Compare travel money card with cash

Wondering whether to take cash or a card with you on holiday?

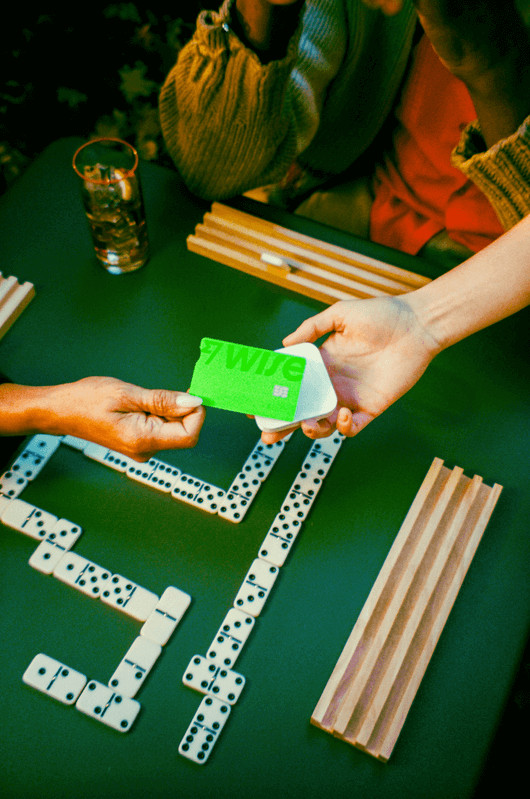

Compare popular travel money cash providers to the Wise travel money card, find the best currency exchange rates and see how you can save.

Travel money card can be cheaper than cash

Forget the cost of exchanging cash. With the Wise travel money card, you can spend like a local while avoiding hidden fees. A travel money card — also known as a prepaid travel card, or a currency card — is easier and safer compared to carrying foreign currency in cash, and less complicated than using traveller’s cheques.

See for yourself. This comparison is based on comparing travel money with the Wise card vs exchanging cash for a holiday.

Travel with the Wise card, and save

This calculation is based on spending 1,000 GBP to compare travel money with the Wise card vs exchanging cash for a holiday.

- Conversion fee

- 3.29 GBP

- Exchange rate markup

- 0.00 GBP

- Delivery fee

- 7.00 GBP

- ATM use *

- up to 16.00 GBP

- Total fee

- 10.29 GBP

Learn more about ATM feesGo back

- Conversion fee

- 0.00 GBP

- Exchange rate markup **

- 1,148.77 GBP

- Delivery fee

- GBP

- ATM use

- 0.00 GBP

- Total fee

- GBP

How does the Wise card work?

It’s free to pay with any currency you hold in your account, and if you want to convert your money to a different currency, you’ll get low conversion fees and zero transaction fees. You can use the card to make ATM withdrawals in your chosen currency, which are free up to £200 a month. Avoid expensive (and often hidden) fees when withdrawing money while abroad, by choosing to withdraw in the local currency and leaving Wise to deal with the conversion.

What is travel money?

The currency rates you’ll get at an airport or hotel - or tourist rates in your final destination - are often not great value. You’ll usually find you pay a high price for the convenience of converting your cash on arrival. Compare travel money and plan how to manage your money before you travel to get the best currency exchange rates.

What is the cheapest way to get foreign currency?

Different currency services use different fee structures, which can make it hard to see which is the best foreign exchange for your needs. Some use upfront commission, but it’s also common for providers to hide their fees in the exchange rate they use. This way they can offer an attractive headline like ‘zero commission’ or ‘fee free exchange’ while still making money from currency conversion. To find the best currency exchange rates for your travel money, you’ll need to compare a few providers - looking at both the fees and the exchange rates used.

You might find it easier and cheaper to use a travel debit like the Wise travel money card when you’re away from home. You can top up in pounds and convert to the currency you need using the mid-market exchange rate with no hidden fees. There’s just a low transparent fee for currency conversion, and then you can spend any currency you hold using your card for free, and get free ATM withdrawals up to £200 each month.

You’ll need to research and compare the best currency exchange rates for your particular currency. Compare both the fees and exchange rates used by different services to get the best deal.

It’s good to know that buying currency in advance, or using a travel money card which offers mid-market rate conversion, can offer the best value. And whatever you do, avoid currency exchange services in airports, train stations, hotels and tourist hotspots, where travel FX rates are likely to be poor.

Many providers offer the option to order money online and then collect it in a local store or have it delivered to your home address. However, you’ll usually have to make sure the person who ordered the currency is home to take delivery, or can go in person to collect it, as ID will be required.

A smart alternative is to get a Wise travel money card sent to you in advance of travelling so you can top up, hold and manage over 40 currencies online or from your phone. Order online and then reuse your card every time you travel - you’ll never need to worry about arranging your holiday money again.

No. As with most things, if it sounds too good to be true, it probably is.

Currency conversion services are businesses and need to make money somewhere. Providers which advertise fee free exchange will usually hide their charges in the exchange rates used. This isn’t transparent and it can mean you pay much more than you should for your holiday money. Hidden costs like these can really mount up - in some cases the true commission charged is as much as 20% - 30%, despite the attractive offers being advertised.

Budgeting for your holiday can vary widely depending on where you’re headed, the type of accommodation you’ve chosen and what you like to do while you’re abroad. Self-catering in rural Italy is likely to cost less than a high end week in Cannes, and entertaining toddlers on the beach will be cheaper than clubbing in Ibiza, for example.

Don’t take more foreign cash than you think you’ll spend, as you’ll only have to pay commission again to buy back currency and switch it back to pounds later. Instead, manage your money flexibly by using a travel money card which you can top up on the go. You’ll never spend more than you’ve topped up, but you can adjust your budget on the fly if you need to.

For more about how much money you’ll need have a look at our blog.