5 Ways to Stand Out and Boost Black Friday Sales

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Many customers are turning to banking apps and other alternatives to the big high street banks to help them manage their small business finances. Mettle is one of the options available alongside a group of other modern alternatives disrupting big banking.

It’s an app-based business account aimed at sole traders and limited companies with up-to 2 owners. Mettle is by NatWest, but it’s not a NatWest account - with different eligibility requirements, costs and processes.¹

To help make sure you choose the right business account for your needs, we will review some of the features of Mettle, as well as looking at an overview of the Wise business to introduce an alternative provider to your international business needs.

If you're a business sending more than 100,000 GBP (or equivalent) monthly across different currencies, get in touch with the Wise Business sales team to discuss the best solutions for your needs.

Talk with Wise Business Sales Team 🚀

There are plenty of reasons you may need to send or receive money from abroad. You may need to pay a supplier based overseas, or take payment from customers from abroad. Or maybe, over time, your business grows until you have a team based outside of the UK, and you need to send salary payments internationally.

Mettle accounts currently can’t make or receive international payments.² For some freelancers, start-ups and entrepreneurs this may be a limiting factor.

If you’re thinking globally about your business, you may want to consider other options. Check out Wise Business, for a multi-currency account which makes it simple to send and receive global payments.

Get started with Wise Business 🚀

If you choose to use a Mettle account you can still access your funds if you’re overseas, by using your linked debit card, with the exception of some countries.³ You’ll be able to spend directly with merchants overseas, as well as using the card to make ATM withdrawals as you’re on the move.

One thing to keep in mind is that Mettle doesn't charge fees when you are using your debit card abroad, however all currency exchange will be done using Mastercard exchange rate³, and in this case a fee is added on top of the mid-market exchange rate.

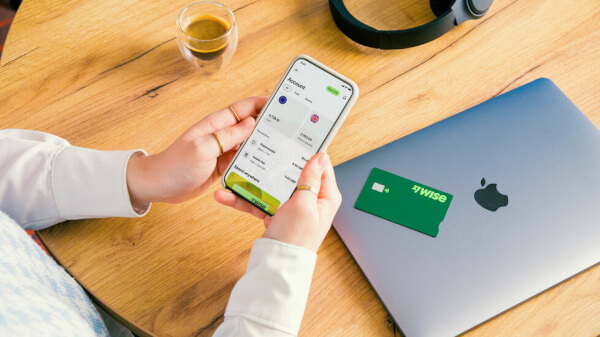

If you need a better option to spend abroad, Wise Business debit card is the way to go. With Wise Business card you can spend in 150+ countries with the mid-market exchange rate and small, transparent fees.

You can pay in 40+ currencies with your Wise Business card even if you don't have a balance for the currency on your multi-currency account. Wise's smart technology will convert your spending automatically to GBP. What is even better? You earn 0.5% cashback on your purchases.

Mettle offers online banking with no monthly fee. Finding free business banking certainly makes sense if you’re growing your business. However, there are some limits to how Mettle can be used that you’ll need to know about before you make a final decision.

Here are some points to consider when thinking about Mettle’s services:

- No fees to pay for your online banking.

- Backed and regulated through NatWest for secure transactions.

- Apply online in minutes and get in app customer support once you’re set up.

- Create and send invoices from your phone, and get spending and income data to see how trends in your account change over time.

If you think Mettle is the account for your business necessities, it is a good idea to check the eligibility criteria⁴:

- You need to be a sole trader or limited company (with up 2 owners) registered and trading in the UK.

- You need to be a UK resident.

- You need to have a UK phone number.

- You need to have an iOS 13 or later device or an Android 7.0 or later.

- Main account balance up to £1 million.

- You need to be over 18 years old.

- You need to be a UK tax resident only.

If your company does or plans to do business overseas, whether it’s customers, workers or suppliers, Mettle won't be the best option, since you won't be able to pay or get paid internationally.

In that case, Wise Business account is the perfect alternative. It’s quick and easy to open online, and gives you a powerful platform for sending, receiving and managing your business finances in over 40+ currencies.

You can easily pay suppliers and workers all over the world, for low fees and the mid-market exchange rate. And best of all, you can get paid for your products or services quickly and easily, accepting payments in 8+ major currencies.

You can also link your Wise Business account with your favorite accounting tools, such as Xero or Quickbooks. This makes keeping track of your company’s finances a breeze.

If you’re looking for a smart new way to manage your business accounts, it pays to do some research, including both traditional and competitive options. Mettle is a relatively new company, and the account product on offer is still growing.

It’s also worth considering whether international payments are important to you. Being able to send and receive transfers in foreign currencies could open your business up to a world of opportunities. International customers, overseas suppliers, and even a remote team crossing time zones working on selling your products while you sleep. If your business is looking beyond borders, you’ll need an account which can support you.

Sources used in this article:

Sources last checked on 21/05/2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

December kicks off the end of year shopping period, with huge uplifts in on and offline sales as people grab a bargain and get ready for the holiday season....

The term "turnover" is used often in the world of business, but its implications vary significantly depending on the context. At its core, turnover is a...

Wise is a financial technology company focused on global money transfers that offers two different types of accounts: a personal account and a business...

In today's fast-evolving digital landscape, e-commerce is quickly transforming the ways consumers shop and how businesses operate worldwide. DHL’s E-Commerce...

In an increasingly interconnected global economy, small businesses in the United Kingdom (UK) have more opportunities than ever to expand through import and...