excellent review from 233,000+ reviews8 | None |

| ANNA Money | 4.5 star, Excellent review from 3,200+ reviews9 | £0 - £49.90 per month depending on plan3 |

| Starling | 4.3 star, Excellent review from 41,000+ reviews10 | None4 |

| Airwallex5 | 3.5 star, Average review from 1,000+ reviews11 | None5 |

The comparison criteria we'll cover for all providers through the article include:

- Eligibility

- Features and services

- Fees

In many cases, banks and providers have different account plans which have varying features and fees, including a broad range of transaction fees. It’s not possible to capture all the features and costs, so use this as a starting point for your own research. Let’s get started.

Tide business banking offers several different plans for UK customers. You can choose a pay as you go plan, or trade up to an account which has a monthly fee but which offers more free features and higher transaction limits.

Accounts offer invoicing, accounting integrations, linked debit and expense cards, and the option to open a savings account to get interest on your unused business cash.

Tide accounts can be opened by the directors of any active company incorporated in the UK and registered with UK Companies House. There’s also a Tide account option for UK-based sole traders and freelancers. In all cases you must be aged 18 or above, and have a valid UK phone number13.

Here’s a summary of the key Tide business fees to know about:

| Free | Plus | Pro | Cashback | |

|---|---|---|---|---|

| Monthly fee | None | £9.99 | £18.99 | £49.99 |

| Expense cards | £5 per month | 1 free card included, then £5 per month | 2 free cards included, then £5 per month | 3 free cards included, then £5 per month |

| Transfer in and out | £0.20 | 20/month free, then £0.20 | Free | Free |

| ATM withdrawals | £1 | £1 | £1 | £1 |

The Revolut Business account is available with 4 different plan options, which allow you to open a basic account with no monthly fee to start with, and then upgrade to an account with ongoing costs and higher no fee transaction limits later if you want to.

All accounts let you hold and exchange 25+ currencies, with some a weekday currency conversion which uses the Revolut rate with no extra fees - and all plans come with cards for spending and withdrawals. Depending on the account you select you could also qualify for extras like no fee transfers, interest on your balance, and preferential customer service options.

To be eligible for this account you must be resident in the UK, Switzerland or EEA, with an active registered business in an eligible country (including the UK). Bear in mind that this account is not available to sole traders14.

Here’s a quick list of some of the key fees for the Revolut account. Other costs may apply depending on how you use your account.

| Basic | Grow | Scale | Enterprise | |

|---|---|---|---|---|

| Monthly fee | None | £19 | £79 | Custom |

| Card option | Plastic and virtual cards | 1 Metal card, plus plastic and virtual cards | 2 Metal cards, plus plastic and virtual cards | Custom options |

| No fee weekday currency conversion | Up to £1,000 per month | Up tp £10,000 per month | Up to £50,000 per month | Custom |

| ATM withdrawals | 2% withdrawal fee | 2% withdrawal fee | 2% withdrawal fee | 2% withdrawal fee |

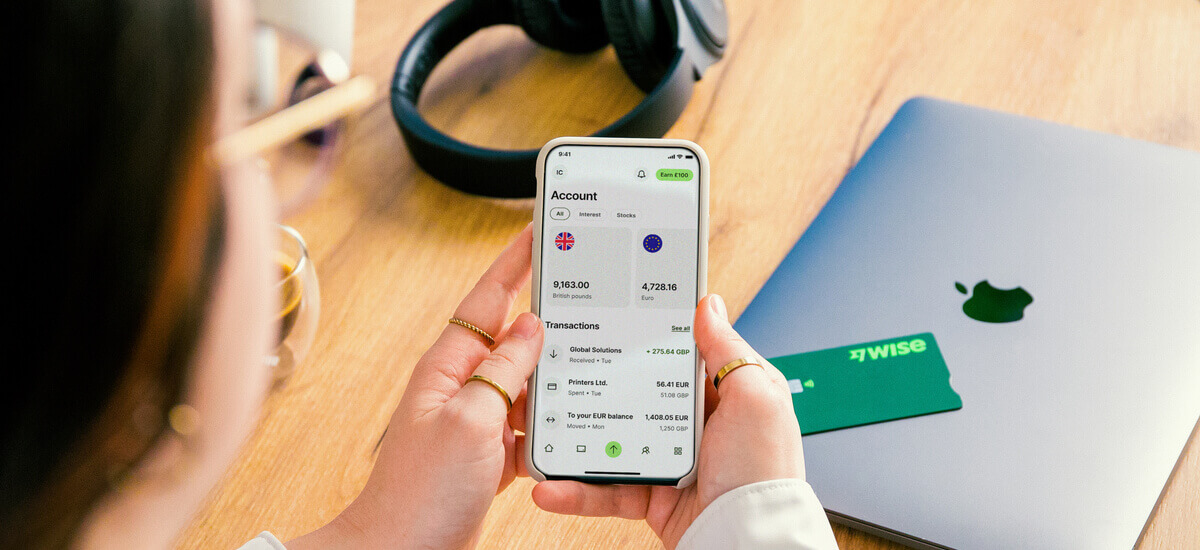

Wise is not a bank but a great alternative for UK self-employed people that trade internationally.

Wise Business account features include ways to hold and exchange 40+ currencies, send payments to 160+ countries, and receive payments with local and SWIFT account details in multiple currencies.

Accounts also offer debit and expense cards and the option to earn Wise Business Interest on balances in pounds, US dollars and euros. Plus, you can make batch payments, get cloud accounting integrations and use the Wise API to streamline workflow.

If you have a UK incorporated business you’ll need the following to open your Wise Business account:

- Personal and contact details of the account representative

- Business name, entity type, registration number and sector

- Business registered address and trading address if different

- Information about the company’s directors

You’ll also need to upload some documents:

- Photo ID and proof of address for the account representative

- Business documents - which vary based on entity type

Let’s look at some of the core fees for Wise Business:

| Wise Business fee | |

|---|---|

| Open an account | £45 |

| Hold 40+ currencies | Free |

| Order a card | £3 |

| Spend with your card | No fee to spend a currency you hold - conversion from 0.33% when needed |

| ATM withdrawals | 2 withdrawals to £200 per month free, then £0.50 + 1.75% |

| Receive payments | Receive with local and SWIFT account details in many currencies for free 10 CAD fee for incoming CAD SWIFT payment 6.11 USD for incoming USD wire |

| Send money overseas | From 0.33% |

Get started with Wise Business 🚀

ANNA Money has 3 different account plans for UK business customers, including the Pay As You Go (PAYG) model, and their most popular Business plan. These plans offer different fees and features - with a PAYG account you don’t get much for free, but can choose to pay for the services you need, whereas with other plans you’ll find more free transaction options.

ANNA Money accounts can offer features including expense cards, local and international payments, payment links for accepting customer transfers, and ways to pay in cash. There’s also cashback on some eligible card spending.

You can open an account with ANNA if you’re a sole trader, a director of a limited company (listed on Companies House) or a partner in a Limited Liability Partnership (LLP). You’ll be asked to provide your personal and business documents when you apply, to show you meet the eligibility criteria.

Here are some of the fees you’ll need to know about when you’re choosing between ANNA plans - check the full pricing details before you pick.

| PAYG | Business | Big Business | |

|---|---|---|---|

| Monthly fee | None | £14.90 per month | £49.90 per month |

| Transfers in and out (local) | £0.20 | 50 free, then £0.20 | Free |

| ATM withdrawals | £1 | 3 free per month, then £1 | Free |

| International transfers | £5 + 1% conversion fee | 1 free per month, then £5 + 1% conversion fee | 4 free per month, then £5 + 0.5% conversion fee |

| Expense cards | 1 free, then £3 per card per month | 5 free, then £3 per card per month | Free |

Starling is a UK licensed bank which offers Starling business accounts in GBP, plus options to add on services for euros and US dollars. There are accounts for sole traders and also accounts for the owners of registered businesses.

Starling business account features include local and international payments, mobile cheque deposit options, analytics tools to track business performance, and savings accounts. You can also pay extra for accounting and bookkeeping services, or add on foreign currency accounts which have a monthly fee.

You can open a Starling business account if you’re the owner of a Limited Company or LLP registered at Companies House, or if you’re a Sole Trader. All Persons of Significant Control (PSCs) must be UK residents and individuals rather than having corporate shareholders.

Let’s look at some of the fees involved with Starling business accounts:

| Starling business fees15 | |

|---|---|

| Monthly fee | No fee for GBP account |

| Add on optional services | Business toolkit - £7 per month Bulk payments - £7 per month |

| Local payments | No fee for Faster Payments, Direct Debits and Standing Orders |

| International transfers | Local payment network transfers from £0.30, SWIFT payments £5.50 0.4% currency conversion costs |

| ATM withdrawals | Free |

Airwallex offers business account services to UK customers as well as serving many other countries and regions. Airwallex accounts can be used to pay and get paid in multiple currencies and are handy for anyone taking online payments as they offer different options to be paid through links and plugins.

Airwallex features include no monthly fees, multi-currency services to hold 23 currencies, local and international transfers, debit and expense cards, and ways to receive customer card payments.

Airwallex UK accounts can be opened by Limited Companies, LLPs, LPs, General Partnerships and Sole Traders. There’s a verification process which requires you to upload ID and relevant business documents which can vary depending on your entity type.

Here’s a summary of some important Airwallex fees to consider:

| Airwallex fee | |

|---|---|

| Monthly fee | None |

| Receive payments | Variable fees for card payments Local payment methods cost £0.20 + fixed fee |

| Transfers | Local payment methods can be free £10 - £20 for SWIFT payments |

| Currency exchange | 0.5% - 1% depending on the currencies |

Check out Wise Business if you’re looking to grow your business across borders, receiving international payments as a local.

With Wise you can hold and exchange 40+ currencies, send payments to 160+ countries, and get local and SWIFT account details to receive payments in multiple currencies by customers, PSPs and marketplace sites.

Whenever you need to convert from one currency to another you get the mid-market exchange rate with low fees from 0.33%. This can cut down the costs of transacting internationally considerably.

Get started with Wise Business 🚀

—-

Use this guide to the best small business bank accounts in the UK to get a feel for your options, and remember to compare bank accounts with non-bank alternatives like Wise Business to find your perfect partner.

So - if your question was do I need a business bank account if self-employed in the UK, the answer may be no if you’re a sole trader or freelancer. However, even if you’re not obliged to have a business account, keeping your company finances separate from your personal money with a self employed business account is a smart move. Use this guide to pick the bank or non-bank provider which works best for you, and watch your business grow.

—-

Sources used in this article:

Sources last checked 18-Sep-2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the best ecommerce payment providers in the Uk to optimize payments and drive growth.

Discover the best digital vat software for small businesses to improve efficiency and streamline financial management.

Learn how predictive analytics in accounts receivable can improve efficiency, predict late payment, forecast cashflow and streamline financial management.

Read our guide to the venture capital process and best practices, for both VC investors and startups looking for funding.

Find out how to extend your startup funding runway, with strategies and tips for UK startups funded by venture capital.

When is venture debt right for your business? Find out here in this essential guide, covering what venture debt is, pros and cons and more.