Welcome to our first half year results blog post as a listed business where we are excited to go through our mission and financial highlights for the six months ended 30 September 2021.

Kristo Käärmann, our CEO and co-founder, said: “We started Wise 10 years ago with the mission to make international banking faster, easier, cheaper and more transparent for everyone, everywhere. We’ve come a long way since then, including some significant strides forward in the last six months: we lowered costs and dropped prices (even faster than expected!), our payments got faster, we developed more features for businesses, initiated more platform partnerships and we launched our exciting new ‘Assets’ feature for customers in the UK.”

Mission Highlights

Money without borders; enabling everyone to move their money across the world - instantly, transparently, conveniently and eventually for free.

We lowered fees for 2.4 million of our customers.

Improving our infrastructure allows us to lower our unit costs, letting us charge substantially less than leading traditional banks and consistently below many payment companies. We proudly charge our customers a transparent fee for each of our services, without cross-subsidising between customers, products or routes. We calculate the precise costs of our offering, and we charge the customer that amount plus a margin which we reinvest in the business. When our costs go down, we aim to lower our prices as soon as possible. We do this because we can, because it’s fair, but also because we believe that over time this approach will ensure we create the lowest cost way to move money around the world.

In the most recent quarter, this average price was just 0.62%, a reduction of 7 basis points as compared to the average prices in Q4 FY21. This is a substantial reduction for millions of customers, with an exceptional 5 basis points coming in the most recent quarter. This reflects the amazing work from the team to reduce costs and our commitment to invest in sustainably lower prices.

Our speeds are faster than ever.

We’re continuously increasing the speed of our transfers as we develop our infrastructure, and in the most recent quarter 40% of our transfers were instant, 58% were delivered in under one hour, and 86% arrived in under 24 hours. We’re able to estimate the time of delivery with an accuracy of nearly 80% which our customers value as important information. This compares to the two to five business days, on average, it takes a traditional bank to complete an international transfer with a high level of uncertainty on the exact time-frame for delivery.

We expanded our coverage, including launching in India.

Our coverage took an important step forward in the period as we launched in India, allowing Indian residents to send money to 40+ countries at the real exchange rate, with lower and more transparent fees. We then went on to make sending money to India a lot faster and more convenient. With the rollout of payouts via Unified Payments Interface (UPI), Wise customers can also send money to India instantly, and without needing to know their recipient’s bank details.

Managing money with the Wise Account just got better with the launch of Assets.

Our Wise Account enables our personal and business customers to send, receive, hold, convert, and spend money in a growing number of currencies, all in one place with only a few taps or clicks.

In the past six months we made the Account even more useful: UK customers can now invest with the UK launch of Assets. Assets give customers a potential return on their balance held with Wise by holding it in an index fund, while still being able to spend and send in an instant as though it were held as cash. We’re also very pleased to be announcing today the launch of cards in Canada.

We are building the world’s most international account for businesses.

Our Wise Business proposition improved in the period with the launch of a number of new features, including the ability to attach receipts and notes to card transactions; and enhanced controls such as the ability for an account holder to delegate tasks, payment approvals and assign spending limits to accountants and team members.

We are integrating the magic of Wise into banks and enterprises.

Additionally, we have made further progress in serving customers through our platform partners. Wise Platform allows many more people and businesses to conveniently access Wise’s cheap, fast and transparent international money transfers. Over the last six months we are delighted to have announced partnerships with Google Pay, Sable, Shinhan Bank, Temenos and Thought Machine, while enhancing the service provided with existing partners, most notably with Monzo and OnJuno. It’s still early days but we’re excited to help these Partners and their customers with their cross-border needs.

Our key product pillars drive high advocacy leading to more customers and greater scale.

We’ve been investing in our infrastructure for a long time, and there is still a lot more to build. But it seems to be working. Our most recent Net Promoter Score was 75, Wise is rated 4.6/5 on TrustPilot with over 135,000 reviews and scores 4.7 out of 5 on the Apple App Store. This helps drive our growth in customers, as approximately 68% of new customers came through “word-of-mouth”. In the last six months customers moved £34 billion through our platform, which represents a 44% growth over the same period last year.

But there are still many trillions moved outside of our platform, largely through the world’s banks. So we have a long way to go to help these customers and achieve our Mission. Onwards.

Growth and Financial Highlights

The number of Personal and Business customers continues to drive growth.

In the second quarter of FY22, 3.7 million personal customers and 230 thousand business customers used Wise Transfer and Wise Account to move and manage money across borders. This was an increase of 22% in the number of personal customers and 44% in the number of business customers as compared to the same period last year which were 3.0 million and 160 thousand respectively.

Across the first six months of the year, we processed £34.4 billion in cross-border payments (£23.9 billion in H1 FY21) which was a 44% increase as compared to the same period last year. Our personal customer and business customer volumes grew by 39% and 61% to £25.9 billion and £8.5 billion respectively.

The volume growth was faster than the growth seen in the number of customers, driven by the average volume per customer. This was significantly lower in the first quarter of last year due to the impact of the COVID-19 pandemic on customer demand for international payments, but quickly rebounded in the second quarter of prior year.

Furthermore, businesses typically send larger volumes compared to personal customers, and, as they represent a growing proportion of the total number of customers, the average volume per customer for the Group is gradually increasing and in the second quarter it stood at its highest point to date of £4.6 thousand.

Revenue grew 33% year-over-year to £256 million.

In the first six months of FY22 we generated £256.3 million in revenue, a 33% increase versus £192.2 million in the same period last year. Revenue is largely a function of the volume our customers move and the prices we charge them.

Our cross-currency take rate reduced by 9bps to 0.65% in the first six months of FY22 as compared to 0.74% in the same period in the prior year. This was primarily as a result of the price drops mentioned above, however, the comparison to the prior period is also impacted by route mix volatility at the onset of the pandemic where we saw more volume being moved on higher priced routes. The reductions in price were enabled by reduced unit costs from more favourable terms with our banking partners and lower FX costs. With price reductions being funded in this way we are able to grow the business and strengthen our market position while generating the same level of gross profit to reinvest into our future.

The total take rate reduced by 6bps to 0.75% in H1 FY22 as compared to 0.81% in the same period in FY21, and is in line with the 0.75% in H2 FY21. This was less than the decline in the cross-currency take rate due to the growth in other fees which now represent 13% of our revenue for the period. The popularity of the Wise account has seen growth in other fees such as interchange fees on the account’s debit card and fees on domestic transfers.

We’ve worked hard to scale our costs of sales.

We produced £173.8 million of gross profit, a 46% increase as compared to £119.2 million in the same period last year and equivalent to a 68% gross margin (H1 FY21: 62%). This was due to cost of sales only increasing by 13% to £81.2 million from £71.8 million in H1 FY21.

Increase in cost of sales is less than the increase in volumes over the same period due to the aforementioned reductions in unit costs we passed on to our customers. This growth in Gross Profit, which is in line with our growth in volume, demonstrates that reductions in price can be made whilst sustaining our ability to invest.

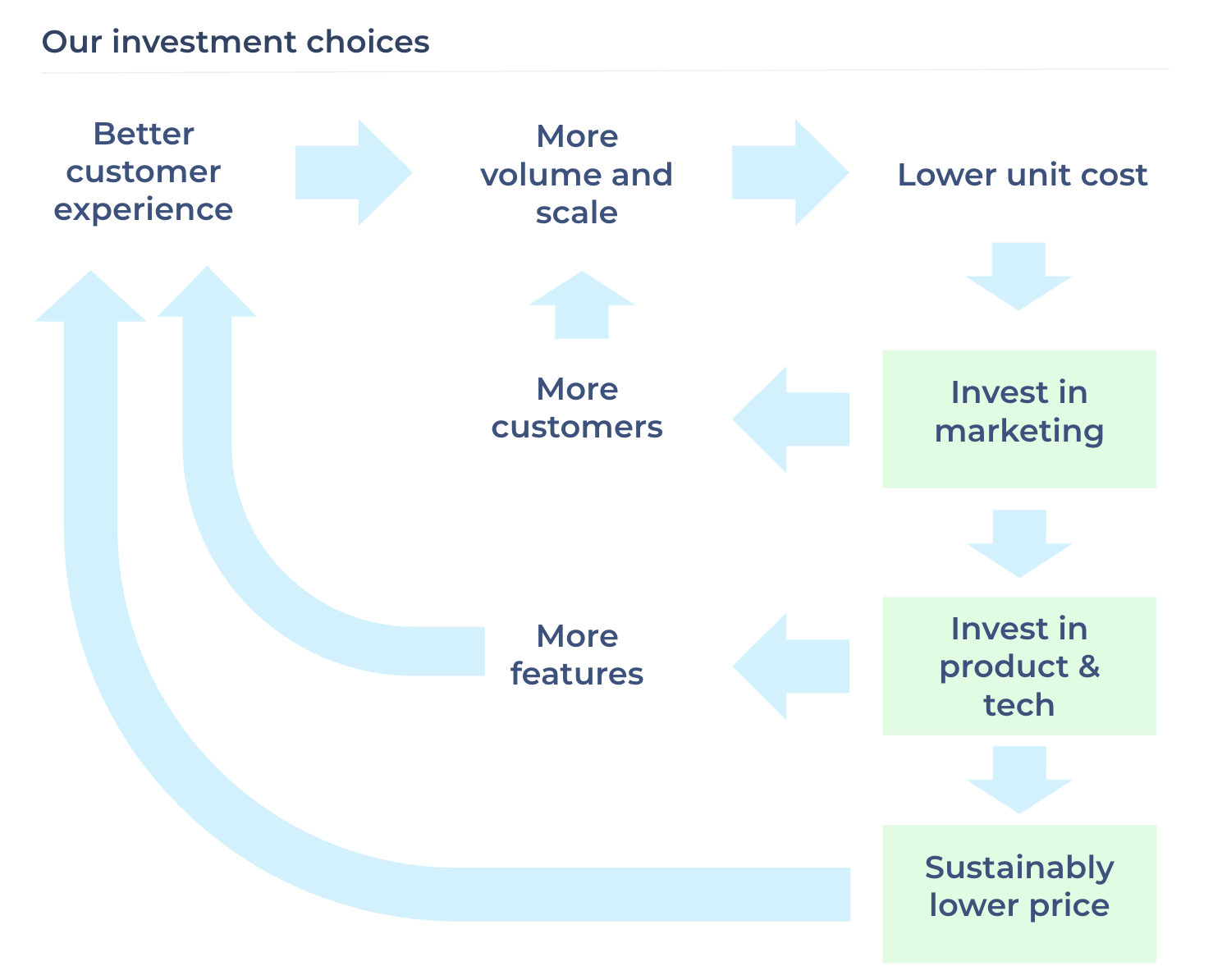

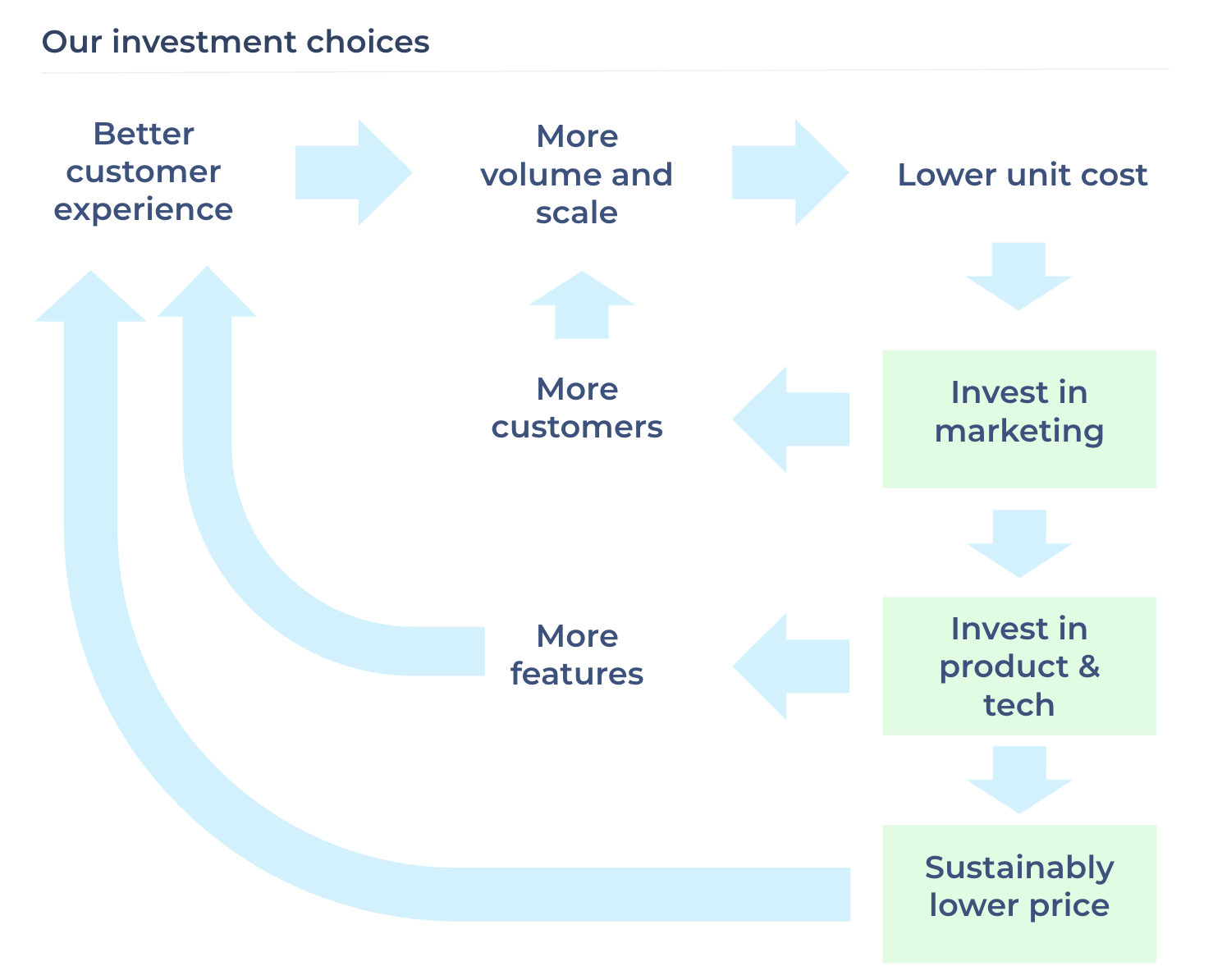

We invested our margin for the long term.

We have three primary areas of investment focus: marketing, our product and sustainably lowering prices; all of which we believe in the long term drive more volume and more scale. This means we get to a lower unit cost and even more capacity to invest. This is how we create sustainable shareholder value.

Administrative expenses increased 56% to £152.2 million in the first six months of FY22 (H1 FY21: £97.6 million) which is primarily due to increase in employee costs and outsourced services and other administrative costs.

Employee costs increased £17.1 million or 25% to £84.8 million in the first six months of FY22 (H1 FY21: £67.7 million) as we continue to invest in our team to support further growth. We have expanded the size of the team by 688 people or 32% over the last year, with 2,883 Wisers working to deliver our mission at the end of H1 FY22.

Outsourced services and other administrative costs grew 101% to £58.3 million as compared to £29 million in H1 FY21. This increase was primarily due to additional costs incurred as part of becoming a public company, additional IT and marketing investments, as well as other costs relating to travel and events returning post-pandemic.

Capitalisation in the first six months reduced versus the same prior last year by 74% to £2.5 million (£9.6 million in H1 FY21). We expect our capitalisation to remain broadly at this lower level going forward. This change does not impact our cash flows and we continue to expand and invest in our engineering team.

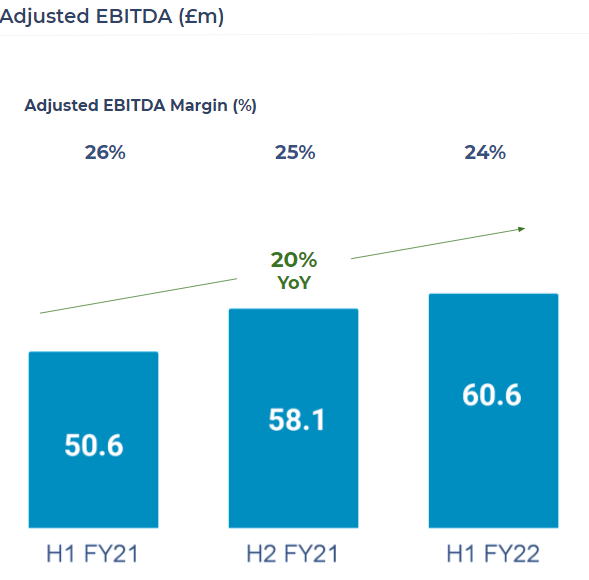

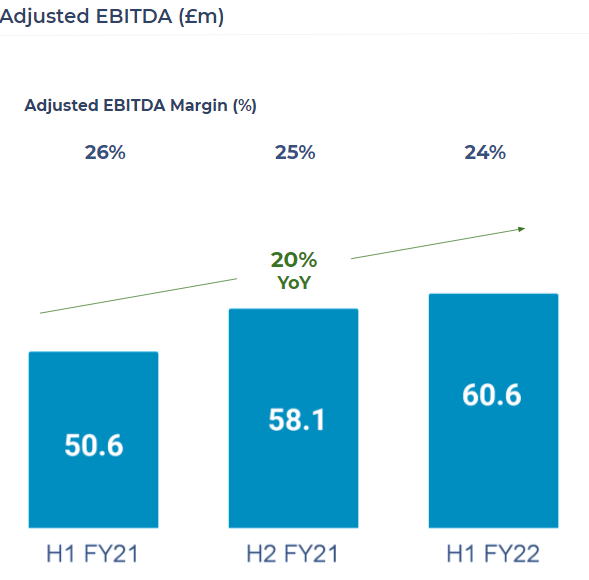

Our Adjusted EBITDA margin was 24% for the period (H1 FY21: 26%) which corresponds to £60.6 million of Adjusted EBITDA (H1 FY21: £50.6 million) and a 20% increase over the prior year which reflects our commitment to investment in future growth whilst maintaining sustainability in our approach.

In the first six months of FY22 our profit before tax was £18.8 million compared to £20.0 million in the same period last year. This level of profit was slightly lower than the previous year as we continue to reinvest the majority of the additional gross profit delivered in the period while also incurring exceptional costs in the completion of our direct listing.

We are highly cash generating, liquid and well capitalised.

Free cash flow increased 39% over the prior year to £59.0 million (H1 FY21: £42.3 million) giving a free cash flow conversion ratio of 97% relative to Adjusted EBITDA (H1 FY21: 84%). This year-on-year increase in free cash flow reflects the underlying growth in Adjusted EBITDA.

As at 30 September 2021 we held £5.4 billion of cash and highly-liquid investment grade assets, up 32% from the end of FY21 (£4.1 billion). The majority of these assets are used to cover the £4.9 billion of Wise account customer deposits (£3.7 billion at the end of FY21), which we keep safeguarded and readily available. We also hold £344.6 million of Wise’s “own cash”, which is increasing thanks to the cash generating qualities of the business we’ve built.

We are well capitalised for the future and as at 30 September 2021, our group eligible capital of £230.7m is significantly above the minimum requirements set by our regulators around the world. We expect Wise to be subject to the new capital regime for investment firms in the UK known as Investment Firm Prudential Regime (IFPR). This will become effective from 1 January 2022 prospectively. Wise is well in excess of the upcoming new requirement and we do not expect any impact to our capital management policy in the near term as a result of this change.

An update to our financial outlook.

Based on our progress and on our current outlook for both volumes and price drops in the second half of the year, we now expect annual revenue growth for FY22 to be mid-to-high 20s on a percentage basis.

As previously guided, our strategy of reducing costs first and then lowering our prices means that the take rate is expected to be slightly lower in the second half of FY22 compared to the first half. Our expectation for the gross margin for FY22 also remains unchanged at c.65-67%, subject to foreign exchange-related costs continuing to remain broadly stable.

Our growth is increasing our ability to invest for the long term.

In summary, our growth has been fuelled by building products and features that customers love and recommend. We re-invest our margins into improving our product and customer experience, marketing to help spread the word, and sustainably lowering prices. Our focus on our mission will not change as we continue to grow and scale, and neither will our focus on building a strong, sustainable and cash-generating business that is best placed to address the evolving needs of our customers and, in so doing, deliver shareholder value.

We’re on a mission that will take a long time. It’ll take investment, patience and commitment to our strategy. There are still many trillions moved outside of our platform, largely through the world’s banks. So we have a long way to go to help these customers and achieve our Mission, but it’s working. Onwards.

Enquiries

Martin Adams - Head of Owner Relations

martin.adams@wise.com

Abigail Daniels - Global Head of Public Relations

press@wise.com

Brunswick Group

Charles Pretzlik / Sarah West / Samantha Chiene

Wise@brunswickgroup.com

+44 (0) 20 7404 5959

FORWARD LOOKING DISCLOSURE DISCLAIMER

This report may include forward-looking statements, which are based on current expectations and projections about future events. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target”, “believe”, “expect”, “aim”, “intend”, “may”, “anticipate”, “estimate”, “plan”, “project”, “will”, “can have”, “likely”, “should”, “would”, “could” and any other words and terms of similar meaning or the negative thereof. These forward-looking statements are subject to risks, uncertainties and assumptions about Wise and its subsidiaries. In light of these risks, uncertainties and assumptions, the events in the forward-looking statements may not occur. Past performance cannot be relied upon as a guide to future performance and should not be taken as a representation that trends or activities underlying past performance will continue in the future. No representation or warranty is made or will be made that any forward-looking statement will come to pass. The forward-looking statements in this report speak only as at the date of this report.

Wise expressly disclaims any obligation or undertaking to update, review or revise any forward-looking statements contained in this report and disclaims any obligation to update its view of any risks or uncertainties described herein or to publicly announce the results of any revisions to the forward-looking statements made in this report, whether as a result of new information, future developments or otherwise, except as required by law.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.