Top Controller Interview Questions | Prepare for Every Angle

Ace your next interview with these top controller questions, sample answers and expert tips focused on financial operations and leadership skills.

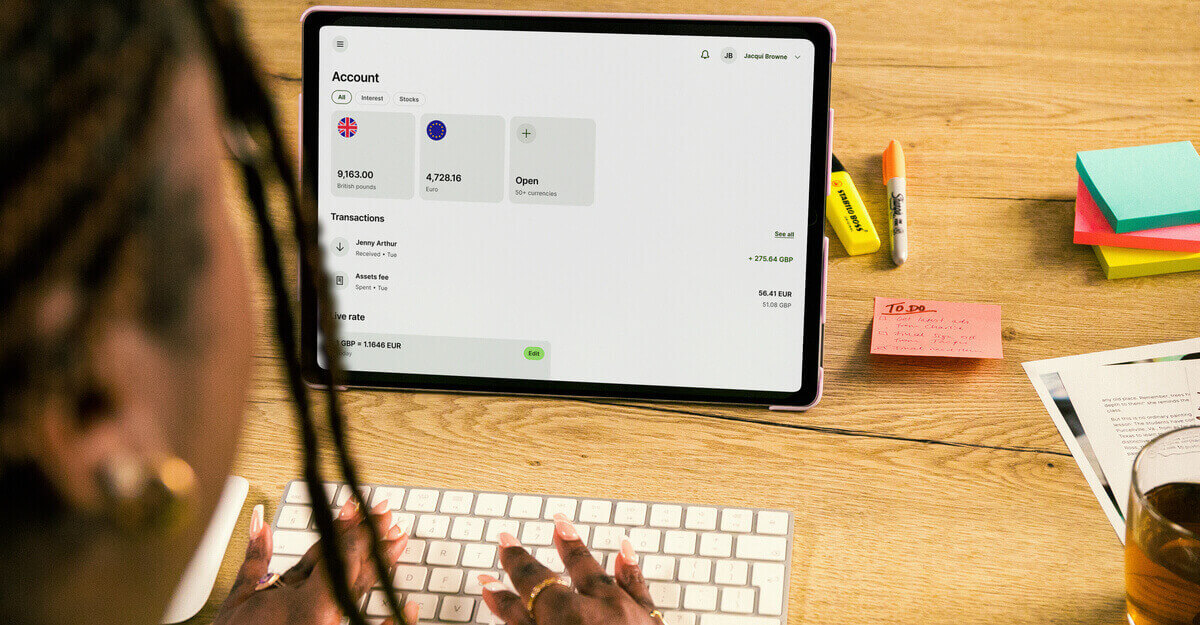

Are you looking to join Wise’s more than 10 million active personal and business customers by opening a Wise Business account?

This article takes you through the process of signing up for an account so you can start taking advantage of its features for your business.

Register with Wise Business today 🚀

Wise is a Money Services Business (MSB) provider that you can use to hold and convert 40+ currencies and send international transfers. If you operate a US business that conducts international transactions, Wise’s online business account can help you send and receive payments around the world using the mid-market exchange rate without hidden fees.

Registering an account with Wise Business is a simple process that you can complete online in minutes. Follow these simple steps.

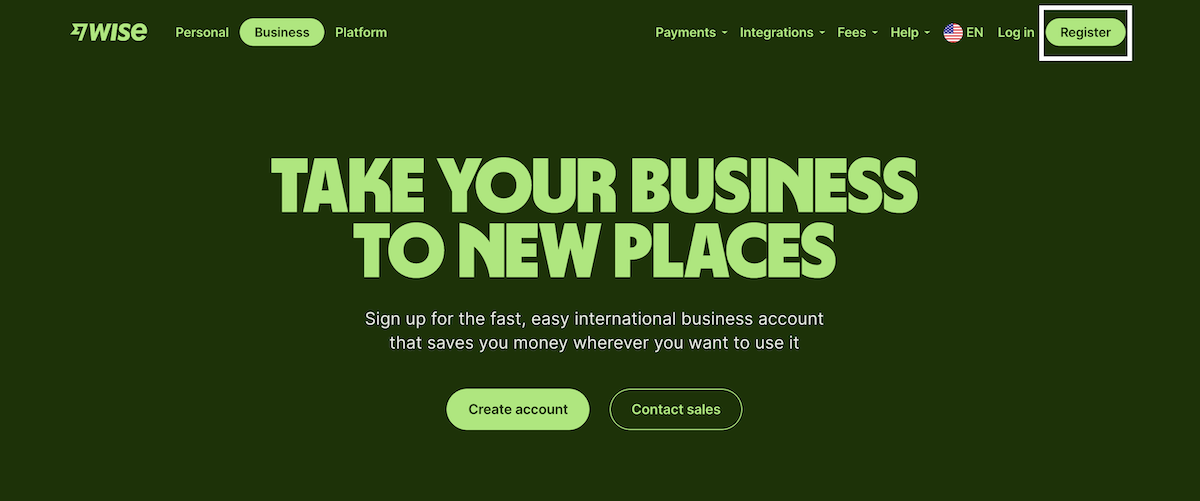

To get started, navigate your web browser to the Wise Business website or download and open the Wise mobile app from the Apple or Google Play store.

If you are using the web browser, look for the Register button on the top right corner of the page or the Create Account button.

You can also click the link and register here.

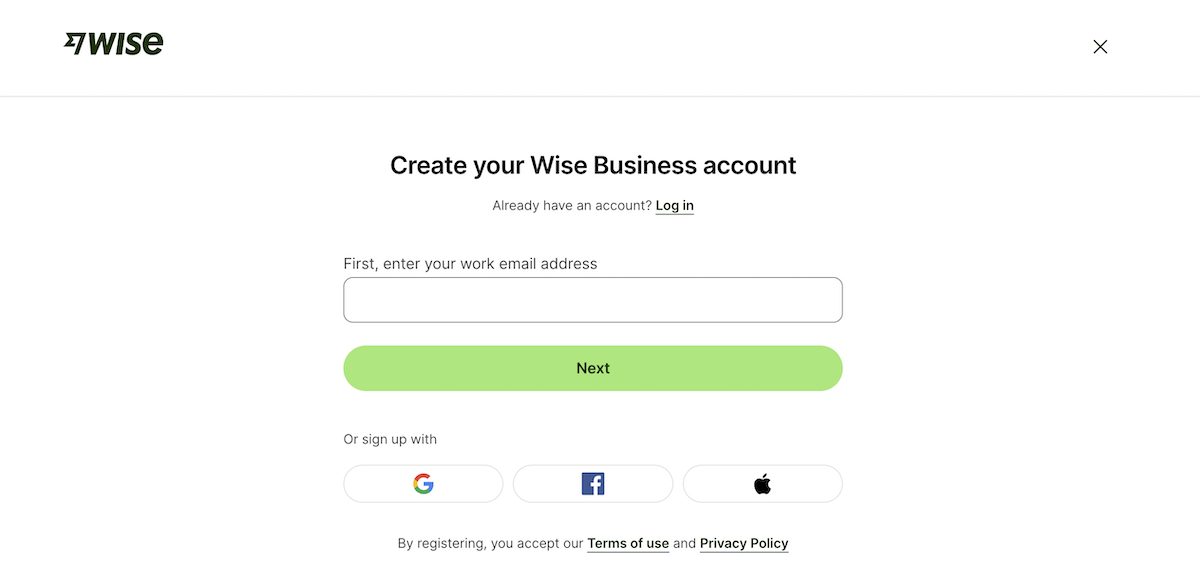

Fill in the appropriate email address for your business correspondence. Alternatively, you can use your existing Google, Facebook or Apple ID account if your business email address is registered there.

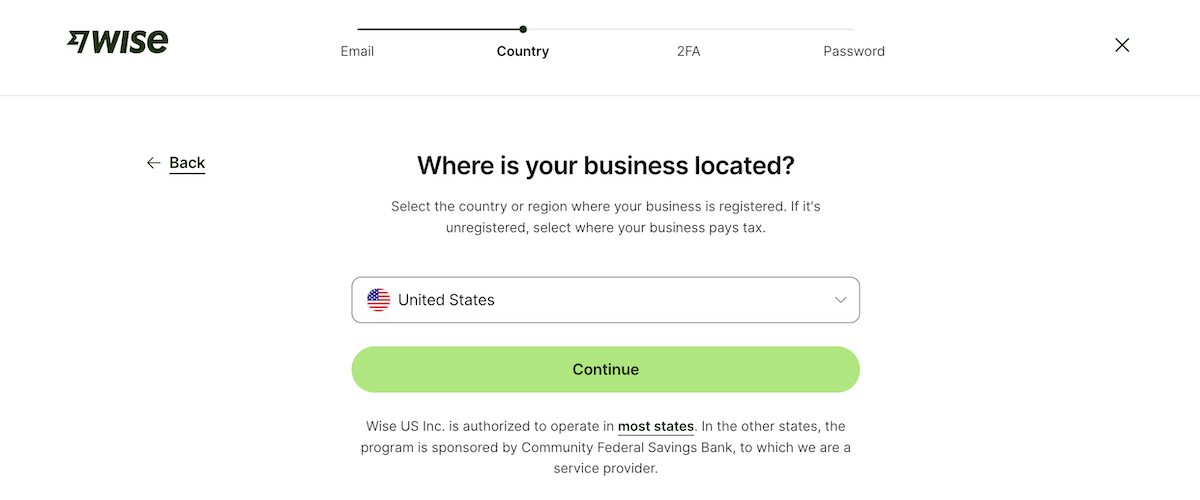

Confirm your country of registration, in this case the United States.

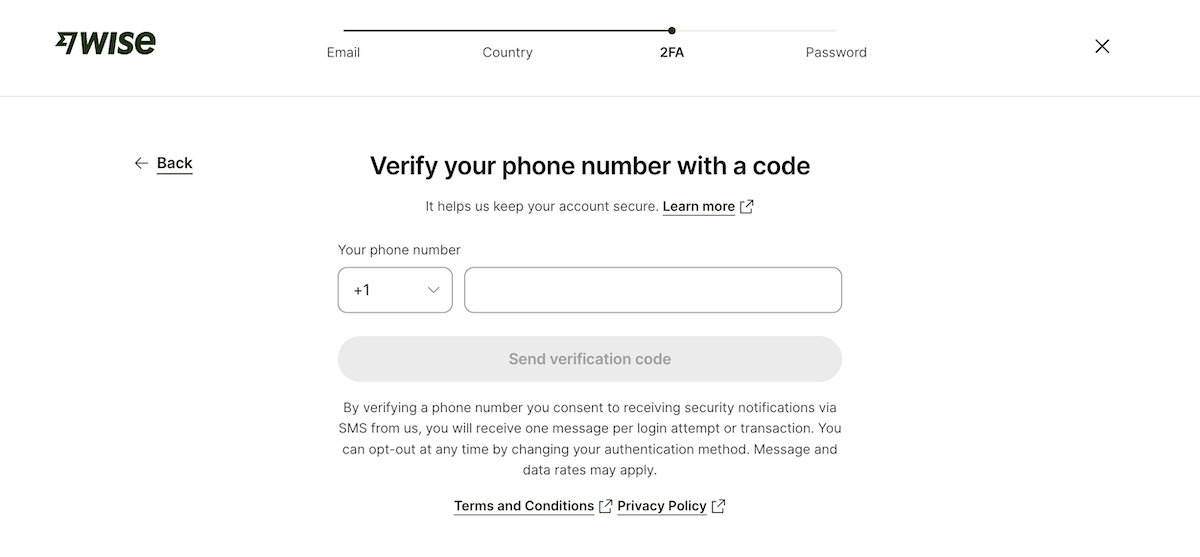

Provide a mobile number to receive a one-time password (OTP) via SMS and enter the OTP for two-step verification to keep your account secure.²

Enter a password for the account that contains a combination of upper and lower case letters, characters and numbers that is not easy for hackers to crack.

Inform Wise whether you are one of multiple stakeholders or the majority owner of the business.

To proceed, you need to provide documentation to verify details about yourself and the business.³

This includes information such as:

As the Wise account owner, you must provide personal details to verify your identity. And if you’re not a company director, you will need to prove that you're authorized to act on behalf of the business.

You may need to upload documents including:

Enter how much you want to send, let us know who you're sending to, and pay for your transfer. Learn more about sending money with Wise.

Another option is paying a one-time set-up fee to get account details for receiving money.

We'll let you know if we need extra information to verify you once we receive your money. This usually takes less than 10 working days. Keep in mind that if you added team members to your business account, they need to be verified, too.

Once your verification is completed, we'll send you a confirmation email and resume your transfer.

You can also watch our video guide on how to open an account, and follow the steps while you watch.

If you already have a Wise personal account, you can link your new business account to it, so that you can access both with the same login. You can open a business account from the web or app by selecting Open a Business Account from your name icon in the top corner.

All different types of businesses — from freelancers and entrepreneurs to large-scale enterprises — can use a Wise account. However, there are restrictions on who can open account and Wise Businesscannot be used by the following entities in the US:³

It’s quick and easy to open a Wise Business account, so you can set one up in just a few minutes if you have your documents at the ready. There's no need to book appointments or wait in line. Verification usually takes less than 10 working days.

Wise Business offers several advantages for US businesses, especially those that operate internationally.

Key account features include:

Open a Wise Business account 🚀

Wise is not a bank, but a Money Services Business (MSB) provider and a smart alternative to banks. The Wise Business account is designed with international business in mind, and makes it easy to send, hold, and manage business funds in 40+ currencies. You can get major currency account details for a one-off fee to receive overseas payments like a local. You can also send money to 140+ countries.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

Sources:¹ THE WISE STORY

² What is 2-step verification? | Wise Help Centre

³ Can my business use Wise? | Wise Help Centre

All sources checked September 2024.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Ace your next interview with these top controller questions, sample answers and expert tips focused on financial operations and leadership skills.

Discover how to build a global recruitment strategy. Learn how to attract, hire, and retain international talent.

DHL Business Account Review: Is it right for your company? Read our comprehensive review to help you make an informed decision.

USPS Business Account Review: Is it right for your company? Read our comprehensive review to help you make an informed decision.

FedEx Business Account Review: Is it right for your company? Read our comprehensive review to help you make an informed decision.

UPS Business Account Review: Is it the right fit for your company? Read our comprehensive review to help you make an informed decision.