To the Wise community,

We’ve just finished Q2. So it’s time to update you on how our teams have made progress on the Wise mission over the last three months.

We publish these mission updates so that you, our users, are able to see and understand the progress we’ve made. There are now 5 million people using Wise to move well over 4 billion pounds a month. But no matter how much we grow, it’s important to me that all our teams stay accountable to you — the Wise community.

So read on to find out how we did on our mission this quarter: Money without borders: instant, convenient, transparent, and eventually free.

Price

Our average price climbed to 0.67%

In May, we changed prices for around 2.5 million users. This change affected the majority of our currency routes and payment methods. And most prices increased by about 8%. The average price is now 0.67%.

In some currencies, we were able to charge less in Q2 than Q1, such as Brazilian Real and Canadian Dollars, which are over 60% and 40% cheaper respectively. However, in other major currencies we’ve had to increase our fees, such as Singapore Dollars and British Pound, which rose by nearly 60% and 35% respectively.

Why did this happen?

We’re on a mission to make Wise free, whilst running a sustainable and dependable service for our users.

As we grow — and serve more and more people and businesses — we’ve had to make investments into hosting our services earlier than planned. The goal here is to make sure Wise is available, whenever and wherever you need us. Investing in this infrastructure now reduces the risk of downtime in the future. We’re working hard to bring prices back down again. As soon as we’ve done it, we’ll let you know.

Whenever we change prices, we’re transparent about it. So with this change, we added all our new pricing information to our price checker.

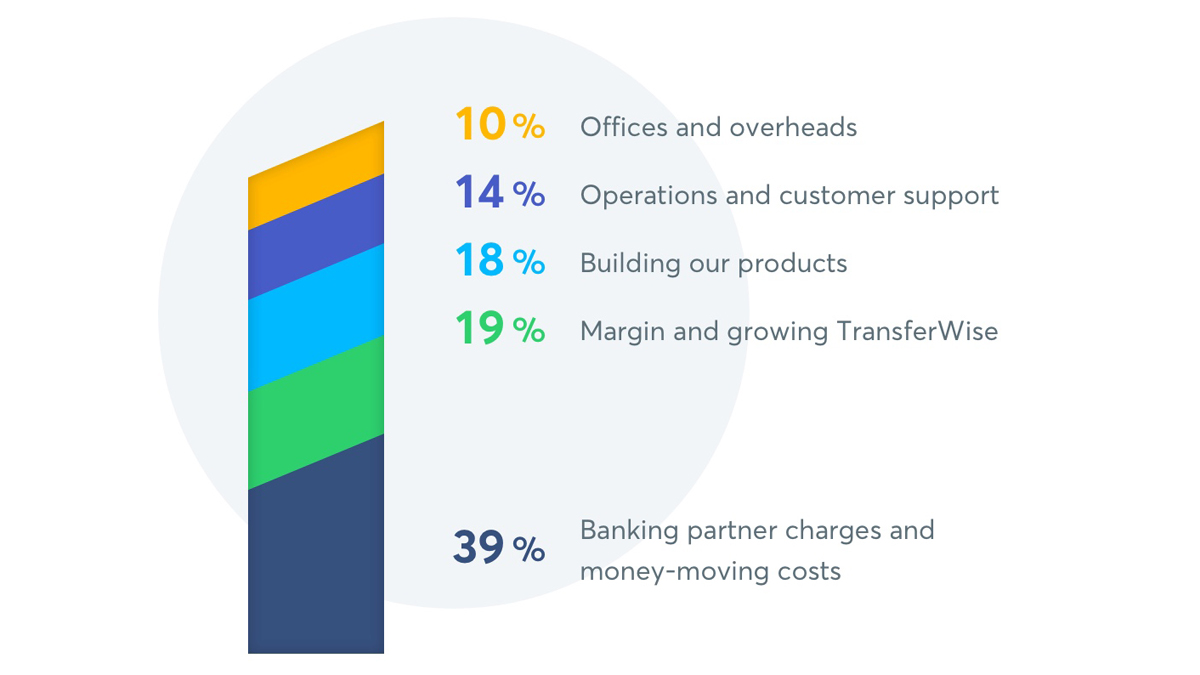

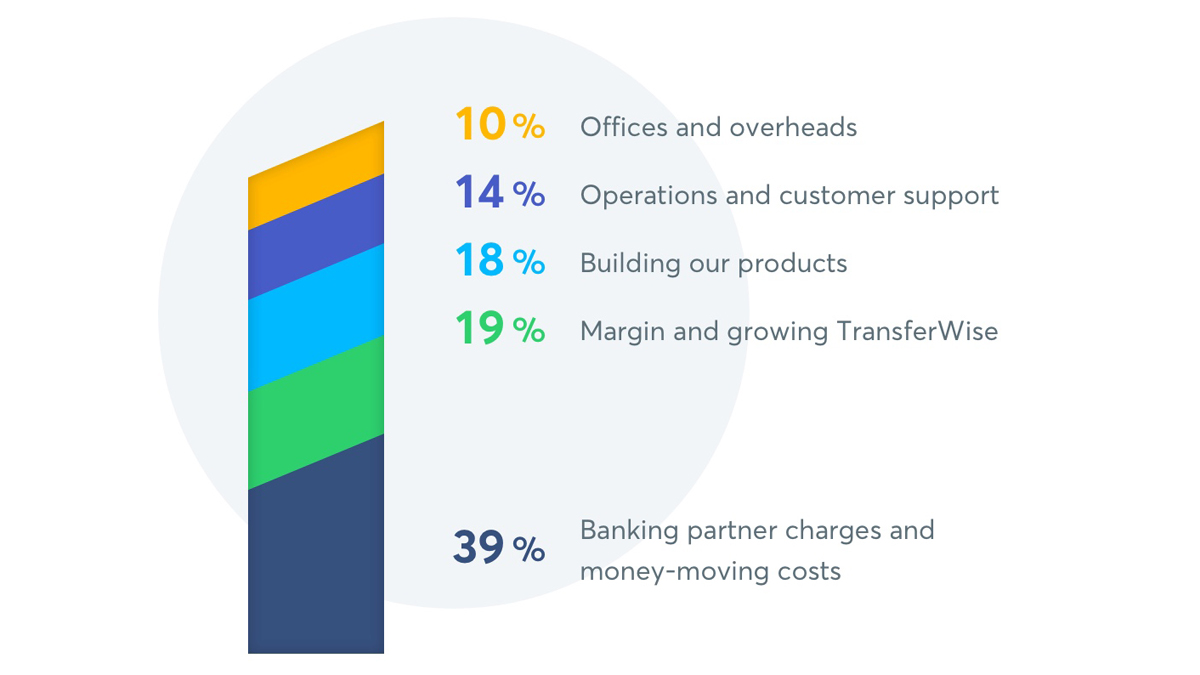

We’ve been profitable for 2 years now, which means our mission is financed by you. The fees you pay cover the cost of your payments on Wise, as well as a small margin that we invest back into making Wise even faster and cheaper in the future. Here’s what that looks like:

Source: Wise Finance Data Q1 2019

Speed

We’ve improved our delivery estimates and made transfers to Ukraine instant

We’ve already proved that money transfers shouldn’t take days. Today, 20.8% of transfers are delivered instantly, compared to 19.1% in Q1. We consider ‘instant’ as less than 20 seconds.

On some routes, sending money isn’t instant yet. But we did improve our estimates of how long these transfers take. Here, we increased the accuracy of our delivery times, with 84% of transfers arriving within two hours of the time we’d estimated. This is up from 75% at the end of 2018.

We also asked for your help on the remaining 16% of transfers where we’re giving inaccurate delivery estimates. When you make a transfer, your recipient’s bank doesn’t tell Wise when that money arrives. This means we have to make an educated ‘guess’ on delivery time, and sometimes, we get that wrong.

So this quarter, we asked our customers to tell us when money arrived in their recipient’s bank account. The more you share this information with us, the better we get at making accurate delivery estimates for everyone. Thank you all for your help so far.

We’ve also improved speed on transfers to Ukraine. Previously, the majority of transfers only reached the recipient’s account within two days. This quarter, we automated a process that used to need manual, human review. The result is that almost all transfers to Ukraine are now instant.

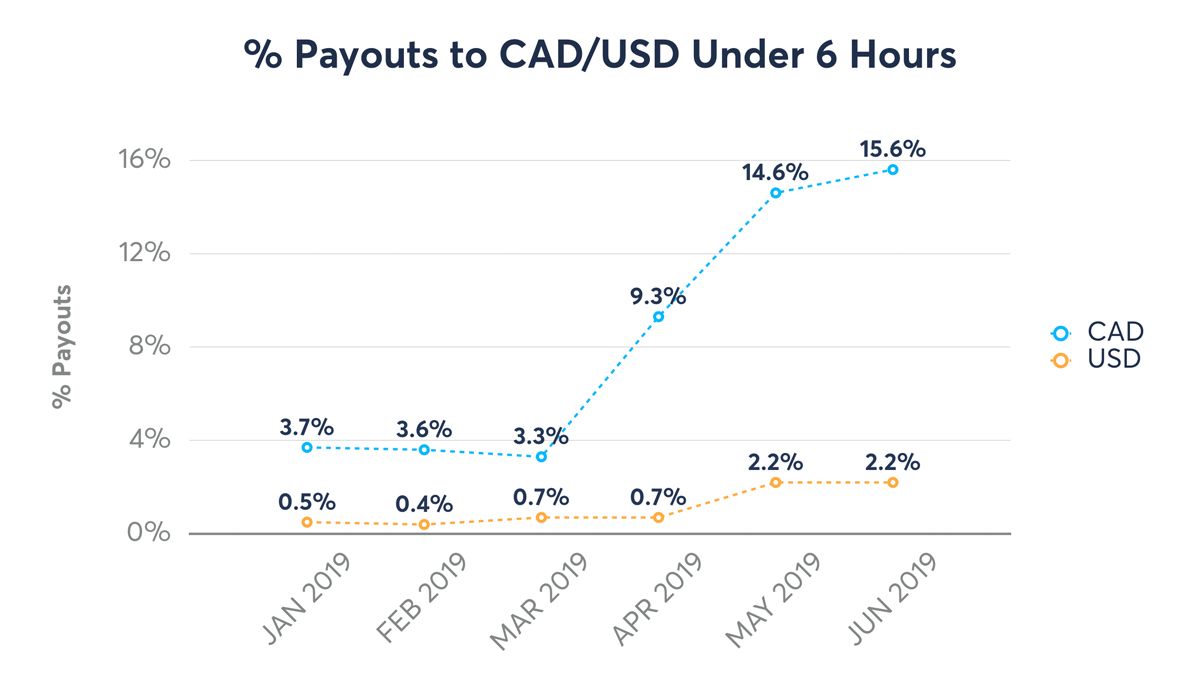

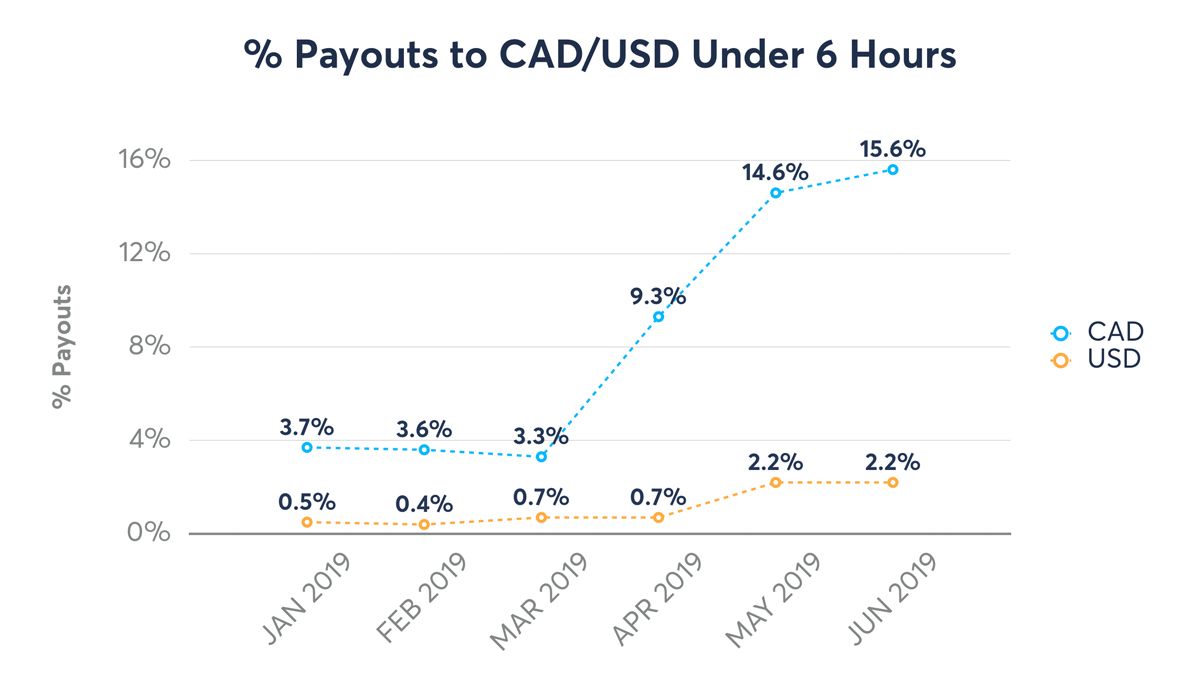

We also sped up transfers to US and Canadian accounts — by extending the hours in which we pay out money to USD bank accounts and Canadian Interac accounts. This is an improvement for 7% of our US customers. And, it reduces how long it takes us to pay out money late at night and on weekends from 11 hours to 6 hours.

Convenience

It’s more convenient to get verified and get started

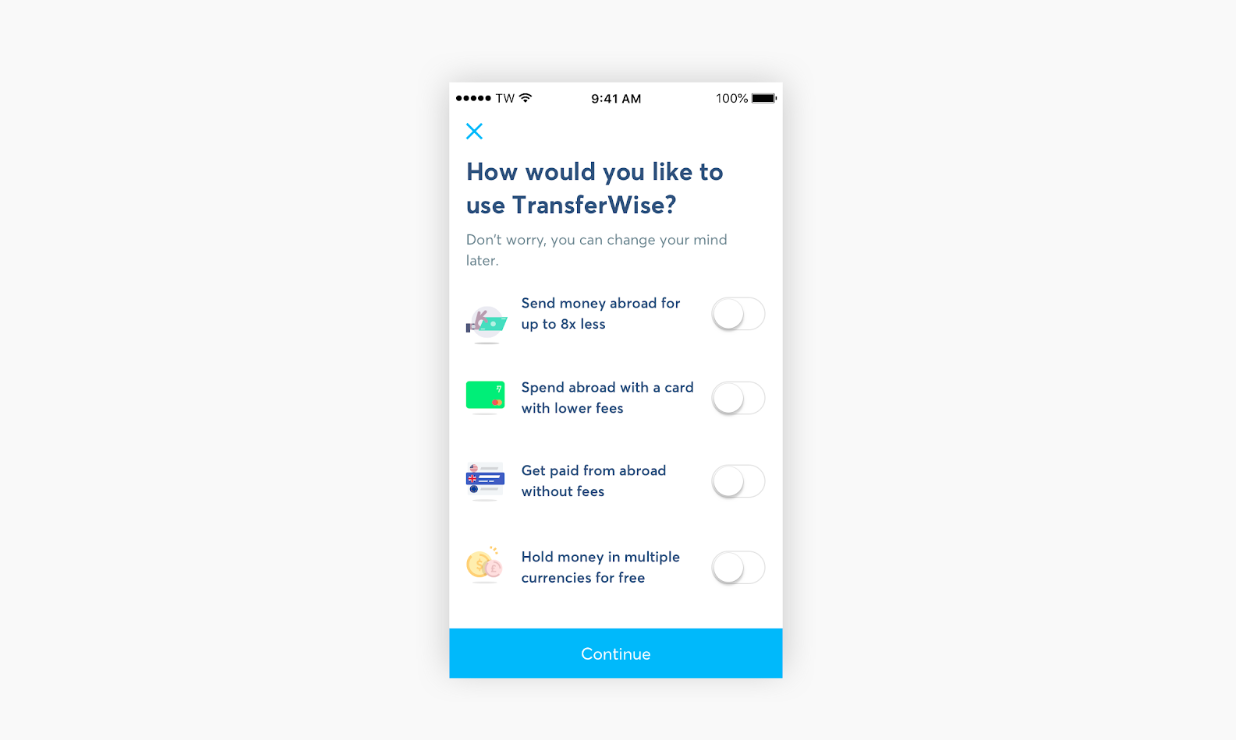

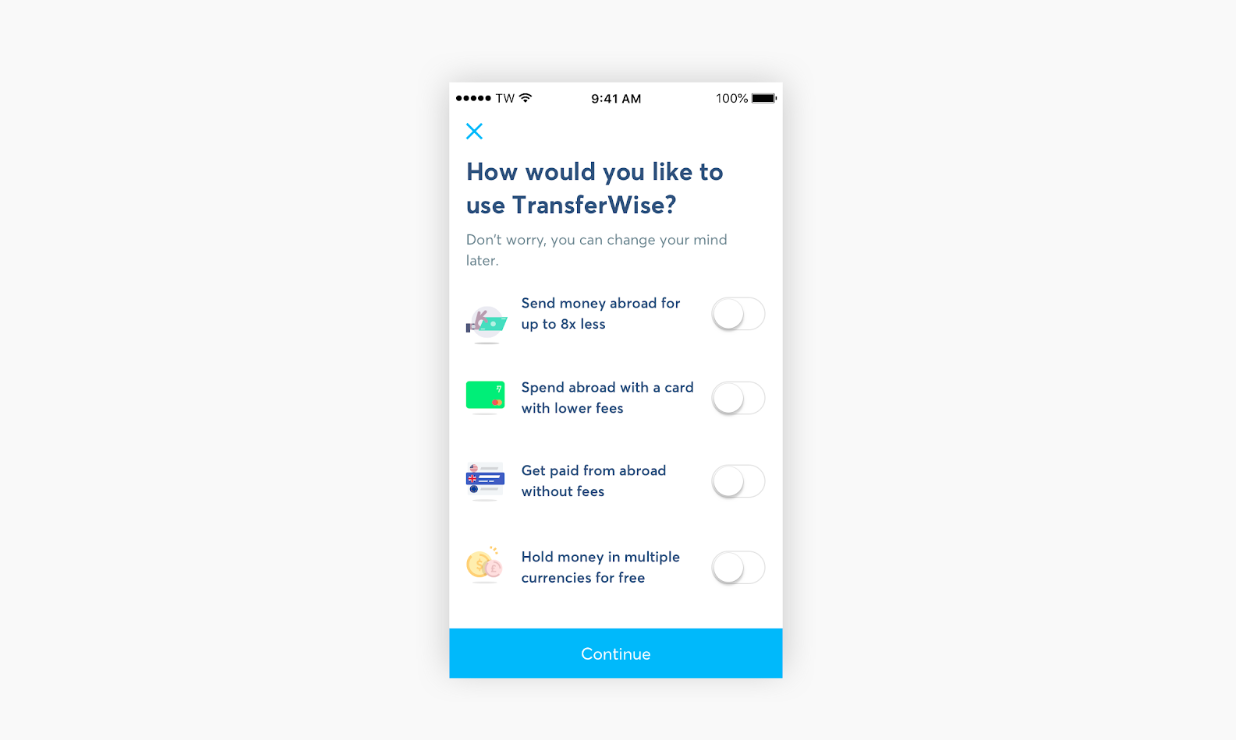

People use Wise in lots of different ways. To send money, to spend on a Wise debit card, or to receive money internationally. To help new users find exactly what they need, we’ve simplified the first few steps of our app. For instance, if you don’t need to send money overseas, and you just need Wise to receive money from another country, you’ll see that option right upfront.

Continuing on the theme of simplicity, we also made some changes to our homepage. There’s less clutter, clearer wording, and a whole new section about how to get started with Wise.

People who need to send bigger amounts of money will also benefit with a more useful look of our page.

We’ve also made it easier for all users to make important changes to their account by themselves. For instance, you used to have to contact customer support if you wanted to change the surname on your account. Now you can simply upload ID showing your new surname, and our verification partner will check it speedily and automatically.

And in Australia and New Zealand, more customers than ever go through background verification, meaning you don’t even notice it when you’re using our apps or website. Two thirds of our Pacific users get verified this way, up from a quarter of users in 2018.

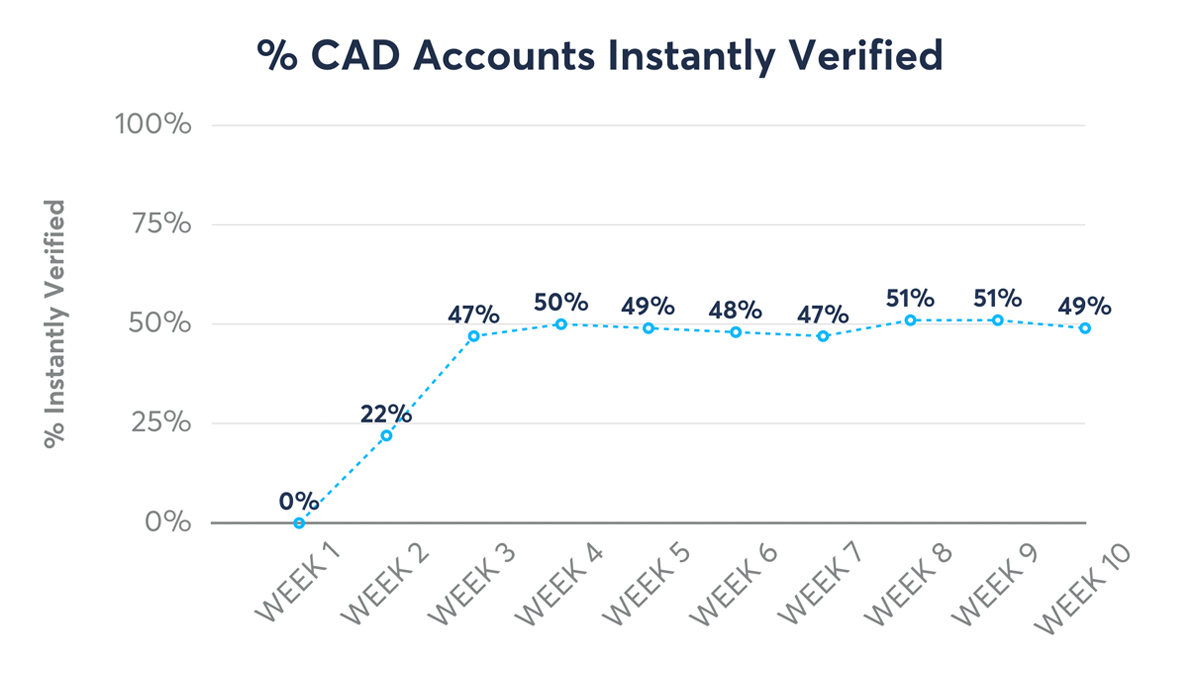

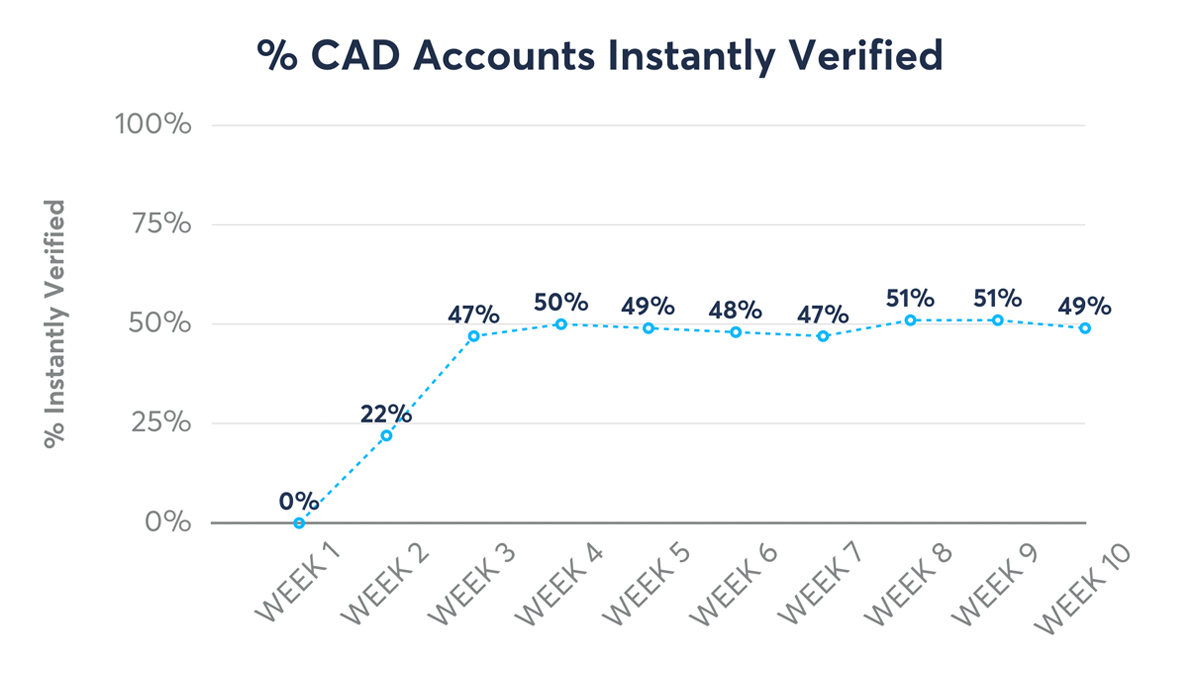

In North America, we’ve also been working on verification speeds. This quarter, we’ve halved the number of manual reviews for Canadian documents. And customers with ACH accounts in the US are now verified on the same day.

We integrated with the UK’s Open Banking API

This quarter, we integrated with the UK’s Open Banking API. This means that the vast majority of users sending money from a UK bank account can now do so instantly and conveniently, right from their internet banking. It brings the convenience of using a card with the low price of a bank transfer. In the first few weeks, more than 20,000 people benefited from this change.

And we welcomed Uganda to Wise

We’ve added another African nation to the list of countries you can send money to. So Uganda, welcome to Wise.

If you’re receiving money, we made things clearer for you

We gave our Android app a makeover. We hope it makes things clearer and simpler for everyone, but especially for those of you that receive, convert and spend your money with Wise.

With Wise, your US, UK, EUR, AUD and NZD bank details mean you can get paid and receive money seamlessly. This quarter, we made that a bit easier, with new screens guiding you through sharing your bank details, and adding and converting money in your balances.

And if you’re using our debit card, life just got simpler (and safer)

You can now order a new card and keep using your current one while you wait for the new one to arrive. We streamlined our packaging and shipping too, meaning card delivery in the UK and Europe is around a day faster than before.

On top of that, our debit cards now have 3D Secure technology — it’s an extra layer of security designed to stop card fraud, and keep your online payments safe.

We launched our debit card in the US

A final big one on cards — if you live in the US, you can now order your Wise debit card. And if you are in the US, your card comes enabled with Apple Pay, Google Pay, and Samsung Pay.

We’re making life easier for Businesses

Last quarter we let you know that 250 beta users from over 60 companies were able to give multiple employees access to their Wise Business account. We’re steadily rolling this out to hundreds more businesses. If it sounds like something your business needs, you can sign up for the beta.

Over 300 businesses a week are also already taking advantage of our new automated verification process, meaning your business account can be up and running in minutes. It’s quicker, and less complex than ever to sign up and get your business started on Wise.

Transparency

Mission Days went live

For the first time ever, we live streamed a portion of our Mission Days — where our 1600-strong team got together to hear from our customers, and each other, about the progress we’re making on our mission. If you didn’t tune in, you can watch my update on last quarter’s progress. I’d love to hear your feedback. We’re looking to do it again in January.

Come and join us on our mission to make money without borders

Wisers are a mix of people from over 76 countries, working in 12 cities around the world. There are lots of people keen to join our mission too — we received 9769 applications in Q2 and welcomed 235 new Wisers.

Sounds like something you’d like to be part of? We have 180 open opportunities right now. Read about working on our mission on Glassdoor and LinkedIn, then apply on our careers site.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.