Welcome to our quarterly trading update blog post where we will be going through our mission and financial highlights from the last three months, July to September.

Wise is disrupting a massive and underserved market and in the second quarter we helped 5.5 million active customers move £27 billion across borders, a 50% increase on the same period last year.

Our success is thanks to our superior products that customers love. Our team continued to improve our products. Wise is now available to more people and businesses, easier to use, and more secure.

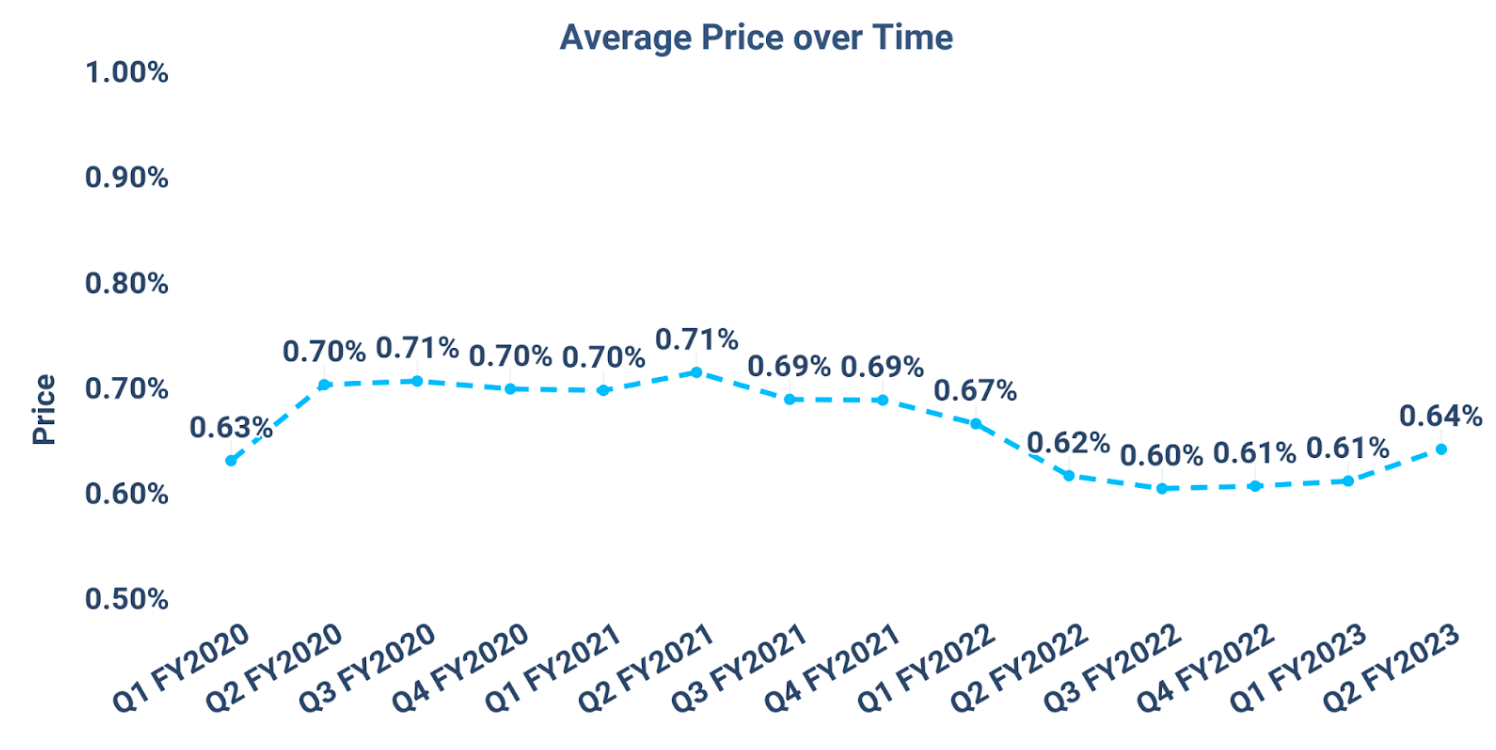

These products are powered by our infrastructure, and we delivered more than half of our payments instantly for the second consecutive quarter. Whilst we continue to work hard to lower prices, the average price increased in Q2 in response to higher FX costs.

We will continue to invest heavily in products and infrastructure and take the lead in driving down the cost of cross-border transfers; but at the same time we maintain a profitable business model that is highly cash generative.

Kristo Käärmann, our CEO and co-founder, said: “This quarter 5.5 million customers moved £27 billion with us, 50% more than in Q2 last year and for the second consecutive quarter more than half our payments were instant. The Wise Account and Wise Business products continue to see good levels of adoption and this increased engagement with our product, higher volumes and faster speeds are a result of the longer term investments that we have been making.

We’ve seen extreme macroeconomic conditions persist throughout the second quarter, and whilst unfortunately this meant we had to raise prices slightly for some customers, we’ve been working hard to limit these increases and are working to bring them back down again.”

Mission Highlights

Money without borders: enabling everyone to move their money across the world - instantly, transparently, conveniently and eventually for free.

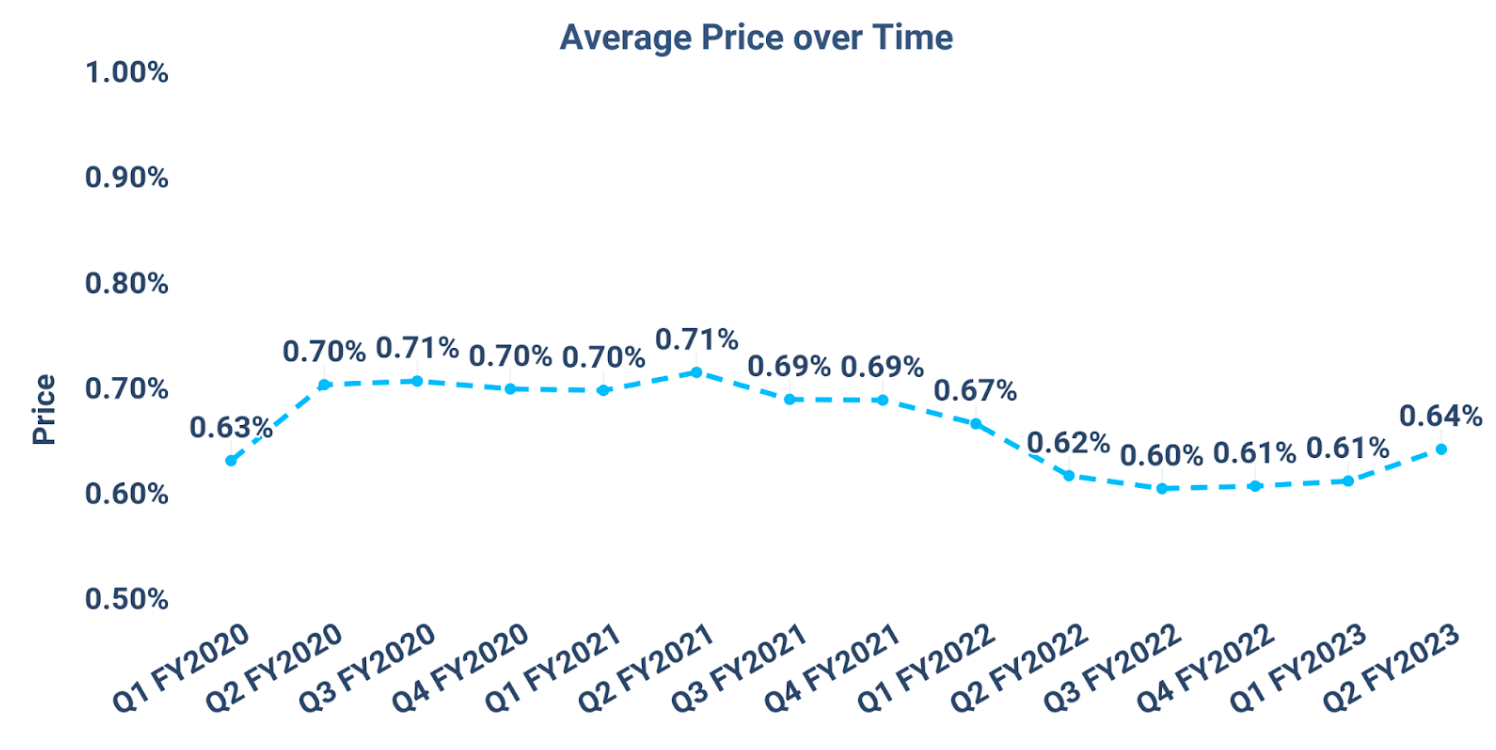

Unfortunately, price was a little higher this quarter 📈

Our mission is to lower prices for customers over time. During this quarter high levels of FX volatility led to higher costs and as a result, the average customer price increased to 0.64% compared to 0.61% in Q1 FY23 and 0.62% in Q2 FY22.

However, we were able to lower fees for some currency routes. Through a new partnership we reduced fees when sending money to Chile and we negotiated cheaper fees for sending money to China. In Brazil, we now use our own FX licence, which has reduced the cost to deliver, and we’ve passed these savings on to our customers.

Over half of all transfers are instant for 2 consecutive quarters 💥

For the second consecutive quarter, we completed more than half of our transfers instantly. Some of our payments in Brazil were slower, but we are rectifying this by connecting directly into our partner bank’s API. After integrating with new partners, it’s now faster to send money to Japan and Chile and transfers to Hong Kong got faster too. We’re also continuing our work to speed up financial crime checks, which once completed is expected to help reduce delays. Overall, approximately 90% of all transfers were completed within 24 hours and speed remains an important feature for overall customer experience.

Ongoing product evolution 💙

Product enhancements in the last few months have made it easier for customers to onboard with us and have made Wise Account and Wise Business easier and more secure to use. Below are some examples of improvements we've made:

- Ability to use wire transfers to send to USD, previously only ACH payments were available; and increased transfer limits when funded by Wise Account balance.

- Over 200 countries and territories can now get USD SWIFT account details, so customers can receive USD from pretty much anywhere in the world.

- When sending money through Alipay in China, customers can now send directly to Alipay Wallet.

- Ability to move money with INTERAC e-Transfer Request in Canada.

- We’ve added ways to get customer ID verified faster and easier.

- Extra security on your account with a unique communication code.

- Improved scam prevention and scam reporting.

- Re-designed Business dashboard making it easier to find the features that matter most to customers.

- Businesses can get paid directly through Wise by sharing 'payment request' links.

- The new “International Receive” feature allows our Platform partners to use Wise as a correspondent, leveraging our SWIFT connection to receive funds from all over the globe, rather than being connected to the SWIFT network themselves.

- We expanded our partnership; adding the Swiss finance disruptor, Yapeal, and financial wellbeing platform, Wagestream.

Our mission roadmap, which is available on our website, sets out the future improvements we have planned for each of our products.

Growth and Financial highlights

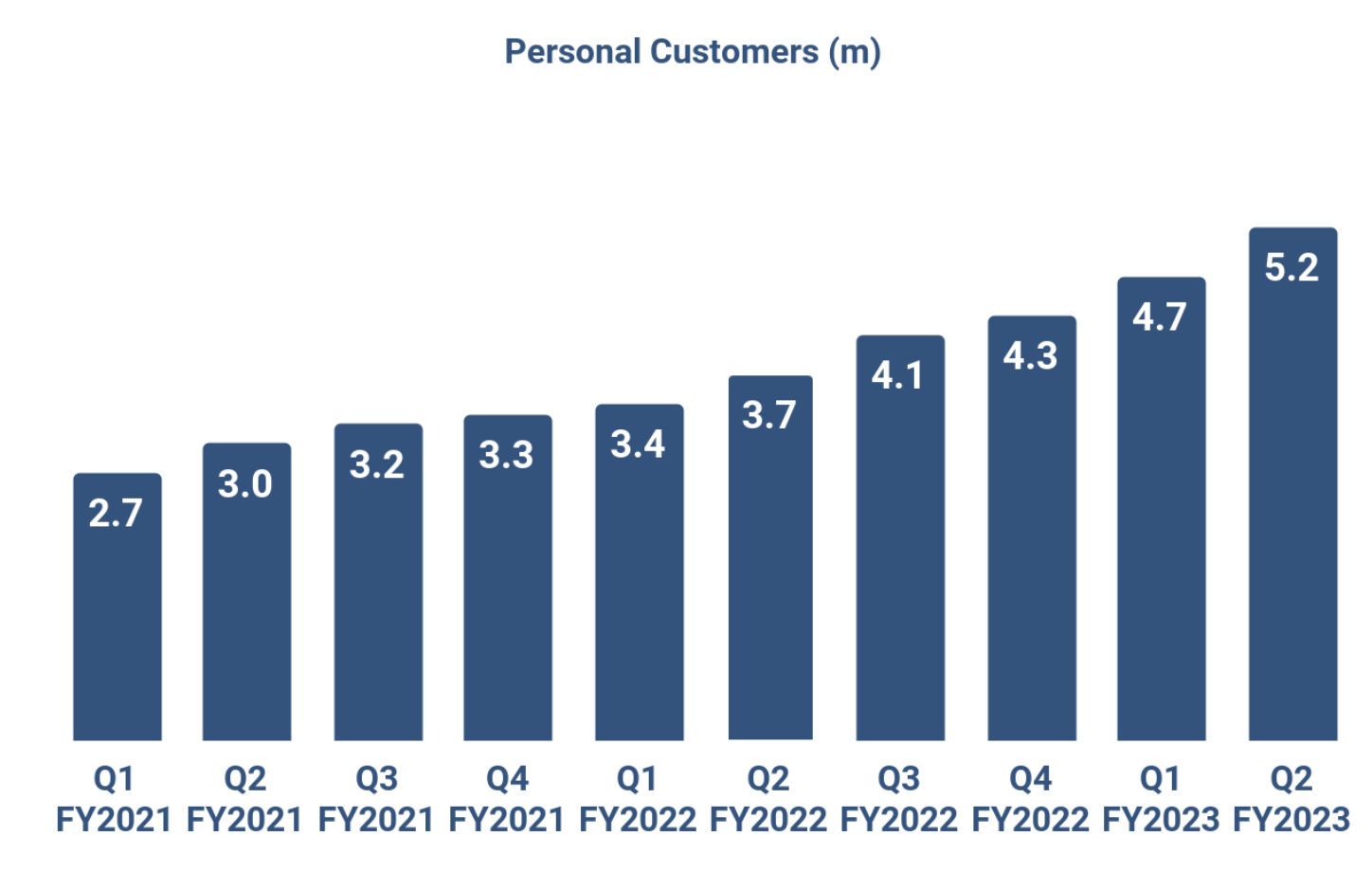

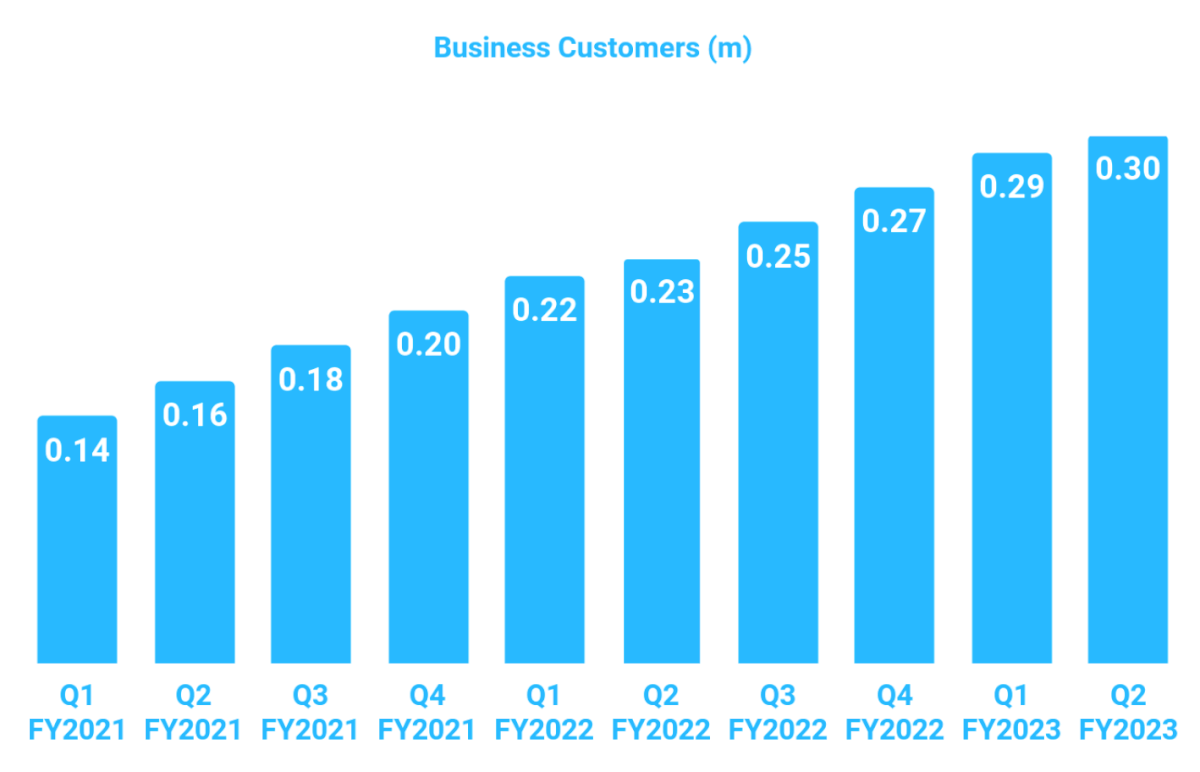

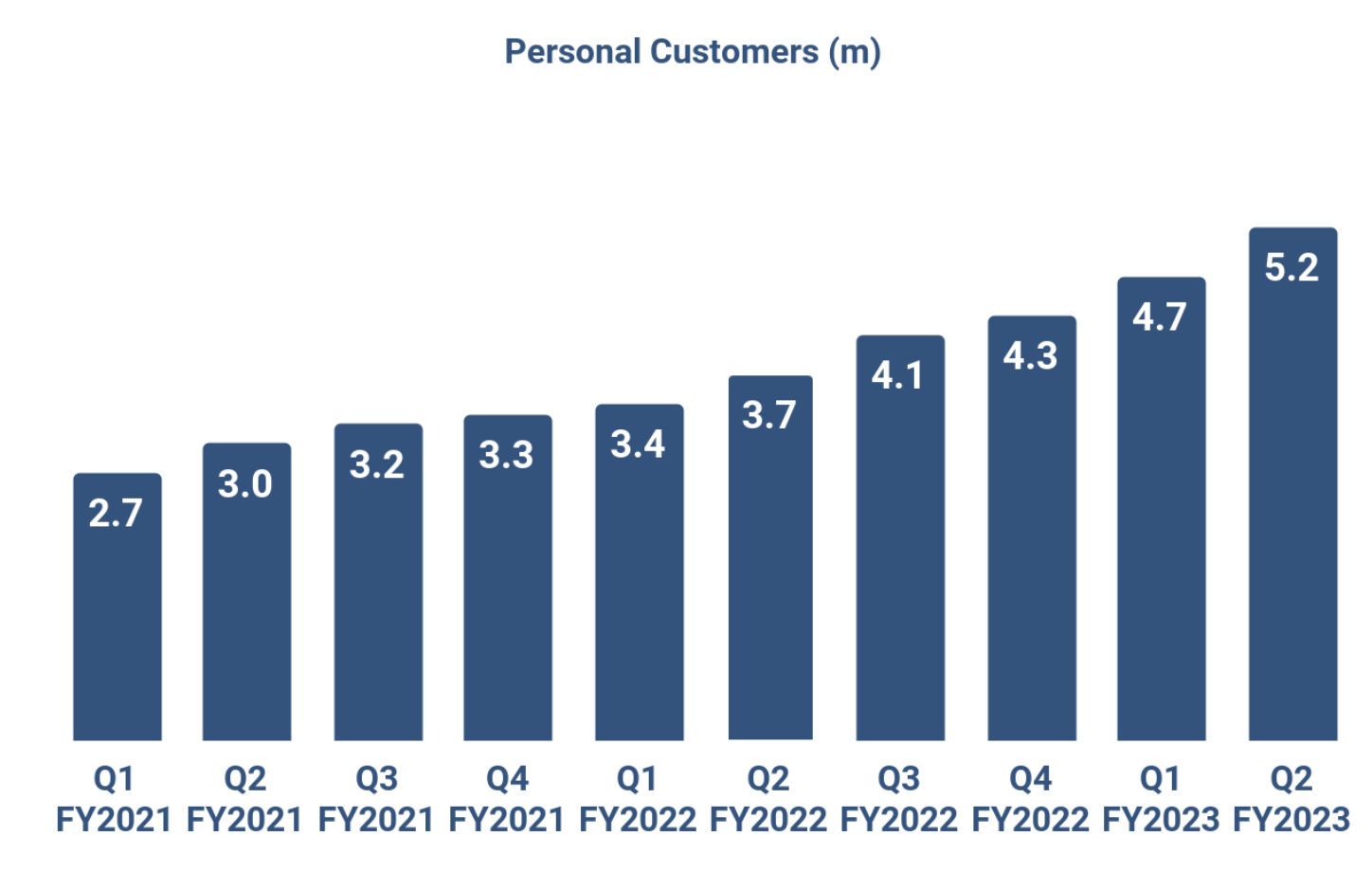

Customers

5.2m

40% YoY, 10% QoQ

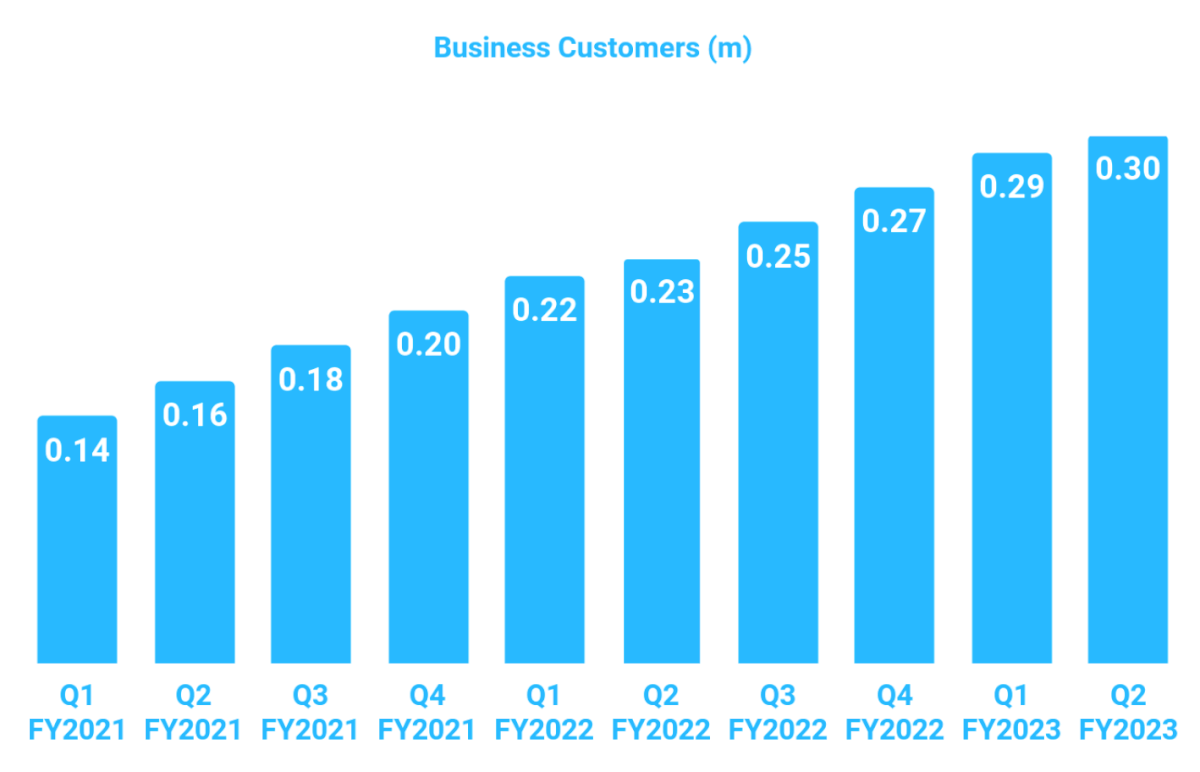

0.3m

31% YoY, 5% QoQ

5.5 million customers transacted with us in Q2 FY23, an increase of 40% YoY and 10% QoQ, comprising 5.2 million personal and 300K business customers. This increase in active customers was mostly driven by greater adoption of the Wise Account and Wise Business products, where customers tend to use more of the features available. Regionally, the growth in active customers across our established markets has been consistent, and we’re seeing strong growth in newer markets where we currently have a smaller share.

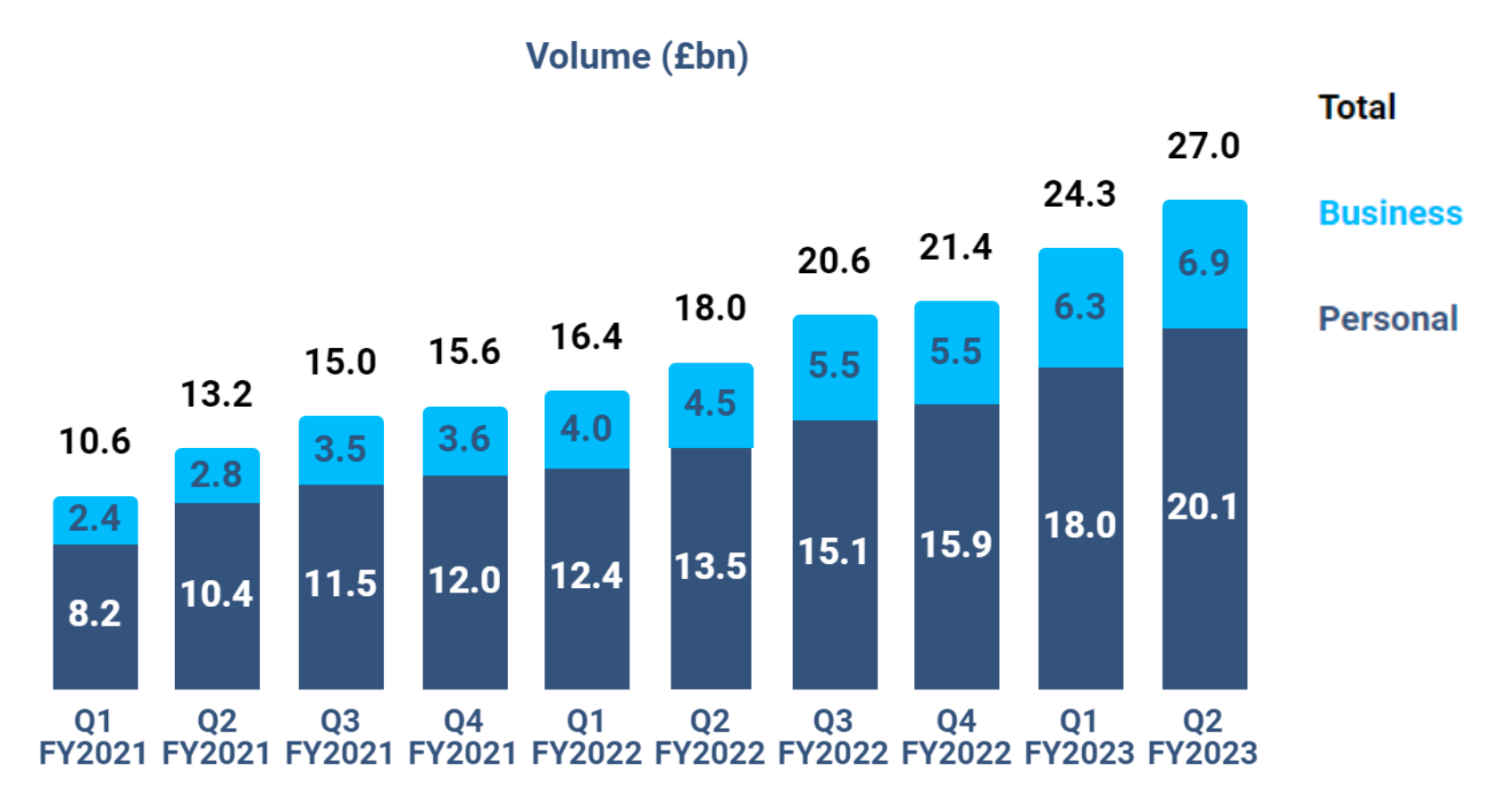

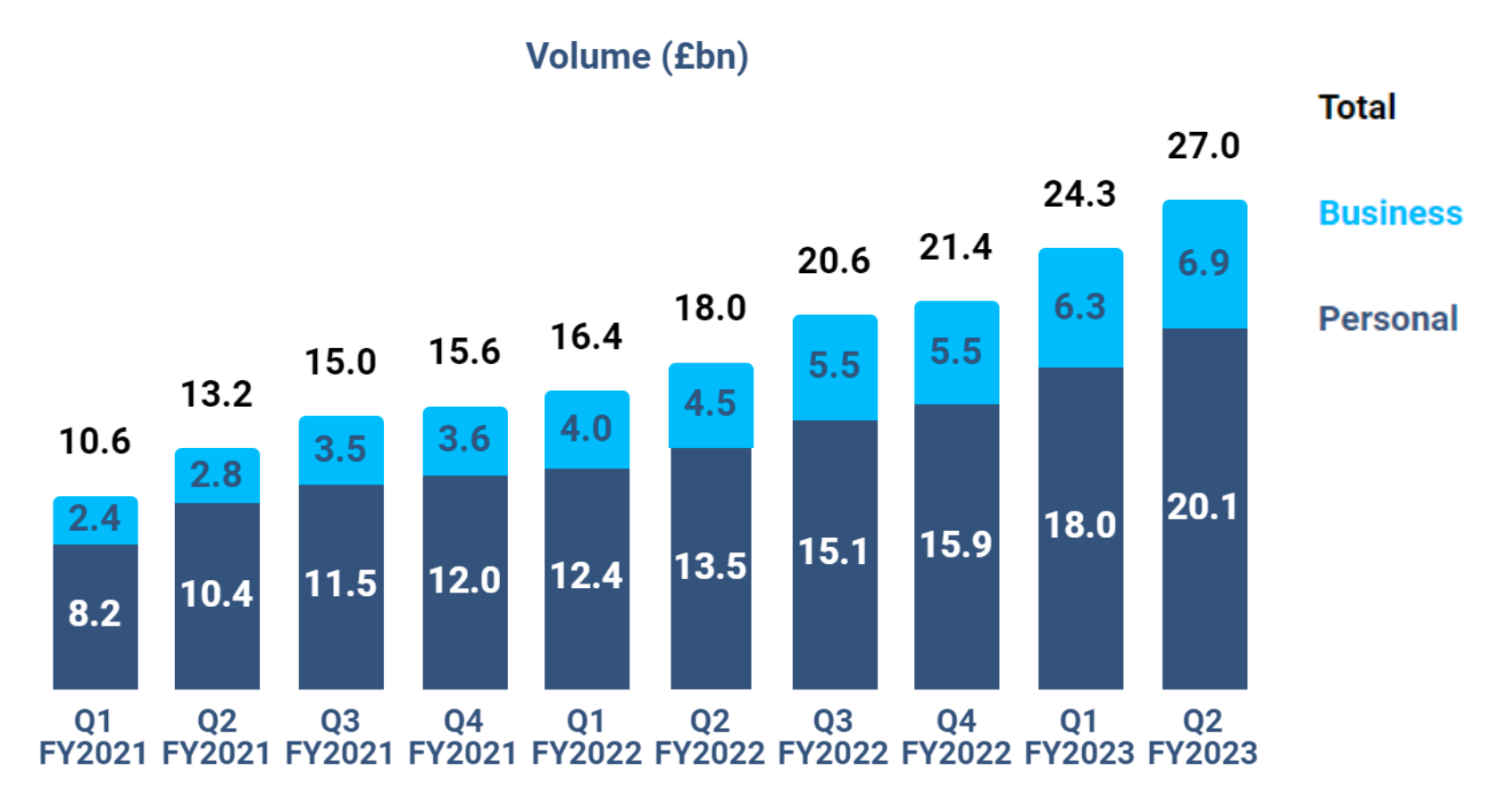

Volume

27.0bn

50% YoY, 11% QoQ

Total cross-border volumes for Q2 FY23 were £27.0 billion, 50% higher YoY and 11% higher QoQ. Personal volumes increased 49% YoY to £20.1 billion and Business volumes increased 55% YoY to £6.9 billion. Volume growth was driven by the higher number of active Wise Account and Wise Business customers, who typically send more with us.

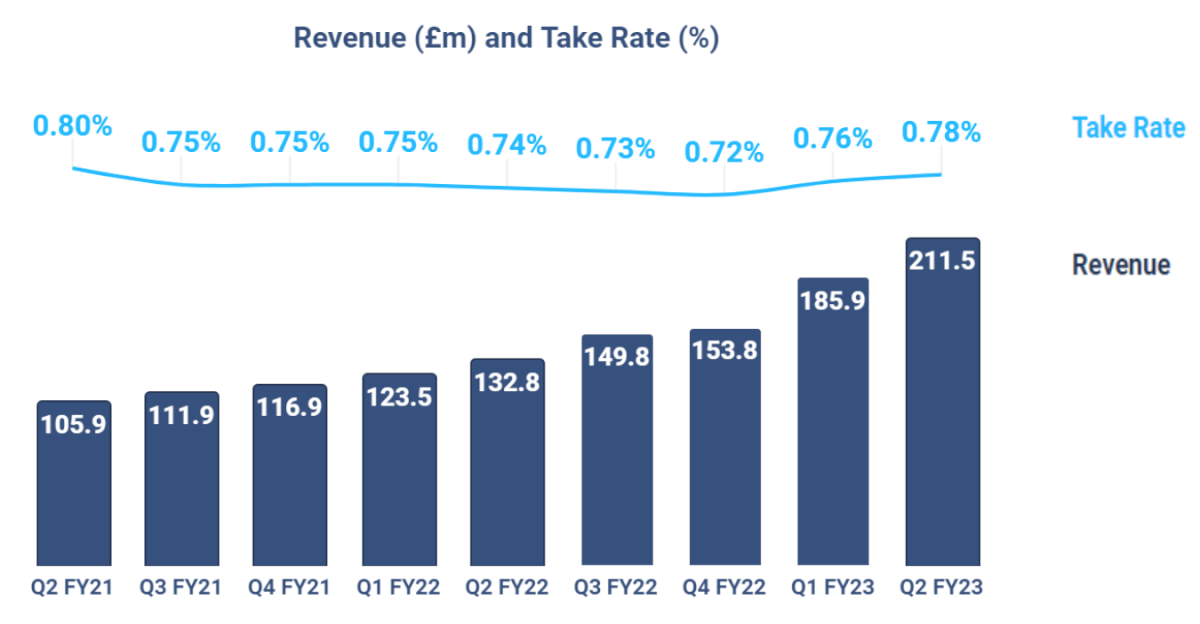

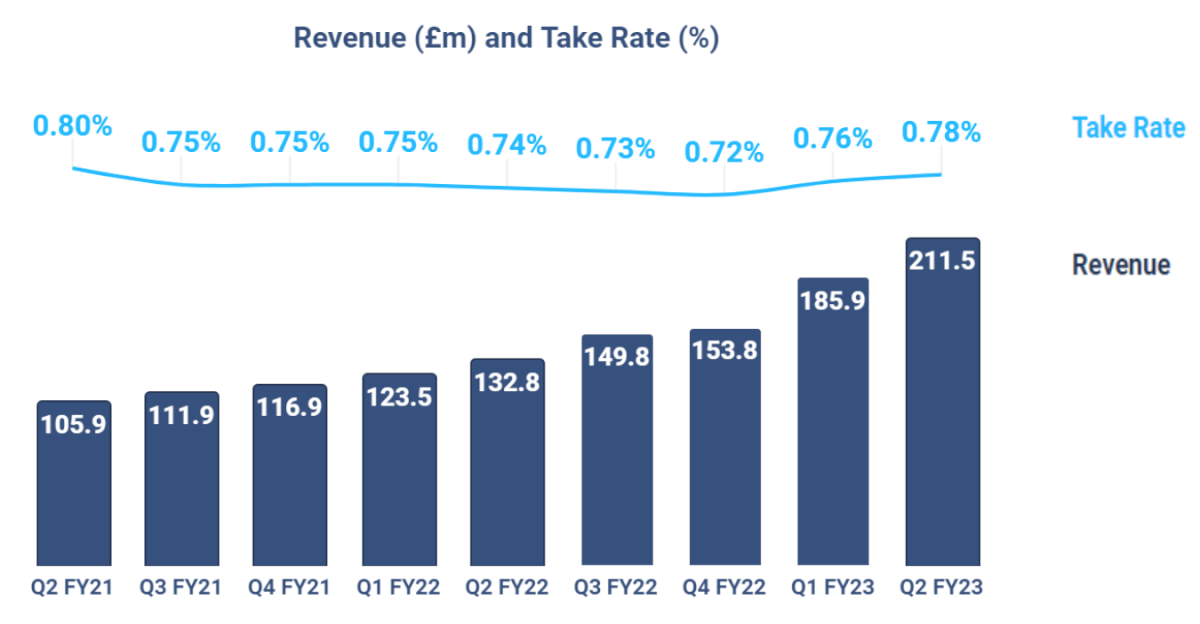

Revenue

211.5m

59% YoY, 14% QoQ

Revenue for Q2 FY23 was £211.5 million, growing 59% YoY and 14% QoQ. Revenue for the first half of FY23 was £397.4 million, 55% higher than the first six months of FY22.

Excluding net interest income, our take rate increased 2bps QoQ to 0.78% from 0.76% in Q1 FY23, reflecting the impact of price rises announced in August 2022 and an increase in the other revenue line items. Other revenue benefited from greater uptake of customers using the Wise Account in the form of higher debit card spend and interchange fees.

Total income

229.0m

73% YoY, 22% QoQ

Total income which comprises ‘revenue’ and ‘net interest income on customer balances’ for Q2 FY23 was £229.0 million, a 73% increase on last year. This included £17.5 million of net interest income, and we expect this to increase in the second half of the year given the interest rate outlook. We will share much of this interest income benefit with our customers, through pricing, but we will also use some to invest in growth. Total income for H1 FY23 was £416.1 million, 63% higher than the same period last year. Total income take rate, which includes net interest income, was 0.85% in the quarter.

And finally in terms of our outlook, we estimate total income will grow by between 55% and 60% in FY23, and greater than 20% (CAGR) over the medium-term. We continue to expect our adjusted EBITDA margin to be at or above 20% over the medium-term.

Enquiries

Martyn Adlam - Head of Owner Relations

martyn.adlam@wise.com

Sana Rahman - Global Head of Communications

press@wise.com

Brunswick Group

Charles Pretzlik / Sarah West / Nick Beswick

Wise@brunswickgroup.com

+44 (0) 20 7404 5959

About Wise

Wise is a global technology company, building the best way to move money around the world. With Wise Account and Wise Business, people and businesses can hold over 50 currencies, move money between countries and spend money abroad. Large companies and banks use Wise technology too; an entirely new cross-border payments network that will one day power money without borders for everyone, everywhere. However you use the platform, Wise is on a mission to make your life easier and save you money.

Co-founded by Kristo Käärmann and Taavet Hinrikus, Wise launched in 2011. It is one of the world’s fastest growing tech companies and is listed on the London Stock Exchange under the ticker WISE.

Over 13 million people and businesses use Wise. Today we process on average over £9 billion in cross-border transactions every month, saving customers over £1 billion a year.

FORWARD LOOKING DISCLOSURE DISCLAIMER

This report may include forward-looking statements, which are based on current expectations and projections about future events. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target”, “believe”, “expect”, “aim”, “intend”, “may”, “anticipate”, “estimate”, “plan”, “project”, “will”, “can have”, “likely”, “should”, “would”, “could” and any other words and terms of similar meaning or the negative thereof. These forward-looking statements are subject to risks, uncertainties and assumptions about Wise and its subsidiaries. In light of these risks, uncertainties and assumptions, the events in the forward-looking statements may not occur. Past performance cannot be relied upon as a guide to future performance and should not be taken as a representation that trends or activities underlying past performance will continue in the future. No representation or warranty is made or will be made that any forward-looking statement will come to pass. The forward-looking statements in this report speak only as at the date of this report.

Wise expressly disclaims any obligation or undertaking to update, review or revise any forward-looking statements contained in this report and disclaims any obligation to update its view of any risks or uncertainties described herein or to publicly announce the results of any revisions to the forward-looking statements made in this report, whether as a result of new information, future developments or otherwise, except as required by law.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.