Buying art as an investment from overseas (UK buyers guide)

Learn about the risks and the long-term rewards of buying art as an investment and how to use Wise for high value purchases abroad.

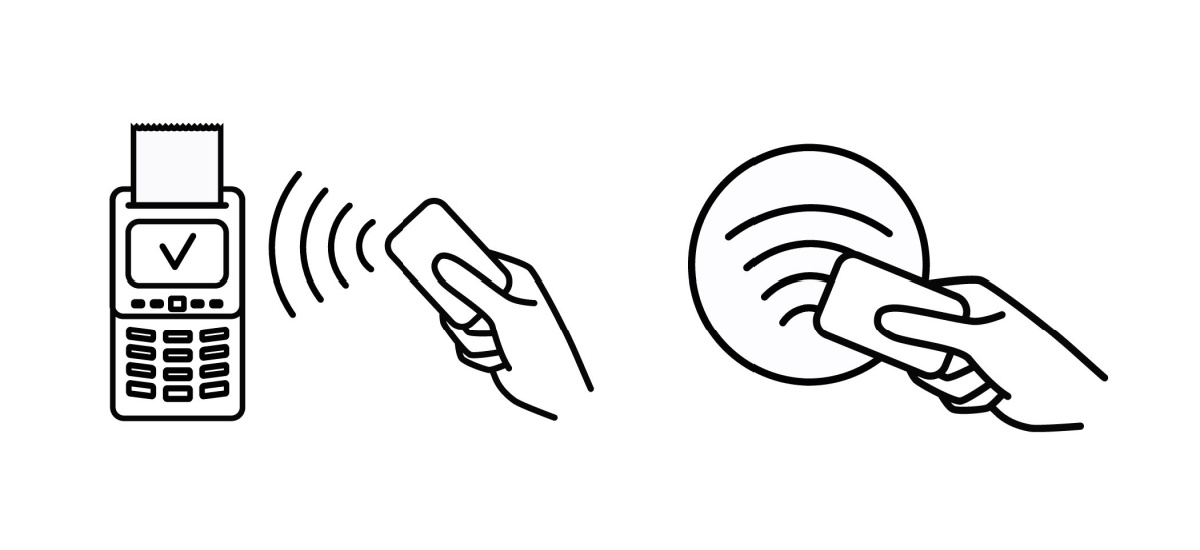

Contactless payments are a lightning-fast, easy way to make payments with your debit card or mobile device in shops, restaurants and many other places.

In this article, you’ll find all the information you need to get started with contactless. Once you tap and pay for the first time, you won’t go back!

We’ll also show you how to use contactless all over the world, with the Wise card linked to your Wise account.

It couldn’t be simpler to make a contactless payment. All you need to do is tap or wave a contactless debit card over a card reader terminal, wait for the beep and the payment will be confirmed.

The terminal looks just like any other card reader used for Chip and PIN payments, except that you’ll see the contactless payment symbol matching that on your card. This indicates the spot where you should tap or wave your card.

The technology behind contactless payments is pretty smart. It makes use of radio frequency identification1 (also known as RFID) to secure a connection between the chip inside your contactless card and the terminal.1

However, the specific technology used to make contactless payments happen is called Near Field Communication (NFC). This is a subset of RFID and only works at very short distances, which is why you need to ‘tap’ your card or mobile device on the terminal.1

When you pay with a mobile device or a physical card, Near Field Communication (NFC) technology is used to create the connection between device and terminal. But how does this work? It’s actually pretty interesting.

The point-of-sale (PoS) terminal in the shop transmits electromagnetic waves to the chip in your card, providing just enough energy to activate the antenna embedded inside it. This generates what is known as a cryptographic token, which essentially gives permission for a single transaction. This is sent back to the terminal, and the authenticity of the token is then verified by Visa or Mastercard’s systems.1

And that’s how a payment is made, and it all happens in just a few seconds.

It’s really simple to tell if your card is contactless. Just look out for a wave-like symbol on it, similar to the symbol used for Wi-Fi. Most debit cards are contactless these days, so it’s likely that you have one.

Ready to embrace contactless? Here’s how to make your first payment:

It’s not just debit and credit cards that can be used to make contactless payments. You can also do it with your phone and other smart devices. Here’s the full list:

Open a Wise account online and you can get yourself a contactless Wise card for a one-off fee of just £7. With this powerful international debit card, the world is your oyster.

You can spend worldwide, just like a local. Tap to spend and the card automatically converts your pounds to the local currency at the mid-market exchange rate. There are no foreign transaction fees, just a small fee to convert the currency.*

Or if you already have it in your Wise account, there’s no fee.*

With Wise, you can also:

You’re up to speed on how contactless cards work, but what about using your mobile device? Yep, you can pay for things just by waving your smartphone or smart watch over a card reader.

All you need is something called a mobile wallet, such as Apple Pay orGoogle Pay. When you use one of these digital wallets, your phone effectively takes the place of a physical debit or credit card.

You simply need to download the app compatible with your smartphone, so Google Pay for Android devices, Apple Pay if you have an iPhone, Samsung Pay for Samsung devices and so on. Once you have the app, you can store your card information within it.

When the time comes to pay for something, you can just tap your phone on a digital payment-enabled terminal. Contactless mobile payments work in just the same way as using a contactless card – instantly, securely and conveniently.

Contactless is hugely popular worldwide, accepted at participating shops, supermarkets, bars and restaurants, as well as public transport hubs, petrol stations, car parks, toll booths and vending machines.

You may even be able to pay for your taxi ride via contactless, depending where in the world you are. Just look for the wave symbol, or ask the vendor if they accept contactless payments.

There is a limit to how much you can spend per contactless transaction. This varies depending where in the world the card was issued, and by which bank or card provider.

For cards issued in the UK (i.e. by Visa or Mastercard), the limit for a single contactless payment is £100.2 If you want to buy or pay for something that costs more than this, you’ll need to use Chip and PIN.

For most debit and credit cards, there’s no daily cap on how many contactless transactions of up to £100 a time you can make.3

However, you may be asked to enter your PIN after you’ve made lots of contactless payments in a 24-hour period. This is a fraud-prevention initiative designed to check that it’s still you making the payments.3

If you’re using your Wise card for contactless payments, there is a monthly limit to the amount you can spend. But don’t worry, it’s pretty generous and should cover all of your spending needs.

You can spend up to £30,000 a month as a UK customer, and withdraw up to £4,000 from an ATM.4

Just like with a normal Chip and PIN transaction, your contactless payment can be declined if you don’t have enough money in the bank to cover the amount.

It may also be declined if you’ve used contactless many times during the same day. This is an anti-fraud measure, one that can cause minor inconvenience but it’s for your own security. All you’ll need to do is enter your PIN and your bank will know it’s you. You can then carry on spending using contactless.

So even if you’re a regular contactless user, make sure you know your PIN - just in case.

Contactless payments are made using secure encryption technology. You also need to be very close to the terminal (within a couple of cm) and have the merchant enter the payment details, so you can’t make an accidental payment by walking past a terminal.

If someone steals your card, they can in theory make limitless contactless transactions of £100 a time. This can be distressing, but fraud protection from your bank should mean that your money is recovered.

What’s more, your bank or card provider will block the card as soon as you report it stolen. If you don’t realise for a little while, the fraudster may still be stopped in their tracks by the intermittent PIN checks on multiple transactions.

Many banks now offer card protection tools in their mobile banking apps. This means you can report a lost or stolen card, and even freeze your card instantly, in just a few taps. If you don’t have access to features like these, simply contact your bank and they’ll block the card instantly.

If you’re worried about security, it could be an idea to get a mobile wallet and add your debit card to it. This allows you to add an extra layer of protection, with PIN, password or biometrics (fingerprint or face recognition) access to your phone.

You could also consider using a virtual card, you can lock it after every purchase for an additional layer of security when paying. Why not check out the Wise virtual card? It’s the same Wise card, but in digital form!

Learn more about the Wise card 💳

And that’s it - your essential guide to contactless payments.

Remember that if you’re going abroad, the contactless Wise card really is a travel essential. It lets you conveniently pay in any currency for great exchange rates and at low fees*.

Sources used for this article:

Sources checked on 17-04-2024. >/small>

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the risks and the long-term rewards of buying art as an investment and how to use Wise for high value purchases abroad.

Got a speeding ticket in the post after your trip abroad? Learn how to pay a Spanish speeding fine from the UK and why Wise is a great solution.

Need to change your payment method on DAZN or fix failed charges? Find out how and to explore how paying with Wise can help you reduce costs.

Need to to manage your Amazon Prime subscription? Learn how change the payment method and save on conversion fees by paying your bills with Wise

Need to change your Spotify payment method? Learn how to update payments, fix failed charges and save on currency conversion fees with Wise.

Read our helpful guide to SIPPs for non-UK residents, covering everything you need to know about Self-Invested Personal Pensions for UK expats.