Online Payment Methods: The Complete Guide to Digital Transactions

Discover the most secure and convenient online payment methods for your business.

| This piece has been written in collaboration with Esther Friedberg Karp, an esteemed bookkeeper and QuickBooks ProAdvisor. |

|---|

Measuring and evaluating business financial performance is incredibly important.

By doing so, you can make smarter decisions about how to grow your business and be more strategic in your investments.¹

However, it’s often challenging to identify the right metrics to measure financial performance.

This article will walk you through how to measure financial performance for your business and how to improve it to strengthen your business moving forward - even going global.

| Table of contents |

|---|

Before looking at how to measure financial performance, let’s take a step back and define the term.

Financial performance is a general term that indicates a company’s financial health. Financial performance encompasses a few different aspects to paint a bigger picture of your business.

As part of measurement, you will need to look at your financial statements such as your cash flow statement, income statement, and balance sheet.

To find out more about the importance of financial performance read below.

So how is financial performance measured? You’ll have to collate different financial statements to paint an overall picture of financial health and put together a financial performance statement.

|

|

There are also apps that connect to accounting software that will perform a lot of the ratios and KPIs (Key Performance Indicators) that are often used to calculate a company’s financial health and liquidity.For example, when using QuickBooks Online, check out apps.com to find integrated apps. There, you can search for integrated apps by name, keyword, job, or category.Make sure that the country flag is correct for your country’s version of QuickBooks Online. Then, type reporting in the search bar and you will see dozens of results.

Evaluating financial performance is performed by measuring and analyzing the following areas of a business:

Let’s look at each of these areas in more detail.

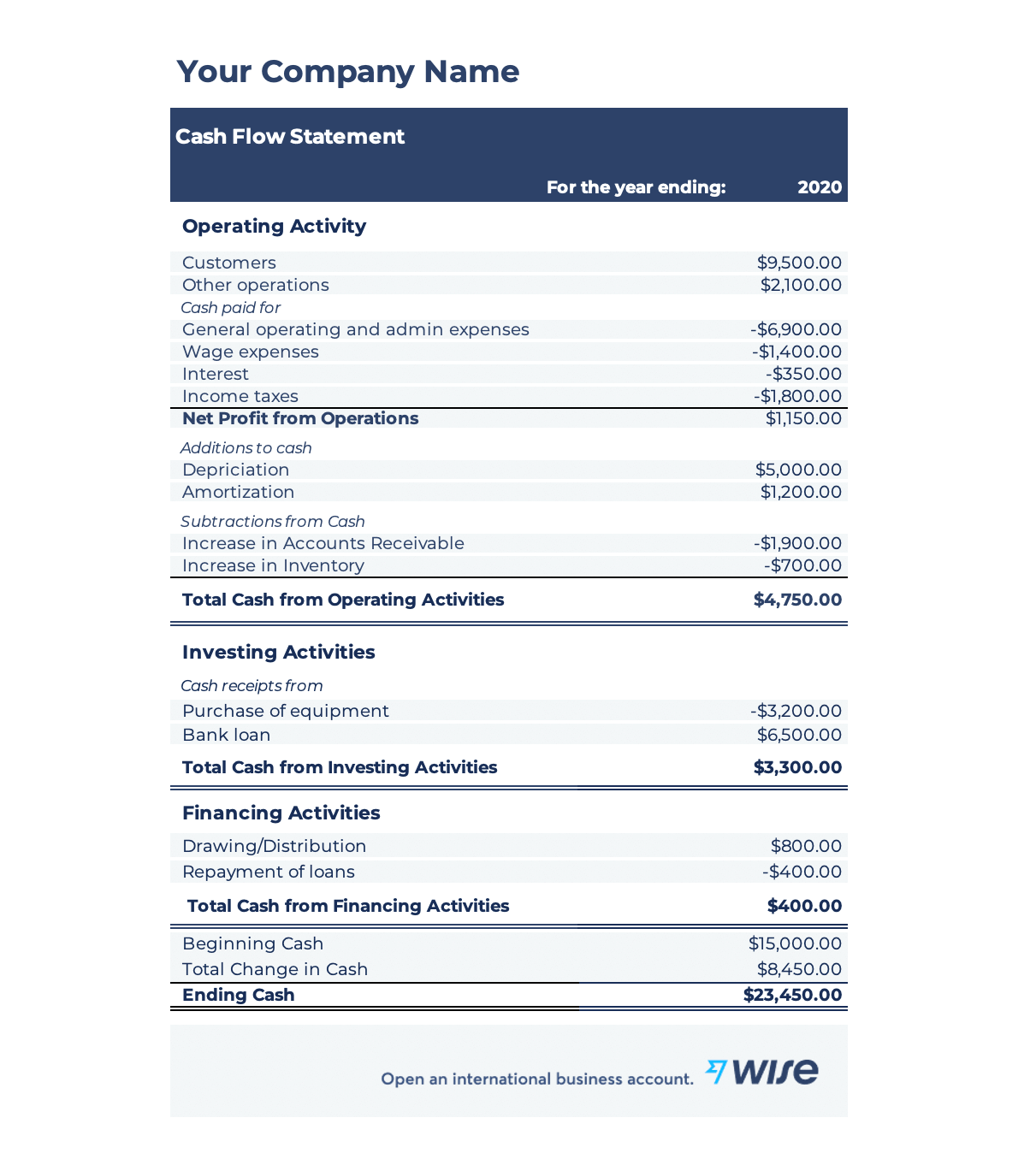

A cash flow statement measures money coming in and out of your business.

Cash flow is a good indicator of overall financial performance. It shows how much cash a business has on hand and how much money is coming in versus what is being spent.

Cash inflow represents the money your business generates in its daily operations.

Conversely, cash outflow refers to money going out of your business to maintain normal operations.

1. Operating cash flow

Operating cash flow refers to cash coming in and out as a result of normal business operations.

Some examples of operating cash flow include office rent, payroll, inventory management, and supplier payments.

2. Cash flow from investing

Cash flow from investing is any cash that is generated from investments.

Incoming cash flow from investing can include any revenue generated from business investments, such as securities and assets.

Cash outflow from investing could include money spent acquiring assets and securities for the business.

3. Cash flow from financing

Cash flow from financing includes inflow and outflow generated as a result of financing activities.

That could include outgoing debt payments or incoming repayments, dividends paid out, purchasing or selling equity, and more.

You can use the Wise template to generate your cash flow statement. The statement takes all three areas into account, so you can easy calculate.

Get your free

Cash flow statement template

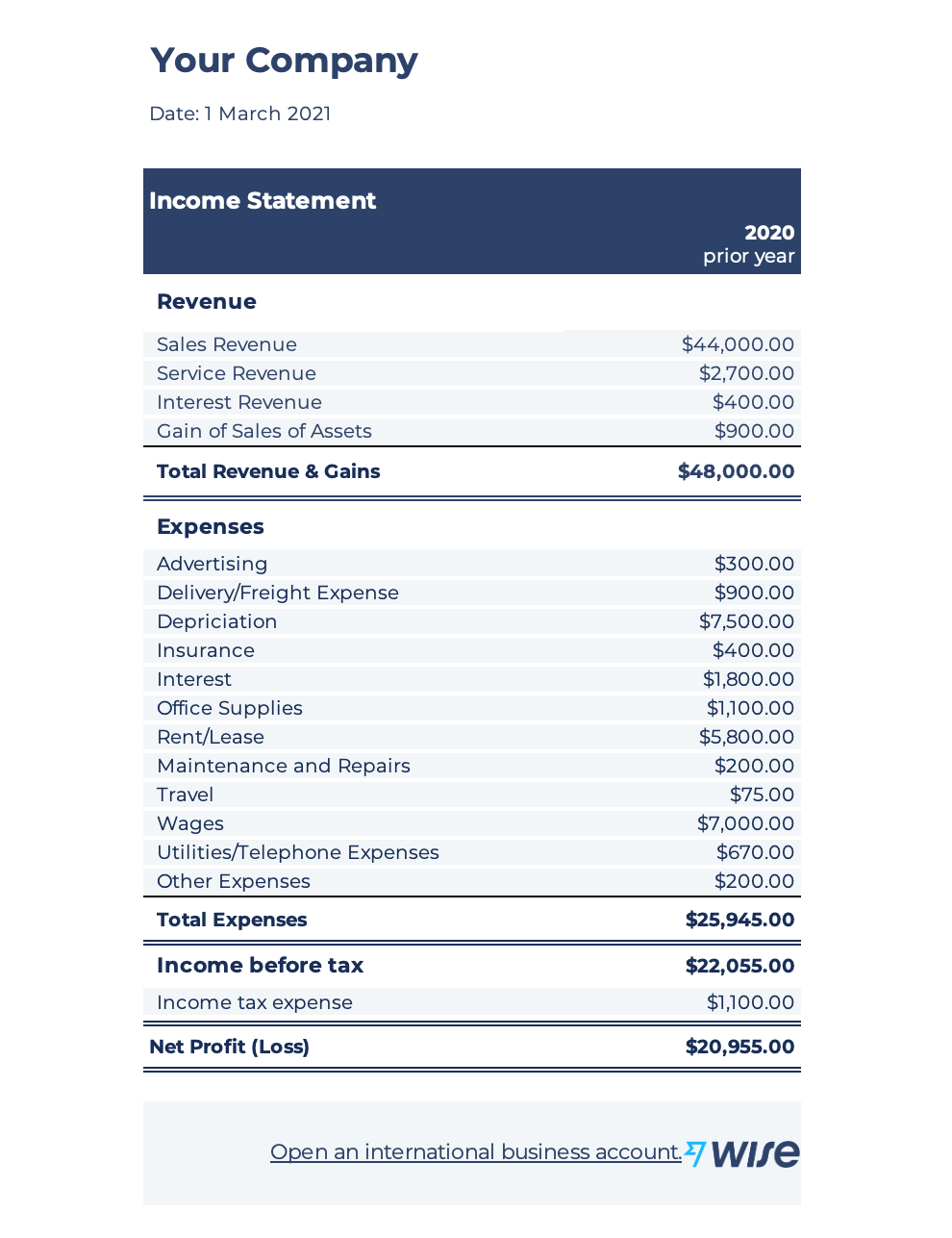

An income statement measures a company’s income and expenses.

Income statements are crucial for financial performance because they show profit and loss in a given period. In fact, another term for “income statement” is “profit and loss.”

By calculating total income earned and monies spent in a period, businesses better understand overall financial health.

It helps businesses identify whether a business is profitable and what expenses need to be controlled to increase profits.

1. Net revenue

Refers to all money generated from selling goods or services, without subtracting for expenses

2. Net expenditure

Total revenue subtracted from expenses accrued to understand how much a business spends.

3. Net profit

Calculated by subtracting revenue from Expenses to understand business profitability and how much revenue is left.

You can use the Wise template to generate an income statement for your business quickly and easily.

Get your free

Income statement template

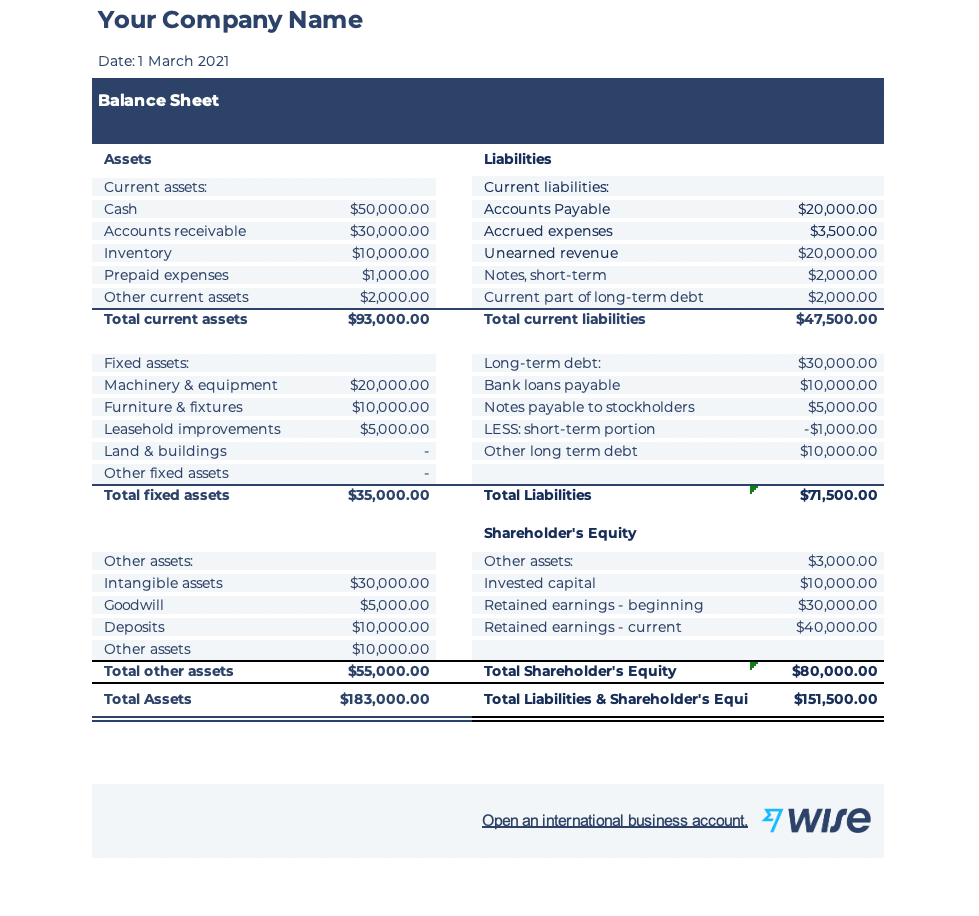

A balance sheet is used to understand the total net worth of a business.

It looks at whether a company balances its assets against the total sum of its liabilities and shareholders’ equity.

The balance sheet is a measure to show what assets a company owns versus what they owe. As a result, a balance sheet provides more insight into a company’s financial position.

A balance sheet is based on calculating net assets by adding together liabilities and shareholder equity - that’s the foundation of it.

Based on this, the balance sheet includes the following line items, which can be added or removed depending on the business:

You can use the Wise template to generate your own balance sheet and develop a better picture of your company’s financial performance.

Get your free

Balance sheet template

As a general note, it’s important to remember to look at all of these different statements together rather than in isolation.

Focusing on only one statement may not give you a full picture of how the business is performing financially.

For evaluating financial performance of a company, here are some of the most important calculations. All of these calculations can be done using the above statements.

| Operating cash flow = Net income + (non cash expenses - working capital increase) (²) |

|---|

| Gross profit margin = (Revenue - Cost of Goods Sold) / Revenue (³) |

|---|

| Net profit = Total revenue - total expense |

|---|

| Working capital = Current assets - current liabilities |

|---|

| Current ratio = Current assets / Current liabilities |

|---|

| Leverage = Total company debt / shareholder equity |

|---|

| Debt-to-equity ratio = Total liabilities / shareholder equity |

|---|

| Return on assets = Net income / assets |

|---|

| Return on equity = Net income / shareholder equity |

|---|

Financial performance is a suitable good measure to understand how your business is managing its money and whether it has room to grow.

It can help with forecasting trends and how the business will perform in the future.

That is crucial information for stakeholders considering investing in the company and can impact their decision.¹

For international businesses, measuring financial performance has additional value.

It can help you understand profitability in different locations and map out the potential for expansion and growth.

Plus, if you have several international employees on payroll, it can help you identify fees and costs incurred the company could reduce.

Currency conversion can lead to costly fees and sky-high rates, so it’s crucial to use solutions that give you competitive rates and manage multiple currencies in one place.

| To avoid high exchange rates and currency risk it's best to send money internationally with the mid-market rate, get a guaranteed rate for your transfer or use an exchange rate tracker. Wise Business offers you all that and more! |

|---|

Open your Wise Business account today

Depending on how your business is structured, measuring financial performance may be required. Public companies are required by law to disclose their financial information regularly.⁴

Annual reports are submitted through Form 10-K and are meant to be a comprehensive overview of how the business is performing for shareholders.

The report must also include audited financial statements for full transparency.

If your company is obligated to submit a 10-K, you can find the PDF form here.

Once you’ve submitted your annual report to shareholders, it will be searchable in the EDGAR database.

After looking at cash flow and income statements as well as your balance sheet, you should have a good understanding of how your business is performing.

For international businesses, the statements and sheets can provide deeper insight into where you’re performing well and where there is opportunity for growth.

In fact, depending on the accounting software you are using and how you are entering your transactions, it might be possible to produce statements that are specific to a particular location or currency.

This would highlight if your pricing and other practices in other currencies yield a profitable bottom line in those areas.

Even within current markets, there can be a lot of scope for improvement.

For example, you can provide customers with more flexibility around payments, such as allowing them to pay you in their currency to cut conversion costs.

That can help decrease late payments and provide more convenience for customers.

Other ways to boost financial performance can include using services with competitive exchange rates to reduce transfer fees.

Wise offers many tools that can help improve a company’s financial performance.

With Wise, you can manage payments and subscriptions in one place using a multi-currency account.

Get paid faster in local currencies, with local bank details - such as IBAN, routing number and more - to streamline the payment process.

Signing up to Wise Business allows access to BatchTransfer which you can use to pay multiple invoices in one go.

You can also take advantage of low conversion rates, and save up to 19x compared to PayPal.

Take advantage of the

Wise Business services now

All sources checked 28 December 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the most secure and convenient online payment methods for your business.

Learn the essentials of how to invest in commercial property in the UK as a US investor.

Compare Mollie vs Stripe to find the best payment gateway for your business. Our guide covers fees, features, and integrations to help make the right choice.

Find out how to open an IBAN account with our step-by-step guide. Understand the requirements, benefits, and best practices.

Explore the top business bank accounts for international payments in the US. Compare features, fees, and benefits.

Discover how to invest in commercial property with our comprehensive guide.