Ecommerce Payment Methods: The Ultimate Guide to Online Transactions

Discover the most popular ecommerce payment methods to improve your checkout experience, increase conversion rates, and meet customer preferences worldwide.

Understanding Net Revenue Retention (NRR) is crucial for SaaS businesses aiming to assess growth and customer retention. This article will cover what NRR is, how to calculate, and some tips for improving NRR as a SaaS business.

Scale Your SaaS Business Globally

With Wise Business

NRR is a metric that reflects a company's capacity to retain and grow revenue from its existing customer base over a given time frame. It accounts for revenue increases from upselling, cross-selling, and expansions, as well as decreases due to downgrades and customer churn.

In the SaaS industry, NRR is vital as it indicates the health and potential scalability of a business. A high NRR suggests effective customer retention and successful expansion strategies, leading to sustainable growth without relying solely on new customer acquisition.

While both metrics assess revenue retention, they differ in scope:

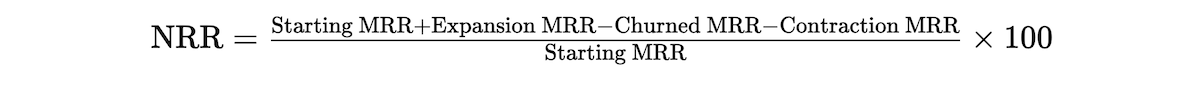

To calculate NRR, use the following formula:

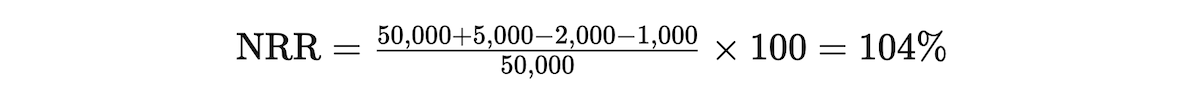

Consider a SaaS company with a Starting MRR of $50,000. During the month, they achieve:

Applying the NRR formula:

An NRR of 104% indicates the company not only retained all its revenue from existing customers but also achieved a 4% net growth from its current customer base.

Enhancing NRR involves both reducing churn and increasing revenue from existing customers.

Efficient financial management is essential for SaaS companies aiming to improve NRR. Especially when multiple currencies are involved. Wise Business offers features designed to streamline your financial operations:

By leveraging Wise Business, you can optimize your financial processes, reduce costs, and focus on strategies to enhance your Net Revenue Retention.

Wise is not a bank, but a Money Services Business (MSB) provider and a smart alternative to banks. The Wise Business account is designed with international business in mind, and makes it easy to send, hold, and manage business funds in 40+ currencies. You can also send money to 140+ countries.

| Read the guide on how to open a Wise Business account |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the most popular ecommerce payment methods to improve your checkout experience, increase conversion rates, and meet customer preferences worldwide.

Find the best tax preparation software for your small business. Simplify your filing process and ensure accuracy with top-rated tools.

Unlock Canadian commercial real estate opportunities. A complete guide for US residents on legal compliance, 35% down payment rules, and cross-border tax tips.

Explore the best electronic payment methods for your business. Secure, fast, and convenient ways to accept online payments.

Learn how to buy commercial property in Australia with our expert guide to the process, costs, FIRB, and saving money on international payments.

Ready to diversify? Discover how US investors can navigate the Indian commercial real estate market, from legal compliance to closing the deal. Read more.