Welcome to our quarterly trading update blog post where we will be going through our mission and financial highlights from the last three months, September to December.

We continue to deliver on our mission to solve a massive problem in a large underserved market and more customers than ever are using Wise. In Q3 FY23, 5.8 million customers moved 28% more volume with us, £26.4 billion, compared with Q3 FY22.

We continue to invest in building the infrastructure that powers our products. For the third consecutive quarter, more than 50% of our payments were completed instantly. We remain focused on lowering cross-border fees over the long term and, although the average customer price increased by 2bps in the quarter, we continue to offer significantly lower rates than those offered by the banks from which our customers join.

Our teams are making the products that people and businesses love even more convenient, which is leading to greater adoption of the Wise Account. Notably in Q3 FY23 we launched new initiatives so that our customers can benefit from the higher interest rate environment, and we made it easier for businesses to spend and get paid.

We are highly profitable and cash generative even after we invest significantly in our products and infrastructure for future growth.

As a result of continued revenue growth this quarter, supported by higher interest income in recent months, we are upgrading our FY23 total income growth guidance to 68-72%, from 55-60% previously.

Kristo Käärmann, CEO and co-founder said:

“Our mission is clear - to make moving and managing money faster, easier, cheaper and more transparent for people and businesses around the world. As interest rates increase, our customers expect a return on the balances they hold with us, and we intend to share much of the benefit of higher rates with customers. This quarter we launched ‘Interest’ within our Assets product in the UK; a whole new way for our customers to hold their money and earn a return. I’m also pleased that for the third consecutive quarter, 50% or more of cross-border payments were completed instantly.

The investments we’ve made to deliver a superior infrastructure and product are resonating, and in this quarter more customers than ever used Wise. This underpins our conviction in the outlook for 2023 and beyond."

Mission Highlights

We focus on four pillars in pursuit of our mission: price, speed, convenience and transparency.

Unfortunately, price was a little higher this quarter! 📈

Core to our mission is sustainably lowering prices for customers over time. To do this, changes in the average customer price reflect the changes in the cost to deliver payments. But during this quarter the average price increased to 0.66% compared to 0.64% in Q2 FY23 and 0.60% in Q3 FY22, as previously announced price changes, which were a result of higher FX costs, came into effect.

We were, however, able to lower fees for some currency routes, including a 50% price reduction for sending money to Mexico and a 10% reduction for sending and converting Brazilian Reais.

Over half of all transfers are instant for 3 consecutive quarters 💥

Speed is fundamental to the excellent customer experience that we aim to deliver, and for the third consecutive quarter more than 50% of our cross-border payments were completed instantly. In fact, over 90% were completed within 24 hours. We saw improvements in speed in a number of countries, including Mexico, Brazil and the US.

Ongoing product evolution; enhanced convenience 💙

We’ve continued to make it more convenient for our customers to move and manage money internationally. In the quarter, we:

- launched ‘Interest’ within our Assets product for UK customers;

- launched a pilot programme in the UK for business customers to earn 1% cashback on Wise debit card transactions;

- launched a pilot programme in the EEA for cashback on balances;

- removed fees on domestic transfers in EUR, GBP, SGD and HUF;

- rolled out physical cards for businesses in the US, previously only digital cards were available;

- improved pay-ins for businesses – where they can now get paid directly through Wise by sharing 'payment request' links and can now pay requested links directly from a Wise balance; and

- expanded our Platform partnerships, welcoming AvidXchange, ZA Bank and Wio.

More detail on our mission highlights for the quarter can be found on our website, including our mission roadmap, which sets out future product improvements we have planned.

Growth and Financial highlights

Customers

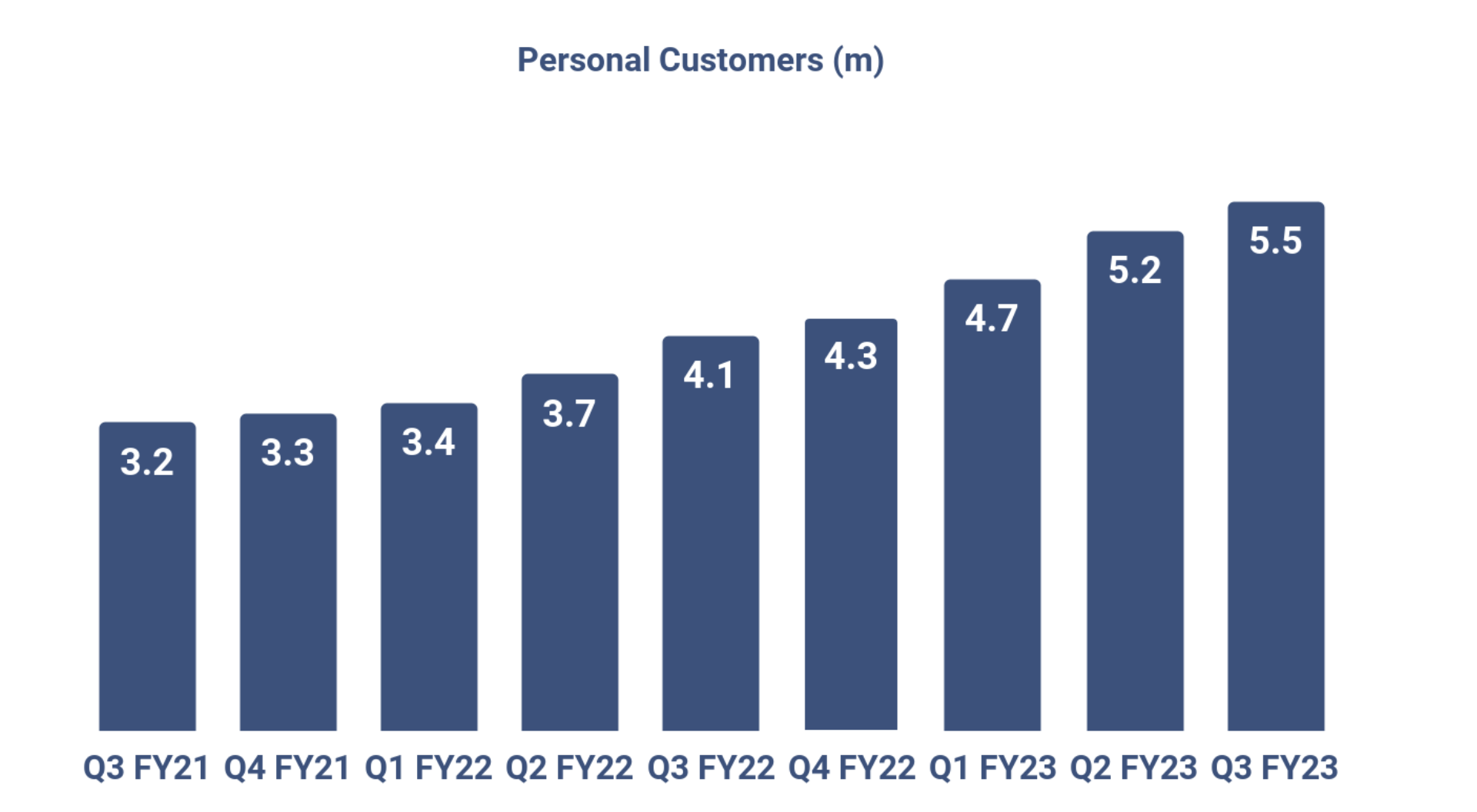

5.5m

34% YoY, 6% QoQ

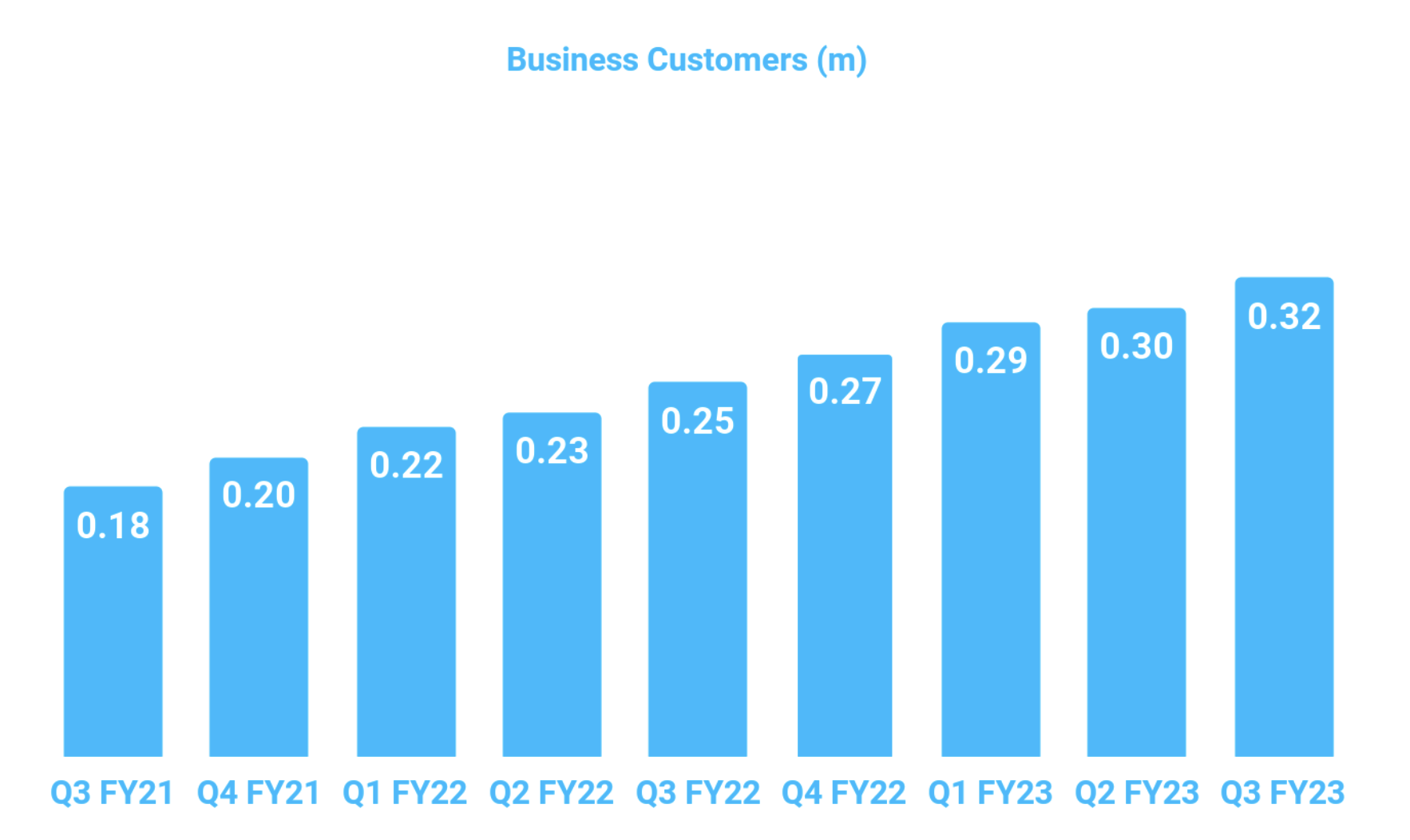

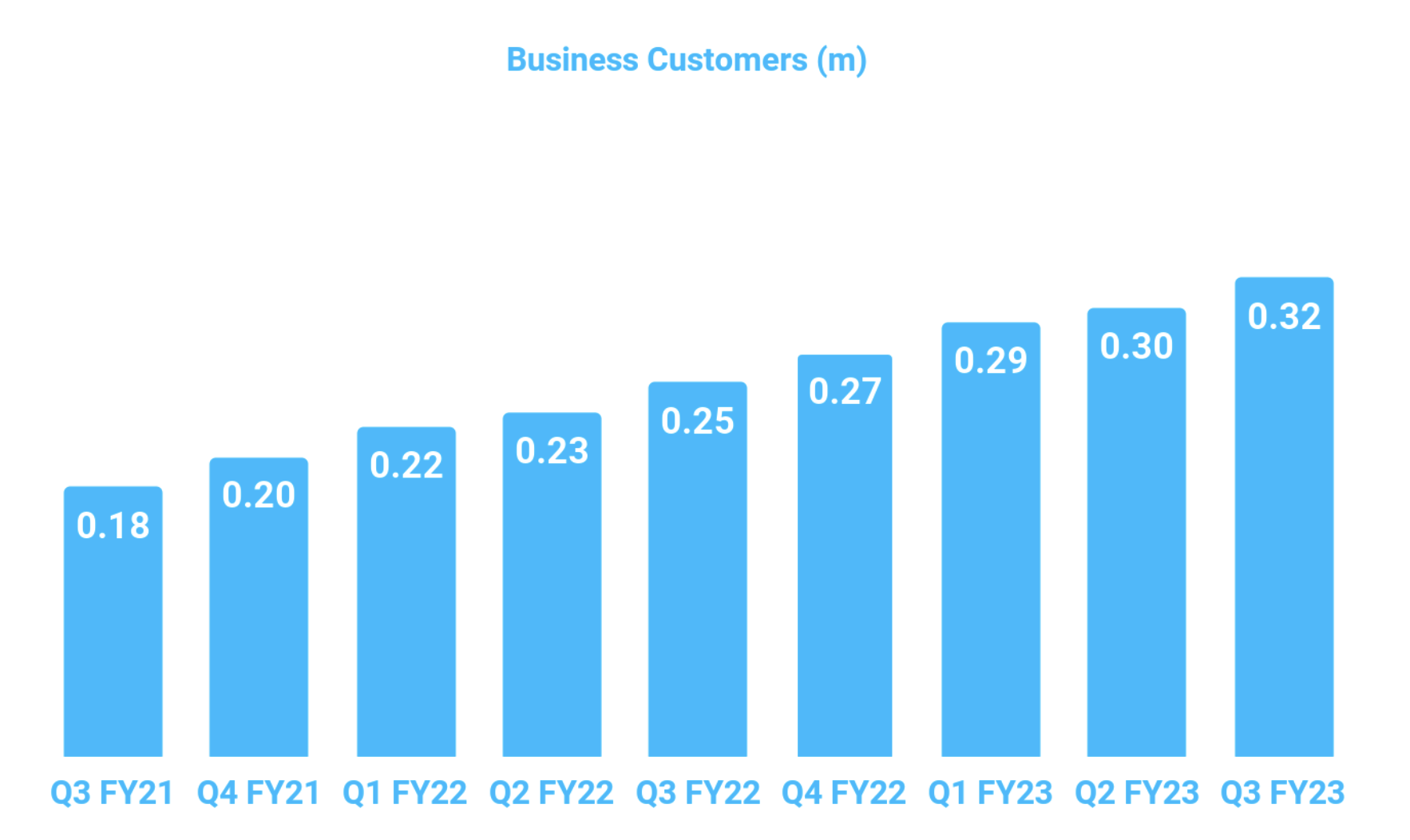

0.32m

26% YoY, 6% QoQ

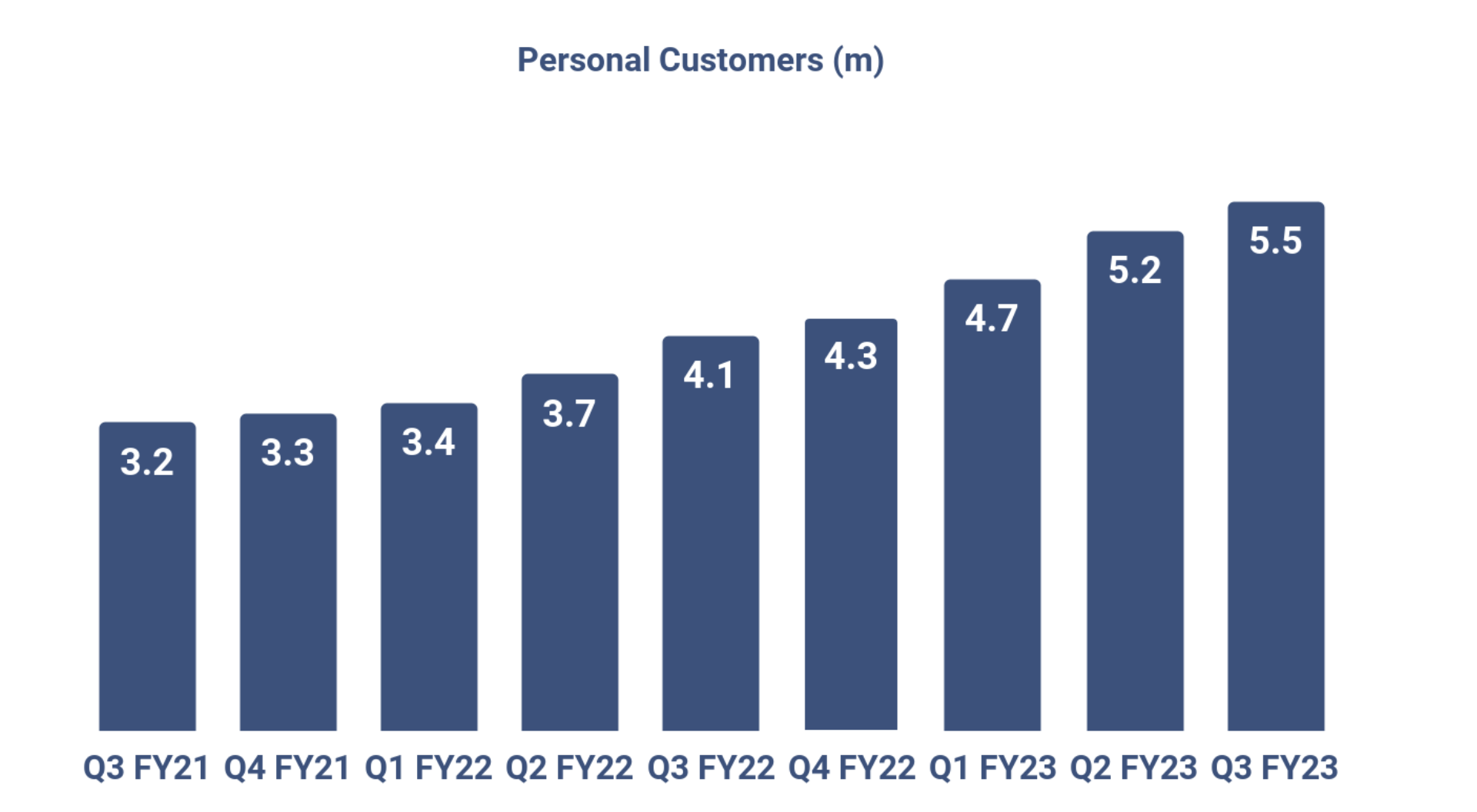

5.8 million customers transacted with Wise in Q3 FY23, an increase of 33% YoY and 6% QoQ, comprising 5.5 million personal (+34% YoY) and 320K business customers (+26% YoY). This increase in active customers continues to be driven by strong new customer growth.

Volume

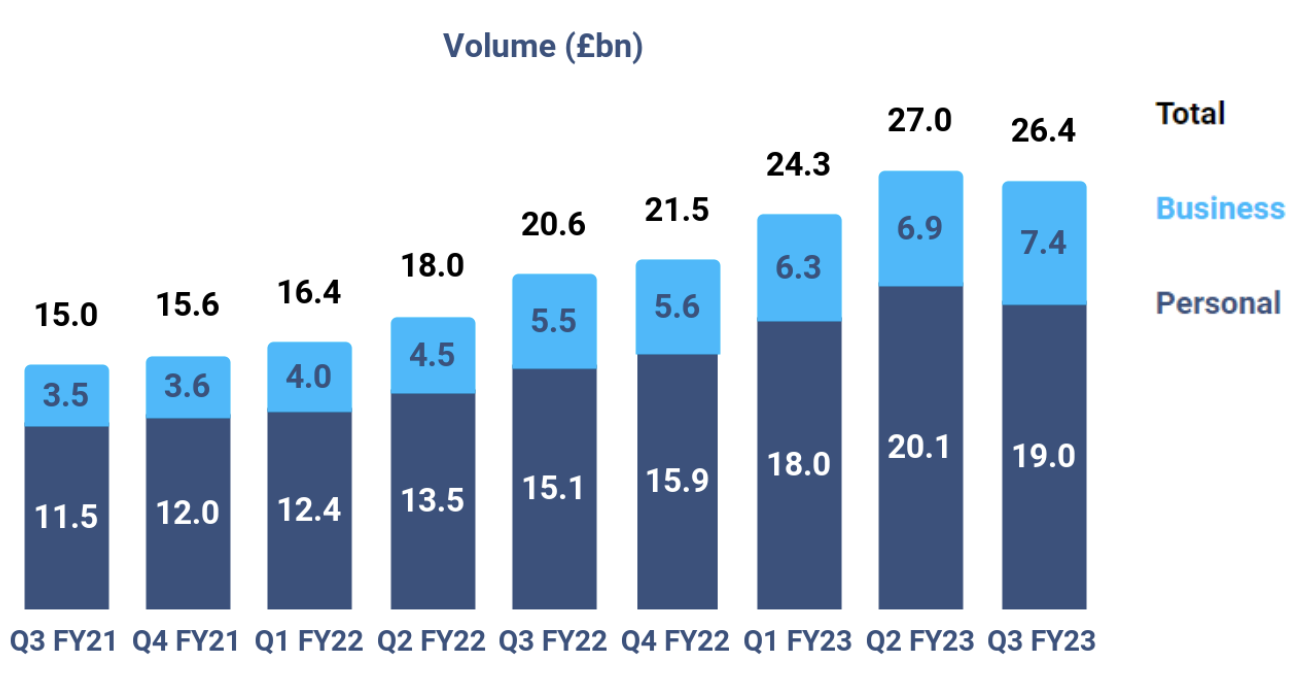

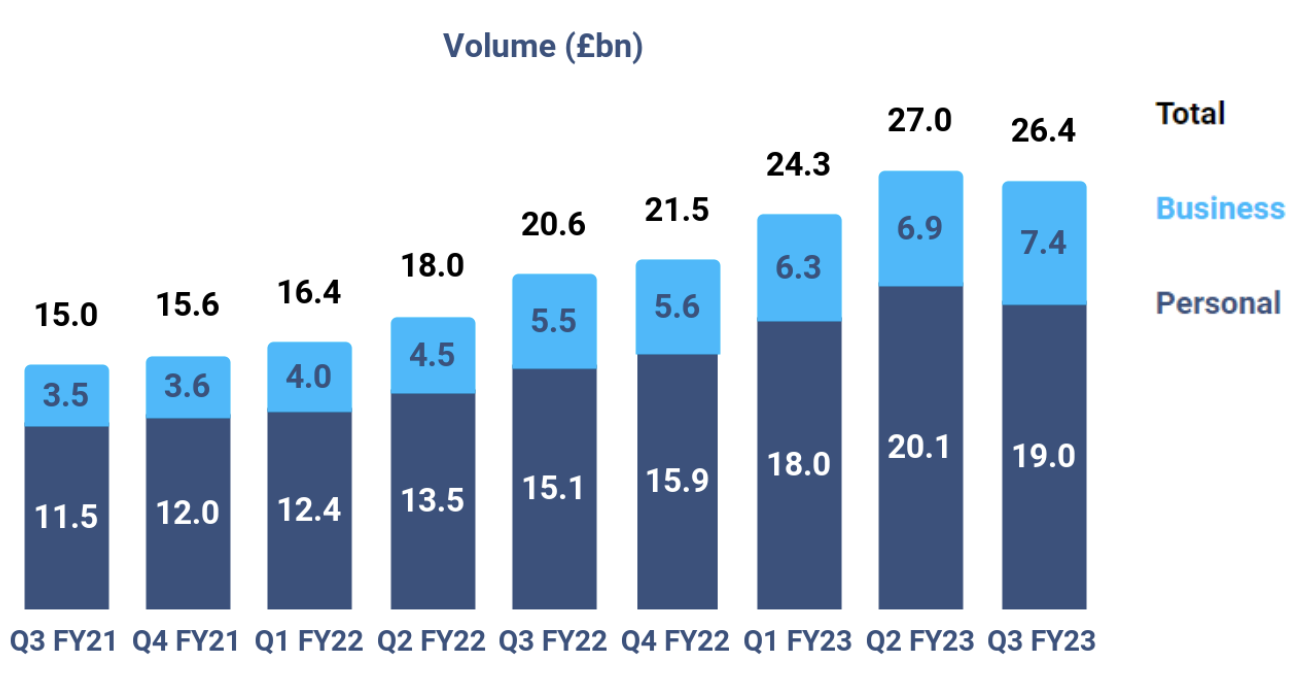

26.4bn

28% YoY, (2%) QoQ

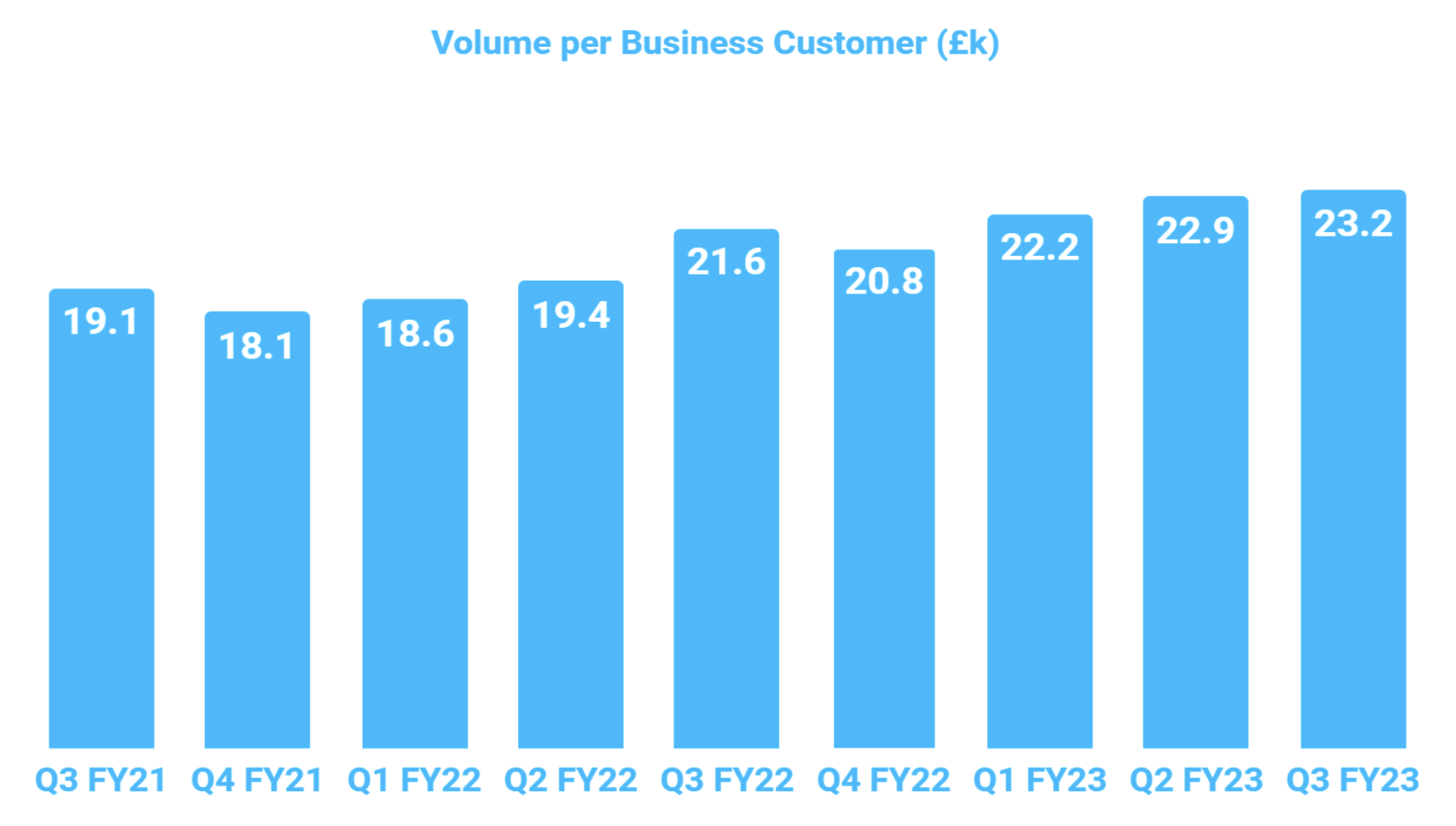

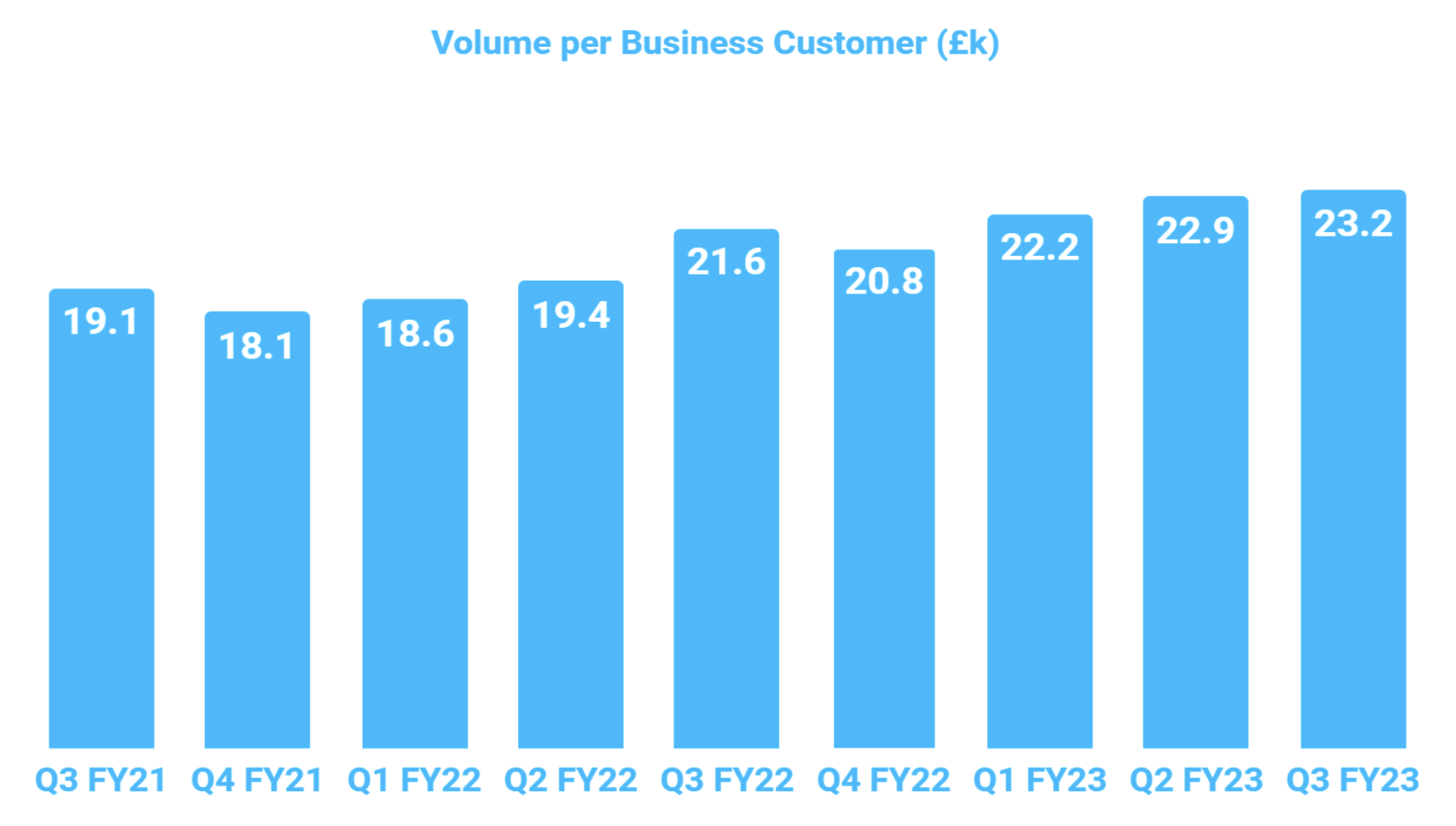

Total cross border volumes were £26.4 billion in Q3 FY23, 28% higher than in the same period last year. Personal customers moved £19.0 billion, a 26% increase compared with last year, reflecting the continued strong growth in active customers. Business volumes of £7.4 billion were 35% higher YoY as we see businesses growing in size and transacting more often with us, leading to a higher VPC. On a constant currency basis, total volumes grew 23% YoY.

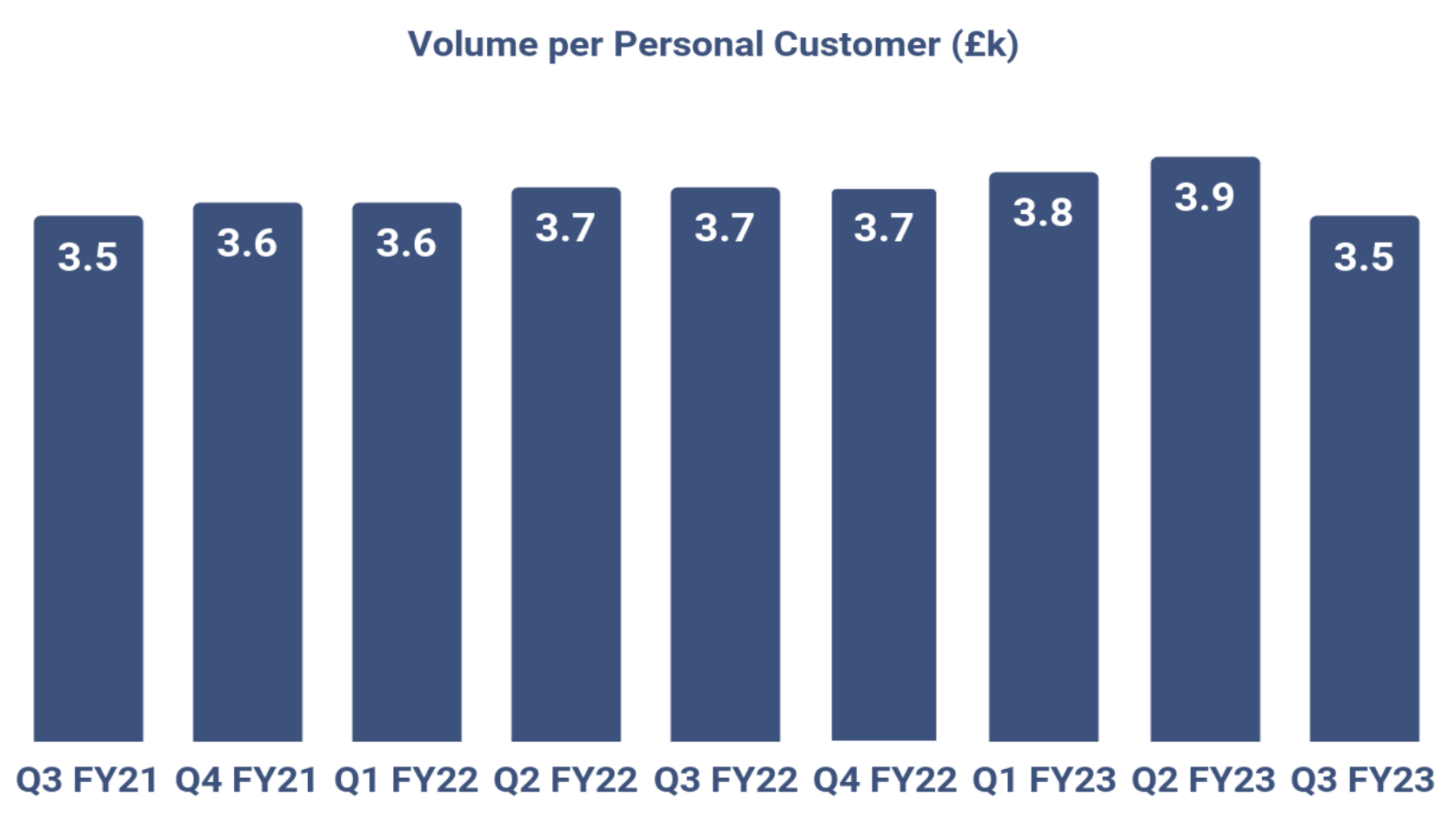

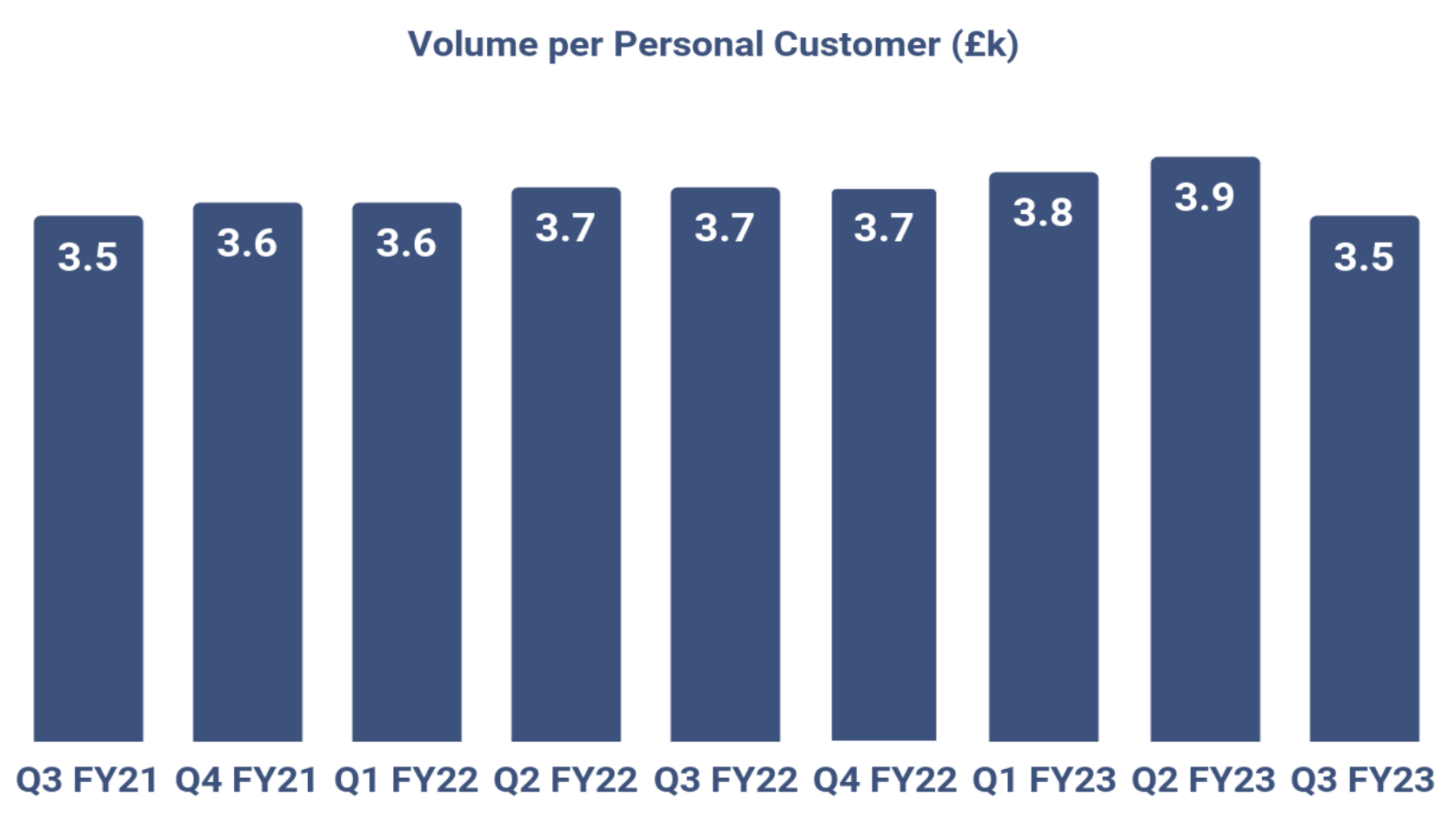

Compared with Q2 FY23, total volumes were 2% lower. Whilst VPC for business customers continued to increase QoQ, personal VPC was down 10%, primarily due to lower levels of activity in the high-volume cohorts of personal customers. This is consistent with the pull-forward we saw in Q1 and Q2 FY23 among these cohorts, which we believe was supported by higher FX volatility and strength in the USD. Volume among the more populous, smaller-volume cohort (<£10k), continues to grow QoQ.

3.5k

(6%) YoY, (10%) QoQ

23.2k

7% YoY, 1% QoQ

Revenue

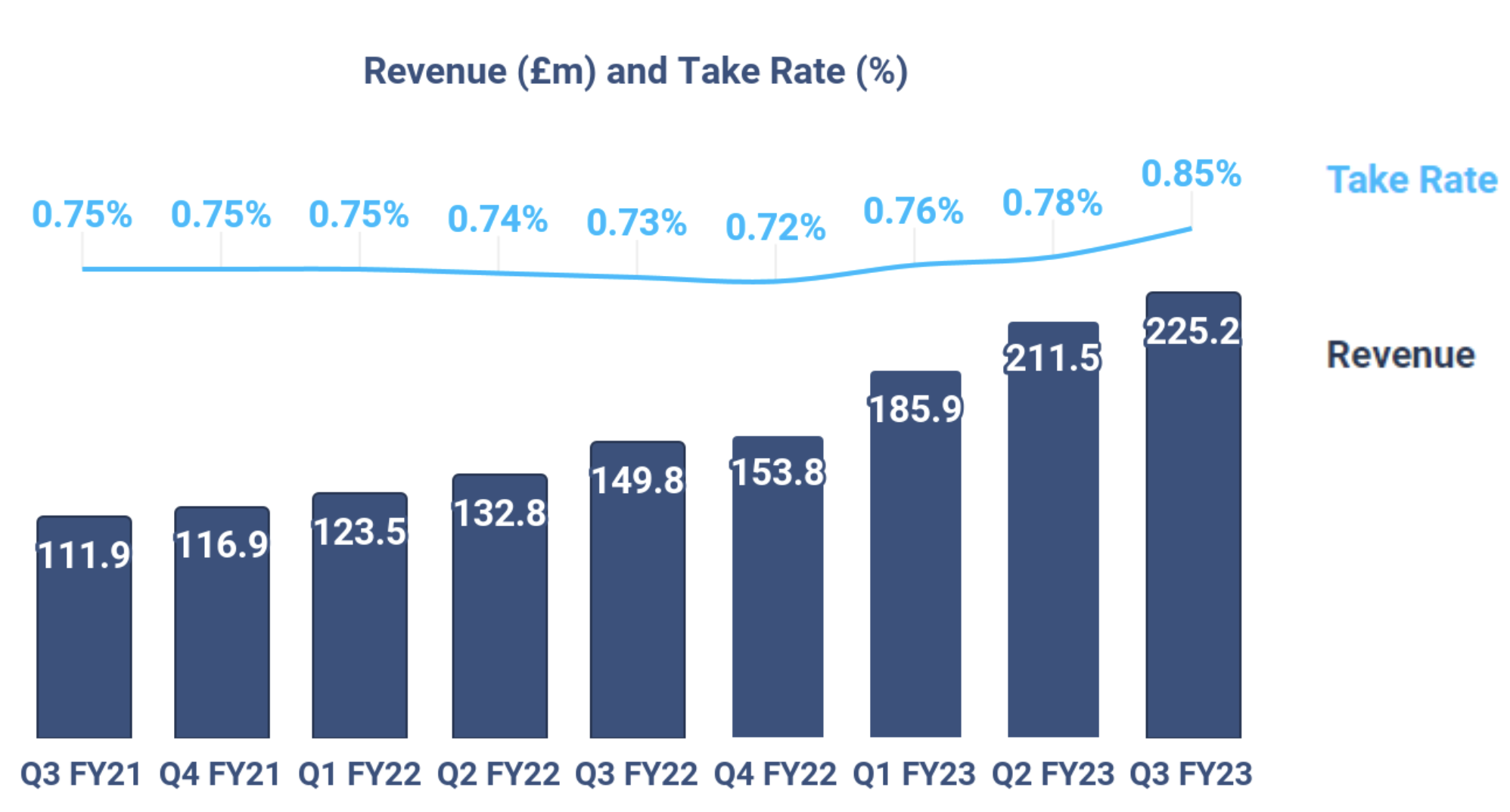

225.2m

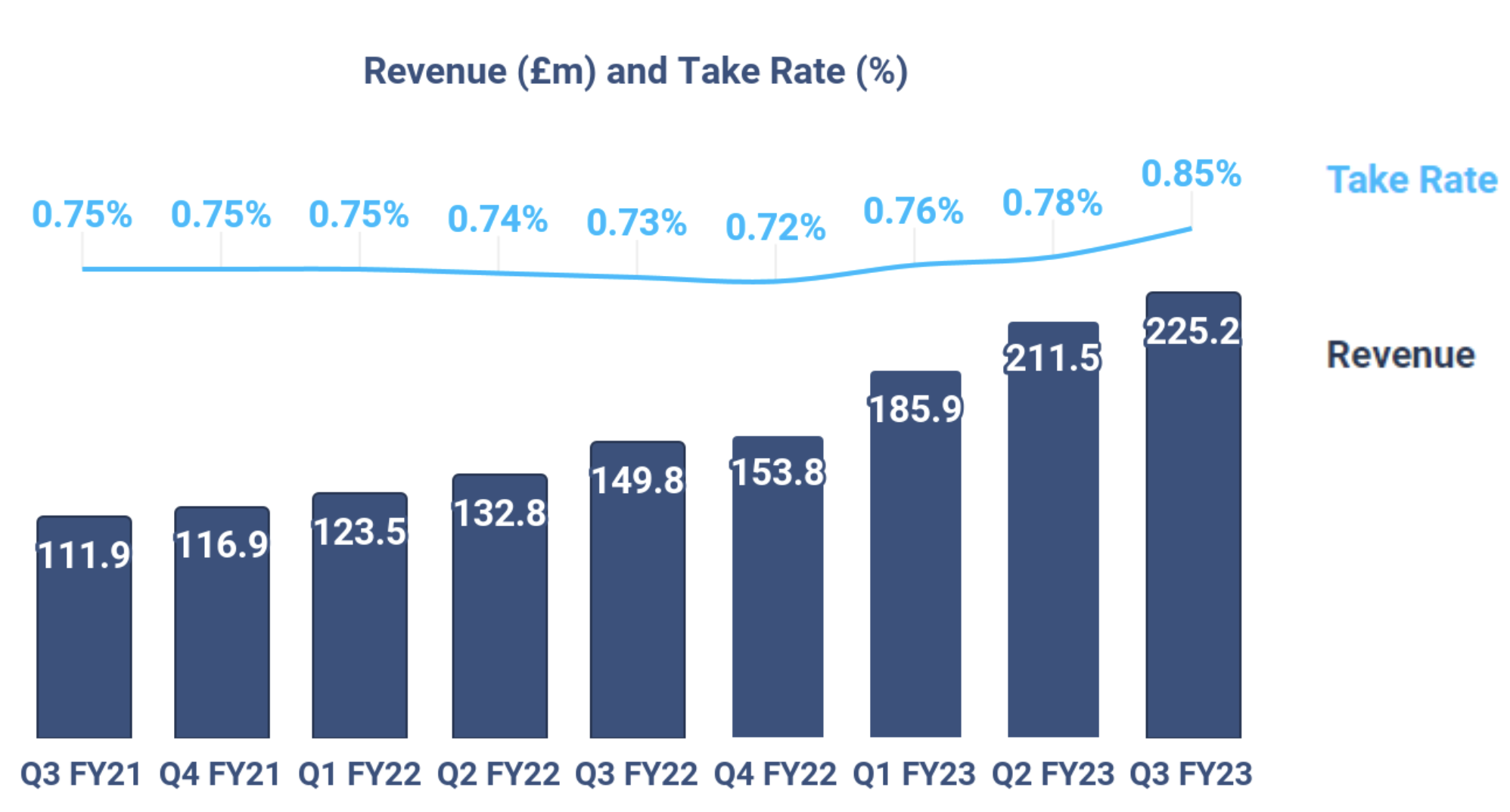

50% YoY, 6% QoQ

Revenue for Q3 FY23 was £225.2 million, up 50% YoY and 6% QoQ. Our take rate increased 7bps QoQ to 0.85% from 0.78% driven by a higher cross-currency take rate, which reflects the full impact of previously announced price increases coming into effect in the quarter, and a change in the overall mix of routes used by customers in the period. Revenue was also supported by higher other revenues, which benefited from greater adoption of the Wise Account, notably in the form of higher debit card spend and interchange fees.

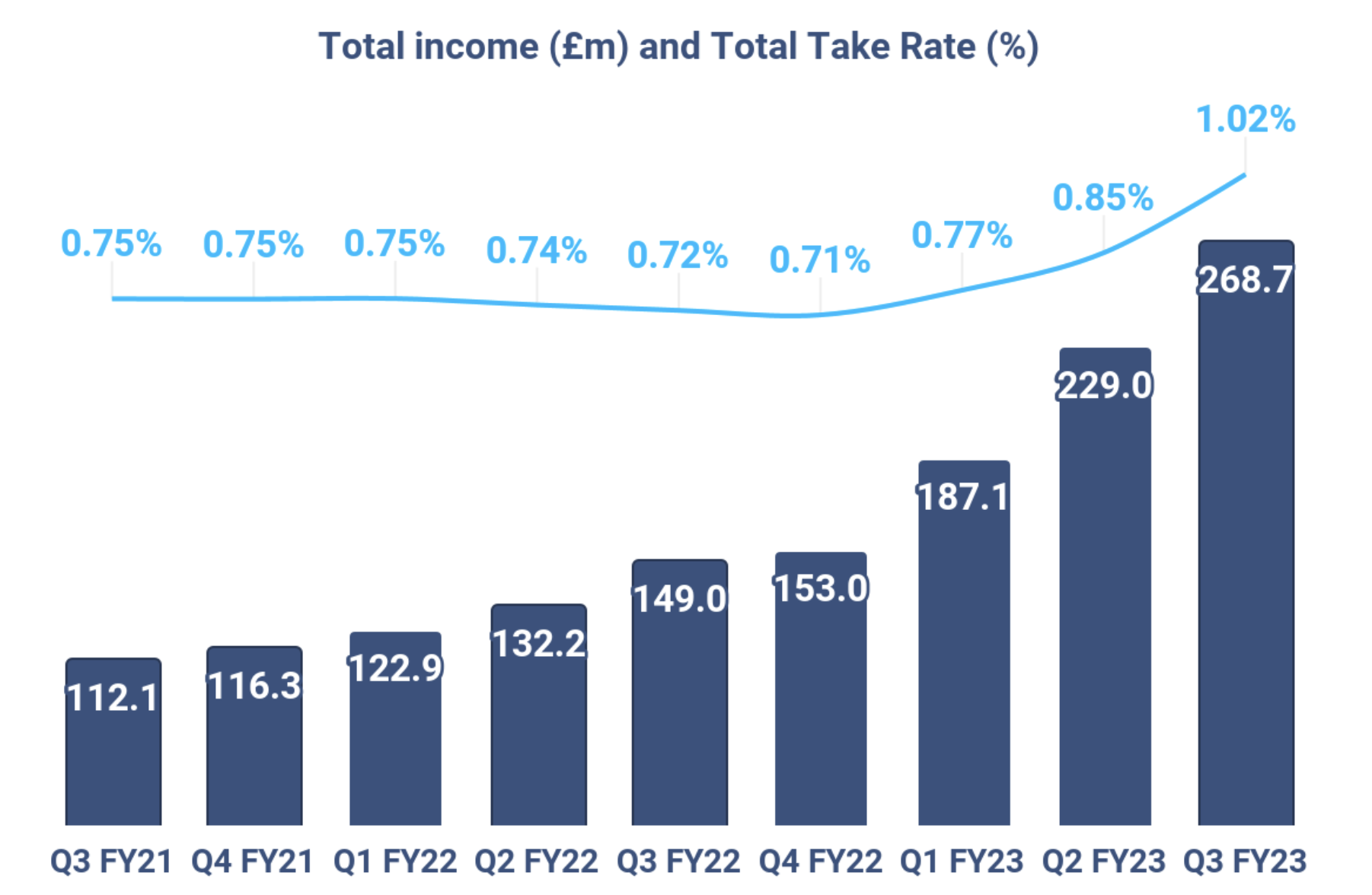

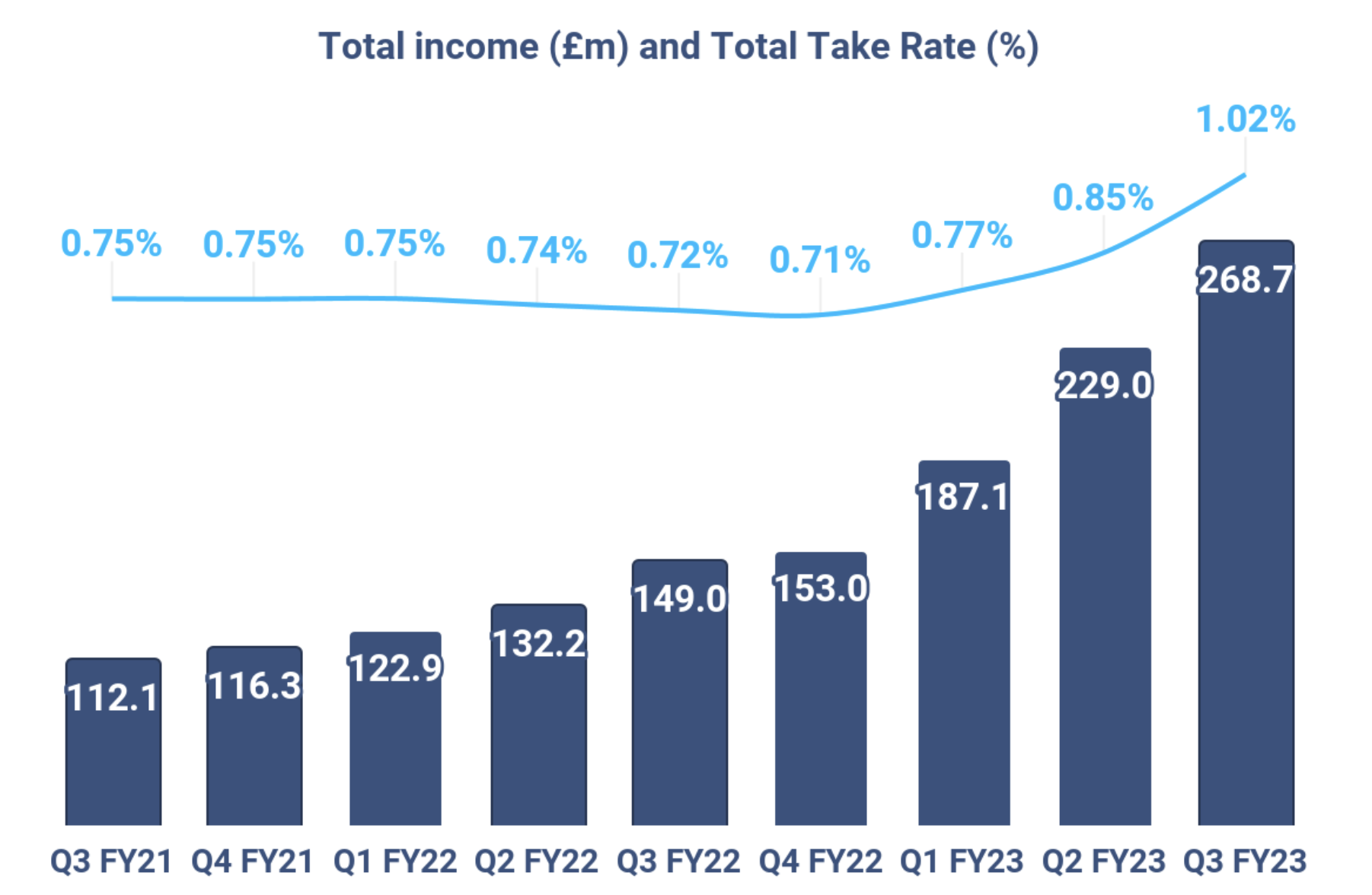

268.7m

80% YoY, 17% QoQ

Total income, inclusive of net interest income, for Q3 FY23 was £268.7 million, an 80% increase on last year and the total income take rate increased 30bps to 1.02%. Net interest income of £43.5 million was 148% higher than in Q2 FY23 due to higher rates on invested assets and continued growth in customer balances. We’ve made good progress in beginning to share this benefit with customers, but there is still work to do to scale up these initiatives in all of our regions, and so until these are fully operational we expect a higher proportion of this net interest income to flow to EBITDA in the short-term.

As a result of the continued growth in revenue this quarter, supported by the increase in net interest income, we are upgrading our FY23 total income guidance and now expect this to grow 68-72%, compared with 55-60% previously. With a higher proportion of the net interest income to flow to EBITDA in the short-term, we expect our adjusted EBITDA margin for the second half of FY23 to be higher than the 22% in the first half of FY23. Our medium-term guidance for total income and adjusted EBITDA margin remains unchanged.

Summary of forward looking guidance:

- Total income growth expected to be between 68-72% in FY23 and greater than 20% (CAGR) over the medium-term

- Adjusted EBITDA margin for H2 FY23 expected to be higher than the 22% margin in H1 FY23

- Adjusted EBITDA margin at or above 20% over the medium-term

Intention to reduce dilution from stock-based compensation

Stock-based compensation forms a core component of how we reward and incentivise Wisers, aligning their interests with those of our shareholders. We have historically issued new shares to satisfy stock-based compensation and this is likely to continue in the near to medium-term.

Wise is profitable and highly cash generative, whilst also making significant investment into future growth. As at 31 December 2022, we had £315 million of eligible group capital, which remains significantly in excess of our regulatory capital requirements.

Given our strong capital position we plan to reduce the impact of dilution from stock-based compensation. The intention is for the Employee Benefit Trust to acquire up to an initial £10 million of Wise shares in the market for this purpose over the remainder of FY23. We will continue to assess our plans beyond FY23.

Enquiries

Martyn Adlam - Head of Owner Relations

martyn.adlam@wise.com

Sana Rahman - Global Head of Communications

press@wise.com

Brunswick Group

Charles Pretzlik / Sarah West / Nick Beswick / Daniel Holgersson

Wise@brunswickgroup.com

+44 (0) 20 7404 5959

About Wise

Wise is a global technology company, building the best way to move money around the world. With Wise Account and Wise Business, people and businesses can hold over 50 currencies, move money between countries and spend money abroad. Large companies and banks use Wise technology too; an entirely new cross-border payments network that will one day power money without borders for everyone, everywhere. However you use the platform, Wise is on a mission to make your life easier and save you money.

Co-founded by Kristo Käärmann and Taavet Hinrikus, Wise launched in 2011 under its original name TransferWise. It is one of the world’s fastest growing tech companies and is listed on the London Stock Exchange under the ticker WISE.

Over 15 million people and businesses use Wise. Today we process on average over £9 billion in cross-border transactions every month, saving customers over £1 billion a year.

FORWARD LOOKING DISCLOSURE DISCLAIMER

This report may include forward-looking statements, which are based on current expectations and projections about future events. These statements may include, without limitation, any statements preceded by, followed by or including words such as “forward looking”, “guidance”, “target”, “believe”, “expect”, “aim”, “intend”, “may”, “anticipate”, “estimate”, “forecast,” “plan”, “project”, “will”, “can have”, “likely”, “should”, “would”, “could” and any other words and terms of similar meaning or the negative thereof. These forward-looking statements are subject to risks, uncertainties and assumptions about Wise and its subsidiaries. In light of these risks, uncertainties and assumptions, the events in the forward-looking statements may not occur.

Past performance cannot be relied upon as a guide to future performance and should not be taken as a representation that trends or activities underlying past performance will continue in the future, and the statements in this report speak only as at the date of this report. No representation or warranty is made or will be made that any forward-looking statement will come to pass and there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements.

Wise expressly disclaims any obligation or undertaking to update, review or revise any forward-looking statements contained in this report and disclaims any obligation to update its view of any risks or uncertainties described herein or to publicly announce the results of any revisions to the forward-looking statements made in this report, whether as a result of new information, future developments or otherwise, except as required by law.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.