Using Revolut Business Integrations (US Guide)

Explore Revolut Business integrations: connect your account with popular accounting and business software to automate workflows and save time.

When it comes to running a business, monitoring and keeping on top of financial performance can be challenging.

Without knowing the right financial performance metrics, issues tend to get overlooked and cause problems down the line.

Understanding the role of specific metrics like operating cash flow can help evaluate a business and its financial health while also spotting any money issues preemptively.

This article will help break down operating cash flow, why it is so important and how to calculate it.

| Easily move money between your currency accounts with Wise Business |

|---|

| This article will look at: |

|---|

Operating cash flow refers to the inflow and outflow of cash generated by a business during its normal operations.

It is one of the core components of a cash flow statement, which is a summary of cash and cash equivalents entering and leaving the business.

A cash flow statement is important because:

Download your free

cash flow statement template

Note that operating cash flow is different from operating cash flow ratio.

Operating cash flow ratio is used to understand if a company can pay off its liabilities or payables (i.e. any money owed by the business at any time) with cash generated from business activities.

Calculating and monitoring operating cash flow is important for a variety of reasons.

First and foremost, it helps you keep track of your business and its financial performance, which takes on even more importance if you operate in multiple locations.

Having positive operating cash flow can indicate that your business has a bit of room or flexibility with your cash reserves/free cash flow.

OCF can help you evaluate performance in different locations and overall financial health - around both international and domestic operating costs.

It is also crucial for future planning, as it gives you an idea of how the business is doing, whether operations are in a place and if expansion is possible.

| Save hours on admin and international payment fees with Wise Business |

|---|

There are two different methods to display cash flow from operating activities on a cash flow statement:

Let’s look at the differences between each one in more detail.

| Indirect method¹ | Direct method¹ |

|---|---|

| Uses net income as a base | Uses all cash transactions as a base |

| Net income and depreciation expense is included (all factors are included) | Net income and depreciation expense isn’t included (non-cash transactions are ignored) |

| Changes in assets and liabilities are included | Changes in assets and liabilities are not included |

| Useful for larger businesses with diverse income sources | Better for smaller businesses that may not have long-term assets to include |

The indirect method for calculating cash flow includes net income and non-cash adjustments.

The net profit or loss the company reports are adjusted for items that affect the figure but do not involve cash, such as depreciation and amortization.

For example, the indirect method would calculate net income and then adjust it for inventory depreciation, such as older equipment the company owns but has depreciated.

The indirect method could also include currency exchange adjustments and impact, such as foreign currency translation and fees.

| 💡 Foreign currency translation - International businesses |

|---|

| For companies operating in multiple countries, foreign currency translation refers to converting money from foreign locations to the parent company’s currency. |

That's why using a multi-currency account, like Wise can help with making cash flow management easier, and reducing the impact of conversion fees and foreign currency translation.

Manage your international cash flow

In 54 currencies with Wise

The direct method for calculating operating cash flow looks at all cash transactions, including accounts payable and receivable.

It’s a summary of the inflow and outflow of cash, in a specific reporting period, using all cash transactions as a basis for calculation.

For example, that figure would include cash received from customers, cash paid to suppliers and employees.

There are two versions of the operating cash flow formula that can be used, a short version or a long version.

The formula you use will depend on your individual business. Note that formulas can be adjusted as needed for items not mentioned below.

What’s most important is to ensure that you have included all relevant items for your business in the formula to ensure the calculation is accurate.

Short formula:

| Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital |

|---|

Long formula

| Cash Flow from Operating Activities = Net Income + Depreciation + Depletion + Amortization + Adjustments To Net Income + Changes In Liabilities + Changes In Inventories + Changes In Accounts Receivables + Changes In Other Operating Activities |

|---|

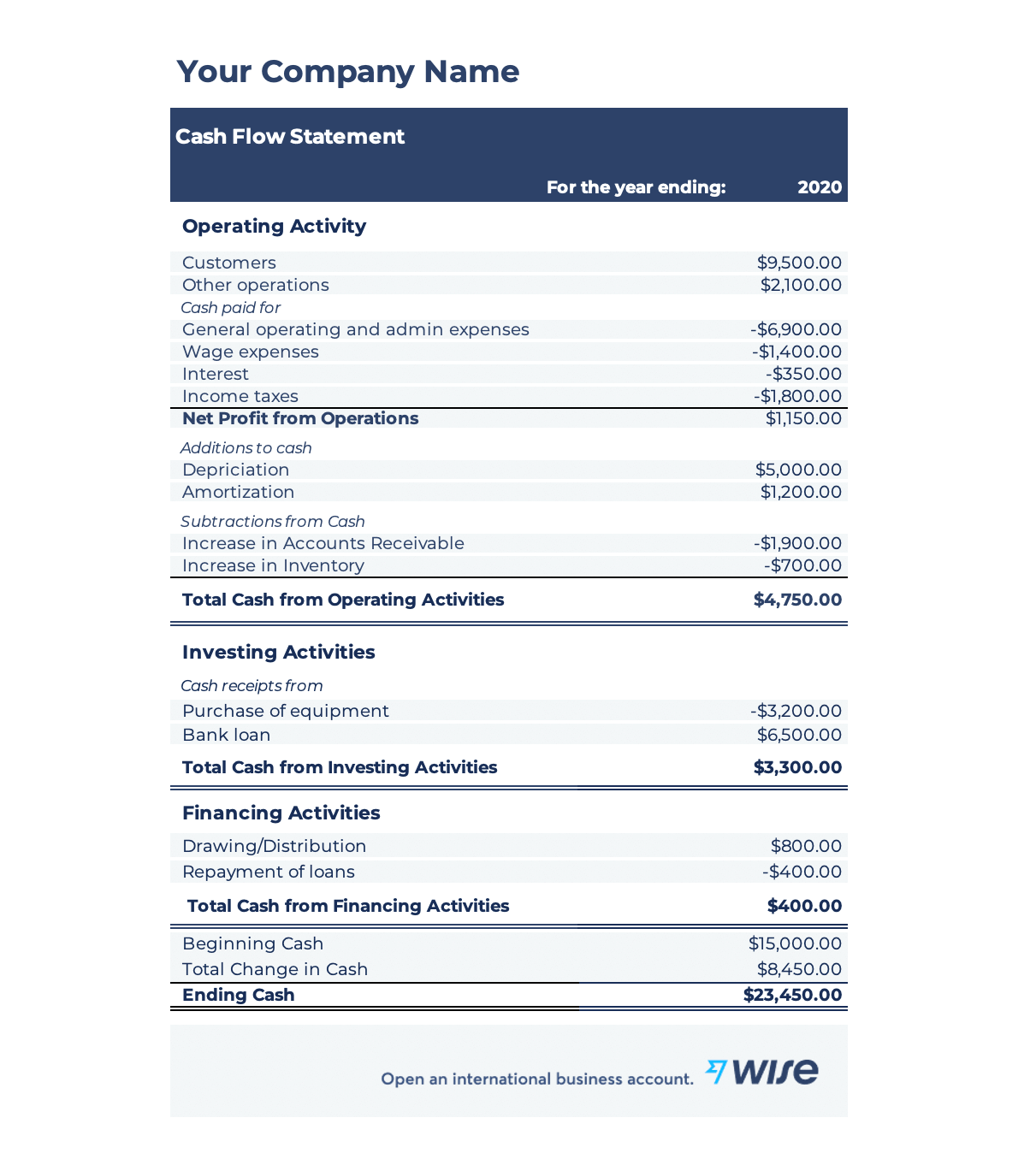

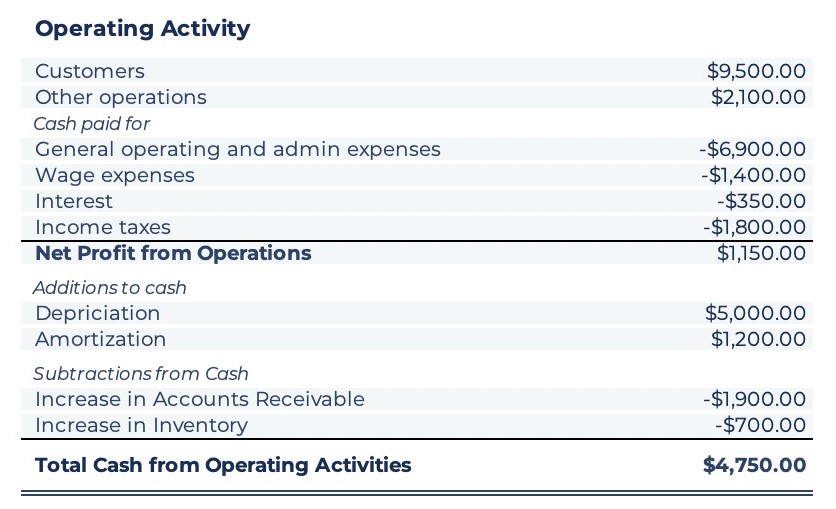

To help with understanding how to calculate operating cash flow, here is an example using the Wise cash flow statement template.

Get your free CF statement in a click

To use the statement, you’ll need to add in figures from your business so that the template can automatically calculate your operating cash flow.

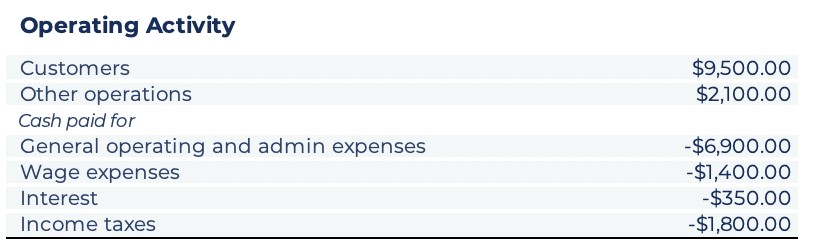

Starting with operating activity, you’ll need to enter figures for:

You can start by entering operating cash inflows and outflows such as operations, wage expenses and income taxes.

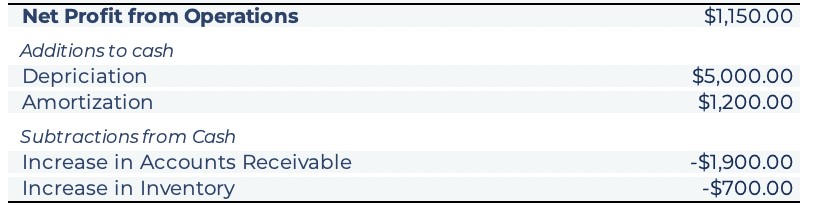

Then move on to the additions and subtractions of the cash section. For this section, you’ll need to enter figures for depreciation and amortization as calculated for your business. You’ll then enter figures for subtractions from cash, which includes increases in accounts receivable and inventory.

After this has been added, you’ll get a final figure that shows the total cash from operating activities.

Calculating operating cash flow gives you better insight into a business’ operating activities and costs incurred.

Doing so can help you plan for the future and ensure that your business operates in a sustainable way that allows it to grow and expand.

That’s why it’s so crucial to plan ahead and consider any operational costs that can be reduced to help your business perform better - and it’s even more crucial when paying or receiving money from overseas is in the picture as that can drive up costs.

Luckily, you don’t need to worry about that with Wise. Using Wise, businesses can save up to 19x compared to PayPal

You can use the multi-currency account to manage money and keep track of costs in a streamlined way, as the account allows you to hold up to 54 currencies in one place.

If your business has customers overseas, you can also get full account details (IBAN, routing number or Sort Code) in up to 10 currencies, making it easier to get your invoices paid faster and on time.

And with Wise, you’ll always see an upfront, transparent fee and send money with the mid-market rate to help you grow your business and keep down costs.

Manage your international business with Wise

Sources:All sources checked 06 October 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore Revolut Business integrations: connect your account with popular accounting and business software to automate workflows and save time.

Compare the best corporate card providers in the EU market. Find cards with competitive rates, spending controls, and integration features.

Discover top grants for women starting a business. Explore federal, state, and private funding opportunities.

Understand the requirements for opening a Revolut Business account and get started with a powerful digital banking solution for your company.

Simplify your business spending with the Stripe Corporate Card. Earn rewards, manage expenses easily, and integrate with your existing Stripe account today.

Find out if linking your bank account to PayPal is safe.