Outsourcing to Romania: Clear Guide & Top Tips for US Businesses

Outsource to Romania with confidence. Discover the benefits, costs, and practical steps for US businesses.

Cash flow is an extremely important measure when it comes to assessing the financial health of your business. 60% of businesses have reported experiencing cash flow issues and 89% of business owners have seen a negative impact on their business because of cash flow problems.¹

Having a clear understanding of what cash flow is, why it’s important, and the different types of cash flow can be incredibly helpful in understanding and improving business performance.

This article will take you through a definition of what cash flow is and what types of cash flow businesses should be looking at.

| This article will look at: |

|---|

The basic definition of cash flow refers to the amount of money that is coming in and out of the business. ²

Cash flow is crucial for a business for many different reasons.

Having a clear understanding of how cash is being received and spent, and to understand overall cash flow management is vital to mitigate any cash flow problems before they arise and damage the business.

Take control of International Cash Flow

with the Wise Business account 🌎

Cash inflow refers to the money a business receives.⁴ Essentially, it’s the income that is generated through the business and its daily activities.

Cash inflow is incredibly important because it is how revenue and profit is generated. A positive inflow of cash, helps a business grow while also maintaining its expenses.

Sources of cash inflow can include:

As businesses generate cash, they can develop additional strategies by partnering or acquiring other companies to increase cash inflow further.

Cash outflow refers to the spent money, that moves out of the business to help it run and operate.⁴

Cash outflow may include:

Multi-currency payments, in particular, can get difficult to manage when monitoring cash outflow, if different methods are being used.

Usually payments and transfers result in costly conversion rates - one of the many cash flow problems faced by international businesses.

| Multi-currency cash flow made easy for your business. Open a Wise Business account to make international payments and cash flow management convenient. Signing up to Wise Business allows access to BatchTransfer which you can use to pay multiple invoices in one go. |

|---|

Manage multiple currencies with Wise

When businesses have a positive cash flow, it means they have increased their liquid assets.⁵

Positive cash flow occurs when a business is left with cash even after paying all cash outflow expenses such as operations and debt.

It means that the business is profitable and that companies have the ability to grow and reinvest as needed with positive cash.

Negative cash flow, however, is a little more complicated.

Although the name might suggest otherwise, it’s not always a bad thing - depending on what is causing the negative cash flow.

For example, if operations and other costs lead to more outflow than cash coming in, that means the business is not profitable, leading to dire consequences down the line, such as bankruptcy.

However, if the negative cash flow is occurring because the business is investing in different areas to bolster the long-term health of the business, then negative cash flow may not be a sign of trouble.

There are three types of cash flow used to measure the business’s financial health across various aspects.

| Cash flow type | Definition |

|---|---|

| Operating cash flow (OCF) | Operating cash flow refers to the cash moving in and out of the business, as part of maintaining normal business operations. Operating cash flow can include inventory management, rent and office expenses, payroll and more. |

| Cash flow from Investing (CFI) | Cash flow from investing refers to cash flow generated from any investing activities a business partakes in. Cash flow from investing can include purchasing assets and securities for the business as an investment or selling assets and securities to generate cash. |

| Cash flow from Financing (CFF) | Cash flow from financing includes any revenue spent or received relating to financing such as debt, dividends, and equity. For example, cash flow from financing includes issuing and repaying equity, paying out dividends, and issuing or paying back debt. |

Many examples of cash flow statements are available from large and small companies to better understand how they measure cash inflow and outflow.

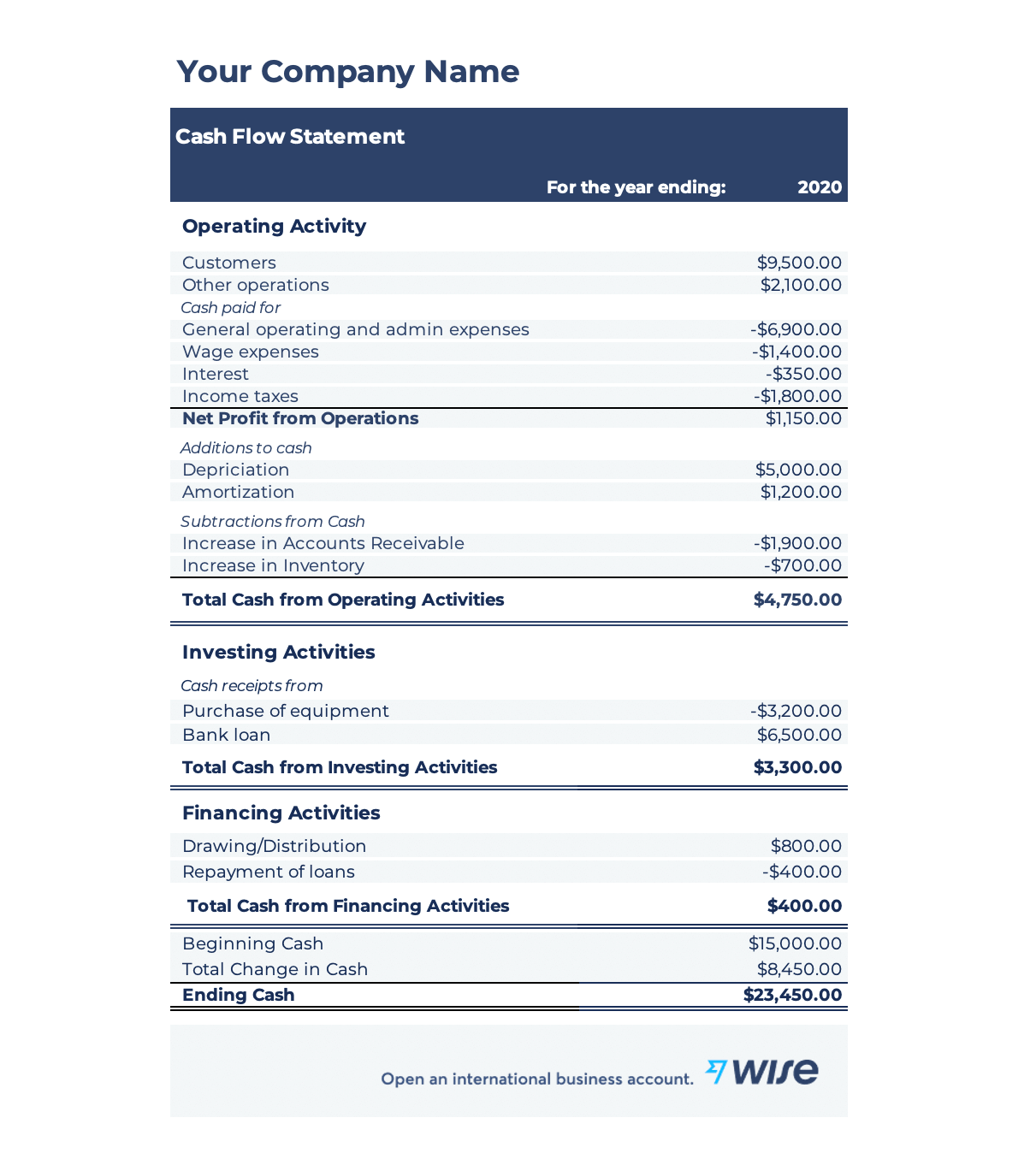

Here is an example of a cash flow statement.

As you can see, using the Wise cash flow template, the cash flow statement includes the different types of cash flow across different parts of the business to understand its financial performance.

| If you’d like to generate your own cash flow statement, use the free Wise cash flow template. |

|---|

Wise enables businesses to gain more control over their spending and monitor cash flow more thoroughly. Wise multi-currency accounts allow you to manage all your currencies and subscriptions in one place.

With Wise, you can use one account for more than 40 currencies. Signing up to Wise Business allows access to BatchTransfer which you can use to pay multiple invoices in one go.

On top of that, Wise makes payments fast and provides upfront, transparent fees. You’ll always get the mid-market rate.

Source:All sources checked 29 September 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Outsource to Romania with confidence. Discover the benefits, costs, and practical steps for US businesses.

In this US guide to buying commercial property in Singapore, navigate the process, costs, and unlock foreign investment opportunities with expert insights.

Discover the most secure and convenient online payment methods for your business.

Learn the essentials of how to invest in commercial property in the UK as a US investor.

Compare Mollie vs Stripe to find the best payment gateway for your business. Our guide covers fees, features, and integrations to help make the right choice.

Find out how to open an IBAN account with our step-by-step guide. Understand the requirements, benefits, and best practices.