Calendly pricing and plans guide for the UK (2025)

Explore calendly pricing to simplify your operations and enhance your processes.

Providing quick and easy ways for customers to pay you is fundamental to business success — especially if you’re expanding operations overseas.

But while it sounds simple, the reality of ensuring funds arrive in your account when you need them can be complicated. To help, we’ve put together the top 3 ways you can use your Wise Business account to get paid in multiple currencies, wherever your customers are in the world.

Receiving money from customers around the world has historically been a complicated and expensive process, with in-person account opening requiring plenty of time and the correct paperwork for the country you’re operating in.

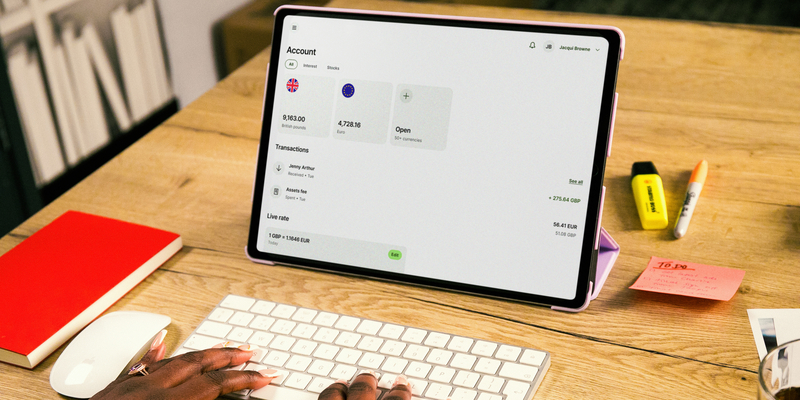

With Wise Business, you can set up local account details and start receiving money, including high value transfers from around the world in 9+ major currencies including USD, GBP, EUR and more.

You can invoice customers and clients using your account details and get paid just like a local, with customers able to pay you in the currency of their choice. For added convenience, you can receive payments quickly, with 52%* of Wise payments arriving in under 20 seconds, so you manage cash flow on the go.

You’ll also be notified in your Wise app as soon as the money lands in your account, ready to use to cover business expenses or pay employees, contractors or suppliers overseas. Thanks to your multi-currency account, you’ll also be able to use your account to convert your money into 40+ other currencies at the mid-market rate and without hidden fees.

Digital payments are now business as usual, so at Wise we’re constantly working on new ways to help you get paid quickly, affordably, and seamlessly. With Wise Business, you can now send a simple link to request payments from customers via bank transfer. All you need to use this feature is to have account details set up to receive into. To generate a payment request link, simply go to the balance you want to be paid into, click the green ‘Receive’ button at the top of your screen, then ‘Request a payment’. Or, under ‘Manage’ go to ‘Payment requests’ then click ‘Request a payment’. Then add your link to an email, invoice or message and hit send.

And that’s not all. We can now automatically detect if you are requesting payment from a Wise customer and give them the option to immediately pay from their Wise account using our fast money transfer service, in 40+ currencies. You can also get a QR code for your customer to scan and pay you — straight to your Wise account.

Plus, we’re in the process of rolling out payment requests by card, giving customers the choice to pay using their credit or debit card. Right now, only certain businesses in the UK and EU are eligible for this feature, but it’s set to be available to all customers by August 2023. You’ll receive an email when they’re able to start using it. Watch this space!

If you’re in the business of e-commerce, or sell online via global platforms such as Amazon, Shopify, Etsy or Upwork, you can now withdraw earnings in multiple currencies directly into your Wise Business account.

By linking these platforms to your Wise Business account, you can choose the currency you want to get paid in and sidestep the hidden currency conversion fees charged by banks and other payment service providers.

If you sell on multiple marketplaces you can also withdraw all your funds into Wise Business and manage your money in one account. To link your account simply open account details in the currency you want to get paid in, then add your account details to the platform you’re selling on and receive the money into your Wise Business account.

Wise is also participating in Amazon’s Payment Service Provider programme, so you can have peace of mind when receiving payments from Amazon Seller Central. The way you use Wise to receive payments from Amazon will not change and you can use your Wise account details to receive payments like a local.

Wise Business is trusted by over 16 million customers, including 300,000 business customers, for fast, low cost and transparent money transfer services.

With Wise Business you can send and spend and manage your money in 40+ currencies to 170 countries around the world.

But our international business account offers much more than being the best way for your company to pay suppliers, contractors and employees overseas at the real exchange rate. In fact, we’re adding new tools and features all the time to help you build your business without borders.

Transaction speed claimed depends on funds availability, approval by Wise’s proprietary verification system and systems availability of our partners’ banking system, and may not be available for all transactions.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore calendly pricing to simplify your operations and enhance your processes.

Get insights on grammarly pricing to optimise payments and drive growth.

Explore all the features and add-ons included in different Klaviyo pricing plans and choose the right option for your business.

Transparency has evolved from a nice-to-have to a business imperative in financial services.

International expansion, trade and investment are now an inevitable part of doing business for any ambitious startup. But with any international transaction...

For Garry Hurskainen-Green, borders have never been barriers - they’ve been invitations. As a seasoned entrepreneur with a background in IT, marketing and...