TL;DR

To the Wise community,

We’ve just finished Q4 and have headed into a new year and new decade.

It’s time for an update on how much closer we’ve got to making our mission of Money Without Borders a reality.

There are now over 6 million people using Wise to move well over 4 billion pounds a month. It’s this community and your fees that allow us to continue making progress on our mission, so we believe it’s important we share regular updates on how we’re investing your money.

Read on to find out how much closer we got to achieving our mission this quarter: Money without borders: instant, convenient, transparent, and eventually free.

Speed

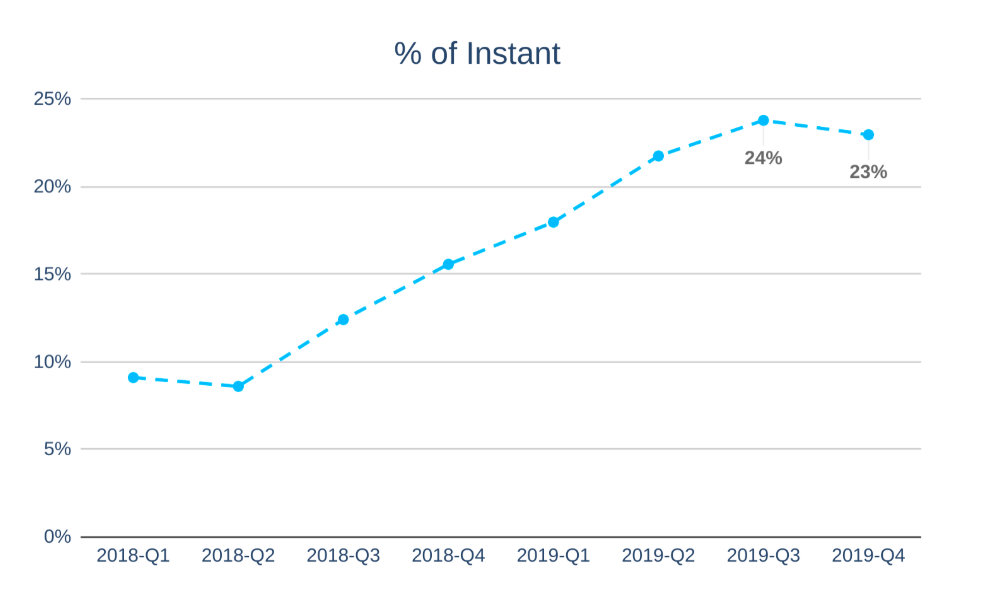

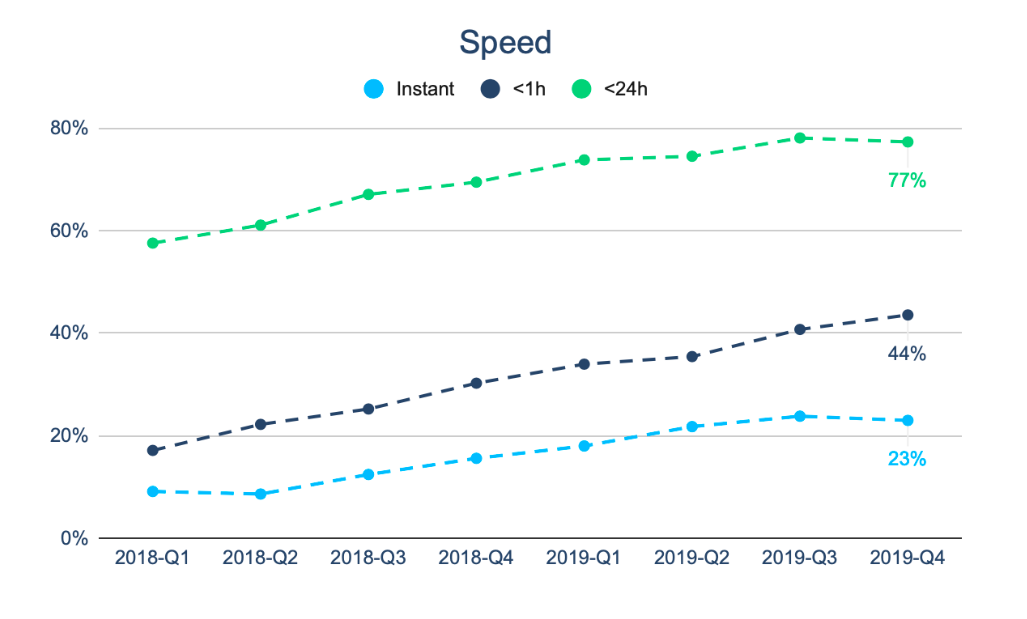

Today, 23% of transfers with Wise arrive instantly. This means money leaving your bank and arriving on the recipient’s bank account in a different country in a different currency - all in less than 20 seconds. The number is a percentage point down from 24% last quarter, because our payouts to India were slower. Many payments, which supposed to take less than 20 seconds, instead took many minutes to complete.

With a new local integration in Mexico we brought our instant sub 20 second transfers to the senders of peso. Since we began the beta, around 13% of our customers sending to Mexico have already experienced instant delivery. As we roll this out for all customers, we should see more impact next quarter.

We didn’t increase the amount of instant transfers, but a growing share of users get their money within minutes. Reflected in numbers, overall 44% of recipients don’t have to wait more than an hour for their money and 77% get it within a day.

The speed up this quarter came from our connection to the new Australian instant payment infrastructure, which averages at 45 seconds to most Australian bank accounts and therefore isn’t quite instant by our standards. Just very fast.

Price

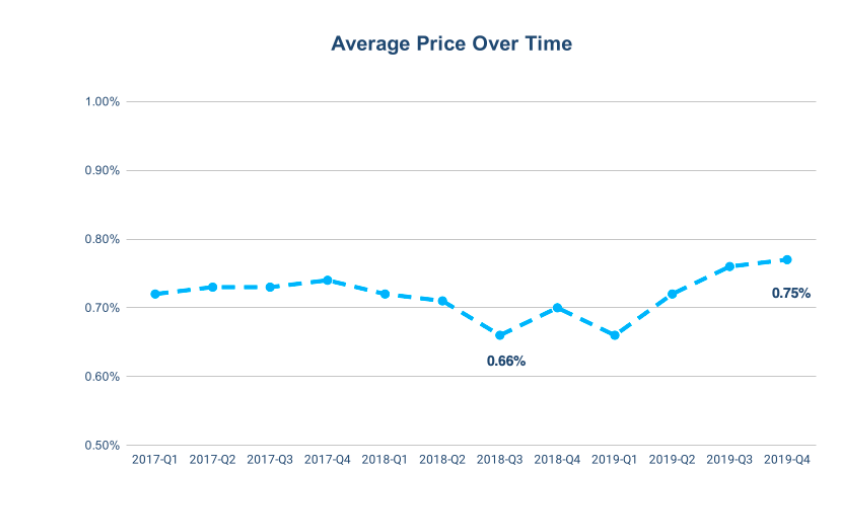

The average price of transfers in Q4 was 0.75%. That’s up (again) from 0.74% in Q3.

Why hasn’t the average price gone down for a few quarters?

While we’re working on making Wise cheaper, some methods for funding payments have gotten more expensive, which in turn has pushed the average cost up.

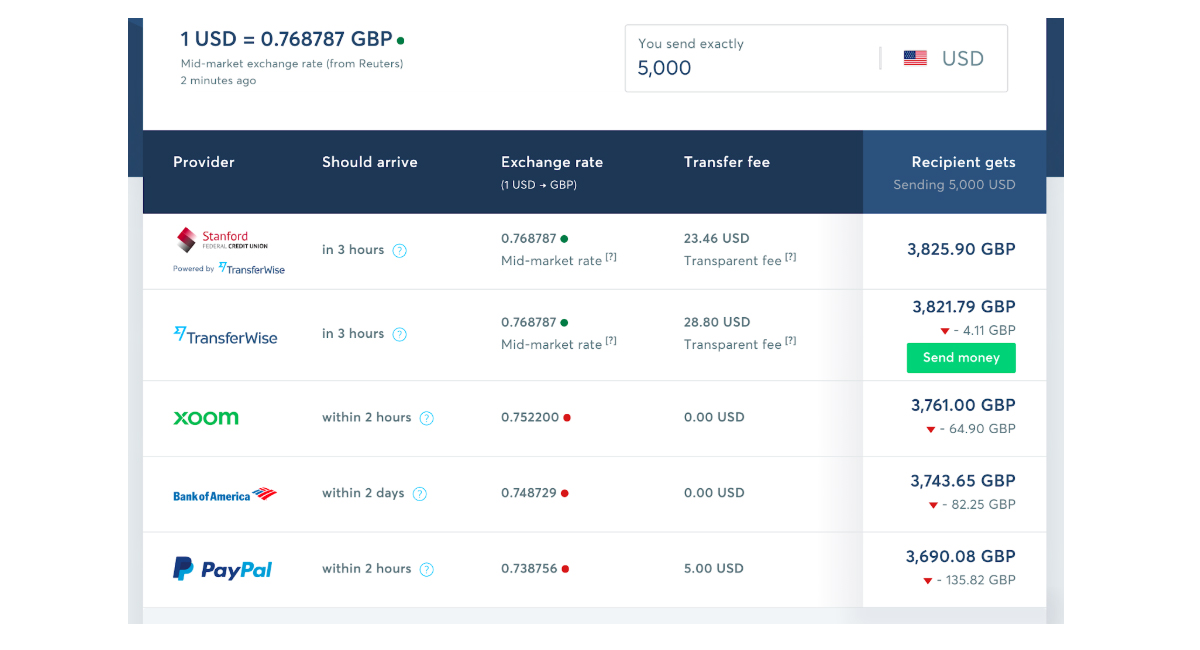

Notably for people and businesses in the US, it costs 0.35% extra to fund their transfer with ACH. For larger amounts it may be cheaper to use a wire. The cheapest option in the US is to use a bank, like Novo or Stanford Credit Union, which have Wise already directly integrated in their apps. In this way you bypass both the ACH charge and the wire fees.

The second headwind to our mission of reducing fees came from increases in costs of using debit and credit cards to fund the transfers in USD, EUR and DKK.

More mission, in more places

Borderless accounts and debit cards around the world

After the USA, Australia and New Zealand in Q3 we launched the debit card for Singaporean consumers and businesses in November and users have already used the card in 49 countries around the world.

Our research showed that Singaporeans lose over S$1.1 billion a year to markups and fees when spending overseas. The Wise card helps people to save money abroad and will bring transparency for Singaporeans spending their hard-earned cash overseas.

New card holders in the UK and Europe will receive their green debit card a day sooner in post as we’ve sped up production and shipping times.

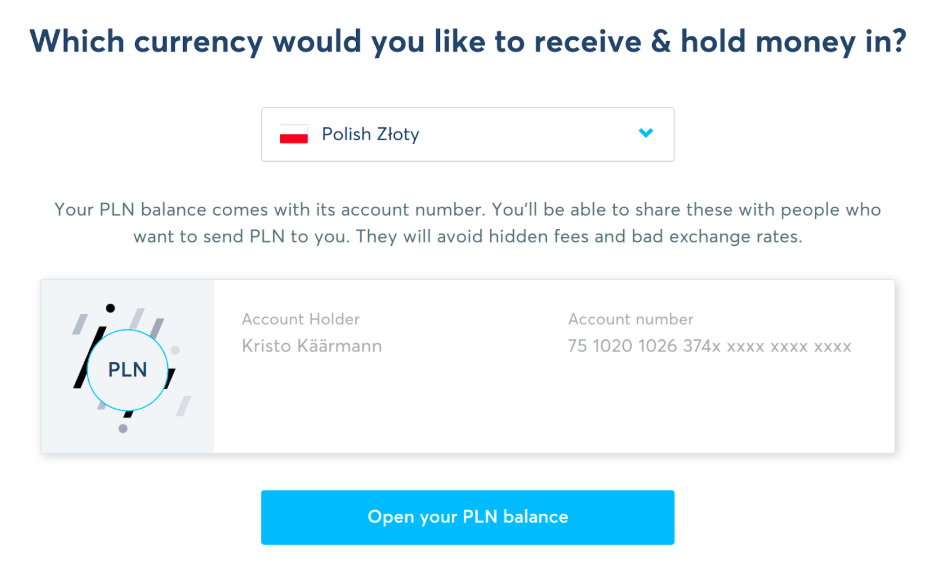

With an account on Wise you have enjoyed your own local bank account numbers in the US, UK, Eurozone, Australia and New Zealand. Now there’s a new country where you get account numbers - Poland.

A few tens of thousands of customers have already taken advantage of receiving PLN locally onto their Polish borderless accounts.

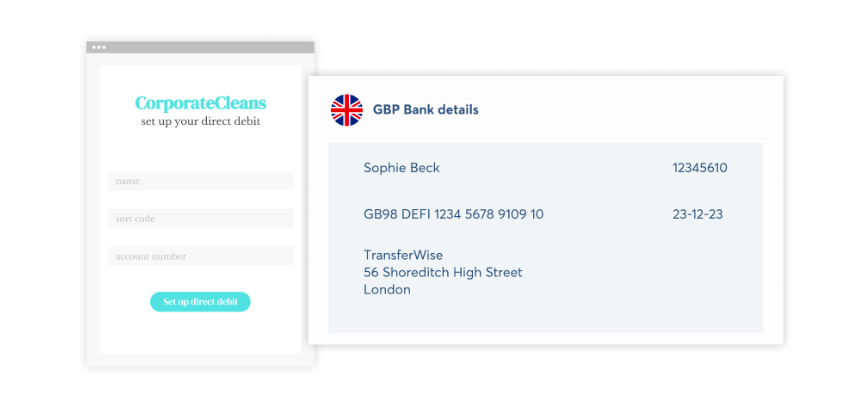

Direct debits in the UK and Europe

For those already using their Wise accounts in the UK and Europe, you may have noticed we’re rolling out direct debits. Users with UK and Euro bank account details can now set up direct debits on web, Android, and iOS. Already we’ve seen thousands of users activate this feature to pay their utilities, phone bills and so on from their Wise accounts.

Adding (and removing) countries for users in Asia and South America

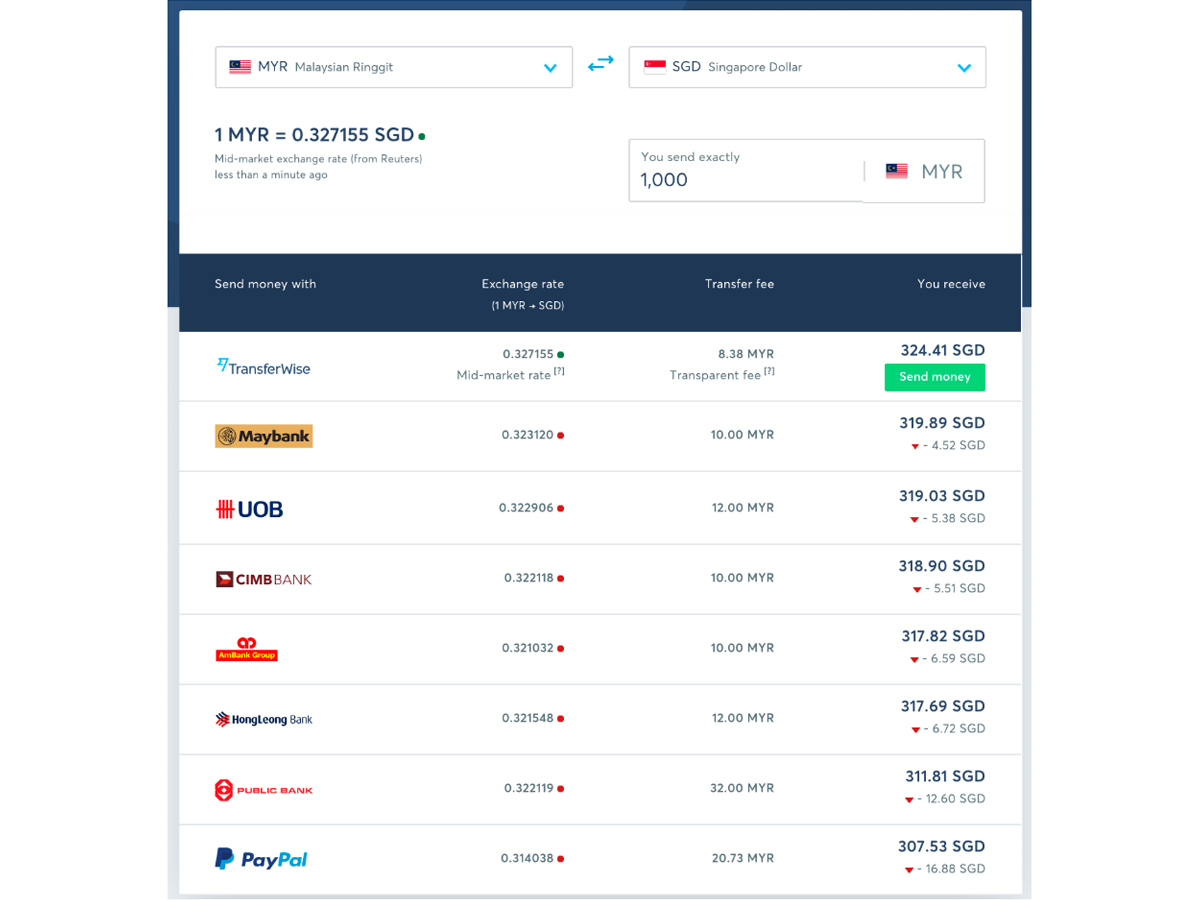

My co-founder Taavet went to Kuala Lumpur to launch Wise for Malaysians together with Dr. Ong Kian Ming, Malaysia’s Deputy Minister of International Trade. Welcome to Wise!

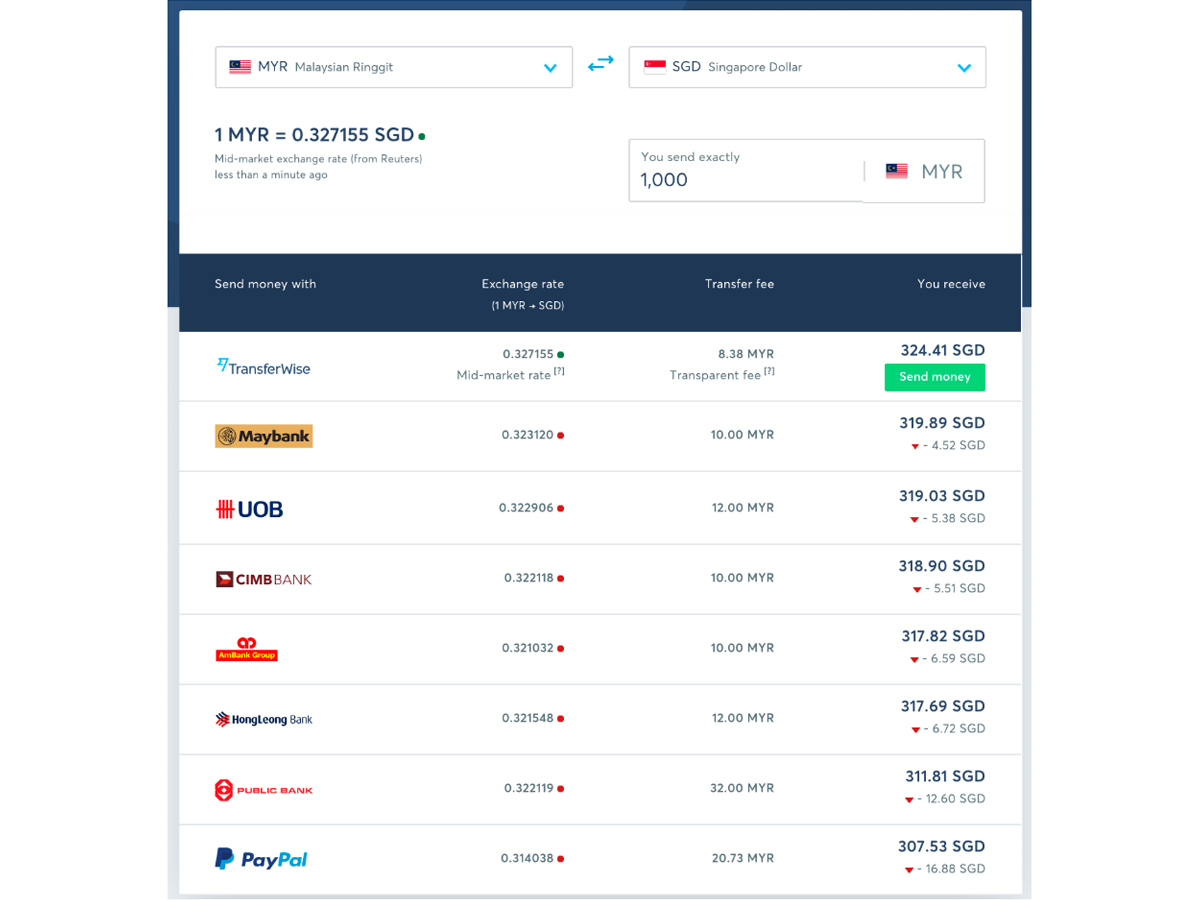

With the launch we included Malaysia’s largest banks in our comparison table so you can transparently see the cheapest way for international transfers.

Botswana pula came to be the 56th currency overall and the 10th African currency available on the Wise network.

It hasn’t been all good news this quarter though in expanding Wise. We’ve been forced to restrict our product in Argentina due to the new incoming governments’ foreign exchange controls. We’re working to find a solution for our users in Argentina, but we don’t have any timeline we can share for when we will be back up to full availability.

API-powered partnerships

This quarter we announced a number of partnerships that are powered by our open API.

Firstly our integration with recurring payments service GoCardless. Until now, GoCardless customers could only collect recurring payments from overseas if they had a local bank account in that market.

Now GoCardless customers can collect recurring overseas payments at the real exchange rate in GBP, USD, EUR, SEK, DKK, CAD, AUD and NZD — all powered by Wise. We will continue to expand the partnership so users can collect recurring overseas payments from over 30 countries - all without having to open a local bank account.

Accountant’s favourite tool Xero announced their integration in November. It is the first “connected app” with Wise and has been a highly requested feature by businesses using Xero for bookkeeping for a few quarters.

The partnership means that small and medium businesses in the UK can pay their bills with Wise, directly through the Xero platform. The integration gives business owners and accountants a seamless process to pay multiple bills and reconcile the transactions in the easiest, most convenient way. This is in a limited rollout for a handful of customers and Xero will open up the beta to more customers in a few months.

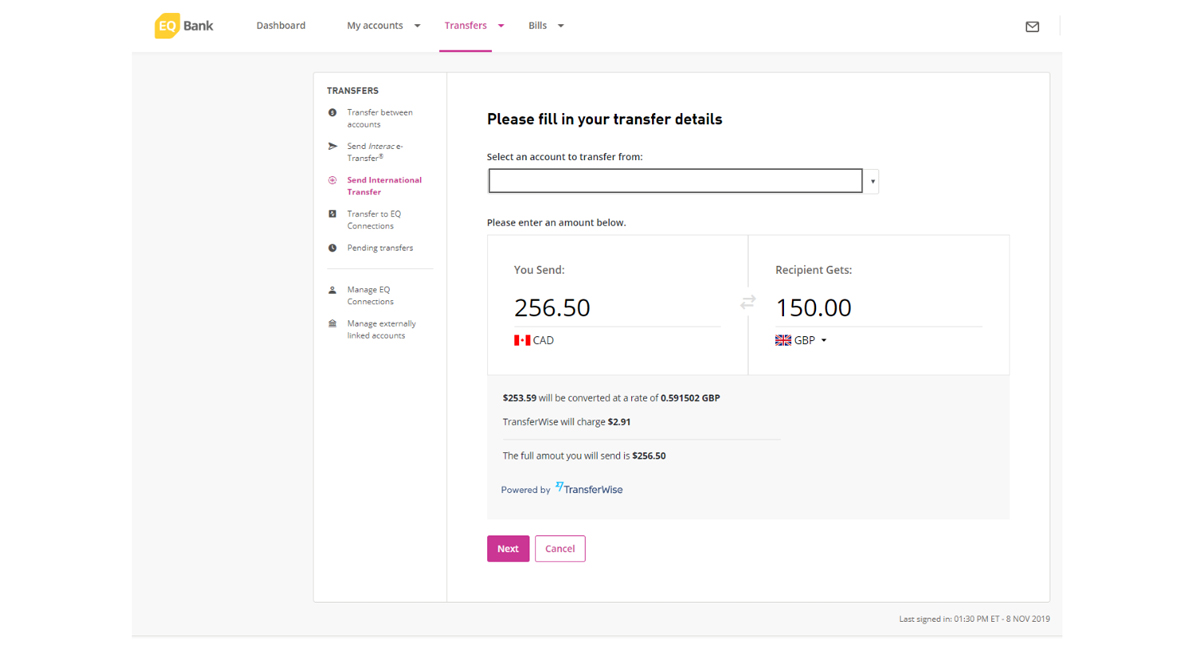

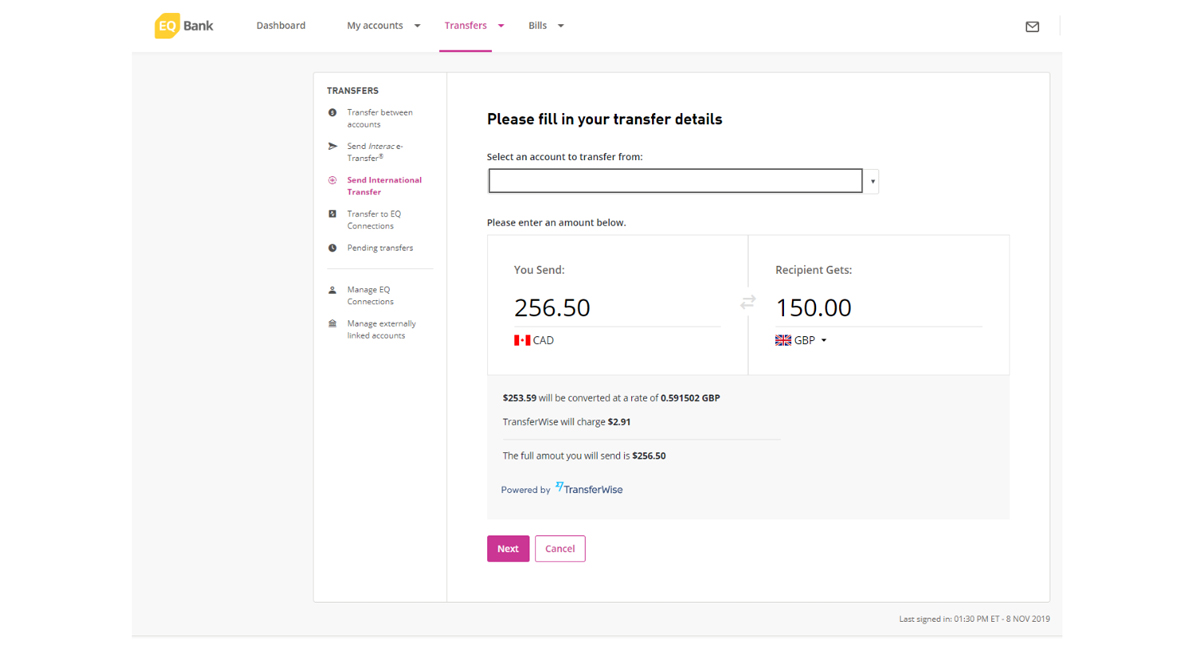

Our open API is also what powers our bank partnerships around the world like our existing integrations with Monzo and N26. This quarter three new banks in North America fully integrated Wise to power international transfers for their users. A new business focused bank Novo in New York, Stanford Federal Credit Union in California, and EQ Bank in Canada all rolled out international payments through Wise for their users. So far, their customers have already saved tens of thousands of dollars by sending millions abroad through Wise.

The best news is that in the US our partner banks like Stanford Credit Union became the cheapest option for foreign wires. Even cheaper than using the Wise app directly!

Convenience

When you need help

It’s not easy in the support teams to keep up with growth and increasing number of features, currency routes and all the good things we build. For example, this year our customer base grew 20% faster than we could grow our customer support team.

We were consistently improving throughout the year and took a different approach to our help centre this quarter, so that we managed to resolve 58% of customer issues within 24 hours.

We did three things to speed up the improvement this quarter.

-

We asked customers to share what their problem was with us before we tried to help them so that we could direct them to the fastest support channel;

-

New guided help with contextual FAQs in our apps point customers to the right help they need - faster than contacting our customer support team.

-

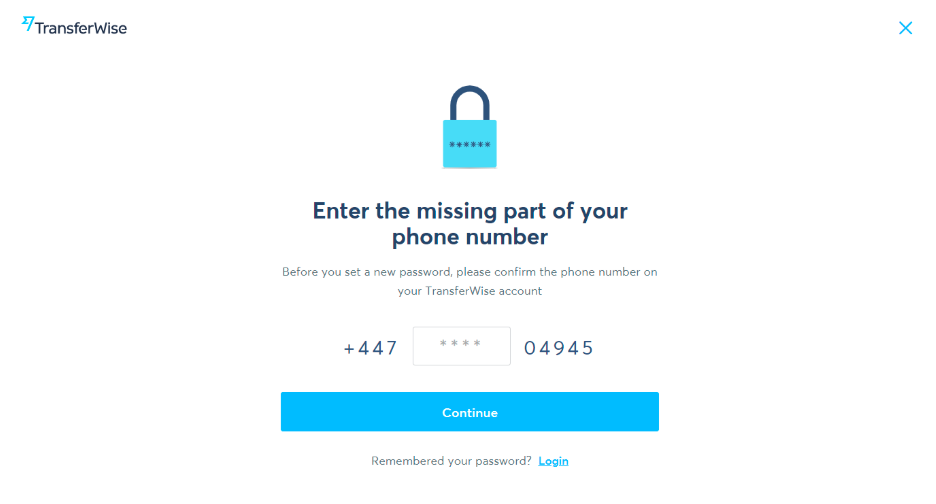

We made product changes that removed the need to contact us. For example, you can now change your phone number and password more easily on the website.

We’re responding to 600,000 customer contacts every quarter, so please bear with us if we’re not yet as fast as we should be.

Bringing Wise to where our users are

In Europe, we enabled instant payout to Visa and Mastercard cards in Spain, Czech Republic, Hungary, Romania, Bulgaria, Russia, and Ukraine. This option is now live for a majority of our users in these countries and will be rolled out further across Europe in 2020. For these customers sending to a card number will be a case when you don't know an IBAN. Sometimes it's easier to open a wallet and see a card number than find bank details.

For our customers in Russia - where card-to-cards transfers have existed for a long time - this is a step towards making sure Wise is as convenient as possible based on how people want to use our service. Already more than 40% of our customers sending money to Russia prefer payout to cards.

Last quarter we enabled users sending money to Bangladesh to send money to the popular mobile wallet bKash. Over 15% of customers sending money to Bangladesh have already taken advantage of this feature and we’re expanding the ability to send money to e-wallets in Asia.

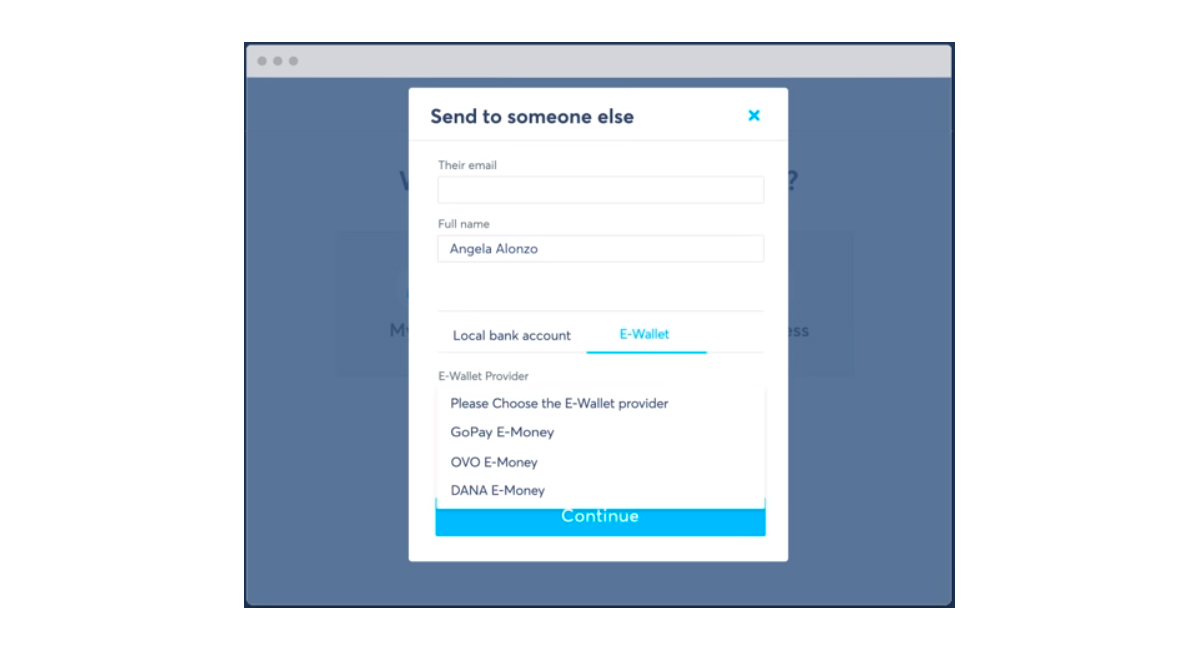

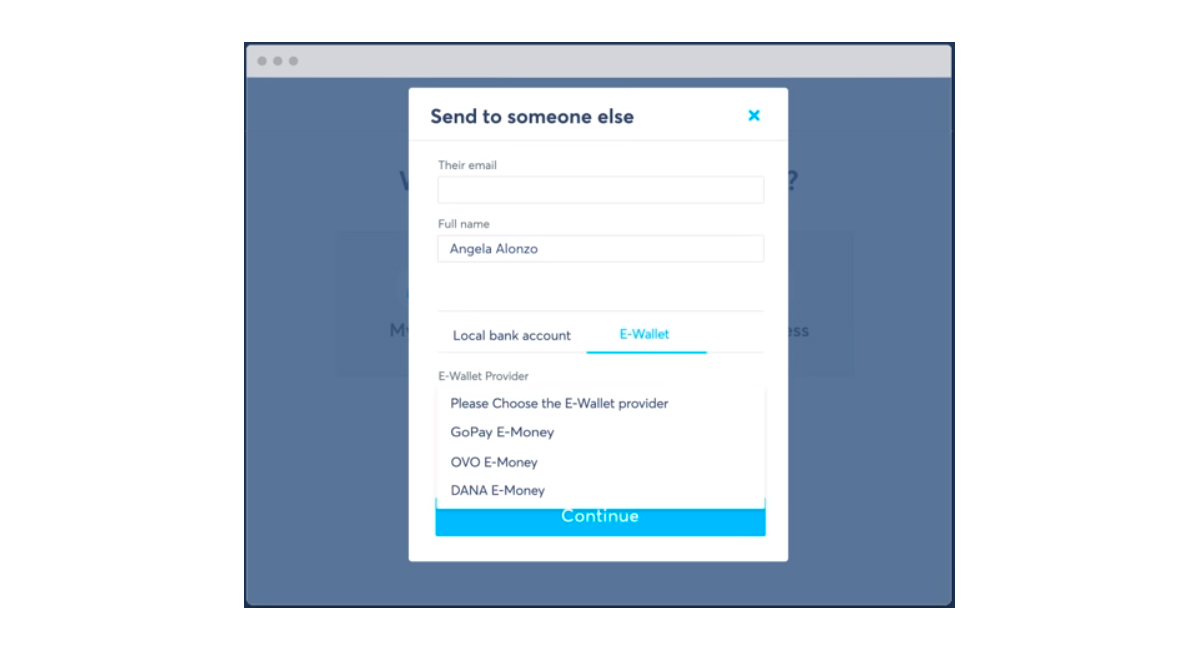

This quarter we also launched integrations with six e-wallets across Indonesia, the Philippines, and Bangladesh - including GoPay, OVO, DANA, GCash, Paymaya, and Antfin.

These e-wallets have over 150 million users and these integrations will let users who are underbanked or unbanked use Wise to receive money from abroad - where they previously would have had to rely on expensive and inconvenient cash transfers.

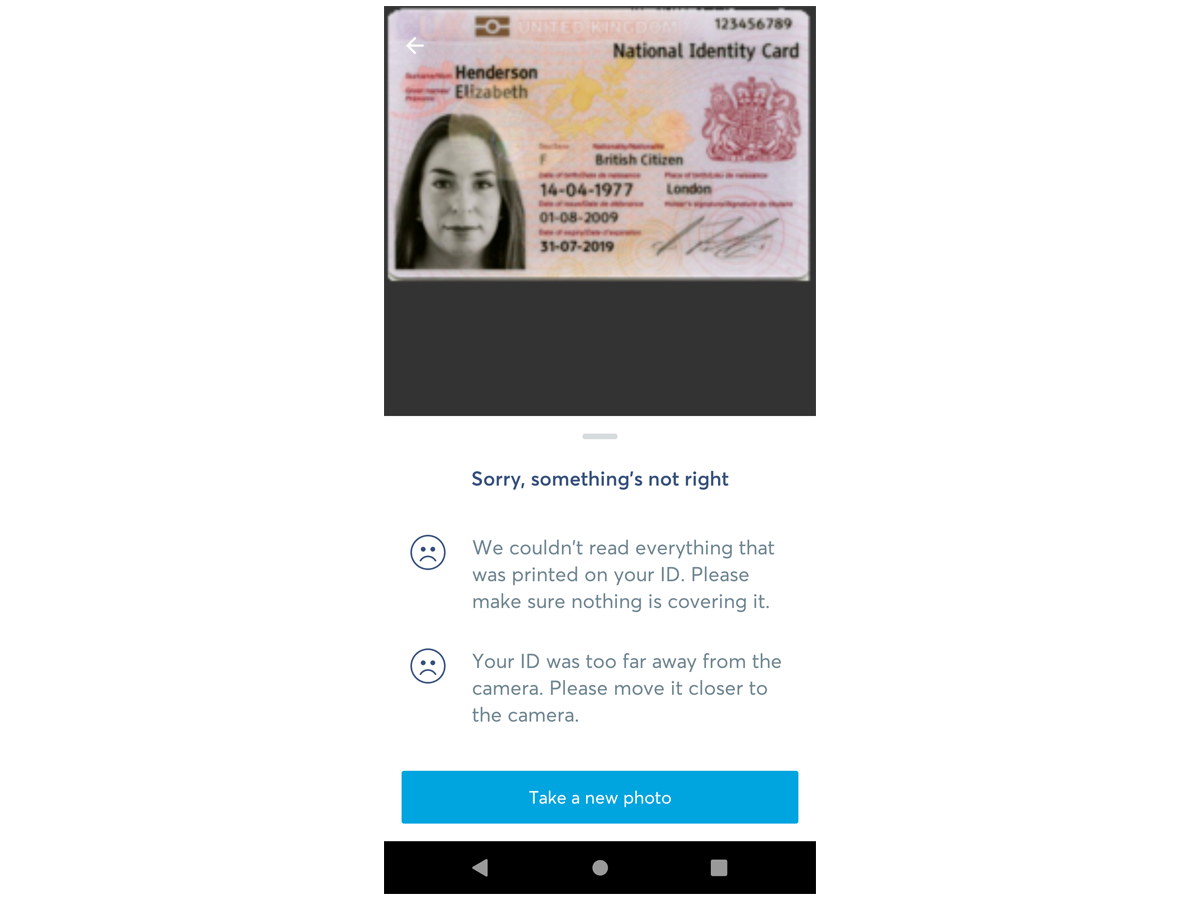

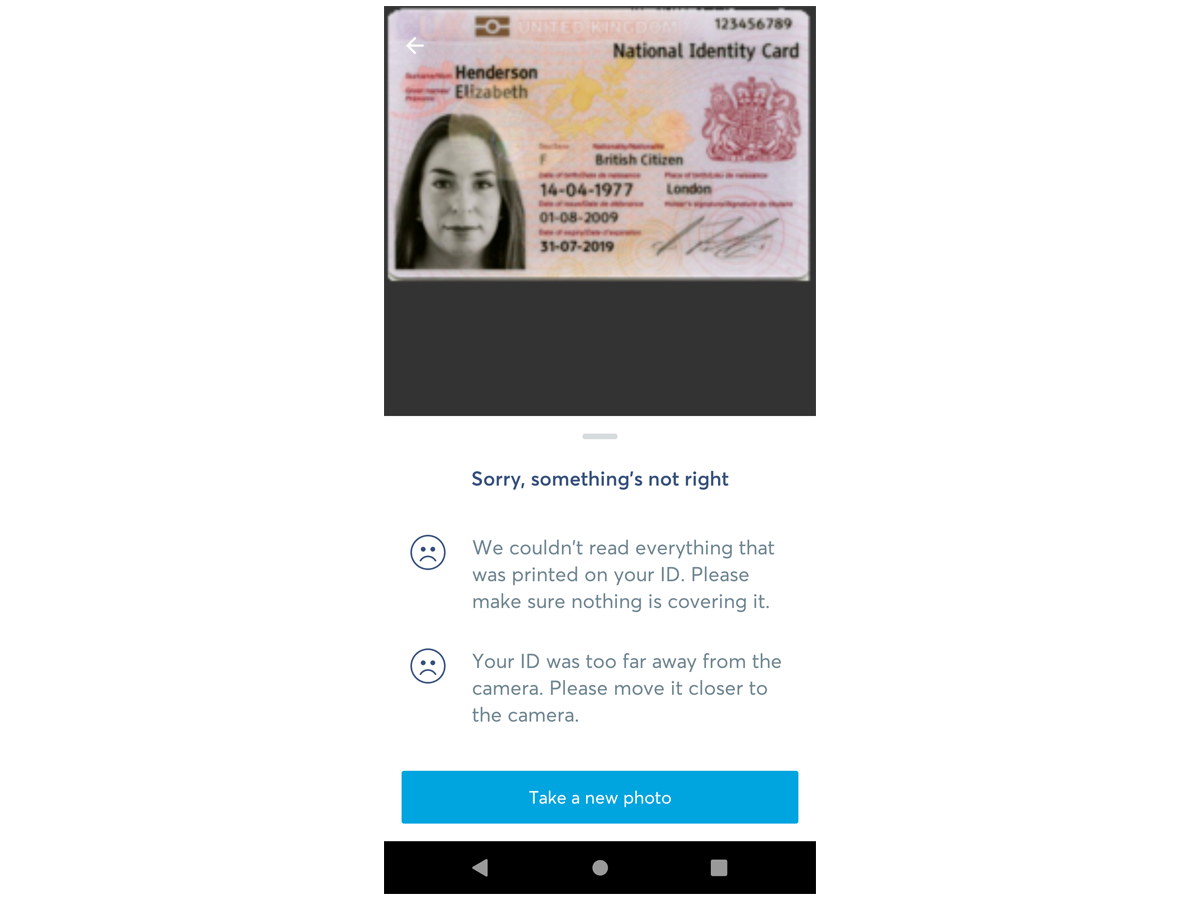

Better document verification and account experience

Previously a large amount of users had to contact us when they submitted an ID document where the picture was of poor quality. This quarter we released a new tool that “pre-evaluates” the quality of the image users submit to verify their identity. This means we can tell you if that screenshot of your passport is good enough, in real time - saving days of emails back and forth. This is currently in testing with about half of our users across all apps and will be rolled out more widely in 2020.

We’ve already seen a 10% increase in likelihood that the image of your document will be accepted for verification.

Sending, spending, and receiving money in more ways than ever

We started switching our borderless Euro account holders from German IBANs to new Belgian IBANs, which will significantly increase the speed at which you can receive money into your accounts. Transfers from more than half of Eurozone banks will already be instant, compared to 1 business day in the past.

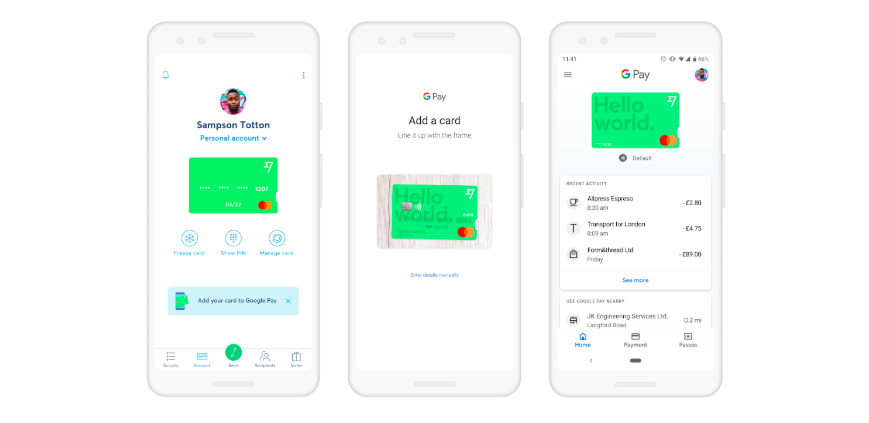

This quarter we gave US users the ability to make “tap to pay” contactless payments using their Wise debit card. Already, over 80% of US debit card users have taken advantage of this improvement.

Users in Europe and a few other countries can now add their Wise cards to their Google, Garmin, and Fitbit Pay wallets so they can securely and conveniently pay with their phones or watches wherever contactless payments are accepted.

Customers who are already familiar with these wallets prefer to use their mobile devices instead of a physical card for roughly half of their transactions. The same group of customers are also using their Wise cards roughly 10% more often now that they can do so from the convenience of their mobile device.

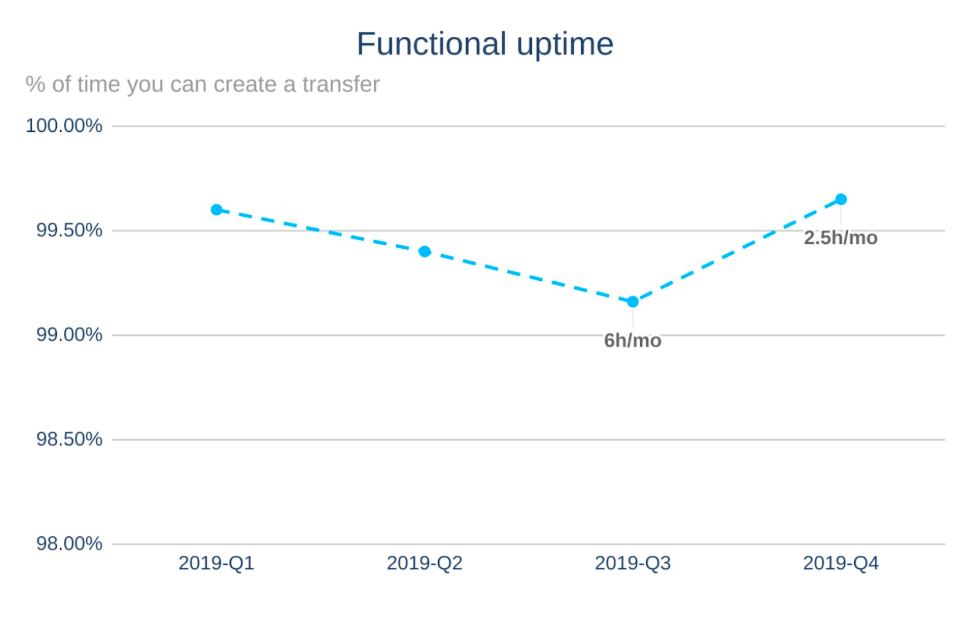

We improved functional uptime for our customers

Users deserve a smooth experience, so we're always working behind the scenes to make this happen. Wise is coded into about 300 independent services, which have to get along to give a reliable experience. About 200 code releases every day make it trickier.

But what does this mean for users? It means customers could count on us to transfer their money, with 99.6% functional uptime during the last quarter.

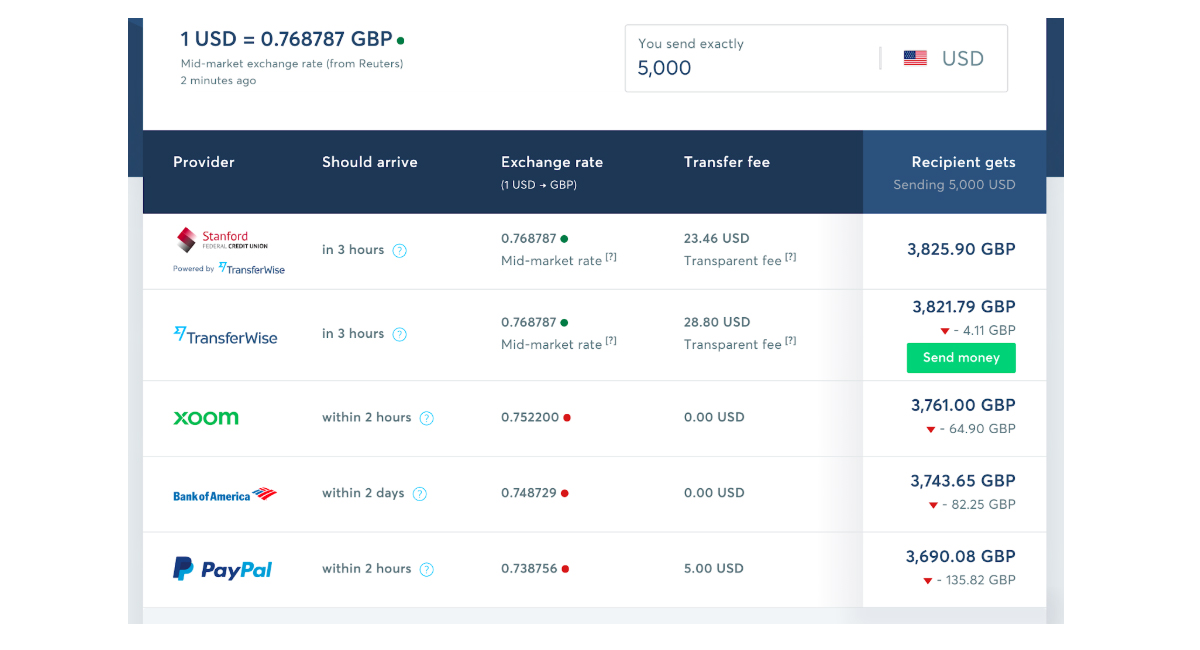

Transparency

Banks everywhere make great effort to hide their fees into the exchange rate. We’ve invested a lot into reverse-engineering their real fees and showing these transparently on our comparison site. This quarter we open-sourced this information and made it available over an API - so if you want to bring this information into your own app, you’re most welcome!

Here are the API docs. There’s no sign-up, just start with a url like this.

https://api.wise.com/v3/comparisons/?sourceCurrency=GBP&targetCurrency=EUR&sendAmount=10000

The coverage improves every quarter - this quarter we added a couple of large US banks and most large Malaysian banks.

Join the Revolution

The team helping build money without borders has grown to over 2000 people across 13 countries. We’ve added over 1,100 people to our team in 2019 and will add even more in 2020.

If you want to help us make our mission a reality, we have 345 open roles right now including various Engineering Lead roles, various Senior Product Manager roles, Head of UX Research, LatAm Banking Expansion Lead, Head of Asia Expansion, & Head of People Operations. Check out https://wise.com/jobs to find out more.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.