Taking cash in or out of India: What are the rules?

How much cash can you take to India? Read this handy guide for info on the rules for taking cash in and out of India.

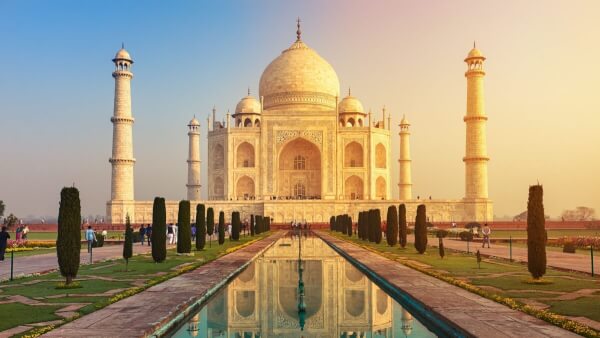

Planning to spend time in India? Whether you’re visiting as a tourist, student or living there, you’ll need to get to grips with India’s currency and money.

In this guide, we’ll cover everything you need to know about money in India as a visitor from the UK. This includes tips on currency exchange, Indian banks and how to spend wisely on your trip.

So let’s dive right in.

The official currency in India is the Indian rupee, which has the currency code of INR. Both coins and banknotes are in use there.

To find out how many rupees you can get for your pounds, use our currency converter.

Here are a handful of useful-to-know facts about India’s currency:

If you’re visiting India from the UK, you’ll need to work out how to exchange your GBP to INR - and get the best deal.

To make your spending money go further during your trip, follow these top tips for exchanging currency in India:

The Government of India has rules that restrict foreigners from bringing any rupees into the country.

This means you’ll need to deal with currency exchange once you arrive, as opposed to beforehand.

So, it’s a good idea to have some cash on you (in pounds) when you arrive in India, in case you can’t find an ATM. This means you can head straight to a currency exchange.

Exchanging currency can sometimes be a confusing and complicated business. There’s always the worry you’ll get ripped off by hidden fees, even with providers who advertise low or no fees. It’s often the case that extra charges are hidden in an unfavourable exchange rate.

To avoid this, make sure you get to know the mid-market exchange rate for your chosen currency pair (in this case, GBP to INR). Also known as the interbank exchange rate, this is the midpoint between the buy rate and the sell rate in global currency markets.

It is the ‘truest’ rate, not subject to markups by exchange desks. By using an online currency converter before switching out your home currency for rupees, you’ll get an idea what your money is actually worth and be better prepared to spot tourist traps.

A note of warning - currency exchange desks may refuse to change banknotes which are in any way damaged or defaced. Make sure that whatever cash you bring is crisp and clean. And it could also be best to avoid notes in too large a denomination, as these could be refused.

Prices in India are low compared with the West, so there’s no need to take large amounts of cash.

In resort or tourist areas, many shops will change money, but avoid exchanges on the black market. Scams and fake currency are not uncommon, so make sure to keep an eye out. If unsure, it’s usually safest to use one of the big name banks to convert currency.

Generally speaking, cash is still king in India. Debit and credit cards are accepted, but usually only in the big cities. Not every vendor will accept cards either, so it’s always sensible to carry some rupees in cash just in case.

If you’re spending on a card, make sure you tell your home bank before heading out to India. Otherwise, there’s a risk that your transactions will be flagged up as fraud.

And if asked, always choose to pay in the local currency (INR), or you could end up with a poor exchange rate.

You should also check that your bank doesn’t have any foreign transaction fees for spending abroad on your debit card.

If it does, the Wise card could be a better alternative for spending in India. It works in 150+ countries wherever cards are accepted and has no foreign transaction fees. Even better, it automatically converts the currency at the mid-market rate whenever you spend, for just a small conversion fee*.

So if you don’t fancy carrying cash around with you, but your bank charges fees to use your debit card abroad, the Wise card is the ideal solution.

And if you’re thinking about opening an account in India, the Wise account could be a convenient and money-saving option.

ATMs are widely-used in India. You will find them at airports or in large urban areas. They are usually the best way for you to take out money.

Though ATMs are widespread, make sure you have a backup plan. Even if you tell your bank you’re going to India, transactions may still trigger a block on your card. Also, ATMs in India frequently suffer technical issues.

Indian state ATMs usually accept Mastercard and Visa. As a general rule, ATMs operated by the largest banks offer the best exchange rates.

To find ATM locations, use one of the following ATM locators:

Do keep your ATM receipts, and remember you will need to convert rupees back at the end of your trip as they are not accepted abroad for exchange.1

You’ll probably use ATMs from one of India’s largest banks as they’re the most common.

There might be other occasions when you need the services of a bank while in India. For example, if you need to wire some money or open an Indian bank account.

Here’s a look at some of the biggest and most popular banks in India:

Understanding the banking system in a new country can be daunting. So if you’re looking to open an account, it could be best to choose a bank known to be welcoming and helpful to English-speaking expats.

Here are some options to check out:

A bank isn’t the only way to manage your money in a new country. You could find it easier and even cheaper to use an alternative such as Wise.

Open a Wise multi-currency account and you can hold, send, spend, receive and convert money in a whopping 40 currencies at once - and all online.

You can also send money back to the UK and worldwide for low fees and mid-market exchange rates*.

Need to pay for accommodation before your trip? No problem. Sign up with Wise while still in the UK and you can send money to India in just a few clicks.

There’s even an international debit card for spending in 150+ countries, including India. It automatically converts your money to the local currency at the mid-market exchange rate, whenever you spend.

Plus, you can keep track of it all on the move using the handy Wise app.

Regardless of what brings you to India, make sure you enjoy your time away. And if you have any rupees left at the end of your trip - rather than losing money in exchanging them back - make sure to treat yourself to a little extra something before you leave for home.

Still have questions about money, banks and currency in India? You might find the answer in our FAQs below.

Yes, cash is universally accepted in all parts of the country. Cards are accepted in major cities and tourist areas, but you’ll definitely need cash if visiting rural, remote or smaller towns and cities.

Traveller’s cheques are sometimes, although not commonly, used in India. You should be able to cash them at one of the major banks in a city branch, but not all will accept them. You may also have to pay a fee.

Lakh is a word used to describe the sum of 100,000 rupees. There are other words for large sums too, such as crore (10 million rupees) and arab (1 billion rupees), although these are not widely used as they refer to such large sums.

You can’t bring any rupees into India from the UK - it’s forbidden under the country’s laws. But you can bring the equivalent of 5,000 USD (around £3,900 GBP) in foreign currency before you need to make a declaration to Indian customs authorities.2

Sources used for this article:

Sources checked on 15-04-2024.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

How much cash can you take to India? Read this handy guide for info on the rules for taking cash in and out of India.

How to travel to India from the UK, including the type of visa you need, how you can apply, how much it costs, and the best way to exchange money.

Travelling to the USA? Read our roundup of the best UK credit cards to use in the USA, comparing interest rates, fees and more.

Travelling to India? Read our roundup of the best UK credit cards to use in India, comparing interest rates, fees and more.

Read our guide on the best travel card for India, including card comparisons and travel tips.

Check out our handy guide to using your Monzo card and account in India, including what fees you can expect.