Benefits of a Business Bank Account

Discover the benefits of setting up a separated business bank account to manage your business finances separated from your personal ones.

Looking for a new current account for your business? Perhaps you’re setting up a brand new business, or you’re not happy with your current provider and want to switch.

In this helpful guide, we’ll be putting a popular option under the spotlight - Acorn, which recently rebranded to Card One Money (although for simplicity, we’ll continue calling it Acorn here).

Read on for everything you need to know about Acorn business bank account features, fees and limits. This should help you decide if it's the right choice for your company.

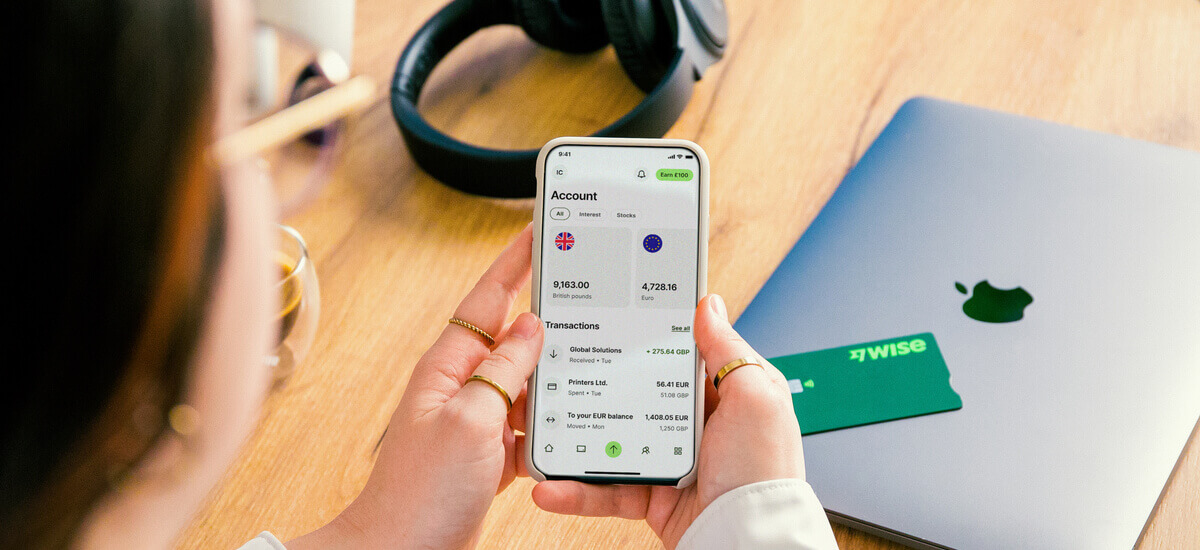

We’ll also show you a non-bank alternative - Wise Business, which lets you effortlessly manage your business finances across 40+ currencies, including GBP, USD and EUR.

💡 Learn more about Wise Business

Acorn started life in 2007 offering accounts to personal customers, before expanding to businesses in 2012. The company rebranded to Card One Money in 2021 and currently has around 33,000 registered business customers.

It’s not a bank, but is authorised to provide payment services by the Financial Conduct Authority (FCA) in the UK.¹

The Acorn business bank account is a wholly digital account, as Acorn has no physical branches. There are two plans - Business and Corporate, each with a monthly fee.

Let’s take a look at the key facts you need to know about each:²

| Feature | Acorn Business Account | Acorn Corporate Account |

|---|---|---|

| Monthly fee | £12.50 | Custom |

| Designed for | Businesses with turnover <£2 million | Businesses with turnover >£2 million |

| Business debit card | Order up to 4 prepaid expense cards | - Order up to 4 prepaid expense cards - Prepaid cards which draw from your balance |

| Online and app banking | ✅ | ✅ |

| FSCS protection | ❌ | ❌ |

| Faster Payments | ✅ | ✅ |

| Direct Debits | ✅ | ✅ |

| Bulk payments | ❌ | ✅ |

| API integration | ❌ | ✅ |

| International payments | ✅ | ✅ |

| Multi-level payment approvals | ❌ | ✅ |

| Dedicated account manager | ❌ | ✅ |

| UK-based customer support | ✅ | ✅ |

When choosing a new business account, there are lots of factors to weigh up. After all, it’s crucial to get the right fit for your company’s needs.

Below, we’ll focus on four of the factors that are most important to UK businesses - features, limits, fees and customer service - and what Acorn has to offer for each.

But first, it’s useful to know what previous customers think about the provider and its accounts.

Over on TrustPilot, the company has an ‘Average’ rating of 3.0 (based on just 25 reviews) under the name AcornAccount.³

Under its new name of Card One Money, it has an ‘Excellent’ rating of 4.4 (based on +900 reviews) on TrustPilot.⁴

While it depends which account you choose, some of the main features available with Acorn business accounts include:

- Business prepaid debit cards - these need to be loaded with funds before use, which can offer extra control over expenses and spending.

- Online and app banking

- Faster Payments, Standing Orders and Direct Debits

- International payments in a range of currencies

- Free text alerts when bills are paid

- Control over permissions, balances and cards

- Pay cheques in at any Barclays branch

- UK-based customer support

- Bulk payments (Corporate Account only)

- API integration (Corporate Account only)

- Multi-level payment approvals (Corporate Account only)

- Dedicated account manager(Corporate Account only).

The standard Business Account with Acorn does have some limits:⁵

| Type | Limit |

|---|---|

| Maximum card balance | £5,000 |

| Maximum account balance | £500,000 |

| Transfers from account to prepaid card | Min. £1, max. £2,500 a day |

| Maximum ATM withdrawal | £450 a day (max. 5 withdrawals) |

| Card purchases | £2,000 a day |

The Acorn business account pricing structure is pretty simple. For most customers on a standard Business Account, there’s just one monthly fee of £12.50 to pay. In return, you’ll get most of your everyday banking services for free.

However, not absolutely all services and transactions are completely free of charge. There are fees for ATM withdrawals, same day and international payments.

Here are the main fees and charges you need to know about:⁶

| Type | Fee |

|---|---|

| Application fee | £55 |

| Monthly fee | £12.50 |

| Prepaid debit card | First card free Additional cards - £5 a month Transfer funds from card back to account - £5 per transaction |

| Standing Orders and Direct Debits | £0.30 |

| Payments | Next day online - £0.30 Same day online - £7.50 |

| ATM withdrawals | In the UK - £1.50 Outside the UK - £3 + foreign currency transaction fee |

| Foreign currency transaction fee | 2.75% |

| Debit card payments | In the UK - free Outside the UK - £3 + foreign currency transaction fee |

| International payments | Send - £10 Receive - £30 Foreign currency transactions fees may also apply |

If you have a larger business and an Acorn Corporate Account, you’ll have a custom pricing model - get in touch with the provider to discuss.

If you need help with your business account, here are all the ways you can contact Acorn Business customer services:⁷

- Phone - call 0345 241 6775, available Monday to Friday, 08:30 - 17:00

- Email customer.services@cardonemoney.com

- Live chat - available Monday to Friday, 08:30 - 17:00, and Saturdays, 09:30 - 13:00

- Online contact form.

Yes, Acorn business accounts are safe to use. The provider isn’t able to offer protection for your money under the Financial Services Compensation Scheme (FSCS), as it isn't a bank.

However, it does use an alternative method known as safeguarding. This is where your money is segregated from the provider’s own funds, and held in a safeguarded account with Acorn’s chosen banking providers (Barclays Bank PLC, National Westminster Bank plc or the Bank of England). This means that your money is separated from Acorn’s other assets in the event of its insolvency, and so can be used to repay you and other business customers.⁸

Acorn is also regulated as a payment services provider by the Financial Conduct Authority (FCA) in the UK. As part of this, the provider is required to use sophisticated security measures to keep your money safe.

To open an Acorn business account, you’ll need to be 18 or over and be a permanent resident of the UK. Your business must also be registered in the UK.⁹

When you apply online, you’ll need to provide both of the following:⁹

- Proof of identity - such as a valid passport or full/provisional UK photocard driving licence

- Proof of address - such as a recent utility bill or bank statement.

The good news though is that there are no credit checks involved, and you don’t need to provide extensive info or documentation for your business. You’ll just need to verify your identity and residency, and your account should be opened pretty quickly.

If you need to pay or get paid in foreign currencies, you could be better off with an alternative such as the Wise Business account.

With a Wise Business account, you can hold and exchange 40+ currencies all in one place. You can send payments to 160+ countries and get local account details to get paid in 8+ currencies like a local.

Whenever you need to send, spend or exchange foreign currencies, you’ll benefit from the mid-market exchange rate, with low, transparent fees.

When you open a Wise Business account, you’ll benefit from all of these useful features:

- No ongoing fees, minimum balance requirements or foreign transaction fees

- Debit and expense cards for you and your team, which you can use in 150+ countries

- Multi-user access for team members, with ways to control and manage permissions

- Pay up to 1,000 people at once with the Wise Batch Payments feature

- Integrate with your favourite cloud accounting solutions, and use the Wise API for automation and streamlining workflow

- Use the Wise Interest feature to make your money work harder when you’re not using it.

It’s quick and easy to open a Wise Business account, with a fully digital application, verification and on-boarding process. Check out the requirements here.

Get started with Wise Business 🚀

And that’s pretty much it - our comprehensive Acorn business account review, covering everything from features to fees. After reading this, you should have all the info you need to compare it to other providers and work out if it’s the right solution for your business.

Sources used:

Sources last checked on date: 23-Aug-2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the benefits of setting up a separated business bank account to manage your business finances separated from your personal ones.

Read our essential guide to the best business bank accounts for startups in the UK, comparing all of the most popular providers

Read our guide to the best online business bank accounts in the UK, including Tide, Starling, Revolut, ANNA and Wise Business.

Discover how to send money from Payoneer to Wise easily. Follow our step-by-step guide to transfer funds securely and save on international transactions.

Read our essential comparison of business bank account fees in the UK, including upfront, monthly and usage charges.

If you’re just starting out on an entrepreneurial journey you need smart ways to manage your money. This probably means you’re looking for the best bank...