What Is Meta Pay? A Guide For US Businesses

What is Meta Pay? Get a breakdown of Meta's digital wallet and payment solutions for a fast and secure checkout experience.

| This piece has been written in collaboration with Esther Friedberg Karp, an esteemed bookkeeper and QuickBooks ProAdvisor. |

|---|

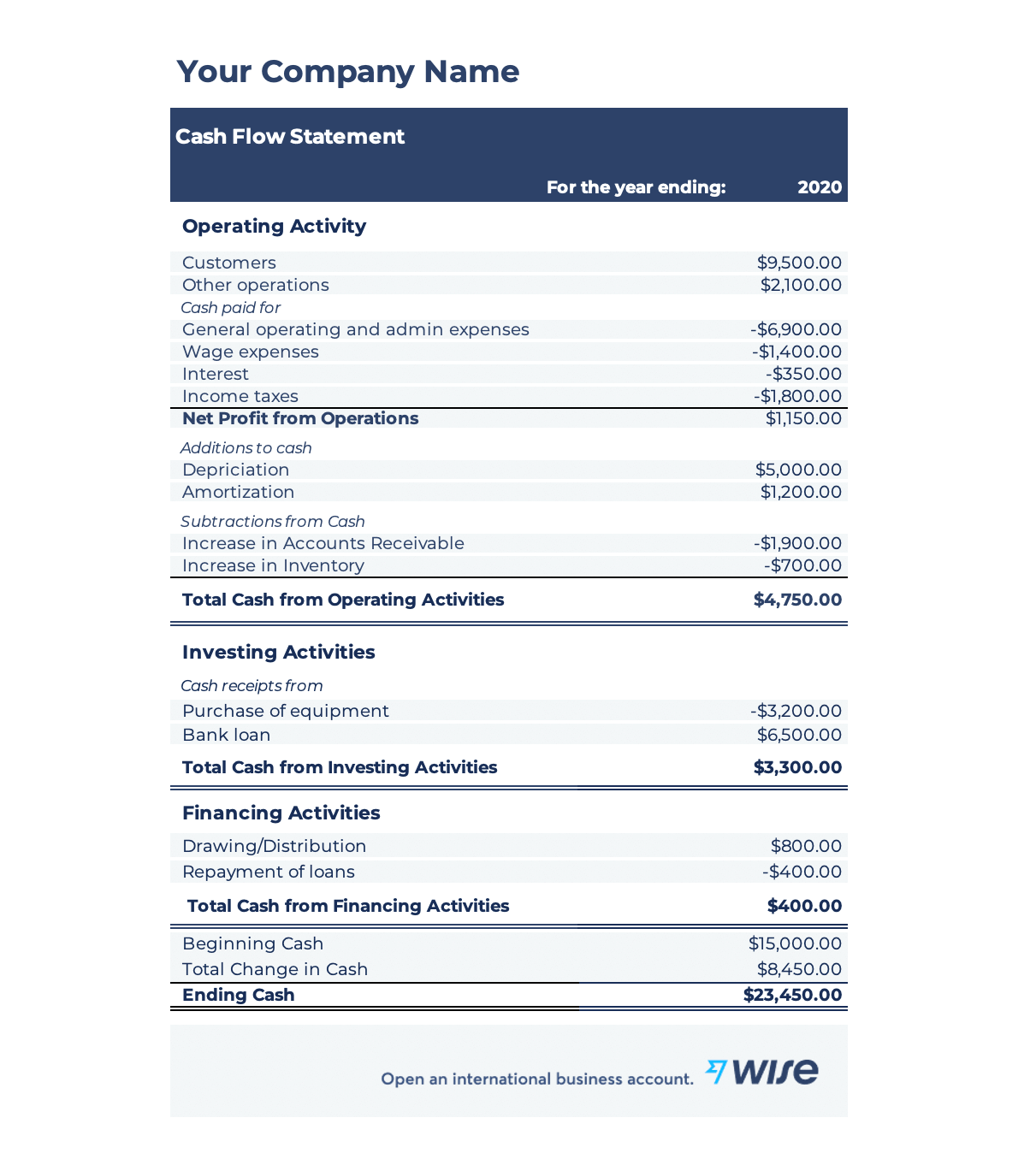

A cash flow statement - or “statement of cash flows” - is an important part of overall financial reporting and gives you insight into how your business is performing.

The statement is essentially used to understand incoming versus outgoing cash so you can see your business’ cash flow. A cash flow statement answers the questions “Where did our money go?” and “Where did our money come from?”

Tracking cash flow is a crucial part of finance as it’s a summary of cash inflows and outflows and can be helpful for planning short-term activity and long-term growth.

Otherwise, it’s too difficult to spot the signs of a failing business before it’s too late and this is an issue for businesses around the world.

| In fact, a global study by Intuit, the company behind QuickBooks, reported that 89% of small business owners dealing with cash flow problems found that it negatively impacted their business and its growth.¹ |

|---|

This article will look at what a cash flow statement is, examples of cash flow statements, and what goes into them, as well as a step-by-step explanation on how to prepare a cash flow statement.

Get your Wise cash flow statement

template for free

| The article will cover |

|---|

A cash flow statement is a financial report that summarizes the incoming and outgoing of funds in a business.

It measures cash inflows and outflows, and how well a company is doing in generating cash. Cash flow statements look at operating expenses, business investments, and financing to make up the summary.

When it comes to looking at the financial health of your business, a cash flow statement is one of the first reports that’s considered. For publicly traded companies, it is a requirement.²

But even if your business is not publicly traded, a cash flow statement is incredibly important for tracking cash inflow and outflow.

A cash flow statement provides a great deal of oversight that can help with operations and planning for international businesses.

Manage international cash flow

with the Wise multi-currency account

A cash flow statement consists of the three major components:

Let’s look at each of the components in more detail below.

Operating cash flow refers to cash inflows and outflows connected to business activities conducted by the company.³

It’s essentially a measure to see cash flow related to the business and its day-to-day operation, and whether sufficient resources are available to maintain and grow the business.

| Examples of cash flow from operating activities | |

|---|---|

|

|

|

|

|

|

Investing cash flow refers to the inflow and outflow of cash that comes from assets needed for the company to generate profits.

Investing activities can refer to any money invested in the business, particularly investments that are meant to be beneficial for the business in the long-term for its activities.

| Examples of cash flow from investing activities | |

|---|---|

|

|

|

|

Financing cash flow is a portion of a company’s cash flow that shows the inflow and outflow of cash to fund the company.

It covers transactions that involve company debt, any equity related to the company, and the disbursal of dividends.

| Examples of cash flow from financing activities |

|---|

|

|

|

To help you get started on your cash flow statement, here is an example below.

If you’d like to start your own cash flow statement, you can use Wise’s easy cash flow statement template to better understand your business' financial health and performance.

Get your CF statement template now

There are two kinds of cash flow statements, and the main difference is how cash flow from operating activities is presented:

US-based businesses can choose either option, but indirect cash flow statements are most commonly used.

Once you’re ready to start your own cash flow statement, here are the steps on how to prepare a statement for your business:

Step 1. Determine the net increase in your cash and cash equivalents (i.e., short-term, highly liquid investments) for a given period, such as a quarter or a year.

Step 2. Identify the change in each balance sheet account, including assets, liabilities, equity.

Step 3. For any balance changes, work out if the change results in an inflow (increase or source of cash) or outflow (decrease or use of cash).

Step 4. Ascertain if each balance change is an operating, investing, or financing activity.

|

|

When you’re preparing a statement of cash flows, if you have foreign currency accounts, you’ll be challenged to calculate the balance difference in those foreign-denominated accounts and what is the difference in your own currency as well.QuickBooks Online offers a Statement of Cash Flows report. Be aware that this is denominated in the “home currency” (i.e. the reporting currency of the country in which the company is located) , with foreign currency totals based on the exchange rates in force on each foreign currency transaction.

QuickBooks Online will populate each foreign currency transaction with the default exchange rate in force on the date of the transaction, but these exchange rates can be overridden to account for actual exchange rates offered by banks, credit cards, and, of course, Wise (which offers more advantageous exchange rates and lower fees).QuickBooks Online’s Cash Flow Planner tool, used for projecting future cash flow, is unavailable in companies in which multiple currencies have been enabled.

Wise Business can help you save big time on international payments.

Wise is not a bank, but a Money Services Business (MSB) provider and a smart alternative to banks. The Wise Business account is designed with international business in mind, and makes it easy to send, hold, and manage business funds in currencies.

Signing up to Wise Business allows access to BatchTransfer which you can use to pay up to 1000 invoices in one go. This is perfect for small businesses that are managing a global team, saving a ton of time and hassle when making payments.

Some key features of Wise Business include:

Mid-market rate: Get the mid-market exchange rate with no hidden fees on international transfers

Global Account: Send money to countries and hold multiple currencies, all in one place. You can also get major currency account details for a one-off fee to receive overseas payments like a local

Access to BatchTransfer: Pay up to 1000 invoices in one click. Save time, money, and stress when you make 1000 payments in one click with BatchTransfer payments. Access to BatchTransfer is free with a Wise Business account

Auto-conversions: Don't like the current currency exchange rate? Set your desired rate, and Wise sends the transfer the moment the rate is met

Free invoicing tool: Generate and send professional invoices

No minimum balance requirements or monthly fees: US-based businesses can open an account for free. Learn more about fees here

All sources checked 07 October 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

What is Meta Pay? Get a breakdown of Meta's digital wallet and payment solutions for a fast and secure checkout experience.

Maximize your savings with the best business credit cards. Compare top-rated corporate credit card programs.

Learn how to choose a business credit card with our expert guide. Compare rewards, interest rates, and fees to find the perfect card for your company's needs.

Open a business account Estonia easily. Learn about the requirements and benefits of banking for e-residents and Estonian companies.

Find the best business bank account Netherlands options. Compare features, fees, and services for your company operating in the Netherlands.

Discover the top choices for a business account Denmark. Compare digital and traditional banking solutions for Danish companies.