Mettle business bank account review UK

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Santander is a large UK retail and commercial bank which has been around for more than a century. Since its entry into the UK market in November 2004, Santander UK has transformed, moving from its heritage of three former building societies to a full-service retail and commercial bank.

However, if you’re wondering whether or not Santander is the best solution for your business banking, this article will help you eliminate some of the biggest questions and help you decide further. We will also present you Wise Business account, an alternative to Santander and other banks in the UK.

💡Learn more about Wise Business

Choosing the right bank account for your business should be the first rule in financial management, as the account will be your primary tool for making business transactions including payments to suppliers, vendors and employees.

It's also very crucial for your cash flow management and accounts receivables - reasons why you should do a thorough research before committing to a bank. Here are the things to consider during this process.

Santander’s fees vary depending on the type of account. Here’s a quick rundown of the fees:

| Fees | 1 -2 -3 Business Current Account¹ | Business Current Account² |

|---|---|---|

| Monthly fee | £12.50 | £7.50 |

| CHAPS payments | £25 | £25 |

| International payments out | £25 | £25 |

| Faster and SEPA payments | Free | Free |

| Local cash withdrawals at Santander ATMs | Free | Free |

As part of your current account application, you can apply for a business overdraft from £500 to £25,000 (subject to acceptance) if:

| Fee type | Cost³ |

|---|---|

| Arranged overdraft annual fee | 1% of arranged overdraft (minimum fee £50) |

| Arranged overdraft interest rate | 10% EAR (variable) |

Going to the bank branch to make any transaction has been unimaginable since banks adopted online banking. Most banks offer online banking via the app or website and even the most crucial transactions can now be done online.

With Santader business banking, you can perform the following transactions online:

Banks and financial institutions are obliged to provide a secure service to their customers. This includes keeping your money and information safe.

Santander conducts fraud detection tests and has security features in place to ensure that your account is safe.⁵ This includes:

We mentioned early on the fees for international payments with Santander. If you do business overseas and are looking for a cost effective way to pay, get paid and manage your finances across currencies, Wise Business can be an alternative!

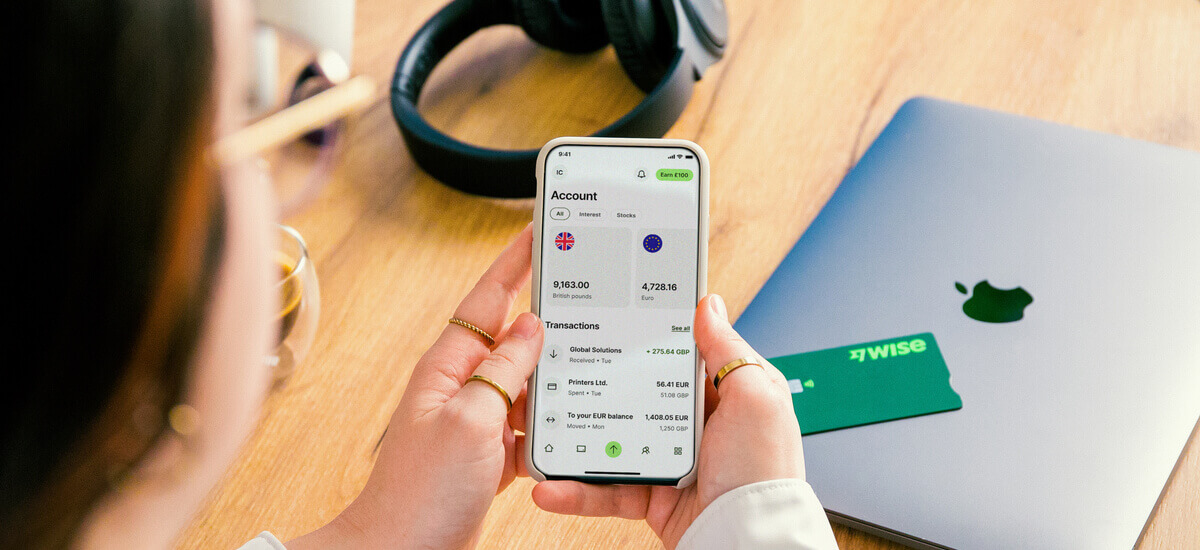

Providers like Wise Business help cut the cost on international transfers. It's a service that is tailored to your global business needs. You can receive, send and hold different currencies in one account and convert between them. Here are some additional benefits that you could take advantage of:

Get started with Wise Business 🚀

Sources used in the article:

Sources last checked September 15, 2023

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Wondering what are the fees related to Revolut's Business Account? Read our complete review of plans and service fees.

A guide to the Starling sole trader account vs. business account, comparing the two on features, fees and eligibility.

Can you use Airwallex in Singapore? Find out here in our essential guide for UK businesses, covering everything you need to know.

Find the best business bank accounts in Canada with our easy guide. We compare top banks and digital providers so you can choose what fits your business best.

AIB offers three types of business current accounts. Each of these accounts is specifically tailored to a segment of the market.